If you’re looking for some quick cash but don’t want to get stuck with a payday loan, apps like Cleo offer short-term loans until your next payday, and they don’t charge any interest.

But Cleo is a sassy, AI-powered bot that regularly uses such colloquialisms as “pissed off,” drops f-bombs and throws up the occasional middle finger. Not all borrowers will appreciate that type of attitude from their lending app.

If Cleo isn’t for you, there are plenty of similar apps to choose from.

Table of Contents

Here are a few of the best apps like Cleo

The number of cash advance apps like Cleo can seem overwhelming. The fintech industry is brimming with competitors that offer similar short-term loan services that can help you save money over traditional high-cost payday loans. These apps don’t check your credit scores, so your credit history doesn’t matter.

We’ve assessed each of these apps, focusing on their ability to provide quick cash advances and financial management tools, and here are the ones that we like the best:

Disclaimer: DebtHammer may be affiliated with some of the companies mentioned in this article. DebtHammer may make money from advertisements or when you contact a company through our platform.

Albert

Albert offers cash advances of up to $250. The catch? You must subscribe to the Genius program to be eligible, and the monthly membership free for that is a hefty $14.99 per month. Of course, you get other benefits with a Genius subscription, including the ability to speak with actual people who can help you with your savings goals.

Albert connects to users’ bank accounts, facilitating easy management of finances and providing a safety net for unexpected expenses.

- Cash advance amount: Up to $250

- Credit check: No

- Fees: Small “convenience” fees if you need instant cash advances

- Monthly membership fee: $14.99

- Key features: Banking services, investing, balance monitoring,

- Perks: Cash back on purchases made with the Albert debit card, bill negotiation

READ MORE: Apps like Albert

Brigit

Brigit will help you bridge the gap between paydays by providing immediate financial assistance. It offers some free features, but to be eligible for an advance, you must subscribe to the Plus plan, which costs $9.99 per month. This immediate financial assistance allows users quick access to a portion of their paycheck on-demand to help handle any charges that arise or meet immediate financial needs.

- Cash advance amount: Up to $250

- Credit check: No

- Fees: No late fees or interest fees

- Monthly membership fee: $9.99

- Key features: Personalized budgeting tools and advice and a platform to find opportunities to earn extra money.

- Pro plan services: Free plan stuff as well as credit building, identity theft protection, instant deposits, automatic advances, flexible repayment plans

- Perks: Not really

- Plus Plan: $9.99 per month

READ MORE: Apps like Brigit

Dave

Dave’s Extracash, one feature of its comprehensive mobile banking app, allows subscribers to borrow up to $500 until payday. At $1 a month, Dave’s monthly subscription fee is one of the lowest we’ve found, and Dave caters to various financial needs beyond cash advances, including no-fee banking accounts, savings accounts, credit-building programs, and a seamless banking experience designed to save time and money.

- Cash advance amount: Up to $500 with Extracash

- Credit check: No

- Monthly membership fee: $1

- Key features: Banking, budgeting help, goal setting and balance monitoring

- Perks: Banking members get free access to Level Credit, which reports your on-time rent payments to the credit bureaus.

- Pro Plan: None offered

READ MORE: Apps like Dave

Earnin

Earnin actually offers you access to wages you’ve already earned. You can get an advance of up to $100 per day or a maximum of $750 per pay period. Earnin doesn’t have a monthly subscription fee. You’ll just have to pay a small fee if you need to have your transfers expedited, and Earnin requests tips up to $13.

- Cash advance amount: Up to $100 per day or $750 per pay period

- Credit check: No

- Fees: A small fee for users who opt for Lightning Speed advances. No information on the fee.

- Monthly membership fee: None

- Key features Balance Shield, Cash Out (early access/money on the day you’ve earned it), Earnin’ Express, finance tools, savings tools,

- Perks: No monthly membership fee, borrowing limits are higher than similar apps

- Pro plan: None

Empower Cash Advance

Empower doesn’t check your credit score, but it will charge you $8 per month in membership fees (after a free 14-day trial). If you choose to stick with your existing bank account (instead of opening a spending account with them), advances will cost $3 per deposit. If you do sign up for their spending account, your debit card offers some useful cash-back rewards.

- Cash advance amount: Up to $250

- Credit check: No

- Fees: late fees, $3 fee to have an advance deposited in an external bank account, fees for instant transfers range from $1 to $8 for advances below $300, or if your advance is between $300 to $500, the lesser of $20 or 3% of the draw amount.

- Monthly membership fee: $8

- Key features: Banking

- Perks: Earn cash back when you use the Empower debit card

- Pro plan: None

READ MORE: Apps like Empower

FloatMe

FloatMe offers a maximum cash advance of $50. That’s a pretty small maximum, and first-time users start out with loan amounts as low as $10. That’s not very much in proportion to the $3.99 monthly fee, which was increased in January 2024.

- Cash advance amount: up to $50

- Credit check: No

- Monthly membership fee: $4.99

- Key features: Financial insights

- Perks: None

- Pro plan: No

READ MORE: Apps like FloatMe

Klover

Klover offers small cash advances up to $200 with no interest or late fees. The catch: Klover makes money from selling your data through its commerce data platform called Attain. You also won’t be able to immediately advance yourself the full $200. Klover uses a point system, and you need ot accrue points from completing tasks in order to be able to increase your advance amount.

- Cash advance amount: Up to $200

- Credit check: No

- Fees: Instant cash advances can cost up to $17 — otherwise, you’ll have to wait up to three business days to get your money

- Monthly membership fee: None required

- Key features: Financial advice, real-time price comparisons, credit monitoring (all only available with a Klover+ subscription)

- Perks: Cash out your points for Amazon gift cards

- Pro plan: $3.99 per month for Klover+

READ MORE: Apps like Klover

MoneyLion

MoneyLion Instacash offers cash advances up to $500 (or $1,000 for people who use other MoneyLion products). There is no mandatory monthly subscription fee, no credit check and MoneyLion doesn’t charge interest on advances. The advances are free (aside from the optional tip) if you can wait up to three business days for the money. If you need it right away, you’ll have to pay the “Turbo” service fee. The amount of that fee varies by the amount of your advance.

- Cash advance amount: Up to $500 in Instacash advances

- Credit check: Not for Instacash users

- Fees: Small fee for “Turbo” services (based on the advance amount).

- Monthly membership fee: Ranges from $1 to $19.99, depending on the services your choose

- Key features: banking services, credit building, investing, crypto, financial planning

- Perks: Cashback rewards, safety net, financial tracking

READ MORE: Apps like MoneyLion

Possible Finance

A cash advance from Possible is more like a small-dollar personal loan for borrowers with bad credit, so they allow you to borrow more money. Possible’s personal loans don’t have to be paid back in full on your next payday. However, the fees are significantly higher than the alternatives.

- Possible’s cash advance amount: Up to $500

- Credit check: Yes

- Fees: Between $10-$25 per $100 borrowed, depending on your state

- Monthly membership fee: None

- Key features: None

- Perks: None

- Pro plan: None

READ MORE: Apps like Possible Finance

Online banking apps

Online banking apps can also be a way to get cash advances. Many offer early access to direct deposits. Some also provide gap loans to help you keep your account in the black from one payday to the next.

Every day there are more and more online banking apps to choose from. Here are two that we know to be safe and reliable.

Chime

You’ve probably seen commercials for Chime. It calls itself the #1 most loved banking app.

Chime offers a number of traditional banking services, including traditional checking accounts (Chime calls them spending accounts). Account holders receive a Visa debit card that includes free withdrawals at any of Chime’s in-network ATMs. And if you’ve been struggling to get approved for a credit card, the Chime Credit Builder Visa credit card could be the solution. If you have qualifying direct deposits, you can access your paychecks up to two days before the deposit is scheduled to arrive.

Chime’s cash advance feature is called SpotMe. SpotMe isn’t really a true cash advance, it’s actually overdraft protection that’s designed to help you save money on overdraft fees. It means you can buy an item or pay a bill, even if you know there isn’t enough money in your account to fully cover the transaction.

Pro tip: Many traditional financial institutions offer overdraft protection, though you may have to pay a fee.

Let’s say you buy something for $50 but it turns out you only have $30 in your spending account. The SpotMe program will cover the remaining $20 for you so that you don’t have to worry about overdraft fees. Customers who qualify for the program start out with $40 in SpotMe funds. Over time as they build a consistent repayment history, that amount will increase to as much as $200.

To qualify for SpotMe, you need to have direct deposit set up with your Chime account and the deposit must come from a “qualifying” depositor. PayPal transfers don’t fulfill this requirement, so gig workers and freelancers will have to turn to one of the cash advance apps that are compatible with Chime.

Varo

Varo is one of Chime’s top competitors. Like Chime, it offers traditional financial services like checking and savings accounts. The nice thing about these accounts is that they are fee-free and cost nothing to open. Varo also offers mobile bank deposits, allowing users to deposit cash at Green Dot locations like Walgreens, 7-11, Safeway, etc.

Varo Advance is the platform’s cash advance program. You can use this cash advance when your account balance gets too low or is unlikely to cover all your expenses before your next payday. You will pay a small fee for advances over $50, which tops out at $5 per $100. Repayment terms are flexible. You can pay the money any way you choose if it is repaid in full within 30 days.

The fee is relatively high, though, ranging from $1.60 for a $20 advance up to $40 for a $500 advance.

To qualify for Varo Advance, you must hold an open Varo account with a positive balance and have direct deposits of $800 or more sent to your Varo account each month.

READ MORE: Cash advance apps that work with Varo

Employer-sponsored cash advance apps

Some employers use fintech platforms to offer employees with direct deposit early access to their next paycheck. They facilitate the advances by pairing with companies like:

- One@Work (formerly Even Instapay)

- Branch

- Amazon Anytime Pay

- Axos Bank Direct Deposit Express

- Flexwage

- Dailypay

- PayActiv

Some of these cash advance apps also pair with companies like Uber, DoorDash, etc, so gig workers have an opportunity to get their pay faster. The drawback? Eligibility is limited to workers whose employers choose to participate.

Peer-to-peer loan apps

Another way to fund the gap between paydays is to use a peer-to-peer lending app. These apps are exactly what they sound like. Users request money. Other users fund those requests.

Many peer-to-peer lending apps promise huge loans, “even with bad credit!” Many are predatory lenders in disguise. Here are three of the most-trustworthy options:

- SoLo Funds

- LenMe

- Zirtue

What you need to know about Cleo

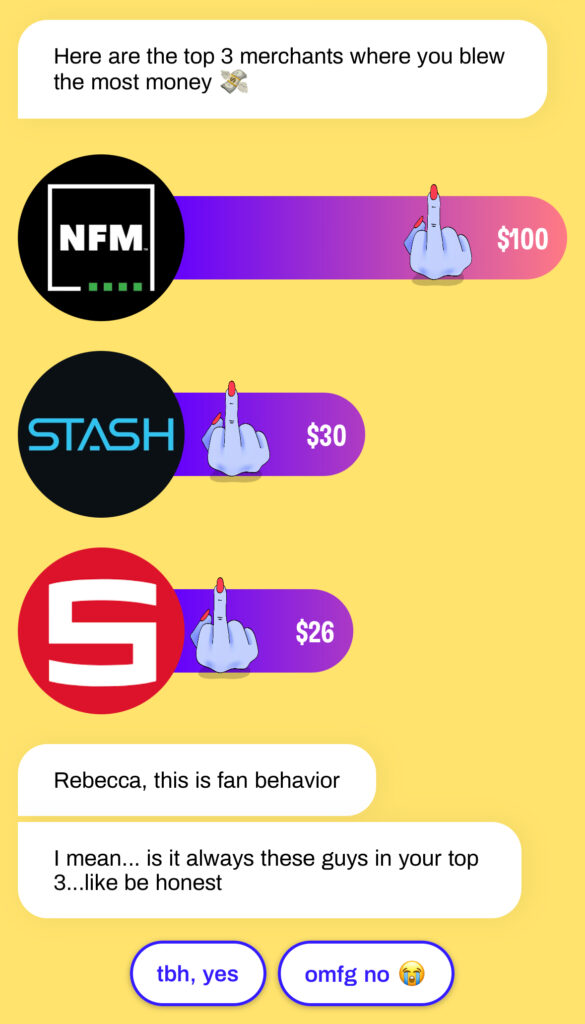

Cleo is designed as the “sassy” alternative for cash advances. It offers convenient cash advances with no hidden fees or interest charges (unless you need the money transferred instantly) that are repaid from your next paycheck.

But Cleo is sarcastic, drops the occasional f-bomb and even flips users the bird sometimes. That type of attitude won’t appeal to everyone.

While some Cleo services are available for free, you must have a monthly subscription in order to be eligible for advances up to $250. Cleo Plus costs $5.99 per month, while Cleo Builder, which includes extra features designed to help you boost your credit score, costs $14.99 per month. Cleo also offers budgeting tools and will mock (or praise) your spending habits.

To use the service, you’ll have to download the mobile app, which is available on Google Play for Android and Apple’s App Store for ios.

READ MORE: Cleo review

Why are loan apps like Cleo better than payday loans?

There are a number of reasons why apps like Cleo are better than payday loans. They are an easy way to cover unexpected expenses. They are more convenient than payday loans. You can access the funds you need directly from your phone. They charge fewer fees. Very few of these apps have any interest charges at all. Most offer financial management tools, budgeting help, and other perks that will help you improve your financial well-being. And if you’re unable to pay them back on your next payday, you have a few options, so you won’t get stuck in the payday loan debt trap. More than 90% of American payday loan borrowers end up regretting their payday loan. Don’t be one of them.

However, these apps don’t offer immediate access to money, and you’ll need to watch out for hidden costs. If you need instant money, expect to pay hidden fees for expedited transfers.

The bottom line

Most cash advance apps and online banking apps offer short-term borrowing options like early direct deposit and gap loans with no interest charges. Some apps also provide additional features including budgeting tools. However, a few cash advance apps go a step further by offering larger cash advance amounts, competitive features such as instant access to wages with no hidden fees or interest rates, and unique financial tools like no-fee overdrafts and credit-builder loans, setting them apart from standard online banking applications.

The app that will work best for you will depend on your financial needs. If you don’t need the extra bells and whistles, it doesn’t make sense to pay a higher monthly fee for access to products you don’t need and won’t use.

The Cleo app is a valuable tool, but it isn’t for everyone. If you’re looking for a more traditional financial app that offers free cash advances, you have plenty of options.