Payday Alternative Loans are small-dollar short-term loans that were designed to be a better alternative to traditional payday loans without the high fees and interest charges. They cost less and offer longer repayment terms, larger borrowing limits and interest rates are capped at 28%.

Unfortunately, many payday loan borrowers are completely unaware that this type of loan exists (less than 2% of payday loan borrowers have used a Payday Alternative Loan). Before you apply for a payday loan, it’s important to consider a PAL.

Stuck in payday debt?

DebtHammer may be able to help.

Table of Contents

Payday Alternative Loans vs. payday loans

Payday alternative loans are better than payday loans in almost every way. Payday loans and PALs have similar eligibility requirements. Your credit score doesn’t matter; the money will be available quickly. The only difference is that PALs have a credit union membership requirement, which we will explain later.

| PALs | Payday loans |

| Must join a credit union to be eligible | Available from storefront or online lenders |

| Annual percentage rates are capped at 28% | Depending on your state, these can have interest rates of 600% APR or more |

| You can borrow up to $2,000 | Average loan amount is $500 |

| The highest application fee is $20 | Charge a fee between $10 to $30 for every $100 borrowed |

| Credit unions are member-owned cooperatives | Payday lenders are notoriously predatory |

| Repaid in monthly payments over 6-12 months | Repaid in a lump sum from your next paycheck |

| PAL repayment periods can be extended | If you can’t afford to pay your payday loan, you will need to apply for a new loan (and pay additional fees) |

| Your loan payments are reported to credit bureaus and will help your credit score | Loans are only reported to credit bureaus if you default, so they can only hurt your credit score |

| Credit unions offer other loan products and financial guidance | Payday lenders usually only offer other predatory loan products, like high-interest title loans and check-cashing services |

READ MORE: Payday loan interest rates

What is a Payday Alternative Loan (PAL)?

PALs are similar to payday loans in structure and mechanics. Still, there’s one major difference — instead of using potentially shady lenders, PALs are offered by some federal credit unions, making them much more affordable. Their purpose serves the same need: to loan small amounts of money to borrowers in need of cash for a financial emergency between paychecks.

They’re designed to give borrowers an affordable way to borrow small amounts of money with more favorable repayment terms.

PALs have capped interest rates, higher borrowing amounts and longer repayment periods.

“PALs generally have much lower interest rates compared to traditional payday loans,” says Leslie Tayne, founder and head attorney at Tayne Law Group. “And unlike payday loans, which typically require repayment by your next paycheck, PALs offer more manageable repayment terms.”

There are two types of Payday Alternative Loans, PAL I and PAL II. Both are strictly regulated by The National Credit Union Administration (NCUA).

Pro tip: PALs II have not replaced the original PALs. Both options are still available, but borrowers must choose between the two. It’s only possible to hold one type at a time.

They follow the same rules as PALs, but there are a few key differences:

| PAL | PAL II |

| Borrow between $200 and $1,000 | Borrow up to $2,000 |

| Repayment terms must be between one to six months | Repayment periods can be between one to 12 months |

| Borrowers must be credit union members for at least one month | Credit union members can apply as soon as they join (no one-month waiting period) |

The National Association for Federally-Insured Credit Unions breaks down the differences between PALs and PAL II.

READ MORE: Do you need help now? Here’s how to get quick cash and other assistance

How to qualify for a PAL

Payday Alternative Loan eligibility requirements are very similar to payday loan requirements. The application process is simple. People don’t typically need a high credit score to qualify for a PAL. In fact, your credit history may not even be checked. Credit unions are usually focused on whether you have the ability to repay your loan.

Unlike payday lenders, the law requires federal credit unions to verify a person’s ability to pay before lending to them. While there may not be a credit check, you may need to show pay stubs or bank statements to verify income. Borrowers will also likely need to explain why they want to take out the PAL and pass a background check.

Pro tip: Eligibility for a payday loan is simpler than a PAL, but that often works against the borrower. Failing to repay payday loan debt will damage your credit score and leave you trapped in a cycle of debt that’s difficult to escape.

The biggest obstacle in qualifying for a PAL is usually gaining membership into a credit union that offers these loans. Remember, only credit union members can apply for a PAL or PAL II. Borrowers can apply for a PAL II immediately upon joining the credit union. You have to be a credit union member for at least one month in order to apply for a PAL.

READ MORE: What is a payday loan?

Credit unions anyone can join

While many credit unions have specific membership criteria, a few are open to everyone. Note that you will have to open an account, but many allow you to do this with as little as $10. Here are some of the best options.

READ MORE: How to get out of payday loan debt in 8 easy steps

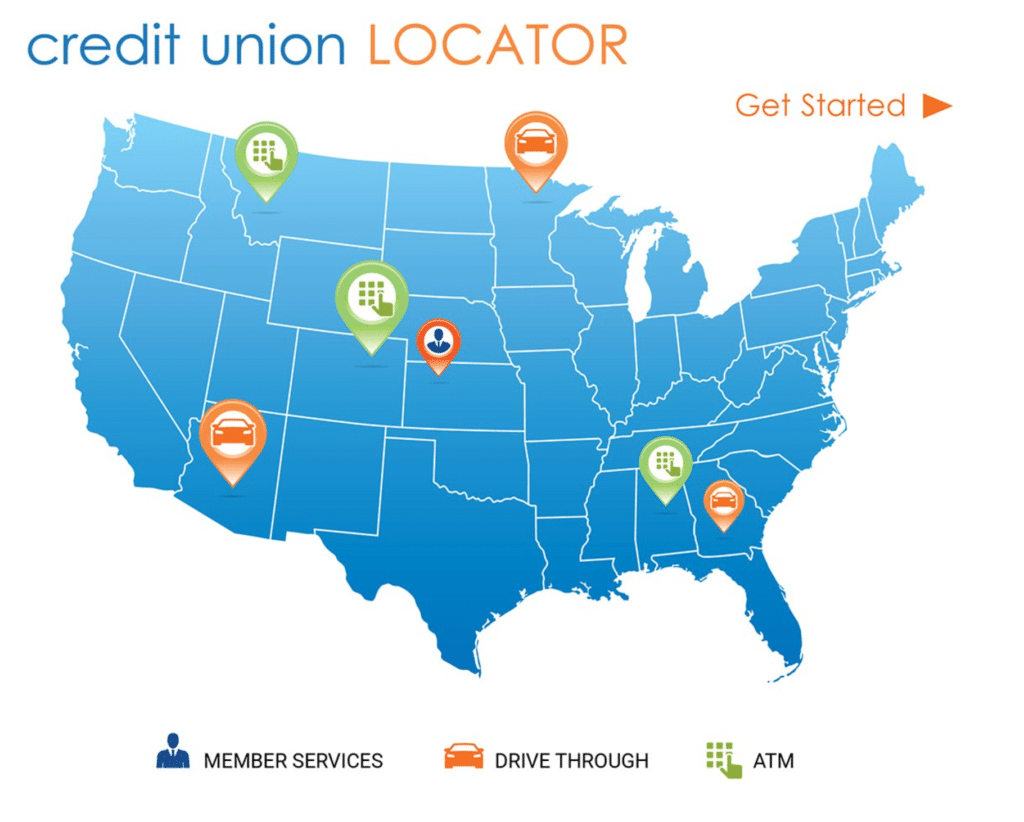

There are plenty of federal credit unions across the country. Not all offer PALs, but locating one that does is not too difficult. This locator will help.

Other payday loan alternatives and loan options

There are several better financial alternatives that can help you get some quick relief at a lower cost than a traditional payday loan. Some of those options include:

- Personal loans

- Debt consolidation loans

- Cash advance apps

- Bad credit loans

- Credit cards

- Debt Management Plan

Looking for other alternatives to payday loans? Click here.

READ MORE: More ways to escape the payday loan debt trap

The bottom line

Payday loans leave borrowers trapped in a dangerous cycle of debt. PALs can help you avoid that.

Before turning to a payday lender, seek out a credit union that you’re eligible to join. Opening an account with a small deposit and presenting a few pay stubs will save you hundreds or even thousands of dollars.