Key 2023 Cryptocurrency and Blockchain Statistics You Need to Know

Since their inception in 2009, cryptocurrencies have experienced immense and unpredictable growth. This new phenomenon has taken the financial world by storm and changed the way individuals and businesses conduct their daily transactions. With no signs of stopping, businesses now more than ever see the need to adapt such currencies in order to keep up with the times.

Below we will present some of the most relevant statistics regarding the state of cryptocurrencies worldwide.

Topics covered

General cryptocurrency statistics

With a market as volatile and ever-changing as the crypto market, it’s important to stay updated with the overall trends. The newest statistics suggest that crypto usage will continue to rise in the months to come.

So far in 2023, the number of crypto users worldwide is estimated at 420 million across all known currencies.

- What exactly is cryptocurrency? A cryptocurrency is defined as a digital coin that is decentralized and tracked through what is known as a ‘blockchain’.

The market capitalization of all cryptocurrencies is constantly changing. However, the latest estimates put it at around $1 trillion.

Research indicates that in 2022, merchants using CoinGate received 927,294 crypto payments, which is a 63% increase from 2021. By 2025, the global blockchain market is expected to grow by $39 billion U.S. dollars.

- When a cryptocurrency transaction occurs, it’s added to the blockchain, which is constantly being updated and registers all the transactions that go in it.

Bitcoin remains the most popular cryptocurrency. As the first coin on the market, it has built its way up to 25.2 million owners.

Bitcoin’s success since 2009 came as a shock for the financial industry. Ever since, it has called attention to the vulnerabilities of the old ways of banking.

In a span of eight years (2012-2020) Bitcoin has increased its value by 193.639.36%. The highest closing price for bitcoin recorded to date is $69,044.77.

Bitcoin’s popularity extends to social media as well, there are approximately 28,866 social media posts about Bitcoin per day. This amounts to 1,203 posts per hour, 20 posts per minute or one post every three seconds.

Bitcoin price over the years

In order to be considered as one of the top 2% of Bitcoin traders, you would need to possess roughly 0.28 BTC. Meanwhile, the average Bitcoin trader currently owns about 0.01 BTC.

- Bitcoin will run out of supplies by the time it hits 21 million, once this cap is reached traders will have to stop relying on block rewards for revenue and will have to focus on transaction fees.

- There are 19 million Bitcoins in circulation as of right now, and the market value for Bitcoin was hovering around $432 billion in March 2023, down from 746 billion a year ago.

Ethereum price throughout history

Even though Bitcoin remains the front-runner, its biggest competitor, Ethereum, is slated to outgrow Bitcoin in the near future. By the last quarter of 2020 Ethereum became the cryptocurrency with the most daily transactions -- almost four times as many transactions as Bitcoin.

While Ethereum did around 1.2 million transactions in February 2021, Bitcoin only did 272k by comparison.

Ethereum is expected to have about 13.1 million owners in the U.S. alone this year. This means that 38.9% of all crypto investors will own Ethereum coins. In 2020 alone, more than one million Ethereum transactions took place every day.

Tokens or coins that are stored in the blockchain grant specific members of the blockchain rights to the blockchain network. Usually the type of rights granted to these members differ but can be categorized in four separate groups:

Equity tokens

Utility Tokens

Intrinsic Tokens

Asset Backed Tokens

Cryptocurrency ownership statistics

Currently, the number of adult crypto owners in the U.S. stands at 46 million users, which is expected to continue growing. It is estimated that on a global scale, U.S. crypto owners represent roughly 8.3% of all holders.

Crypto ownership is not spread out evenly across all ages with the highest ownership rate found among adults aged 25 to 34, followed closely by those in the 35 to 44 age range. The smallest group of crypto owners are those 65 and over, however, they are the fastest-growing group.

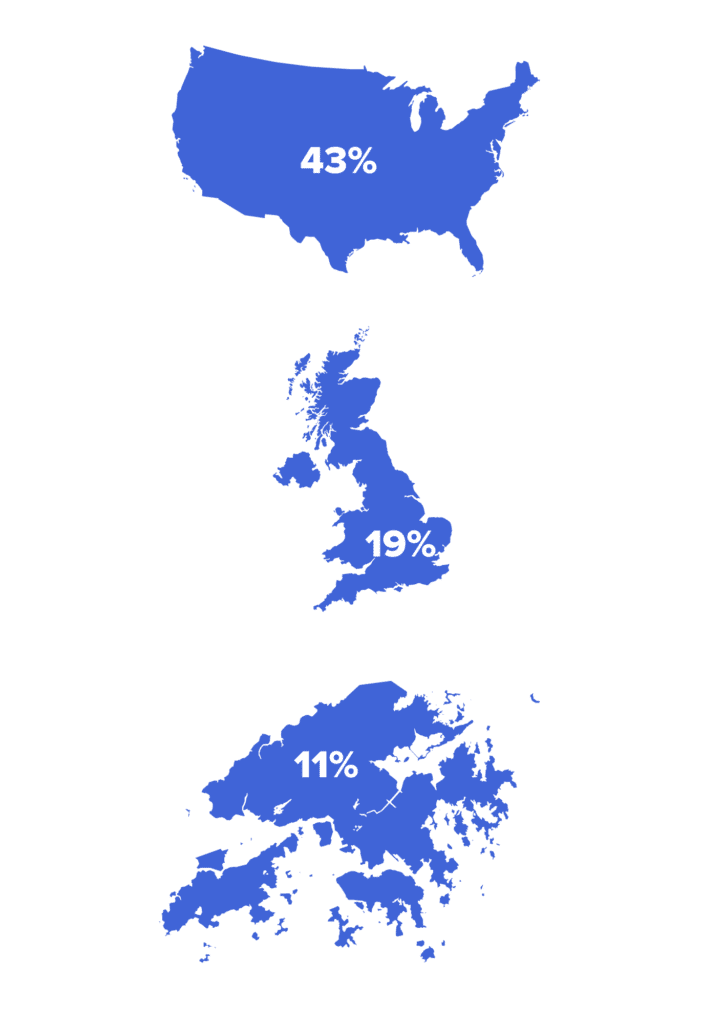

Most hedge fund managers reside In these countries

34% of the world’s hedge funds can be found either in the U.S. or in the tax-friendly Cayman Islands. Hedge fund managers live in the U.S. with 43%, Another 19% reside in the U.K. and 11% live in Hong Kong.

These funds manage a large number of assets worth $59.6 billion in cash. Just a small percentage of crypto companies have assets worth more than $100 million, while 39% of them have $10 million or less.

Students most likely to invest in Crypto based on their major are:

Students least likely to invest in Crypto based on their major are:

19% medical students

18% computer science students

8% Humanities students

3% social science students

By 2022, the number of crypto users owning Bitcoin rose to almost 70%. Of Bitcoin users, 40% hold their coins in hopes of them selling for a higher price, 11% use them to pay for goods and services and 22% of them stake them for profit.

Bitcoin continues its dominance by being the most popular coin on the market, making it around 42.2% more recognizable than other cryptocurrencies. However, based on 24h volume statistics alone, the latest data put Tether in the lead position with $90 Billion.

Cryptocurrency mining and market

Crypto continues to grow with 24 new cryptocurrencies created every week. As of right now there are 18,465 cryptocurrencies in existence.

Mining refers to the process by which cryptocurrencies are generated and by which new coins and transactions are verified. The income worldwide generated by mining is estimated to be $20.1 billion annually.

Turkey is the country with the highest cryptocurrency adaptation to date. It is responsible for roughly 20% of the world’s cryptocurrency transactions.

China continues leading as the country with the most Bitcoin miners to date. They continue to rule around 60% of all global hash rates.

The top ten cryptocurrencies in terms of market capitalization take up about 88% of the entire crypto market value, while the rest of the lesser known coins take up the remaining 12%.

A factor to keep in mind is that in order to mine effectively, the necessary component is a computer with around 40TH/s computer power.

This costs around $4.32 daily or $1,576 per year. If this is effectively done, the reward expected for a currency like Bitcoin, for example, is 0.08875 Bitcoins. That translates into $3.017 for the miner.

Top ten cryptocurrencies by market cap

Cryptocurrency use statistics

Because of the rise in interest in crypto mining and trading, there’s been an increase in their utilization as a method of payment for various purposes. However, the fragile nature of the crypto market means that prices are highly unstable and prone to sharp fluctuations in a very short time span.

That said, today the value of online Bitcoin transactions is massive and surpassed only by companies such as Visa and MasterCard, which -- with a revenue of $30.3 billion and $16.2 billion respectively -- happen to be the biggest payment networks in the world.

Because of the widespread popularity and usage, the number of crypto ATMs has been rapidly increasing. As of November 2022, there were nearly 39,000 Bitcoin ATMs around the globe.

The most crypto ATMs in the U.S. can be found in Los Angeles with 1,991; Chicago with 1,209; Houston with 1,207; Dallas with 1,153 and Atlanta with 965.

Men are statistically more likely to be aware of Bitcoin than women, a slight difference of 78% for men and 71% for women. Out of those participating in Bitcoin trade and using the currency, 85.77% are male.

Most crypto users reside in these countries

White people are also more likely to be more familiar with cryptocurrency compared to other races, with familiarity rates of 66% among Hispanic people and 61% among Black people.

67% of millennials consider Bitcoin as a safer trading option than the previous traditional assets, such as silver or gold.

Businesses most likely to accept crypto as payment

2,352 American businesses accept Bitcoin as an acceptable payment in exchange for goods and services. Some of the businesses more likely to adapt this practice include:

Casual dining

IT services

Public ATMs

Convenience stores

Gas stations

Cryptocurrencies have made their way into gaming as 42 million gamers owned crypto in 2020. The revenue for the crypto gaming industry in 2020 is $321 million. Gamers in the Asia-Pacific region have the highest crypto ownership, with 22.6 million owning crypto.

Malware, threats and downsides

Despite the rise in popularity, cryptocurrencies still cause many security concerns. By January 2020, over 600 million crypto-malware were unleashed. Over about a year, this number increased by 16 million. Just for the period from 2019 to 2020, crypto theft occurred 160% more frequently than before.

About $46 million worth of crypto is stolen each month. Overall, from their creation until now, $3.19 billion worth of crypto has been lost either due to theft or other types of scams.

A big concern about the safety of using cryptocurrencies is the ongoing trend of cryptojacking.

Cryptojacking is both a financial and cybercriminal activity. It specifically refers to the usage of a mining machine without the prior knowledge of the owner. In the last few years, this has become the biggest threat to cryptocurrencies around the world. In 2022, crypto crime hit a record $20 billion worldwide. In 2022, the total amount of crypto stolen surpassed $51 billion.

U.S investors' stance on crypto

Certain currencies such as Tether are backed by the U.S. dollar and are considered more legitimate. However, the fact remains that many big players in the financial field are not interested in investing in crypto.

Cryptocurrency investing and loans

While crypto prices fluctuate wildly, investors have been trying to take advantage of the price dips. Many have turned to loans to invest in cryptocurrencies.

About 21% of crypto-investors reported that they’ve used a loan to pay for their cryptocurrency investments. Personal loans were the most popular, but payday loans, title loans, mortgage refinances, home equity loans and leftover student loan funds also have been utilized.

When researching cryptocurrencies, YouTube is the top source of information. Websites and blogs are second, while friends and family are third. Reddit, TV, newspapers and radio broadcasts are also popular sources.

Environmental concerns

One of the biggest drawbacks when it comes to mining crypto is the amount of energy used during the process. The mining process requires powerful computers and a lot of electricity. Enough electricity, in fact, to power a country the size of Argentina.

The process of mining Bitcoin consumes the same amount of energy that is used to power all data centers around the world.

The future of crypto

Experts are divided on the future of crypto, and there are also points of contention between experts and lawmakers. One of the primary reasons for this split is that even though some believe in the future power of crypto, many are worried that the negatives outweigh the positives.

As of right now, 24 countries have banned cryptocurrencies. This number might grow, but the likelihood of a worldwide ban is very low.

2030 predictions

Regardless of your personal views on crypto, the fact remains that it is here to stay for a while.

However, with a market as fragile as the crypto market, it’s always a good idea to invest smartly and do your research before making any major financial decisions.