FloatMe is an app that offers cash advances (or floats) of up to $50 per payday. But what if $50 isn’t enough?

If you’re looking for apps like FloatMe that offer interest-free paycheck advances up to $500 per pay cycle, here are the best alternatives.

Table of Contents

Key points

- FloatMe offers small loans (or “floats”) of $50 until payday

- FloatMe charges a monthly subscription fee of $3.99 after a free seven-day trial

- If $50 isn’t enough to carry you through, there are plenty of other apps that will advance larger amounts of money

Here are the best cash advance apps like FloatMe

Disclaimer: Some or all of the products featured in this article are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. All opinions are our own.

Best for its “Genius” program: Albert

Albert has one of the higher monthly subscription fees, but it includes perks like spending alerts, overdraft warnings and access via text to a live person. If you’ll use those services, it can be worth the extra cost. If you’re only looking for quick advances, there will be better options.

- Albert lets you borrow up to $250

- No credit check

- To get advances, you will have to subscribe to Albert’s “Genius” service, which costs $15 per month

- Albert offers banking, account balance monitoring, and help with investing

- It will take three to four business days to get your advance, unless you pay $6.99 for an instant transfer

- Albert’s Better Business Bureau rating is B (1.5 of 5 stars)

- Tips are encouraged

READ MORE: Apps like Albert

Best for repayment flexibility: Brigit

Brigit is one of the few cash advance apps that doesn’t ask for tips. However, you will have to pay for the “Pro Plan” to be eligible for cash advances, and that costs $9.99 a month. It includes perks like identity theft protection, so it’s worth considering if you’ll use those extra services.

- Brigit offers advances up to $250

- No credit check

- You’ll have to subscribe to the “Pro Plan” to be eligible for cash advances, and that costs $9.99 per month

- It will take one to three business days to receive your advance, or you can pay a fee ranging from $1 to $4 for an instant transfer

- Offers extra financial services including savings advice, help finding gig work, etc.

- Pro Plan is $9.99 per month and includes identity theft protection, flexible repayment plans, and more.

- Brigit is not rated by the BBB and has earned 1.2 of 5 stars

READ MORE: Apps like Brigit

Best for extra services: Earnin

Earnin allows you to access your wages as soon as you’ve earned them. You aren’t getting a cash advance per se. Instead, you’re getting your salary before payday. Earnin doesn’t charge a monthly fee and does not require direct deposit, but you must link your bank account.

- Earnin caps its advances at $100 per day and $750 per pay period

- No credit check

- There is no fee unless you want to speed up your advance deposit

- Offers extra services like Balance Shield, which monitors your bank account and notifies you that it gets too low

- It will take between one to three business days to get your money unless you pay a transfer fee of $2 to $4 for instant transfers

- Earnin’s BBB rating is A (2.7 of 5 stars)

Best for traditional banking services: Empower

Empower offers a free trial for new members so you have some time to figure out whether this is a good platform for you before you have to commit to paying. However, the trial is very short and the monthly membership fee is on the high side. The cost for instant transfers is also relatively high.

- Empower offers advances up to $250

- No credit check

- Empower offers a free 14-day trial for new members

- After that trial ends, membership costs $8/month, but there’s no pro plan

- Also offers banking services, budgeting tools and cash back when you use their debit card

- Money is available in one business day, unless you pay between $1 to $8 for instant transfers

- Empower has earned a BBB rating of A (1.33 of 5 stars)

READ MORE: Apps like Empower

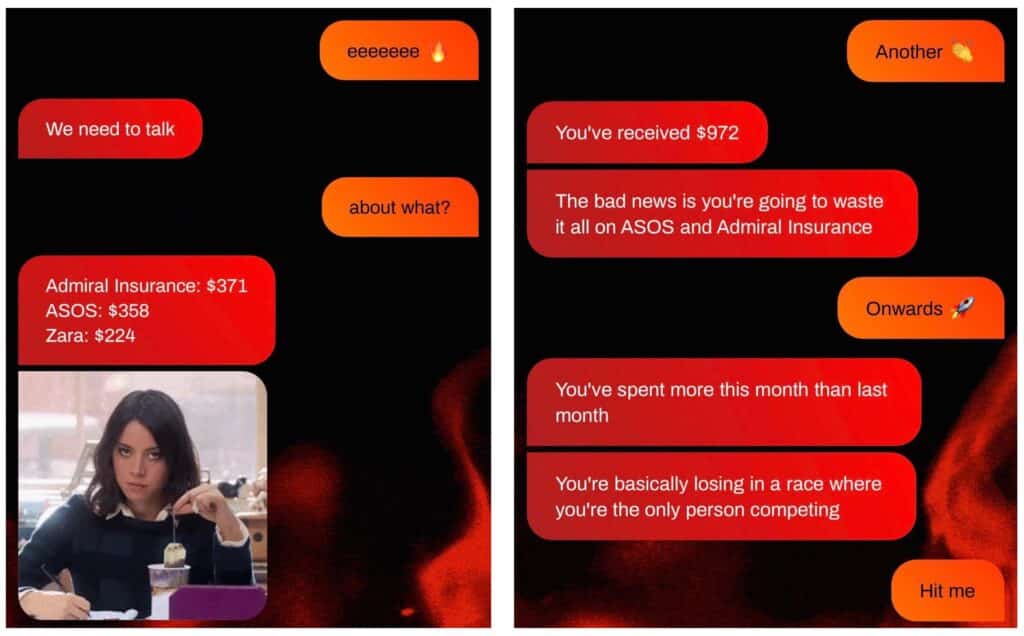

Best for honest feedback on your financial habits: Cleo

Cleo offers cash advances from $20 to $200, but first-time borrowers won’t be able to borrow the maximum amount. The most you can expect to borrow at first is $70, and you’ll have to subscribe to a premium plan for any size advance. Cleo is the app with attitude, and if you ask the app to “roast” you, it will make fun of your spending habits. You can also ask for positive reinforcement.

Cleo’s “roast mode”

- First-time Cleo borrowers get up to $70

- If you want an advance, you have to opt-in to the premium plan, which is $5.99 per month

- No credit check

- Tips are encouraged

- The app has a conversational approach and offers to critique your spending and saving habits, encourage you to save, celebrate your wins, etc.

- It will take up to four business days to get your money unless you pay $4 for an instant transfer

- Cleo has earned a BBB rating of F (1 of 5 stars)

READ MORE: Apps like Cleo

Best low-cost option: Dave

Dave offers cash advances of up to $500 with Extracash. The company also offers checking account services to people who might have trouble getting (or don’t want) traditional bank accounts. Dave’s monthly fee is among the lowest, at $1 per month.

Dave doesn’t require direct deposit to use ExtraCash, so it’s ideal for gig workers or people who have a steady source of income but not a steady paycheck.

- Dave offers advances up to $500 with ExtraCash

- No credit check

- Costs $1 per month – there is no free plan

- The app offers banking and balance monitoring. Also, apps like Dave offer an extra financial service by reporting on-time bill payments to the credit bureaus. This can boost your credit score.

- Dave requests tips

- It will take three business days to receive the advance unless you pay for instant transfers – $1.99 to $9.99 for instant transfers to a Dave Spending account or $2.99 to $13.99 to an external debit card

- Dave had earned a BBB rating of B (1.13 of 5 stars)

READ MORE: Apps like Dave

Best for small advances: Klover

Klover is one of the only apps that will give you cash advances without any type of paid subscription. However, there are a couple of catches: Klover uses your personal data to offset the costs and if you need the money instantly, the transfer fee is higher than most other apps charge.

- Klover offers advances of up to $200

- No credit check

- $3.99 per month if you want to upgrade to Klover+, but that isn’t required for cash advances

- No fees for advances

- No perks

- You can complete micro-tasks like watching ads to increase the amount you can borrow

- It can take up to three business days to get your money unless you pay an instant transfer fee of between $1.99 to $16.78

- Klover has earned a BBB rating of A+ (1 of 5 stars)

READ MORE: Is the Klover app legitimate?

Best for larger advances: MoneyLion

MoneyLion’s Instacash feature offers short-term cash advances of up to $500, or as high as $1,000 if you use other MoneyLion features. There’s no membership fee. However, first-time borrowers will only be eligible to borrow $10.

- Offers up to $1,000 in Instacash advances

- No credit check for Instacash

- It will take up to three business days to get your advance unless you pay for “turbo” services; then, the fee is based on the amount of your advance but ranges from $.49 to $8.99

- Also offers banking, credit building, financial planning, crypto and investing services for additional fees

- MoneyLion has a BBB rating of F (4.7 of 5 stars)

READ MORE: Apps like MoneyLion

Best for longer loan terms: Possible Finance

Possible’s “cash advances” are actually small-dollar installment loans for borrowers with bad credit, so they allow you to borrow more and they don’t have to be paid back in full on your next payday. However, the fees are significantly higher than the alternatives.

- Possible allows loans up to $500

- Loans are repaid in four payments over eight weeks

- No monthly fee, but you will have to pay a loan origination fee of 2%

- Does a credit check

- No tips

- The fees are $10 to $25 per $100 advance, depending on where you live

- It will take up to five business days to get your money

- Possible has earned a BBB rating of B (4.58 of 5 stars)

Possible loans are only allowed in the following states: Alabama, California, Delaware, Florida, Iowa, Idaho, Indiana, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Ohio, Oklahoma, Rhode Island, South Carolina, Tennessee, Texas, Utah and Vermont.

READ MORE: Apps like Possible Finance

Best for speed: FrontPay

Frontpay is a platform that’s very similar to FloatMe. It offers short-term cash advances of up to $100 with no interest. FrontPay says that borrowers get their money within a business day, and there is no additional fee for the expedited transfers. Frontpay is a legitimate business registered in and licensed in Utah. It was founded in May 2022.

However, Frontpay charges a monthly subscription fee of $14.99 (which is very high compared to competitors) and does not offer any additional services at that price point. The company also doesn’t have much of a customer review history with the Better Business Bureau, the Google Play Store or Apple’s App Store. Most of the referring links to the company are from the same external website.

Frontpay also requires a lot of personal information upfront before you can even complete the signup process. This includes your home address, telephone number, Social Security number, bank account information and routing number. The website needs to be more robust and answer more questions about the service.

Online banking apps

Best all-in-one banking option: Chime

Chime doesn’t technically offer cash advances. Instead, its “SpotMe” program allows you to overdraft your account if your balance is too low to cover your spending. SpotMe is only available to some of Chime’s customers. The program only accepts certain types of direct deposits in its enrollment criteria. Usually, the direct deposit must be from an employer. Right now, self-employed people can’t take advantage of the program.

When enrolling in SpotMe, you’ll only qualify for around $40 in spending coverage before the usual fees are applied. Over time, if you pay back what SpotMe has “loaned” you on time, your spot limit will increase. Currently, the largest amount users qualify for is $200.

Best for no fees or minimum deposits: Varo

Varo is “younger” than Chime but is already its primary competition. Varo markets itself as “a bank for all of us” because “money shouldn’t just work for some of us.”

Varo offers checking and savings accounts. The accounts are 100% free. They don’t charge any setup fees or require any minimum deposits. They also don’t charge overdrafts or returned service fees. Users can access mobile bank deposits for checks and partner Green Dot for cash deposits. Account holders can also sign up for “Varo Believe,” the bank’s credit-building program.

Varo also bridges the gap between online banking and cash advances with its Varo Advance program. The program is a little like Chime’s SpotMe, or your bank’s paycheck advance program. You can have up to $500 of your next direct deposit “advanced” when needed. The catch is that you’ll have to pay a small fee. The fee ranges from $1.60 to borrow $20 all the way up to $40 to borrow $500 (this is the equivalent of an annual percentage rate of 103%.) Unlike most cash advance programs, however, Varo Advance allows borrowers to repay their advances however they want, as long as the balance is taken care of within 30 days.

Best apps that require your employer to sign up

Many workers have said they prefer to access their pay as it’s earned instead of waiting for payday. To this end, some employers are partnering with apps to allow this to happen.

Employer-sponsored payday cash advances link to your time card platform or salary database. They allow you to receive the money you’ve earned as you earn it instead of waiting for one lump sum. The apps use your employment information as verification of your earnings instead of your personal bank account.

Some of these apps also pair with gig providers like Uber, DoorDash, Instacart, etc.

If you’re unsure whether your employer has partnered with a cash advance app, ask. If they haven’t, maybe they’ll consider a partnership.

Here are the most reliable and popular employer and gig provider-sponsored cash advance apps:

- ActiveHours

- Amazon Anytime Pay

- Axos Bank Direct Deposit Express

- Branch

- Dailypay

- Even Instapay

- Flexwage

- PayActiv

Peer-to-peer loan apps

Finally, if you aren’t sure about cash advance apps and your employer doesn’t sponsor this service, try a peer-to-peer loan. These match private individuals or groups who want to loan money to others. In exchange, they collect the interest.

Here are some of the top P2P lending platforms:

- SoLo Funds combines lending and social media in a unique way. Here’s how the platform works: Hopeful borrowers create listings that ask for money. Lenders then browse the listings and send money to the people whose listings they like best.

- Lenme is the inverse of Solo Funds. With LenMe, hopeful borrowers post their requests and then the lenders compete to offer those borrowers the best deals. The borrowers decide which loan to take. Lenme charges borrowers a $3 minimum or 1% of the total loan amount. Lenme also doesn’t require Plaid for use.

- Zirtue is more of a lending facilitator. You request a loan from someone you already know. They agree to lend you the money. Zirtue acts as the go-between to ensure that rates are fair, payments are made on time, etc.

READ MORE: 8 steps to break the payday loan cycle for good

What you need to know about FloatMe

FloatMe is a paycheck advance app that loans or “floats” you $50 until payday. You can use the money however you need to, whether it’s to buy groceries, fill up the gas tank or pay a bill.

FloatMe doesn’t charge interest, but it does charge a $3.99 per month “connection fee.”

The low borrowing amount and difficulty canceling the service means you may be better off choosing a different app.

Pro tip: FloatMe only allows one $50 float at a time, and there are no repayment deadline extensions or loan “rollovers.”

READ MORE: FloatMe review

FloatMe’s legal challenges

In January 2024, the Federal Trade Commission sued FloatMe and its co-founders, alleging that FloatMe’s app was designed to thwart cancellation and the company charged users without their consent.

The lawsuit says FloatMe lured customers with promises of $50 Floats, but only .05% of customers were eligible to borrow the full $50.

The FTC also alleges that FloatMe’s cofounders were aware that FloatMe was “double or triple” charging subscription fees but didn’t immediately fix the issue.

FloatMe was also named in a class action lawsuit, Pierce et al. v. FloatMe Corp., filed on February 28, 2024, in Pennsylvania. The case alleges FloatMe charges rates higher than legally allowed in the state, citing more than 1,000% APR equivalents.

READ MORE: Best cash advance apps

The bottom line

If you need a short-term loan, apps like FloatMe will almost always be a better option. There are no hidden fees or loan rollovers and repayment terms are more flexible.

However, some of these apps are significantly more expensive than others. It’s best to choose the one that best suits your needs so you aren’t paying extra each month for features you don’t want or need.