Dave is one of the most popular cash advance apps, but there are plenty of other alternatives with a variety of benefits, including interest-free loans with instant access to your money.

Here are 14 other online banking options that can help you get the cash you need to make it to payday.

Table of Contents

Dave ExtraCash at a glance

Dave ExtraCash is a popular option for short-term cash advances until payday. Here are some of Dave’s key features:

| Loan amount | Up to $500 |

| Repayment term | Two weeks |

| Monthly membership fee | $1 per month |

| Credit check | No |

| Time to funding | 5 minutes or less (with extra fee) |

| Does Dave offer a checking account? | No |

| Does Dave require Plaid? | No |

| Does Dave offer an ATM/debit card? | Yes, the Dave Debit Mastercard |

| Credit-building | Dave reports regular rent payments to the credit agencies to help boost your credit score. |

| Additional fees | No late fees or overdraft fees |

| Does Dave require direct deposit? | No, unlike most cash advance apps, Dave Extracash doesn’t require direct deposit. |

Here are a few of the best cash advance apps like Dave

If Dave doesn’t work for you — or you simply want to explore other options — here are some of the best apps like Dave that are available.

No monthly fee: Klover

Klover offers small advances of up to $200, but you’ll have to establish a steady borrowing history to be able to borrow that much. There are no interest charges, hidden fees or credit checks. Instead, Klover sells your data to offset expenses and allows users to accumulate points to borrow more money. Klover charges a small monthly fee for Klover+, which includes upgraded features, but it is not required for Klover cash advances.

- Monthly fee: None for cash advances, $3.99 per month for Klover+

- Credit check: No

- Maximum advance: Up to $200

- Checking account available: No

- Debit/ATM card offered: No

- Credit-builder loans: No

- Overdraft/Returned Payment fees: None

- Other perks: Klover offers opportunities to earn points that enable you to increase the amount you can borrow, and they also have daily sweepstakes where one user per day can win $100 and five runners-up can win $20

The app with attitude: Cleo

Cleo is an AI-based platform designed to appeal to Generation Z. Cleo will mock your spending habits and reply to texts like a friend. Cleo even has pronouns (she/her). Cleo offers small cash advances along with some straight talk about spending habits. You can also ask Cleo whether you can afford to make a purchase, like whether that late-night pizza you’re craving is within reach.

- Monthly fee: $5.99 per month, or $14.99 for a “Builder” account that includes credit-building features

- Credit check: No

- Maximum advance: Up to $250

- Checking account available: No

- Debit/ATM card offered: No

- Credit-builder loans: Yes, with the “Builder” subscription

- Overdraft/Returned Payment fees: None

- Other perks: Offers straight talk about your spending habits and is easy to chat with

READ MORE: Cleo app review

Free trial offer: Empower Cash Advance

Empower acts more like a bank/money manager than a lender. If you want help managing your money, Empower connects to all your existing accounts and helps you track your spending and savings from a single location. If you’re interested in the cash advance, you’ll need to open an account. Here’s the important stuff:

- Monthly fee: $8 (after a free 14-day trial)

- Credit check: No

- Maximum advance: Up to $250

- Checking account available: Yes

- Debit/ATM card offered: Yes

- Credit-builder loans: No

- Overdraft/Returned Payment fees: None

- Other perks: Cashback (up to 10%), budgeting tools, etc.

Offers extra tools: Brigit

Brigit offers users various products and tools to help them stay on track financially. It also offers help with building credit, budgeting and even finding part-time or gig work for users who don’t mind paying a monthly fee. Here’s the important info:

- Monthly fee: $9.99 (required for cash advances)

- Credit check: No

- Maximum advance: Up to $250, depending on your “Brigit Score.”

- Checking account available: No

- Debit/ATM card offered: No

- Credit-builder loan: Yes

- Overdraft/Returned Payment fees: None

- Other perks: Account monitoring, identity theft protection

READ MORE: Brigit app review

Multiple advances per pay period: Earnin

Earnin bills itself as the app that lets you “get access to money as soon as you earn it.” The app lets you advance up to $100 per day and $750 per pay period. The app also offers Balance Shield, which links to your bank account. With it, you choose a minimum account balance that you want to maintain. When you get close to that amount, the Earnin app will notify you and let you know how much you can advance to keep your account from overdrafts.

Earnin offers Lightning Speed, which promises instant access to your money. However, there are a number of criteria you must meet, and you’ll have to pay an extra fee for the convenience.

Here’s what else you need to know:

- Monthly fee: None

- Credit check: No

- Maximum advance: $100 per day, $750 per pay period

- Checking account available: No

- Debit/ATM card offered: No

- Credit-builder loans: No

- Overdraft/Returned Payment fees: None

- Other perks: “WeWin” members are entered for a chance to win money every time their account increases by $10

Access to a “Genius”: Albert

Banking and financial advice are Albert’s primary services, and the app also offers small cash advances and budget tracking. Albert will send notifications when a bill is due and will track your spending in various categories, like restaurants or entertainment. Albert users who set up an account with direct deposit can access their paycheck up to two days early.

What sets Albert apart is that it doesn’t rely on an AI bot for financial advice. Albert allows users to connect to actual humans (or “Geniuses”) for answers to their questions. However, that feature isn’t free. Genius access and cash advances require a monthly subscription.

- Monthly fee: $14.99

- Credit check: No

- Maximum advance: Up to $250

- Checking account available: Yes

- Debit/ATM card offered: Yes, Genius subscribers can withdraw cash fee-free at 55,000+ ATMs

- Credit-builder loans: No

- Overdraft/Returned Payment fees: None, though you could incur a fee through your bank

- Other perks: Genius subscribers get cash back on gas️, groceries, delivery, and more when they use their Albert debit card. Subscribers can earn an average of $2.00 per tank of gas and $1.50 per fast food order

READ MORE: Albert review

Lots of extra features: MoneyLion

In addition to a cash advance, which it calls “Instacash,” MoneyLion offers a checking account, credit building, and much more. It offers so many options, it can feel overwhelming, and the monthly subscription fee varies based on the options you choose.

For its Instacash customers, the process is straightforward. Like Dave, you need to link your bank account directly to the app. You’ll be approved for an advance if you have a steady income or qualifying deposits. New users are usually limited to $25 for their first advance. However, as they build a history with the app, they can increase their borrowing limit to $250.

- Monthly fee: $1 to $19.99

- Credit check: No

- Maximum advance: $25-$500, or up to $1,000 if you have a “Roar!” checking account.

- Checking account available: Yes

- Debit/ATM card offered: Yes

- Credit-builder loans: Yes

- Overdraft/Returned Payment fees: None

- Other perks: It depends on the product

Small advances: FloatMe

FloatMe’s service is very basic. They offer small cash advances (or floats) of up to $50. To qualify, you have to pay a monthly fee, which can be high in proportion to the small amount you can borrow.

- Monthly fee: $3.99

- Credit check: No

- Maximum advance: $50

- Checking account available: No

- Debit/ATM card offered: No

- Credit-builder loans: No

- Overdraft/Returned Payment fees: None

- Other perks: None

READ MORE: FloatMe review

Short-term installment loans: Possible

Possible Finance offers installment loans that are better alternatives to payday loans. This is true, but only barely. Possible loans are only offered in small amounts with high interest rates. However, the interest rates are still lower than the average 300% APR you’d pay a payday lender. The loans are paid back in four installments over eight weeks instead of a single lump-sum payment, making it easier for borrowers to avoid the payday loan debt trap. Possible also checks your credit score and reports to the three major credit bureaus, so on-time payments could bump your credit score.

First-time borrowers will only be approved for up to $500 and the interest rates are 150%-200%, depending on where you live, the amount you borrow, etc. While this is much lower than you’d pay a payday lender, it is much higher than you would pay any of the other apps listed here.

Pro tip: Other popular cash advance apps include Kora, Current, Vola, 15M Finance, Gerald, Hundy and Loan Hunter.

Banking apps that will spot you some cash

These banking apps offer small advances to cover you until payday.

Chime

Chime is a bank account that allows its users to access paychecks a few days early — with qualifying direct deposits. The company also has a product they call “Spot Me.” “Spot Me” offers overdraft protection, allowing users to overdraft their accounts without facing any penalties. The amount a user is allowed to overdraft depends on various factors.

Chime is partnered with two FDIC-member banks, Bancorp Bank, N.A. and Stride Bank, to ensure that your deposits are safe.

- Monthly fee: None

- Credit check: No

- Maximum loan amount: Eligible SpotMe enrollees can overdraft up to $200 per pay period

- Checking account available: Yes

- Debit/ATM card offered: Yes, the Chime Credit-Builder Visa

- Credit-builder loans? Yes

- Overdraft/Returned Payment fees: None

Varo

Varo is another banking app that’s similar to Chime. Varo offers paycheck advances through a program it calls Varo Advance.

Varo Advance works kind of like overdraft protection. Once you qualify, it gives you access to instant cash up to $500, so you can avoid overdraft fees.

- Monthly fee: None

- Credit check: No

- Maximum loan: $500, but it may be less to start

- Checking account available: Yes

- Debit/ATM card offered: Yes

- Credit-builder loans? No, but it does offer the Varo Believe secured credit card

- Overdraft/Returned Payment fees: None

Employer-sponsored payday advance apps

Your employer may have already partnered with a cash advance app service to help you manage your money. These apps provide pay advances so you don’t have to wait to spend the money you’ve already earned. These are especially popular among employers of “on-demand” workers, like rideshare drivers, delivery drivers, etc.

One@Work (formerly Even Instapay)

One@Work is an app that allows users to access the money they have already earned at work, even before payday. It works with employers to track employees’ time and wages. Employees can log into their app to see how much money they have earned so far during that pay period. If the employee needs the money before payday, they simply request it. The employee doesn’t have to pay taxes or fees on their advance. All of that is taken care of by the employer.

Unfortunately, right now, One@Work is not available for individuals or the self-employed. It is only available through your employer. There are no fees for employees.

Branch

Like Even Instapay, Branch is a tool that employers can use to allow employees to access their wages as soon as they are earned. What makes Branch great is that it is also set up for people who employ gig workers and independent contractors.

In addition to on-demand payments, Branch also offers resources like tip and mileage trackers to help with reimbursements, off-cycle payments, etc.

Axos Bank Direct Deposit Express

Axos Bank has grown greatly in popularity over the last couple of years. This is probably because of its Direct Deposit Express. Axos Bank’s Direct Deposit Express helps you get your paycheck a few days earlier than usual. Usually, banks make you wait to access your funds until after your paycheck has cleared. Axos deposits the amount of your paycheck into your account as soon as they get notified of an incoming direct deposit. Then they keep your deposit when it clears.

Other good options to check out (or to mention to your employer) are:

What makes the Dave app stand out?

Dave is one of the most popular financial apps currently on the market. You may have seen Dave’s TV ads featuring a cute cartoon bear. It offers cash advances of up to $200 for people to help them prevent their bank accounts from overdrafting while waiting for their next paycheck. The company also offers a checking account to people who might have trouble getting (or do not want to use) traditional bank accounts.

Dave doesn’t require direct deposit to get an advance through ExtraCash. This makes it ideal for gig workers or people who have a steady income but not a steady paycheck. Instead, you need:

- At least three recurring bank account deposits into your Dave checking account

- Monthly deposits amounting to at least $1,000

- A minimum history of 60 days with your bank account

- To be a U.S. resident

- To be age 18 or up

- To pass an identity verification

- A Social Security number

For returning users, Dave also considers repayment history when deciding whether to provide another advance and how much to advance you.

Dave doesn’t require Plaid

Dave doesn’t require access to Plaid, a platform that connects your banks to various money sites. If you don’t have access to Plaid, your cash advance options are much more limited, Right now, in addition to Dave, only B9, Grid Money, Cash App Borrow, Venmo, Branch and Line don’t require Plaid.

Pros and cons of Dave

Dave’s biggest pro is that it learns your spending habits. That sounds a bit invasive, but the information it learns is used to help you keep better track of your money. It lets you know if your account gets below a certain amount and if you have an automatic payment coming up but don’t currently have enough in your account to cover it.

Dave also offers Dave Banking, a cash management account similar to an online checking account. If you choose to use Dave Banking, you’ll get a Visa debit card and access to a network of fee-free ATMs. There’s no minimum deposit requirement to open a Dave Banking account.

Pros

- No interest charges

- Easy qualification terms

- Dave doesn’t charge late fees

- Cash advances up to $500 with Extracash

- No credit check

- Much cheaper than dealing with an overdraft fee

Cons

The biggest drawback to using Dave is the same as its biggest benefit: it requires access to your bank account and tracks your spending habits. Not everybody loves sharing that information.

Other cons include:

- Monthly membership fee (it’s only $1, but every bit counts)

- Automatically withdraws payments for both advances and monthly fees from your bank account

Customer reviews

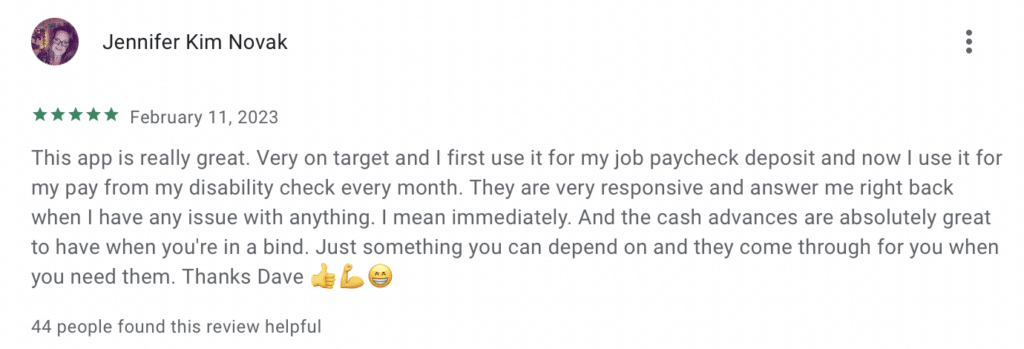

Dave has earned a B grade from the Better Business Bureau (BBB). It has 4.3 out of 5 stars from Google Play, and 4.8 stars from Apple’s App Store.

Upvoted helpful customer review:

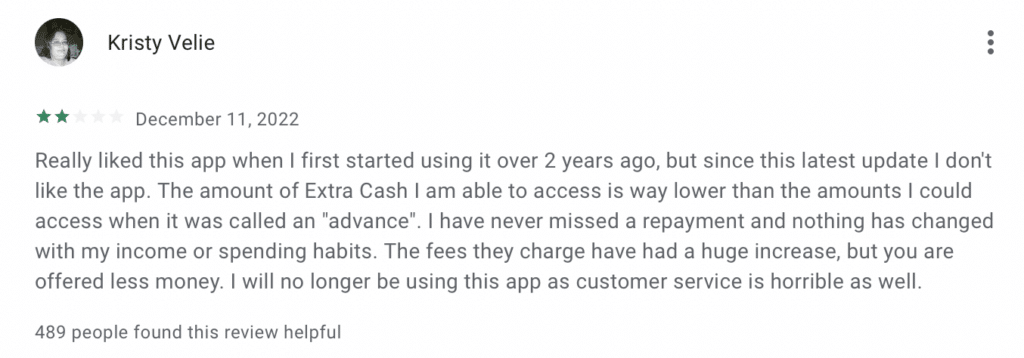

Upvoted helpful negative review:

Want to learn more about Dave? Check it out now.

How do cash advance apps work?

A cash advance app, also called a payday advance app, is a mobile app that will send you money to help you cover your expenses while waiting for your next paycheck. When that next payday arrives, the app will automatically deduct the amount of your advance from your deposit.

These apps are available on iPhone (iOS) and Android smartphones. Many even have traditional websites you can use if you’re not entirely sure you want to use your phone.

Cash advance apps allow users to access money they’ve already earned before it has been deposited.

They are skyrocketing in popularity: 33% of Americans have borrowed money using a cash advance app.

Cash advances may take a few days to post to your account

You can submit a request once you have been approved for an advance. These apps are designed for speed, so the money should arrive quickly. Some loans are approved and funds are sent within minutes. Others may take 1-2 business days. If you need the funds immediately and need to bypass a waiting period, some apps will allow you to do so for a small fee.

Apps like Dave are better than payday loans

There are many reasons that cash advance apps are better than payday loans. Apps rarely charge any interest, let alone exorbitant interest. Their repayment terms are flexible. They are easier to access.

Payday loans are designed to keep you financially desperate, so you need more payday loans. This is what keeps them in business.

The bottom line

Even the best budgeter can run short on cash toward the end of a pay period. Cash advance apps are made for this: to help you bridge the gap between paychecks.

Dave is an excellent option with a low subscription fee and minimal requirements. But Dave won’t work for everyone, and if you need an alternative, you have plenty of options.

FAQs

Klover offers small cash advances without requiring a monthly subscription.

Dave won’t check your credit score to determine whether you’re eligible for a cash advance. Dave reviews your banking information instead, weighing factors like income, account balance and spending patterns.

Plaid is a platform that securely connects apps with financial institutions. But some of the major banks aren’t compatible with Plaid. Because Dave uses both Plaid and Galileo Financial Technology (a similar platform), you can often sign up for Dave even if you use a bank that isn’t compatible.