Payday loans are never good. A cash advance app can be a better alternative for those needing extra cash before their next paycheck.

Klover is a legitimate option for quick, no-interest loans — but there’s a catch.

Our take: Klover is a legitimate way to get short-term cash advances of up to $200, and it has no paid subscription requirement. It’s easy to use. However, the trade-off is that Klover makes money by selling user data to be used for anonymous market research and advertising. This may make some people uncomfortable. You’ll also have to earn Klover “boosts” to increase the money you can borrow. However, Klover has earned an A+ rating from the Better Business Bureau.

Table of Contents

Key points

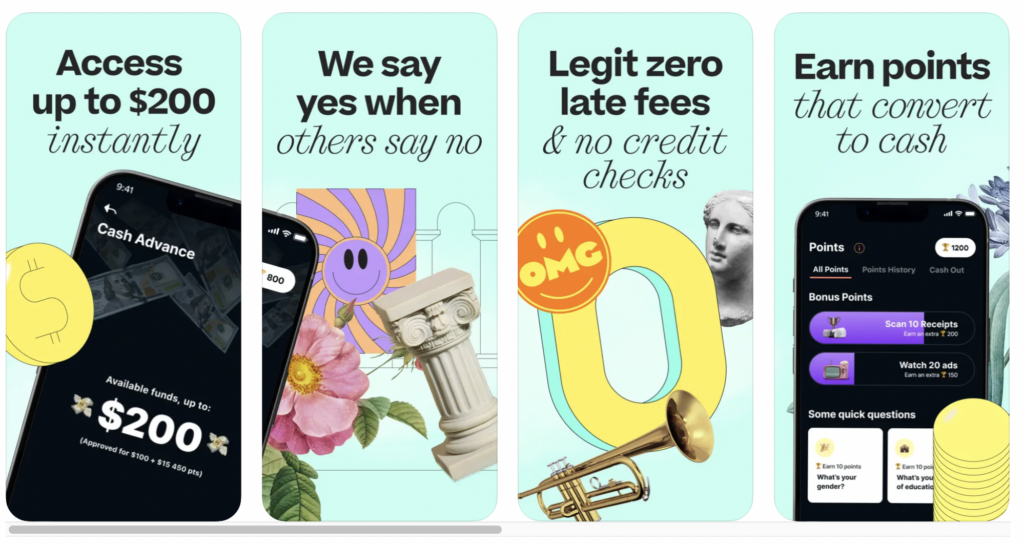

- Klover is a legitimate app that offers short-term loans of up to $200

- Klover calls its cash advances “boosts”

- The maximum initial “boost” you’ll be able to get from Klover is $100

- You can earn larger “boosts” by completing various activities

- Klover makes money by selling data — if this is a concern for you, choose one of our other highly-rated alternatives for quick cash advances

Update: Due to a change in state laws, Connecticut customers can no longer request a Klover cash advance with immediate debit delivery unless they use points to pay the delivery fee.

Klover cash advances: What you need to know

Klover is a Chicago-based company established in 2019. It offers a quick, convenient way for consumers to borrow small amounts of money to carry them over until their next payday. The maximum available cash advance is $200, but you’ll have to establish a steady borrowing history to be able to borrow that much.

There are no interest rate charges, hidden fees or credit checks. Instead, Klover sells your data to offset expenses and allows users to accumulate points to borrow more money.

Klover+ costs $3.99 monthly, but a Klover+ subscription is not required for cash advances. This makes Klover one of the lowest-cost options available.

Pro tip: According to a Klover customer service representative, Klover+ is automatically activated as soon as you link your debit card. You will need to cancel the membership if you simply want cash advances.

“Failure to cancel your Klover+ subscription will result in your account being charged a membership fee,” Klover said in a written response, adding that canceling the paid subscription will not delete your Klover account.

How much money can I borrow through Klover?

According to Klover’s official website, consumers can borrow up to $200. However, most borrowers start out at a maximum of $100 or less.

Even though the starting limit is lower than some of the other cash advance apps, Klover also uses a points system to increase the limit.

What is a Klover app boost?

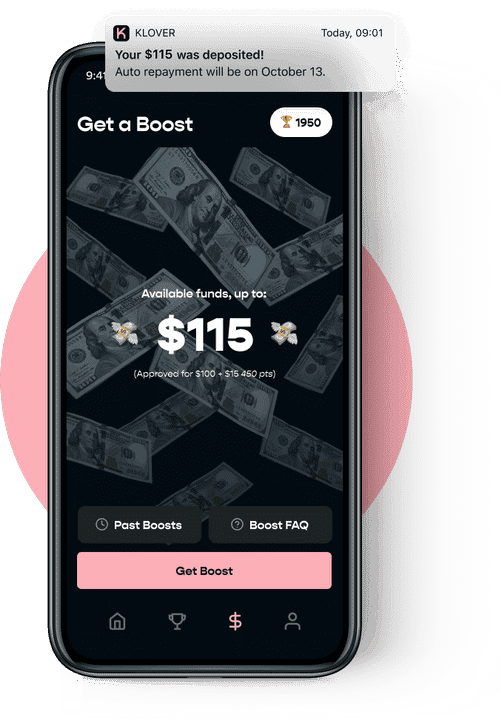

When a subscriber needs money, they request a boost. To increase the maximum boost, the borrower must accumulate points.

Before you’re eligible for boosts, you must link a bank account with at least three consecutive direct deposits. After you complete this step, Klover will determine the amount of your initial “boost.” Note that it could initially be as low as $20. The good news is that you can use Klover’s points system to earn enough points to borrow more. money. Points start to accrue as soon as you sign up, and they continue to increase with regular use of the app.

How to earn points through Klover for bigger boosts

The key ways to earn points are:

- Scan receipts from purchases made using the debit card linked to the account. Each receipt is worth up to 20 points

- Use the app to monitor spending habits to earn 50 points

- Watch video ads: Each ad is between 10 and 30 seconds long and adds a few points

- Save $100 in a given month for an additional 200 points

- Complete surveys for a few points

- Refer a friend to Klover. If they sign up (and qualify) for the app, this will add 600 points to the total balance

The total points you earn will determine the potential increase in the borrowing limit.

Ten points equals $3. For example, 300 points add an extra $10, while 900 points add an extra $30.

No membership fee is required

Klover does not charge any interest or late fees on your short-term loan. However, it charges a membership fee of $3.99 per month for Klover+. A Klover+ subscription is not required to be eligible for boosts.

However, even if you opt to pay the membership fee, there’s no guarantee that you’ll be eligible for cash advances.

Klover lists the following notice on its website:

“Klover memberships do not entitle you to boosts. Instead, our membership program gives you access to our financial tools, extra points, credit monitoring and giveaways.”

Klover+ benefits

Klover+ is a premium subscription with a monthly membership fee of $3.99. While you do not have to subscribe to Klover+ for cash advances, it includes the following extra benefits:

- Access to financial advisors

- Credit monitoring

- Help to track spending habits

- Real-time price comparison tool

- Options to earn bonus points to increase cash advance amounts

How the Klover app works

Borrowers start by downloading the Klover app. It is available through Google Play for Android and Apple’s App Store for ios.

Next, you must enter some basic information and connect your checking account to the Klover app.

Pro tip: Klover will not let you get past the introductory pages until you link your account via Plaid. If your bank isn’t compatible with Plaid, you won’t be able to use Klover’s mobile app.

Once the account is set up, there is a 24- to 48-hour waiting period in which the user’s information and account are verified.

After this, the user can request a cash advance or “boost.” It usually takes 1 or 2 business days for the money to be deposited into the account, but if you need it faster, you can pay a fee for an instant cash advance.

Once the money is in the borrower’s account, they can spend it as needed. The app will automatically withdraw the amount borrowed from the borrower’s paycheck on their next payday.

On the repayment date, Klover takes out the same amount borrowed. For example, if someone takes out $50, the app will also withdraw $50.

READ MORE: How cash advance apps work

Klover’s daily sweepstakes

One of the perks of Klover is a daily drawing where subscribers can win a $100 prize, and five runners-up win $20. Each point you earn equals one sweepstakes entry. Prizes are credited to your linked Klover debit card.

Budgeting tools

In addition to cash advances, Klover offers a few budgeting tools. These can help you:

- Manage expenses

- Monitor spending and set spending limits

- Make better financial decisions

- Set goals

How long does it take to get money from Klover?

Klover offers a standard ACH service, which is free, and an immediate debit option for instant cash advances.

With the standard option, requests for funds are typically processed within two business days. The funds are then directly deposited into the user’s linked checking account by the following day. There is no charge for this service. The speed for the free ACH transfers will depend on your financial institution.

The immediate debit option, however, expedites the transfer of funds, providing almost instant access to your money, even on weekends. The express fee ranges from $1.99 to $16.78, depending on the advance amount.

Klover makes money through customers’ data

While many cash advance apps make money from tips, Klover does not. Klover mainly makes money by leveraging its users’ data.

When you download the Klover app, you must agree to opt-in on a Truth in Data agreement. This agreement indicates that the user data will be used for anonymous market research and advertising.

Klover takes data from anonymous users and makes deals with partners or affiliates to show users relevant ads. The users may then watch those same ads to increase their points for additional boosts and sweepstakes entries.

Then, Klover takes a cut from the advertising revenue. Klover’s partners, meanwhile, benefit by gathering market research.

Klover says it does not sell or share information that could help its partners identify the users.

Pro tip: If you’re concerned about your data being used for targeted ads or collected by anonymous companies, Klover is probably not the service for you. You’d be better off choosing a tip-based service, like Dave.

Klover is legitimate

Klover is only a few years old but is a legitimate app with a secure financial service.

Klover promises top-notch security. They pledge to keep it protected using bank-level, military-grade 256-bit encryption technology.

In addition, Klover has earned an A+ rating from the Better Business Bureau.

Klover pledges to keep your data safe

Klover shares real-time consumer transaction data, survey-based data and retailers-specific data from major retailers in exchange for access to financial services, but it does not sell or misuse any personal data or other identifiable information in any way. Klover also says it is simple for users to delete their data anytime.

Besides that, Klover uses 256-bit encryption to keep its customers’ data safe and secure. Using 256-bit encryption is one of the most secure ways of protecting online information. It is used in nearly all modern security systems and would take years to get through.

“We believe consumers’ data is an extremely valuable asset and should be used to their benefit,” said Klover CEO and co-founder Brian Mandelbaum. “We provide consumer empowerment by allowing Americans to opt to share data and unlock meaningful access to cash and savings in return.”

In short, Klover takes its promise to keep its users’ data safe very seriously.

Customer reviews

Klover has overwhelmingly positive reviews on various app stores.

Many customers praised the app for its simple design and straightforward process. Most users found it easy to set up an account and navigate the app. On multiple occasions, users complimented Klover for helping them and their families out in a financial pinch.

On the other hand, some customers have complained about being charged membership fees without authorization and say Klover continued to charge fees after closing their accounts.

Another customer disliked that the app required them to do different things to accumulate points for boosts (ex. fill out surveys or watch ads). That said, many consumers liked earning points for more cash.

It has:

4.7 stars and more than 157,000 reviews on the Apple App Store. This is one of the most helpful Apple App Store reviews:

4.3 stars and over 56,000 reviews on the Google Play Store. This is one of the most helpful Google Play reviews:

The Better Business Bureau gives Klover an A+ rating but Klover has only earned one out of five stars from customer reviews.

Borrowing requirements

Borrowing through Klover is relatively easy, but consumers must meet a few qualifications before signing up and making their first transaction. To be eligible, the consumer must demonstrate the following:

- An active bank account that is at least 90 days old and in good standing

- At least three consecutive direct deposits into the account over the past two months

- Consistent employment with the same company. All direct deposits must be from the same employer. Klover does not accept deposits from ATMs, Venmo, Paypal, Cash App, or paper checks. This means Klover won’t be a good option for gig workers or freelancers

- Identical information on the bank statement’s paycheck and previous paychecks. Any inaccuracies or misspellings may be rejected

- A positive checking account balance

- Bi-weekly or weekly deposits into the account. Monthly or semi-monthly deposits will not be accepted. Irregular payments will likely be rejected

Klover’s pros and cons

As with any other cash advance app, Klover has its benefits and drawbacks.

Pros

- Klover does not charge hidden fees or interest

- Once requested, the money is deposited into the account within minutes (if expedited) or 1 to 2 business days

- Klover allows borrowers to increase their borrowing limit by completing simple tasks like watching an ad or scanning receipts. Many other cash advance apps have stricter requirements for those who want to increase their limit

- The app does not require a credit check, meaning there is no hard inquiry or impact on credit score

- It is easy to activate, reactivate or close an account with Klover

Cons

- Klover does not allow any extensions on repaying the cash advance

- Borrowing with Klover does not help build credit

- Klover’s borrowing limit is low

- To qualify, the user must have a checking account. Prepaid or savings accounts are not accepted.

- Klover does not support all financial institutions, such as BECU (a credit union originally established to serve employees of The Boeing Company) or SECU (State Employees’ Credit Union)

- Requires Plaid to sign up

Other paycheck advance apps

Looking for another option? Here are some highly-rated alternatives to Klover.

Disclaimer: DebtHammer may be affiliated with some of the companies mentioned in this article. DebtHammer may make money from advertisements or when you contact a company through our platform.

Brigit

Brigit offers the following:

- Cash advance up to $250

- No credit check, no overdraft and no hidden fees

- Free financial health updates through the app

- Resources on additional earning opportunities

- Automatic payments with up to three extensions

There is also a premium membership for $9.99 a month. With this membership, users receive extra perks like automatic funding in their accounts and instant access to funds.

Brigit requires an active bank account with no overdrafts and at least three direct deposits from the customer’s employer or another main source of income.

Chime

With Chime, users get:

- Immediate access to funds if they have direct deposit

- No monthly fees

- Limited overdraft protection ($20 to $200)

- Access to 38,000 free in-network ATMs

- Security through a partnership with an FDIC-insured institution

- Potential earnings from a high-yield savings account

To qualify, users must meet minimum income requirements and have a valid checking account.

Cleo

Cleo offers:

- Cash advances of up to $250

- No interest charges

- To get cash advances, you must pay a subscription fee of $5.99 a month

- Will monitor and assess spending habits and offer budgeting tips

- Will roast you if you make questionable financial decisions and hype you when you make good choices

- You can text Cleo’s AI chatbot for advice or to ask whether you can afford to purchase an item

- Conversational and relaxed tone

Earnin

Earnin offers customers the following:

- Up to $100 per day in a cash advance or $500 per pay period

- No credit check

- One payment extension

- Extra security via an FDIC-insured bank

- Financial tools like a savings tool and low balance alert

- Overdraft protection (if selected)

The app is free, but users may tip up to $14 per $100 to help support it. Users must also have a steady job with regular deposits, an active account, and direct deposits.

Dave

With Dave, customers get:

- Up to $500 cash advance with Extracash

- Immediate access to funds with direct deposit

- No credit check

- Tiered membership system for higher cash advances

- Credit-building

- Access to more than 30,000 free ATMs

Dave doesn’t require a minimum account balance, but the app costs $1 monthly to use it. Users must have consistent direct deposits into their accounts.

MoneyLion

MoneyLion offers the following:

- Up to $500 cash advance (or $1,000 if you use other MoneyLion products) in 1 to 5 business days with Instacash

- No credit check

- No hidden fees

- Cashback on debit card purchases with the option to auto-reinvest earnings into a small investment portfolio (for members)

Membership costs a few dollars a month and offers additional perks like a higher cash advance limit, instant access to funds and ways to help build credit. Users start at a low limit ($25) and can build up to $250 or $300 with regular use and deposits to a linked account.

Varo

Varo offers online banking services and emergency loans. It also offers:

- Small cash advances from $20 to $500

- No interest

- Debit card purchase rewards and up to 15% cash back

Users must pay a small fee for cash advances, ranging from $1.60 to $40. Customers must have at least $1,000 in direct deposits in the past month to qualify.

The bottom line

Cash advance apps have grown rapidly in popularity — 33% of Americans have now borrowed money through one.

Klover is a legitimate cash advance app that can help you escape a sudden financial jam without turning to a payday loan. Unlike most apps, there is no monthly membership requirement, making this a low-cost way to borrow. Fees for instant transfers can be high, so it’s best to set up your account and start building points before you need any advance.

FAQs

Klover was founded in 2019 by CEO Brian Mandelbaum & CTO Dominic Bennett.

The best way to contact Klover is via email at [email protected]. Klover’s phone number is 888-293-8767. The mailing address is 222 West Hubbard Street, Suite 210, Chicago, IL 60654.

Yes, Klover is compatible with Chime. This mobile banking app allows borrowers early access to monies already earned before payday. Chime has a lot of benefits, but it can sometimes be difficult to find compatible cash advance apps.