If the utility company is threatening to cut off your water if you don’t pay the bill immediately, but payday is a week away, you may feel like a payday loan is your only option.

It’s not.

Possible Finance offers small personal loans. You don’t have to repay them on your next payday, but the loans have interest and fees.

If you simply need money for two weeks, you may not want to deal with a longer-term loan (and the credit score implications it may have.) If that’s the case, here are 11 apps like Possible Finance that offer short-term cash advances.

Table of Contents

11 best apps like Possible Finance

- Best if you need help from a “Genius”: Albert

- Best for flexibility: Brigit

- Best if you need straight talk: Cleo

- Low monthly fee: Dave

- Get up to $100 a day: Earnin

- Best for free trial: Empower

- Best if you only need a small advance: FloatMe

- Best to win money: Klover

- Best for extra services: MoneyLion

- Best for overdraft protection: Chime

- Best one-stop option: Varo

Disclaimer: DebtHammer may be affiliated with some of the companies mentioned in this article. DebtHammer may make money from advertisements or when you contact a company through our platform.

Here are the best apps like Possible Finance

If you don’t want to work with Possible, or you’re just looking for some extra options, here are the best apps for quick cash advances:

Best if you need help from a “Genius”: Albert

- Albert users can get: Up to $250

- Credit check: No

- Interest and fees: None

- Pro plan: Albert’s pro plan is called “Genius,” and it’s required for all cash advances. It costs $14.99 per month

- Also offers: banking (comes with a debit card), balance monitoring (even for outside bank accounts) investing help

- Perks: Help negotiating down bills, banking customers can get cash back when they use their Albert debit card

READ MORE: Albert review

Best for flexibility: Brigit

- Brigit app users can get up to $250

- Credit check: No

- Interest and fees: None

- Free plan offers: Financial insights, financial advice, links to gig working services

- Plus membership includes: everything in the free plan as well as credit building, identity theft protection, immediate deposits, automatic advances, flexible repayment plans

- Brigit’s Plus plan costs $9.99 a month and is required for cash advances; Brigit also offers a Premium plan that includes credit-building products

READ MORE: Brigit review

Best if you need straight talk: Cleo

- Cleo users can get a first advance limit of up to $70, which grows as you build a solid repayment history with the app

- Credit check: No

- Cost: $5.99 per month membership fee is required to get cash advances

- Interest and fees: None

- Cleo is AI-based, and the app will roast and praise your spending habits — it’s designed for people who sometimes need a bit of a reality check

READ MORE: Cleo review

Low monthly fee: Dave

- Dave users can get up to $500

- Credit check: No

- Cost: The Dave app charges a $1 per month membership fee

- Interest and other fees: None

- Also offers: Banking, budgeting help, goal setting, balance monitoring and credit building through Level Credit

Get up to $100 per day: Earnin

- Earnin users can get up to $100 per day or $750 per pay period

- Credit check: No

- Interest and fees: None

- Also offers: Balance Shield, Cash Out (access to wages as soon as they’re earned) Earnin’ Express, finance tools, savings tools

Best for free trial: Empower Cash Advance

- Empower users can get up to $250

- Credit check: No

- Cost: Free 14-day trial, then $8 per month membership fee

- Interest and other fees: No interest charges, $3 fee to have advance deposited in an outside bank account

- Also offers: Banking

Best if you only need a small advance: FloatMe

- FloatMe users can get up to $50

- Credit check: No

- Cost: $3.99 per month membership fee

- Interest and other fees: None

- Also offers: Financial insights

Best to win money: Klover

- Klover users can get up to $200

- Credit Check: No

- Interest and fees: None

- Pro plan: $3.99 per month for Klover+, which is not required for cash advances

- Klover has a daily sweepstakes, and users can win up to $100

READ MORE: Klover review

Best for extra services: MoneyLion

- MoneyLion users can get: Up to $500 in Instacash advances

- Credit check: Not for Instacash advances

- Cost: $1 to $19.99 per month depending on which services you choose

- Interest and fees: None

- Also offers: banking, credit building, investing, crypto, financial planning, cashback rewards, financial tracking, safety net building

Online banking apps

If you’re not super familiar with fintech, it’s easy to mix up online cash advance apps with online banking apps. This is because so many of the services offered overlap! As you read above, a lot of cash advance apps offer banking services, balance monitoring, etc. Online banking apps usually offer some form of cash advance/early paycheck access, too. So, which do you choose? Ultimately, it’s up to you and your specific needs.

Here are two of the most popular and widely used online mobile banking apps on the market right now.

Best for overdraft protection: Chime

Chime’s SpotMe offers overdraft protection of up to $200. Basically, you can make a purchase even if the money isn’t in your account, and Chime will spot you until payday.

- Chime offers: Checking account (Chime calls it a “spending account), savings account, credit builder loans, credit card, early direct deposit access, automatic savings, overdraft protection (via the SpotMe program)

- Fees: None

- FDIC insured: Yes, through Bancorp Bank or Stride Bank, N.A.

- ATM access: Yes. Use the ATM finder to find the nearest in-network ATM

Not all cash advance apps are compatible with Chime, so if that’s where you bank, do a little research before choosing an app.

Best one-stop option: Varo

Varo is a one-stop banking app that offers cash advances up to $500 through Varo Advance. However, you won’t be able to borrow the maximum amount until you’ve established a long-term banking history.

- Varo offers: Checking (Varo calls it “Banking”) accounts, a savings accounts, cash advances up to $500 and credit building (called “Varo Believe”)

- Fees: None

- FDIC insured: Yes. Varo is a member of the FDIC

- ATM access: Yes, Varo is a member of the “AllPoint” ATM network

As with Chime, not all cash advance apps will work with Varo.

Employer-sponsored cash advance apps

In addition to personal cash advance apps, many employers choose to sponsor payday advance access through these apps:

One@Work (formerly Even Instapay)

- Employees are allowed access to up to 50% of their “earned wages.”

- No fees

- Get advance via direct deposit into an existing bank account or in cash at Walmart Money Centers

Branch

- Employees can qualify for up to 50% of what they’ve earned so far in the current pay period

- No fees

- Get advance via direct deposit onto an account connected to a “Branch Card.” The account can also be added to Apply Pay and Google Wallet

Axos Bank Direct Deposit Express

- Not technically a cash advance or paycheck advance. Axos reduces waiting time on your paycheck by depositing your wages as soon as the payroll notifies Axos of an “impending transfer,” instead of waiting for the transfer to clear the ACH

- No fees

- Get advance deposited directly into employee’s Axos bank account—a requirement for accessing their paychecks early

Dailypay

- Employees qualify for however much they have earned in that specific pay period

- No fees

- Advance is direct deposited into an existing bank account

Flexwage

- The amount employees can advance is unclear. The documentation says employees can get “a portion” of what they’ve earned during the current pay period

- No fees

- Advance is deposited directly onto a Flexcard (a Visa debit card)

PayActiv

- Employees can get “a portion” of the wages they’ve earned that pay period. PayActiv doesn’t specify the size of that “portion”

- No fees

- Advance can be deposited into a PayActiv account (accessible via the PayActiv card), outside bank account, prepaid debit card

- Employees can get their advance in cash at any Walmart Money Center

READ MORE: Survey shows 33% of Americans are now using cash advance apps

Peer-to-Peer loan apps

Peer-to-peer (P2P) loan apps are another good option if you need cash but want to avoid the payday loan trap.

There are a lot of P2P lending platforms out there. If you only need a small loan, apps like SoLo Funds and LenMe are your best bet. SoLo funds and LenMe are sort of like a dating app, a social app and a payment platform combined.

SoLo Funds

Here’s how SoLo Funds works: you create a listing. You explain how much money you need, how long it will take to pay it back, and other details. After you publish your listing, it gets put up in the marketplace. The marketplace is where the lenders are, metaphorically swiping through loan requests until they find one they want to fund. As you borrow and repay loans, the lenders will rate you. This rating is your “social score”, and it tells other lenders how reliable or risky you are. The higher your score, the bigger the loan you can request.

READ MORE: Apps like SoLo Funds

Lenme

Lenme works in pretty much the same way, except that with Lenme, borrowers have more power. The borrower creates a listing explaining how much they need and the loan term they want. The lenders then compete to offer the borrower the best terms. Instead of a credit score, borrowers are assigned a Lenme score that gives investors an idea of how risky the loan may be. The borrower looks at all their offers and picks the one they like best. However, this is not exactly a low-cost way to borrow. Many investors will request loan APRs ranging from 100% to 200%, even for borrowers with relatively good credit.

READ MORE: Lenme review

Possible Finance review: What you need to know

Based in Seattle, Washington, Possible Finance is the brainchild of Tony Huang, Prasad Mahendra, and Tyler Conant. According to Geekwire, the founders’ intention was to build a financial product to compete with traditional payday lenders but it wound up being accessed by a much broader network of borrowers. During the interview with Geekwire, founder Tony Huang said this:

“By being more accessible and by reporting to the credit bureaus to help users build a credit history, we’re de-stigmatizing small-dollar loans and expanding financial access to a much larger audience.”

Named one of the fastest-growing fintech companies in Seattle by IBS Intelligence, Possible Finance is not yet available everywhere. According to the website’s footer, they are only licensed to offer loans in 18 states:

- Alabama

- California

- Delaware

- Idaho

- Indiana

- Iowa

- Florida

- Kansas

- Kentucky

- Louisiana

- Michigan

- Missouri

- Oklahoma

- Ohio

- South Carolina

- Texas

- Utah

- Washington

If your state isn’t listed here, stay calm. The company is working on adding more states to its roster.

How does Possible Finance work?

Possible Finance works as most other cash advance apps do. After creating your account, you like Possible Finance to your existing bank account. The platform then analyzes your banking activity to determine whether you qualify for a loan and, if so, how much. It is your banking history that determines your eligibility, not your credit.

What makes Possible Finance stand out?

Loans like those from Possible Finance have more in common with personal loans or installment loans than payday loans or your typical cash advance. You’ll pay interest. And you won’t have to repay the full amount from your next payday.

And unlike most other apps, Possible Finance does a credit check, though the website says that bad credit or no credit won’t matter. The company does a “soft pull” on your credit. According to the company’s support site, this credit check is purely “for fraud prevention and identity verification.” And, since it’s a soft pull, it won’t show up on your credit report or affect your score.

The Possible Finance experience

Here’s a fun thing: if you live in one of the states that do not yet allow Possible Finance loans, you aren’t going to be able to check out the app’s features. Instead, you’ll get this message:

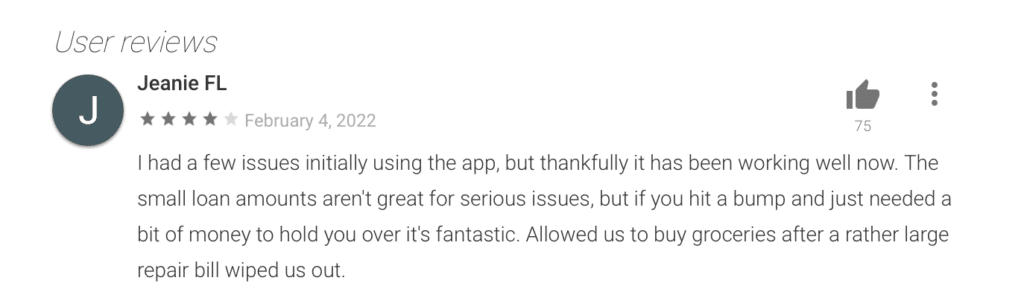

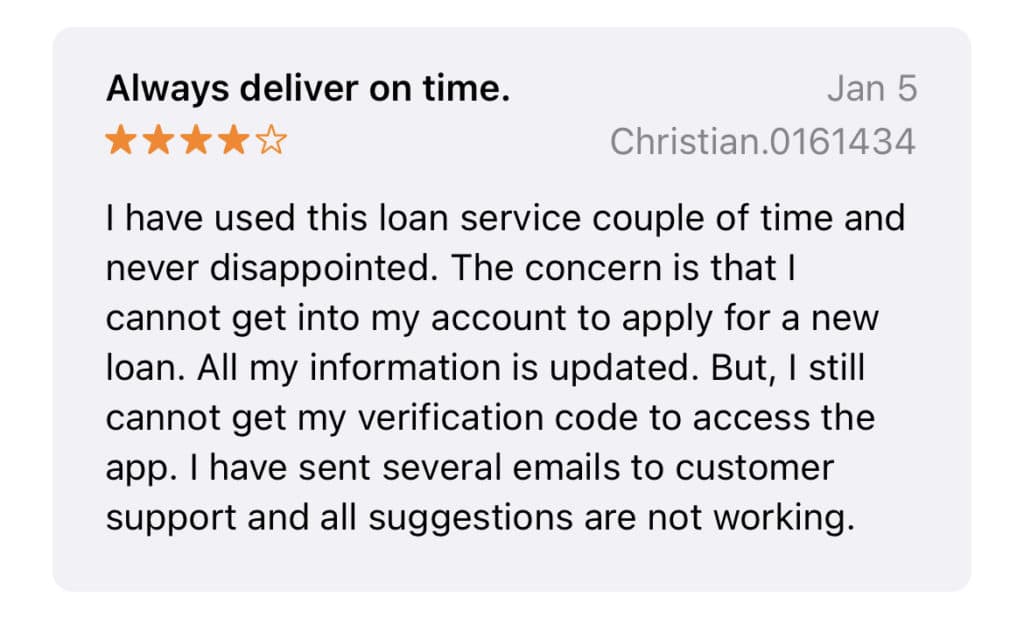

Users who live in “approved” states (our word, not theirs) have found that, while the service Possible Finance provides is awesome, the app itself can be buggy.

Customer reviews

Possible Finance has earned a B rating and 4.59 stars out of 5 from the Better Business Bureau (BBB.) Possible has 4.1 out of 5 stars in the Google Play store, and 4.8 out of 5 stars in Apple’s App Store.

Here’s a review from the Google Play store:

Here’s what iPhone user Christian.0161434 posted in the Apple Store.

Pros and cons of using Possible Finance

The biggest pro of using Possible Finance could potentially also be its biggest con: the company reports your loan and repayment history to all three of the major credit reporting bureaus: TransUnion, Equifax and Experian.

If you make your payments on time and pay off the loan as expected (or sooner), your credit score will go up. If you miss a payment or take longer to pay it off than expected, it could cause some serious damage to your credit score.

Outside of that…

Pros

- Your credit score is not factored into the loan approval process (so bad credit is OK).

- The loan requirements are minimal.

- Loan approval can be fast; you can sometimes get a push notification in a matter of minutes.

- Loan rates are cheaper than payday lenders.

Cons

- They do charge interest on loans (most cash advance apps don’t)

- They don’t offer budgeting tools

- The interest rate is high (though not as high as payday lenders)

- The app is buggy on both Android and Apple (ios) devices

READ MORE: Here are the best cash advance apps

The bottom line

When you’re struggling to make ends meet, a cash app is one of the safer ways to get it. It is better than a payday loan! Make sure, though, that you don’t let yourself become dependent upon these apps. You want your financial situation to improve.