MoneyLion is an app that offers various financial features. One of the most popular is that it can help you get extra cash if you can’t wait for your next paycheck to pay for bills, groceries, gas, or whatever. And they’re interest-free. Here’s what you need to know.

But MoneyLion’s wide array of features comes with a wide array of monthly fees, and the setup might be too complicated for someone who only needs a single quick loan until payday.

If you’re not sure that MoneyLion is right for you, here are 11 more options.

Table of Contents

Here are the best cash advance apps like MoneyLion

While MoneyLion is a favorite of many, there are other cash advance apps to get you what you need, offering checking accounts, personal loans, or ATM cards. There’s an app for everyone to make waiting for the next paycheck not so bad.

Click on the app name to go directly to that information:

Disclaimer: Some or all of the products featured in this article are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. All opinions are our own.

Best for financial features: Brigit

Brigit is an app that helps you “bridge” the gap between paydays, hence its name. The app also keeps track of your banking activity and protects you from overdrafts.

If Brigit sees an expense that will overdraft your account, you’ll get a notification and the option to have Brigit advance you up to $250 to halt the overdraft. However, to be eligible for cash advances, you’ll have to pay a monthly subscription fee that ranges from $9.99 to $14.99, depending on the type of plan you want.

The notification will include a payback date that Brigit determines based on your account activity.

Pros

- Automatic overdraft protection

- Free budget tracking tools

- Optional credit monitoring service

- Easily extend the due date for repayment

Cons

- Doesn’t support irregular pay schedules

READ MORE: Apps like Brigit

Best for Genius access: Albert

Though Albert’s primary services are mobile banking and financial services, the app also offers small cash advances of up to $250. Albert users who set up an account with direct deposit can also access their paycheck up to two days early.

Albert’s best feature is that its “Genius” plan offers access to real humans when you need help. You will need to pay for an Albert “Genius” subscription in order to be eligible for cash advances, which costs $14.99.

Albert has earned a B rating with the BBB.

Pros

- No credit check

- No minimum credit score

- Advances are available in two business days for free

- Checking account

- Debit card

- No fees

Cons

- No credit-builder loans

- No personal or installment loans

- Small cash advance limit

- Additional fee for instant advances

READ MORE: Apps like Albert

Best option with a free trial: Empower Cash Advance

Like other cash advance apps, Empower lets you get a cash advance and repay it from your next forecasted direct deposit. And while it charges no late fees or interest, Empower’s terms let it remove fractional amounts from your account until the entire advance is finished.

Requirements include proof of regular income and giving Empower access to your bank account to qualify for cash advances. Or, if you open an Empower account, you may qualify more quickly and receive free instant funding.

Empower offers a free 14-day trial, but after that it will cost a monthly fee of $8.

Pros

- Free instant fund delivery if you qualify

- 14-day free trial with full features

- Empower checking account generates interest

- Free financial coaching

- Optional recommendations to save money

Cons

- Cannot select cash advance amount

- Monthly fee

READ MORE: Apps like Empower

Best for overdrafts: Chime

Chime is a newer kind of banking service: a financial technology company versus a bank. This means it doesn’t have the same costly overhead as traditional banking and offers lots of benefits a bank doesn’t.

Chime doesn’t technically offer cash advances. Instead, its SpotMe program will “spot” you up to $200 until payday by allowing you to overdraft your Chime debit card account. There are no overdraft fees or other charges.

If you qualify for Chime’s SpotMe program and a charge results in an overdraft, Chime will cover the missing balance (up to your maximum advance) and debit it from your next deposit. This service has no monthly fee, but you will have to open a Chime Spending account (which has no minimum deposit).

Pros

- Automatic overdraft protection if you qualify

- No late fees

- Credit-building tools

- Early paycheck deposits

Cons

- Only covers overdrafts on debit card purchases

- Starts with only a $20 cash advance

READ MORE: Apps that work with Chime

Best for multiple advances per pay period: Earnin

Earnin is another popular cash advance app because it doesn’t ask for a lot of fees. Earnin introduced Balance Shield Alerts and Balance Shield Cash Outs. By turning on Balance Shield Alerts, customers will be notified via push notification when their bank balance falls below an amount they specify, ranging from $0 to $400. If their bank balance falls below $100, they can also enable Balance Shield Cash Outs, which will preemptively cash out up to $100 of their earnings.

Earnin is free to download and use but will request a tip for cash advances. The tip is optional, however.

Earnin began under the name Activehours and offers an atypical way to access your wages before payday: you can withdraw a portion of the money you’ve already earned. You don’t have to wait for your next payday because you get the money within the next business day. Then, Earnin debits it from your bank account when you get paid.

Pros

- Optional tipping instead of fees

- Potential for instant funding

- Early withdrawal of earned wages

- Offers Balance Shield to help you avoid overdrafts

- Can help you reduce medical bills

- Available in all 50 states

Cons

- Tips can quickly get out of hand

- Doesn’t currently support work-from-home

Best AI-based alternative: Cleo

Cleo is designed as a “sassy” alternative. Cleo will even make fun of your spending habits. The idea is to make it seem like you’re talking to a friend rather than an algorithm.

Cleo doesn’t check credit scores or charge interest but has a monthly subscription fee of $5.99.

In addition to small cash advances of up to $200, Cleo also offers budgeting help and credit-building accounts. It can even identify steps you can take to raise your credit score.

Pros

- Helps discourage overspending

- Earn cash back when shopping through the app

- Provides payday advances, but only if you subscribe to the premium plan

- Offers privacy protections

Cons

- AI-powered

- Not FDIC-insured

- Money in your Cleo Wallet doesn’t earn interest

Best for the low monthly fee: Dave

Dave is a financial services app that became popular after getting funding from billionaire entrepreneur Mark Cuban of “Shark Tank” fame. The key role of Dave is to help people prevent overdraft fees. It calls itself “Banking for humans.”

It works by liking Dave to your bank account, and should you be in danger of an overdraft, you’ll get an alert from the Dave app. You can receive an advance of up to $500 that you’ll need to pay back from your next paycheck. There are no mandatory fees, only an optional tip. Dave charges a monthly subscription fee of $1, making it one of the more economical options.

Pros

- Helps prevent overdraft fees

- Includes a budgeting tool that creates a customized plan for you

- Search for gigs with Dave’s Side Hustle service

- Manual or automatic payments

- Doesn’t charge late fees

Cons

- Merely one advance per pay period

- It takes a while to build up to the maximum advance of $500

READ MORE: Apps like Dave

Best for people who work in traditional workplaces: Branch

Branch is mostly an employer-side service, but your employer doesn’t have to use Branch for you to get access to cash advances.

Branch is not available to remote workers. Only people who work in traditional workplaces are eligible. And those who work in traditional offices will still need to meet several other requirements, including:

- Two consecutive months of direct deposits into a checking account at a supported bank

- A debit card attached to your supported checking account

- Recent spending levels Branch doesn’t consider “high”

Unlike apps that loan you money based on fixed limits, Branch’s system checks the hours worked to support your request. If you qualify for an advance, Branch will advance you up to 50% of your upcoming paycheck.

Then, Branch debits the advance amount from your next paycheck deposit.

If you prefer, you can pay an additional fee of $2.99 to $4.99 (based on the advance amount) to receive the money instantly to an external account.

Pros

- Instant advance with Branch account

- Supports contactless payments

- Branch pay card for employers

- No credit checks or contracts

- No late fees

- Max cash advance: $150 per day; up to $500 per pay period

- Up to three business days or instant cash advance for a fee

- Income requirements: two months of consecutive deposits from the same employer

- Fees: none; optional tips

- Loan term: next scheduled payday

Cons

- Doesn’t support remote employees

- A cash advance cannot exceed the wages you already earned

Best for extended repayment terms: Possible Finance

Possible Finance offers short-term installment loans of up to $500. Rates vary by state, but expect to be charged around $15 or $20 per $100 borrowed. This means an APR of around 91% or 122%. This is relatively high, but still lower than a payday loan, and Possible loans can be easier to repay because they don’t have to be repaid in a lump sum.

Every loan has the same two-month term: Borrowers make four payments over eight weeks until the loan is paid off. After the loan is paid, Possible Finance will report those repayments to all three credit bureaus, helping build your credit if you pay on time.

Pros

- Repayments aligned with your payday

- No credit checks

- Can build your credit

- Good customer service

- Quick turnaround with Visa

Cons

- Must have a checking account

- The app may have technical problems

- Not a payday advance app

- Limited availability

Best for chances to win money: Klover

Klover offers small cash advances of up to $200.

Klover uses a points system (called Boosts) to increase the limit users can borrow. Points begin to accrue when a customer signs up and continue to increase with regular app use.

Klover also offers a daily sweepstakes, so users have the chance to win up to $100.

Klover charges a membership fee of $3.99 per month, and to avoid any fees on your cash advance, you may have to wait up to three business days to get the money. If you need cash more quickly, you’ll have to pay an express fee based on how much money you need to transfer. The smallest transfers will cost $1.99 while the largest can set you back up to $16.78.

Pros

- Borrowers can boost borrowing limits by completing simple tasks like watching an ad or scanning receipts

- No credit check

- Activating, reactivating or closing an account is simple

Cons

- Klover does not allow any extensions on repaying the cash advance

- Borrowing with Klover does not help build credit

- Klover does not report to any of the three credit bureaus

- Klover’s borrowing limit is low

- Klover does not support all financial institutions, such as BECU (a credit union originally established to serve employees of The Boeing Company) or SECU (State Employees’ Credit Union).

- Requires Plaid

READ MORE: Is Klover legit?

Best employer-sponsored option: PayActiv

In addition to having the ability to access earned wages before payday, PayActiv users also get aid with financial counseling. The app has a platform designed to serve as more than a payday loan alternative and lets users pay bills and get prescription discounts.

PayActiv also offers a debit card attached to the account to access your money fast and with fraud protection. There’s no charge if users set up direct deposit to the card or users can pay a $1 per day fee when using PayActiv.

Pro tip: Other employer-sponsored apps include FlexWage and DailyPay.

What you need to know about MoneyLion

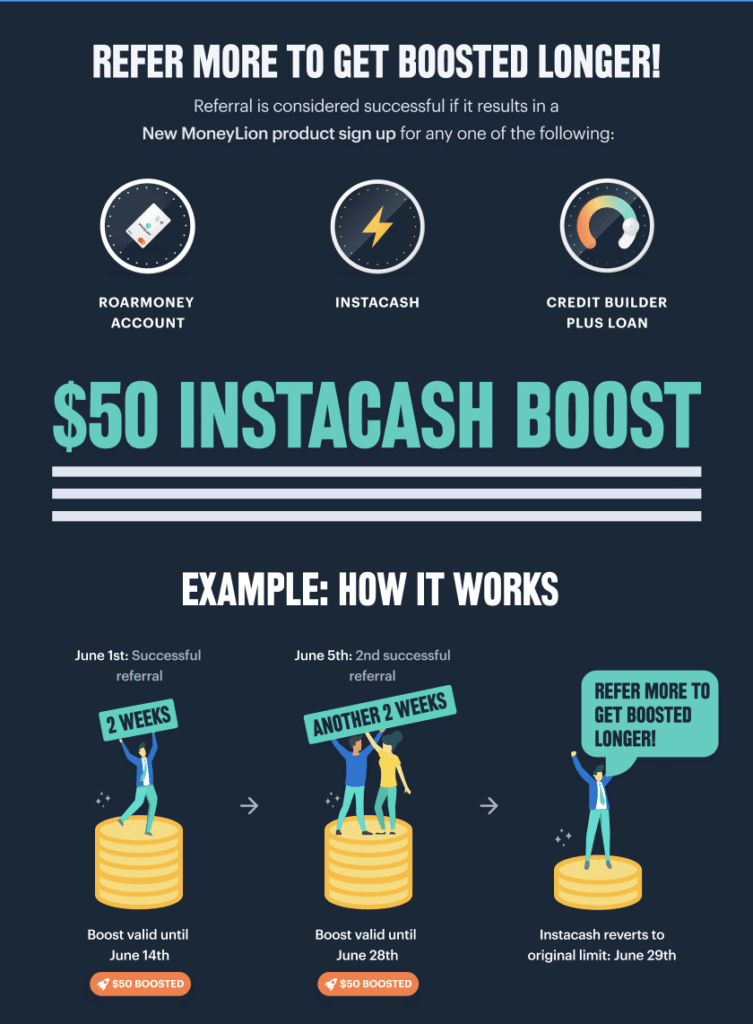

One of the most popular cash advance apps is MoneyLion. MoneyLion offers a wide array of banking services. One of the most popular is Instacash.

If you qualify, Instacash offers same-day cash advances of up to $500 per pay period. MoneyLion will examine your bank account and set the due date to pay it back on the next expected deposit. There are no interest charges or fees.

Requirements

MoneyLion doesn’t need to see employment history. Instead, you only need a checking account to qualify if:

- It’s at least two months old

- Shows regular income deposits

- Has a consistently positive balance

- It’s active

Costs

MoneyLion bases its fees on the services you choose. The cost can range from $1 up to $19.99. There’s no subscription fee for cash advances, but expedited transfers cost between 49 cents up to $8.99, depending on the amount you need.

Pros

- No monthly fee or interest rate

- Fast delivery with a MoneyLion account

- Credit-builder loans available

- No transaction limit per day

- Five-day due date grace period

Cons

- Instant funding costs extra

- Some features require premium members

- Must have a MoneyLion checking account

- Must have funds directly deposited to your account

Apps like MoneyLion are better than payday loans

Cash advance apps will almost always be better than a payday loan when you need quick cash. Both have low loan amounts, but these apps lack the hidden fees and extra costs hidden in payday loans.

Because payday lenders charge sky-high interest rates (often above 600% APR), many borrowers have to take out a second loan just to pay off the first, trapping people in a vicious cycle of debt that can be difficult to escape. Payday loans are considered so predatory that they are outlawed in some states. In fact, more than 90% of borrowers have regretted their payday loan.

The bottom line

MoneyLion is an affordable option for cash advances of up to $500 when you need quick money, and it’s a plus that you can choose the services you’re willing to pay for. However, you’ll have to set up a checking account, and the fee for Turbo transfers can be hefty.

If you don’t want to open a new account, you’ll be better off checking out some of the other options first.