Chime is a popular app that provides mobile banking services through its bank partners.

But many Chime users have had problems linking their Chime accounts with other popular banking apps, including a number of apps that offer quick, interest-free loans until your next payday.

Before you devote time and money to setting up a cash advance app, it’s important to know which apps will work with Chime.

Table of Contents

Key points

- Eligible Chime customers already have access to overdrafts up to $200

- First, figure out whether you’re eligible for SpotMe and sign up (don’t worry, we explain how)

- If you need money (rather than an overdraft) seven other apps sync seamlessly with Chime accounts

- Chime uses Plaid, so you’ll only be able to link accounts from other platforms that use Plaid.

Which paycheck advance apps work with Chime?

| Cash advance app | Does it work with Chime? | Maximum advance |

| Albert | Yes | $250 |

| Dave | Yes | $500 |

| Cleo | Yes | $250 |

| Empower | Yes | $250 |

| Klover | Yes | $200 |

| Earnin | Sometimes | $100 |

| MoneyLion | Yes | $500 |

| Branch | Yes | $500 |

| Chime SpotMe | Yes | $200 |

| Brigit | No | $250 |

9 top apps that work with Chime

These apps are similar to payday loan apps, except there are no fees or interest charges. There’s no credit check. However, many charge a monthly fee to be eligible for cash advances.

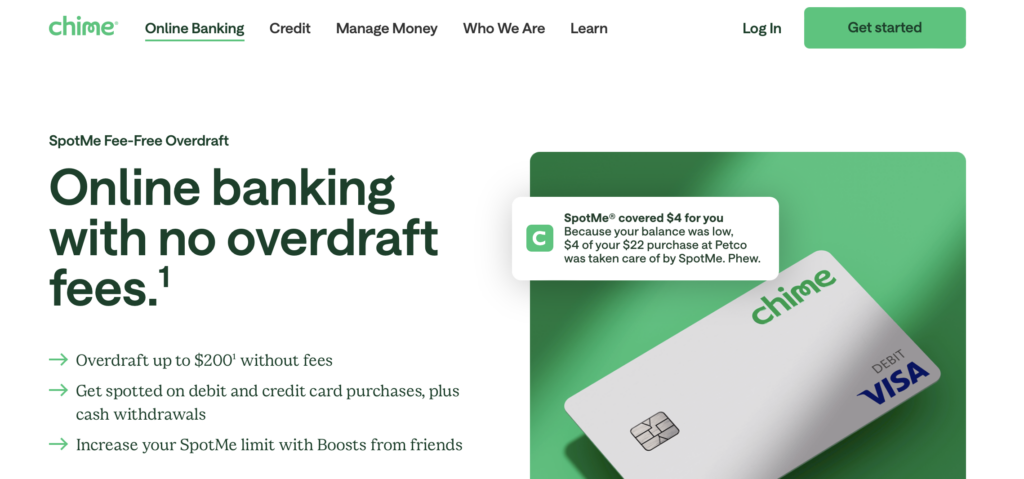

Best overall: Chime SpotMe

If you already bank with Chime, the simplest (and cheapest) option is to use Chime SpotMe. This is a popular program that allows you do overdraft your account by up to $200 until payday. This allows you to pay your bills and avoid late fees without having to wait until payday. There’s no fee or penalties for the overdrafts, though Chime may request optional tips, which they use to offset the cost.

Pro tip: In addition to the SpotMe program and checking and savings accounts, Chime offers a Credit Builder Credit Card, which can help you establish a credit history with the three major credit bureaus. Also, Chime partners with two FDIC-member banks, The Bancorp Bank and Stride Bank, so your money is secure.

Your limit starts at $20 and can go up to $200, depending on your account history and risk assessment.

After you enroll, all you need to do is make the purchase. Chime will approve the overdraft up to your current limit. SpotMe covers overdrafts for debit card purchases, cash-back transactions, and ATM withdrawals. You cannot use it to pay a friend, transfer funds to Venmo or CashApp or use it for automatic bill payments.

To qualify, you need a single deposit of at least $200 from an employer, gig economy payer, or government benefits payer. While freelancers can use the service, gig economy payments do not qualify for instant payouts and must arrive as an ACH payment.

Signing up for SpotMe is pretty simple if you already have a Chime account.

- Activate your Chime Visa debit card

- Make sure you have the latest version of the Chime app

- Open the Settings tab in your Chime app to find out if you’re eligible for SpotMe

- Once you agree to the terms and conditions, you are enrolled

Pro tip: To be eligible for SpotMe, you must set up at least $200 per month in qualifying direct deposits to a Chime checking account. You also must have an activated Chime Visa debit card.

Best if you need help from a “Genius”: Albert

Albert can give you a cash advance from $100 to a maximum of $250, depending on your income. Albert basic budgeting and savings features for free, but for cash advances, you must subscribe to its premium service, Albert Genius, at $14.99 a month. In addition to cash advances, Genius features include personal finance tips and advice from live experts, a 1% reward on your savings, and a micro-investment account. You can also shell out an extra $4.99 fee for an instant cash advance.

Pro tip: It will take a few weeks of direct deposits to be eligible for a cash advance, and you will not be eligible to borrow the maximum amount immediately. When DebtHammer tested the service, it was eligible for a cash advance of $100 despite an ample balance and regular direct deposits. However, the setup process was relatively simple and the ability to text a “Genius” for advice was useful.

READ MORE: Albert review

- Navigate to the Budget tab

- Tap + at the top of the screen

- Select Chime, or search for it by name if it’s not listed

- Enter Chime’s account credentials on the following screen

Lowest monthly subscription fee: Dave

Dave is a cash advance app that links to external accounts like Chime to offer early payday access. This payday advance app covers up to a $100 advance if connected to a Chime account and up to a $500 advance for a Dave direct deposit. The advance amount you’re allowed will depend on two qualified direct deposits, anticipated income, history of deposits and transactions for the last two months, how much you keep in the account, and if you have had recent negative balances on the account. The Dave app works on tips charges and a $1 monthly subscription fee.

Pro tip: Dave is simple to use, but you won’t initially be able to advance yourself the full $500. The low monthly subscription fee makes it a good option for long-term use.

- Go to Profile Tab

- Choose Linked Banks and Card

- Tap Change next to Linked Banks

- Select bank and continue

Best for honest financial assessments: Cleo

The Cleo app is a “sassy” AI-based money management platform. It will roast you, make snarky comments about your spending habits and let you know where your money is going each month. The app also allows you to borrow funds based on your spending habits and balances. You would need to subscribe to Cleo Plus, which costs up to $5.99 per month, and you can get advances of up to $250.

To connect Cleo with Chime, all you have to do is follow the steps provided on the app to add an external account.

Pro tip: Cleo won’t be everyone’s cup of tea. It regularly drops f-bombs and will occasionally shoot you a middle finger. And the initial cash advances are very small. But it’s efficient and easy to set up.

READ MORE: Cleo review

Best if you maintain a $100 minimum bank balance: Empower

Qualified members who set up an Empower checking account can get an interest-free advance of up to $250. Eligibility requires a healthy current bank account, recurring deposits higher than $500 from your employer, and an $8 monthly subscription fee. In addition, you need two deposits of at least $100 within the last two months and a balance of over $100 for at least ten days within the previous 30 days.

Pro tip: If you already have a checking account through Chime, you may not want the hassle of adding a new checking account and rerouting your direct deposits. In this case, Chime SpotMe is probably a better option.

How to link Chime to Empower:

- Go to the Home page of your app

- Scroll down to the Accounts section

- Click on the + icon on the upper right

Best with no subscription requirement: Klover

Klover has a cash advance limit of up to $200, but its eligibility requirements are a bit more complicated than those of its competitors. Klover requires three direct deposits to the primary checking account from the same employer within the past two months to qualify. Your paycheck must average $250 or greater, a bank account with at least three months of history, and regular biweekly or weekly deposits. No monthly or semi-monthly deposits will qualify. It also offers spending insights and overdraft protection. They use a points system to increase your borrowing limit.

While Klover offers a premium program with additional features for $3.99 per month, you do not have to be a premium subscriber to be eligible for cash advances.

Pro tip: Klover makes money by selling data — if this concerns you, you will need to choose a different app.

Chime customers can only be approved for a maximum boost of $100.

Klover uses a unique points system that allows you to boost the amount of money you can advance yourself. You earn points for simple tasks like scanning receipts, completing surveys, watching ads and referring friends. Points can be redeemed for larger advances or to cover the fee for instant money transfers.

Linking your bank account is easy. You will see the prompt during the registration process during the initial phases of getting started.

READ MORE: Klover review

Best for a large range of products: MoneyLion Instacash

MoneyLion allows you to borrow up interest-free up to $500 with optional tipping to keep it free. You need an established two-month checking account, regular income deposits, and a positive checking balance. They have other services like credit builder loans, checking accounts, managed investing, personal loans, and credit score tracking.

MoneyLion offers several different subscription levels that range from $1 to $19.99 per month.

To link Chime to MoneyLion:

- Click on the ‘Add Account’ link under the Transfers section. Or you can click on the ‘More Options’ menu located under the Finances tab

- Select Add Account option

Best employer-provided option: Branch

Branch offers early access to wages for workers whose employers participate in the program. It helps break away from the traditional pay cycle, allowing people to access their money as soon as they’ve earned it. It is only available to people who work in traditional offices or workplaces. Remote employees aren’t eligible. And if even if you work in a traditional workplace that participates, there are a few criteria you’ll have to meet before you can get an advance.

- Two consecutive months of direct deposits into a checking account at a supported bank

- A debit card matching your checking account

- Recent spending activity that Branch doesn’t consider “high”

Some companies that offer Branch include global workforce solutions provider Kelly, Cartwheel, tipping platform Tippy and SuperSalon.

To link Branch and Chime, you’ll need to do the following:

- Open up the Chime app and select Settings, then Payment Methods

- Click on add bank or card and select Bank

- Click Instant Verification (where you’ll receive an agreement to allow Chime to use Plaid to verify and link your Branch account)

- When you reach the ‘Select your bank’ page, enter Branch in the search box

- Enter the phone number listed with your Branch account

- Wait for a text from Branch with a code

- After entering the code, you’ll put in your personal Branch passcode

Click Next to finish linking your account and then return back to Chime - To confirm the account, click Add

Pro tip: At this time, Branch is the only employer-sponsored earned wage access app that’s compatible with Chime. Other products, including DailyPay, One@Work (formerly Even Instapay), PayActiv and TapCheck, will not work with Chime.

Does Earnin work with Chime? It’s complicated

Earnin is another cash advance app, but what makes it stand out is a unique feature called Balance Shield. By activating Balance Shield Alerts, customers are informed by push notification whenever their bank balance falls below an amount they specify, up to $400. If the balance falls below $100, customers can also enable Balance Shield Cash Outs, which preemptively cash out up to $100 of their earnings.

Pro tip: If you have a Chime account that Earnin can support, turn on Allow Transactions in your Chime settings. This will give Earnin access to send Cash Outs to your Chime account and debit you on payday.

However, Earnin only works with a limited number of Chime accounts. To learn whether yours is one of them, you will need to go to the bank selection list and choose Chime. The app will show you a message indicating whether Earnin supports your Chime account.

Pro tip: If you already linked your Chime account but need to switch to another bank, please be aware that you may no longer be able to relink your Chime account after the switch.

Does Brigit work with Chime?

Brigit is a cash advance app that also helps you manage your budget. Although the basic membership to Brigit is free, the free version won’t give you access to most of Brigit’s features. Brigit Plus costs $9.99 a month, and offers instant access to instant cash advances whenever you need them.

Unfortunately, due to connectivity issues, Brigit doesn’t work with Chime, Capital, Net Spend, and Varo. However, some have reported that it can work for some old users but no longer supports new users due to connectivity issues.

READ MORE: Brigit review

Why won’t all cash advance apps work with Chime?

Chime users will sometimes have trouble borrowing through cash advance apps due to connectivity issues.

Chime doesn’t allow some ACH e-check payments, and some payment apps are incompatible with Chime because they are employer-sponsored. That means you can only use the service if your employer partners with them and offers it an employee benefit.

The industry is constantly evolving to try to fix some of these issues, but because the process of signing up for a cash advance app and establishing the necessary amount of banking history can be a lengthy process (and may involve committing to a monthly membership fee), it’s important for Chime users to know which apps will work before they start the process.

Pro tip: It will be a waste of time and money if you devote six weeks to one app only to request a transfer and learn that it won’t work. It’s important to choose the best app for you first, then download the app and sign up.

Does Chime require Plaid?

Chime uses a third-party provider called Plaid to facilitate external account linking and transfers. However, not all banks are compatible with Plaid. If you’re unable to connect other accounts with Chime, that could be the reason. Check with your bank to figure out whether there is a limitation. Chase, Capital One and PNC Bank are some of the major banks that won’t connect through Plaid. In this instance, if you want to utilize Chime’s features, you’ll have to set up a banking account and set up direct deposit straight to Chime.

Pro tip: If you need a quick cash advance and your current bank doesn’t work with Plaid, your options will be limited. These apps don’t require Plaid: B9, Venmo, Cash App Borrow, Line and Grid Money.

Cash advance apps: Know the risks

Cash advance apps — also called payday advance apps — allow you to tap into earnings you’ve already earned before your next payday. They are a digital equivalent of a payday loan provider and are sometimes referred to as earned or early wage access apps.

These apps can help you get a quick loan until your next paycheck, usually with low or no fees, though some charge a small membership fee. The money is instantly transferred to you (for another small fee) or you should have it within three business days.

But they aren’t a long-term solution, and if you’re using one app to borrow money to repay another app, they can become almost as dangerous as payday loans. If you find yourself repeatedly needing cash advances or payday loans, consider applying for a Payday Alternative Loan instead.

READ MORE: Best cash advance apps when you need instant money

The bottom line

Cash advance apps can help you bridge the gap until payday. But if you bank with Chime, it’s important to know that there are some apps that you simply won’t be able to use due to connectivity issues.

However, you still have an ample number of options, including Chime’s own overdraft program called SpotMe.

FAQs

Yes, Chime works with Venmo, but there’s a limit of $15, and you pay a 1.5% transfer fee for instant funding when you withdraw from Venmo to Chime.

Yes, Chime can receive money from Cash App if the linked bank accounts are correctly set up.

Possible Finance offers installment loans with higher-than-average interest rates, but they’re less expensive than payday loans, and easier to repay. Possible is limited to 20 states; you need a state-issued ID, three months of transaction history, and a positive checking account balance. The fees vary by state, and you can borrow up to $500 and be repaid in multiple payments over several pay periods. This app reports to the three major credit bureaus, which allows you to build a credit history.

Unfortunately, Possible says that it currently is not compatible with Chime.

Cash advance apps are easy to use, and simple to set up, and you can instantly get your funds with just a few taps on your phone. They give you an almost seamless infusion of cash until your next paycheck. They also don’t have the fees and high interest rates associated with typical payday lenders, and some help pay bills and offer a safety net to cover expensive overdraft fees. The high costs of payday loans make repayment difficult and often lead to a second — and third, and fourth — loan. The interest rate on a short-term loan from a payday lender can be as high as 600%.

Best of all, there are no annoying, threatening phone calls to contend with because what you owe is automatically deducted from your account at the next pay period.