Topics covered

The state of payday loans in the U.S.

When bills, gas, groceries and other nagging expenses pile up and the checking account is empty, it might be tempting to search for an easy way out, some fast money to alleviate the financial pressure and avoid an overdraft fee. Many cash-strapped Americans see payday loans as the only option.

Payday lenders are so pervasive that there are more payday loan stores in the U.S. than McDonald's or Starbucks.

Here’s a rundown on some helpful information and statistics to help you get a better understanding of payday loans — who uses them, the high interest rates and fees, repayment difficulties and why they should be avoided as much as possible.

What is a payday loan?

Payday loans are a common form of fast money and an easy solution for many cash-strapped Americans who have difficulties dealing with mounting expenses and paying their bills from one paycheck to the next.

And getting a payday loan is simple: all you need is a driver's license, a Social Security card, proof of income, and a bank account number.

Note: Payday loans are usually small-dollar, high-cost loans -- generally for $500 or less. These small loans are typically due in a lump sum on a borrower's next payday.

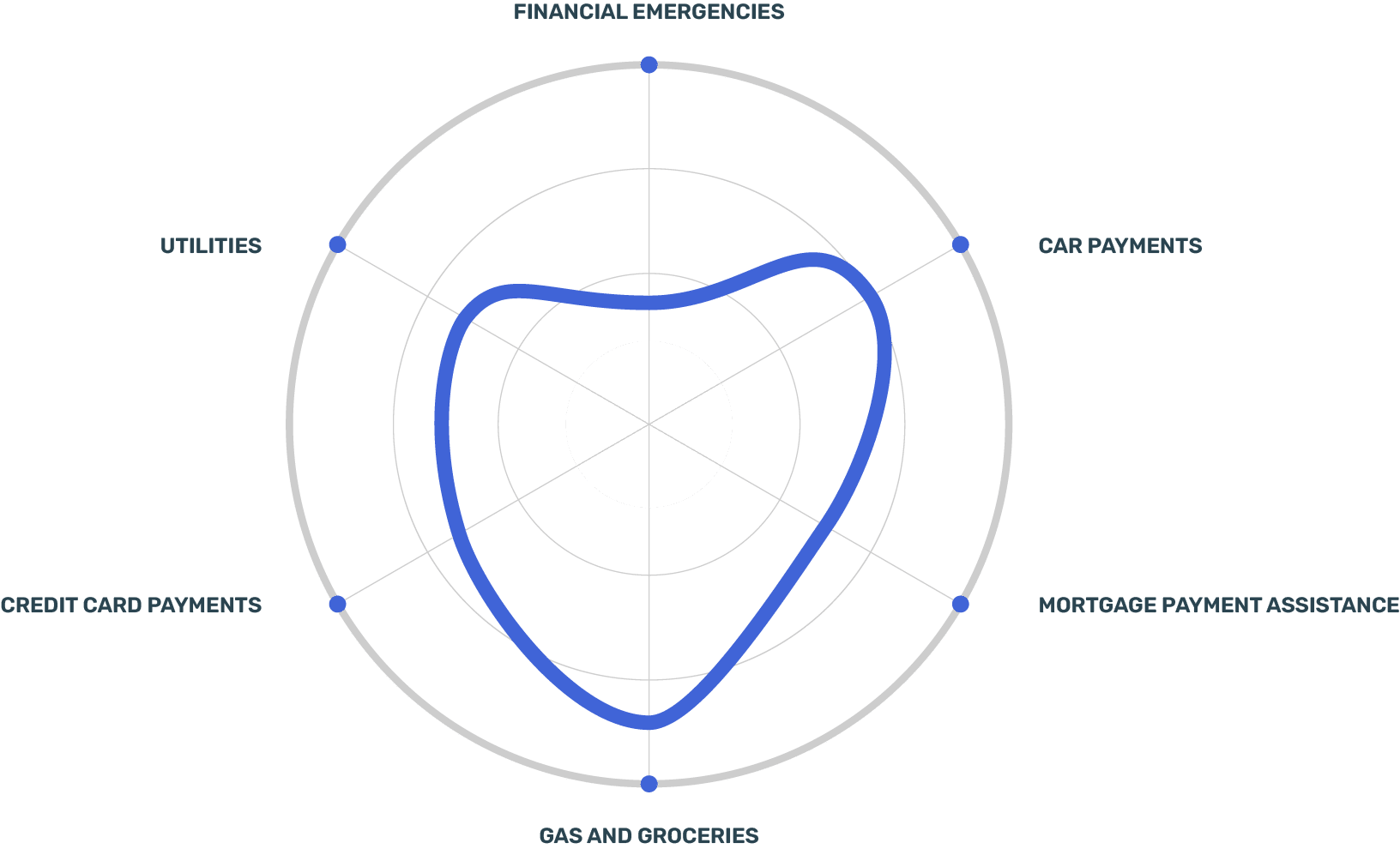

Why do people use payday loans ?

Payday loans satisfy a need for many people, particularly those who do not have access to traditional loans or have no or low credit scores.

Although payday loans are meant to be used to cover urgent expenses, the majority of payday loan users use these short-term loans to pay for recurring expenses such as electricity, car payments, or other debt commitments, and they don't have the cash to repay the loan by the time their next paycheck rolls around.

Borrowers with negative credit (no or low credit score) are frequently unable to obtain traditional loans, so they're forced to turn to predatory lenders.

Who uses payday loans?

As many as 12 million Americans use payday loans each year. While payday lenders target a wide range of Americans, they mostly put a tail on traditionally vulnerable demographics. People without a college diploma, renters, those earning less than $40,000 per year, and those who are separated or divorced are the most likely to have a payday loan.

And, increasingly, many of these payday loan applicants are under the age of 25.

Findings from DebtHammer's survey

DebtHammer collected survey responses from a random sample of more than 250 adults aged 18 or older via DebtHammer’s subscriber list from September 8-14. Each response was anonymized using a unique user ID.

Of those we surveyed, 74% were female, 25% were male, and 0.5% identified as either non-binary/other or preferred not to say.

Here's a rundown of some key statistics extracted from our survey:

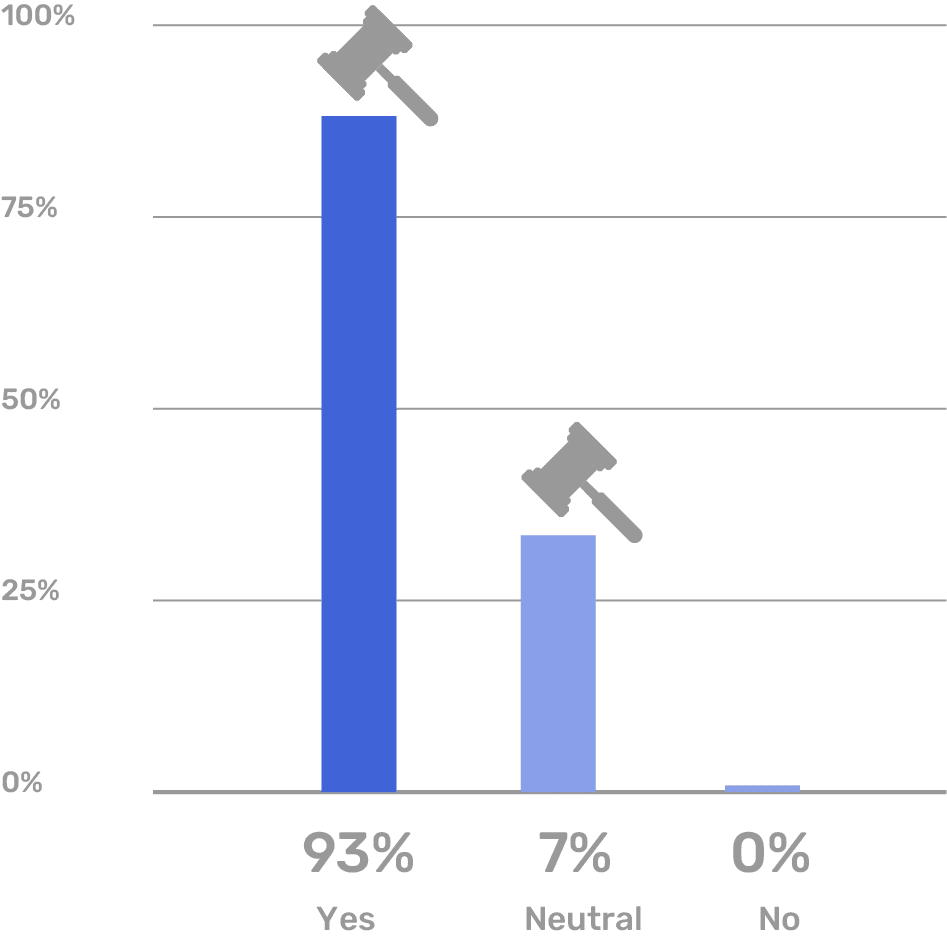

Do borrowers regret using a payday loan?

Payday loans don’t improve borrowers' financial well-being: 93% of respondents said they regret taking out their original loan. Roughly 80% of those surveyed said that their payday loan left them in a worse position than they were in before they took out the loan.

That’s because it generally takes borrowers roughly five months to pay off the loans, and by then they’ve paid an average of $520 in interest and fees on top of the original loan amount.

Other debt is a factor

51% of respondents said they have more credit card debt than they had as of March 2020, the start of the COVID-19 pandemic. Another 20% said their debt is about the same. About 45% of respondents have more than $2,500 in credit card debt, with 10% owing more than $10,000.

Borrowers generally knew what they were getting into

61% of respondents said they paid their first loan back on its due date. 45% said their loan was enough money to solve their problem, and another 28% said they borrowed more than they needed.

Millennials aren’t really the problem

Almost three-quarters of respondents were born before 1981, meaning the majority of people who reported payday lending issues are either Generation X members (born between 1965-1980) or Baby Boomers (born between 1946-1964.)

The risks of payday loans

Although payday loans are meant to be a one-time solution to cover unexpected expenses, they come with many drawbacks for borrowers. Payday loans are frowned upon due to the exorbitant fees and interest rates imposed. A single payday loan is significantly more expensive than other options such as credit card cash advances or personal loans.

Here are a few specific payday loan statistics that highlight these common issues:

High startup fees and aggressive due dates

The payday lending industry has been heavily criticized for preying on low-income customers and trapping them in debt by demanding high fees.

According to the Consumer Financial Protection Bureau (CFPB), more than 80% of payday loans are converted into new loans before they are entirely returned. This is known as a rollover. In fact, 80% of borrowers wind up getting 11 or more payday loans in a row, paying extra fees and interest on the same debt with each new loan. They get stuck in what's known as the payday loan debt trap.

Where do borrowers get payday loans?

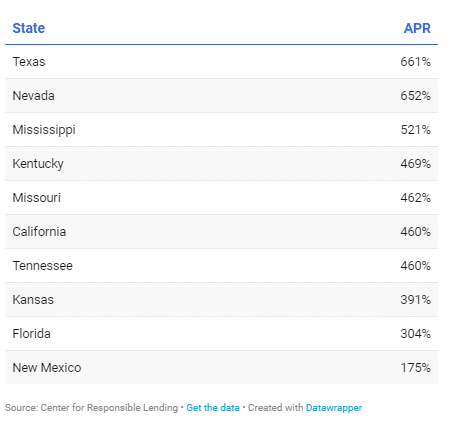

Payday loans are offered by payday lenders, most of which are found in brick-and-mortar locations in cities and towns throughout the U.S. Historically, payday lending has been governed by state law; each state has its own set of rules. Many states either cap APR or have additional rules that make the payday lending sector unprofitable.

The cost of borrowing varies widely among states

Payday loans are available in 32 states and banned in 18.

The 18 states are Arizona, Arkansas, Colorado, Connecticut, Georgia, Maryland, Massachusetts, Montana, Nebraska, New Hampshire, New Jersey, New Mexico (as of Jan. 1, 2023), New York, North Carolina, Pennsylvania, South Dakota, Vermont, West Virginia and the District of Columbia.

The states where payday loans are banned either explicitly prohibit payday lending or impose interest rate caps that push lenders out of business.

Payday lending is legal in the remaining 32 states. These states have either exempted payday loans from usury laws or have opted not to regulate loan interest rates.

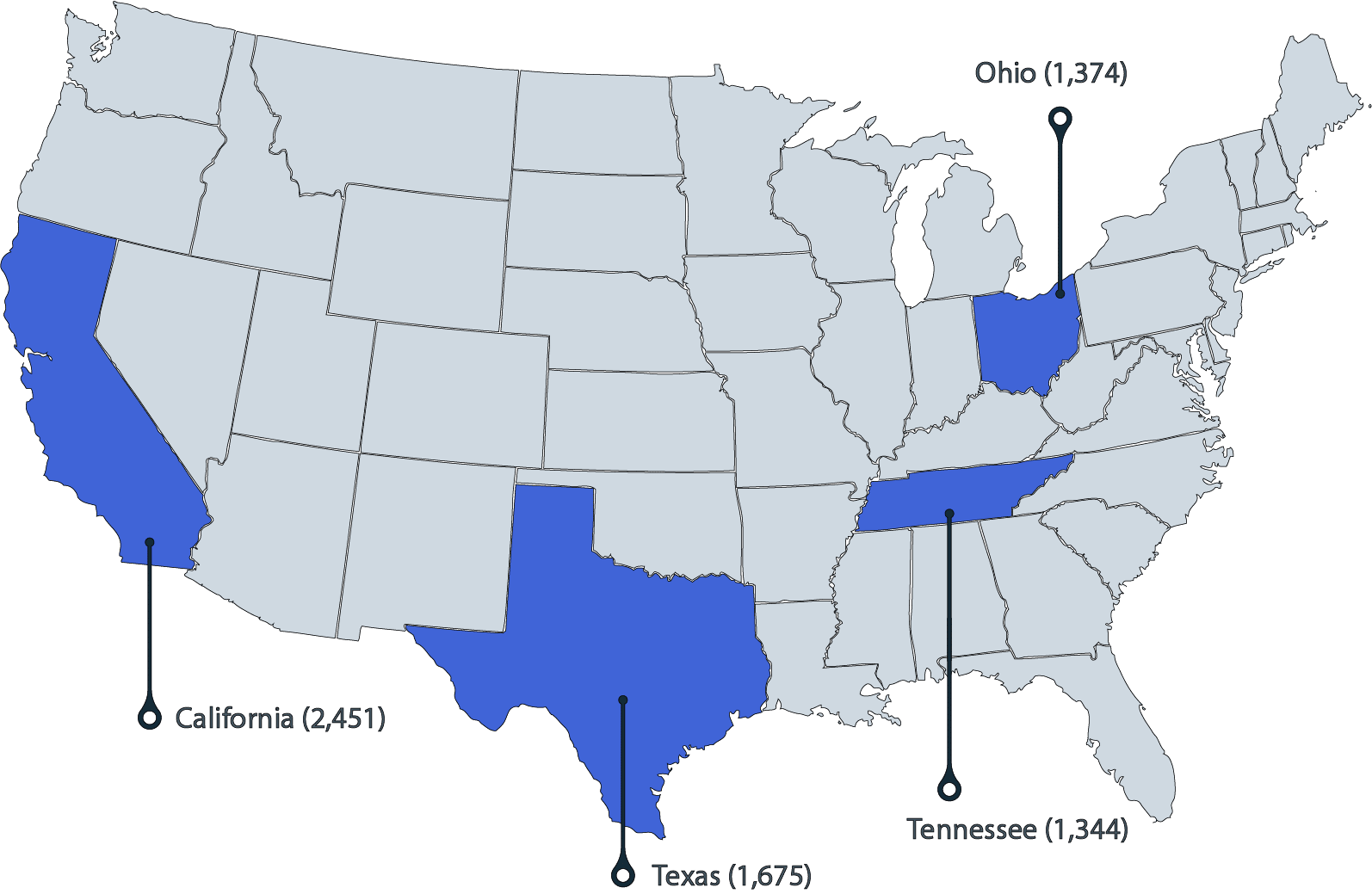

States with the most payday lenders

Payday loans are offered by payday lenders, most of which are found in brick-and-mortar locations in cities and towns throughout the United States.

Payday loan stores are even outpacing McDonald’s in the majority of the states where payday lenders thrive. California has the most payday lenders (2,451) than any other state. Texas follows with a whopping 1,675 payday stores followed by Tennessee (1,344) and Mississippi (1,100).

Payday loans are more common in urban areas

Payday lending is significantly higher in urban areas than suburbs. The different ways in how states regulate payday loans is a major factor contributing to the large disparity in payday loan usage by region and division.

The higher usage in urban areas can also be explained that payday lending has generally been associated with relatively densely populated areas.

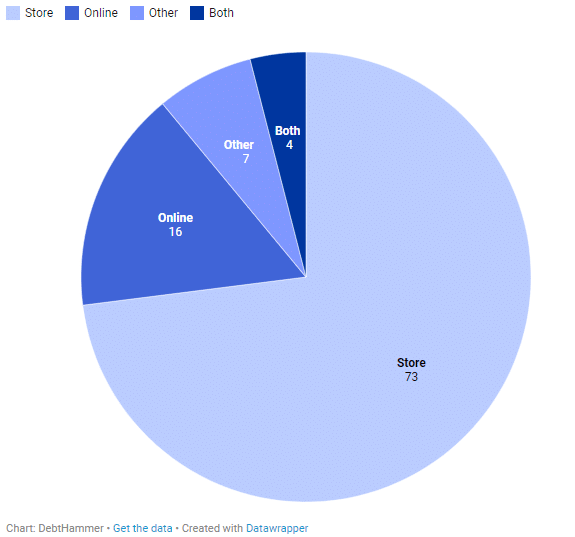

Most people are getting payday loans from storefronts

People usually get their payday loans directly from storefronts. Online payday lending and other sources may continue to experience substantial growth in the coming years. While internet borrowing is frequently cited as a concern in areas without storefronts, it is almost as common in states with payday lending businesses.

In states with permissive payday loan policies, more than one-third of online borrowers also borrowed from shops, preferring both methods over one or the other.

Payday loan alternatives

There are a few better options for people who need some quick cash. These include:

Payday Alternative Loans: PALs are similar to payday loans, but there’s one significant difference — instead of using potentially shady lenders who charge exorbitant interest rates, PALs are given out through federal credit unions, making them much more affordable.

Cash advance apps: These apps offer a quick paycheck advance, but unlike payday loan providers, many don't charge fees. Instead, they rely on tips or charge a small monthly fee.

The bottom line

While payday loans are designed to be a short-term solution for underserved borrowers in need of a quick cash infusion, that’s not how the industry is functioning. And while some states are cracking down on payday lending, the increase in online borrowers raises questions about whether these limits are merely pushing borrowers online.

DebtHammer’s finding that people are turning to short-term loans to cover everyday expenses is particularly troubling because of the business model that preys on desperate Americans and counts on borrowers being unable to repay as scheduled, leaving them trapped in a debt cycle that can take years to escape.