Artificial intelligence is seemingly everywhere these days, including bank accounts. Cleo is a cash advance app that calls itself “the world’s first AI assistant dedicated to personal finance.”

If you’re the type of person who wants some help managing your money but doesn’t want to have to talk to an actual human, Cleo may be the app for you.

Our take: Cleo is a legitimate app offering valuable financial insight and small cash advances to tide you over until payday. It’s easy to sign up and doesn’t require a significant amount of your personal information. However, it is AI-based, so the app can’t necessarily distinguish good expenses (housing payments, automatic savings, etc.) from bad ones. Thus, it doesn’t always give you the best advice about where your money should go. The chatty format makes it relatively fun to use, and you can get financial tips without paying a monthly subscription fee. You must pay a monthly fee of $5.99 if you want cash advances.

Table of Contents

Cleo app: What you need to know

Cleo is an AI-based fintech platform that handles your financial needs. It’s geared more toward young people who need basic financial advice and guidance and is designed to be chatty and conversational. Cleo even has pronouns (she/her).

Your communication with Cleo will be via text.

Cleo offers small cash advances of up to $250, but most first-time users won’t qualify for the maximum from the start. Many will only be eligible at first to spot themselves $20, and to even be eligible for that, you’ll have to sign up for a paid monthly subscription.

While some Cleo services are free, cash advances require Cleo Plus, which costs $5.99 per month, or Cleo Builder, which includes extra features designed to help you boost your credit score, for $14.99 per month.

What makes Cleo stand out?

Cleo’s AI has been programmed to have a “sassy” attitude. The goal is to make you feel like you’re chatting with a friend rather than dealing with a bot. The AI does an excellent job of faking sarcasm. It uses conversational tones, current slang, emojis, etc.

Cleo’s free services are best for people just learning how to manage money.

Assessing your habits

Once a week, Cleo will send an alert about your spending. If you log into the app, it will explain where your money went and how close you were to staying on your budget. This can be a reality check for many new users.

For example, one posted this experience on Reddit.

I know my shopping has gotten completely ridiculous since the new year with my family issues. It went from a normal amount to actual shopaholic level. So after I connected all of my info, the Cleo AI roasted me. At the end it told me how much money I had spent in the last 12 months.

Over 27k. I work part time, but I didn’t realize how much I was putting on credit cards, paying a little on, putting back on. I can’t even fathom how it happened or how it’s possible. (Read the full post here).

However, because it is AI-based, it has a problem separating essential expenses from nonessential spending.

For example, it told me I was overspending on my mortgage in a month when I intentionally paid extra.

Cleo will roast your spending choices

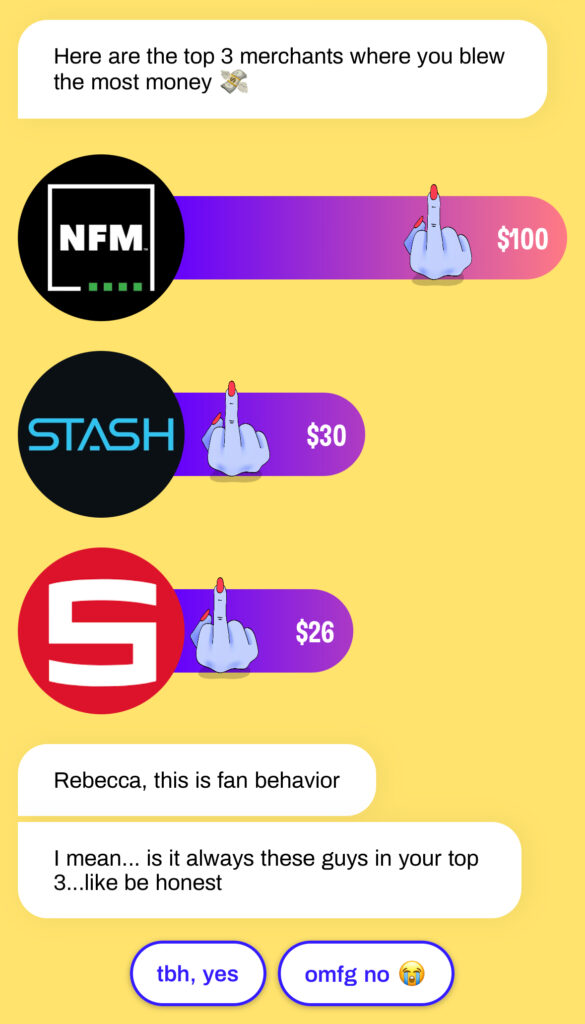

If your spending habits are problematic, Cleo will “roast” you over your financial situation.

But for more experienced savers, Cleo’s roasting can be a little off-base. I was excited to see what it would come up with: would it be holiday spending? Grocery bills? Restaurant expenses? Nope.

This was the response roasting my spending patterns.

Hype mode

You can ask Cleo to hype you if you need positive reinforcement or encouragement.

Cleo also offers budgeting help and credit-building accounts and can identify steps you can take to raise your credit score.

You can ask Cleo if you can afford that late-night pizza delivery to your college dorm or a pair of shoes you’ve been eyeing, and Cleo will give you an honest answer.

How Cleo works

After downloading the mobile app and creating your account, you must connect your bank account to the app via the Plaid platform. This allows Cleo’s AI to analyze your deposit, spending and savings data without giving it access to any of your personal information.

The app (available for Android and iOS) analyzes your bank activity to decide whether you “qualify” for an advance and how much that advance will be. If you accept the advance, the advance amount is automatically deducted from your next direct deposit. First-time borrowers can qualify for up to $70. There are no interest charges. If you need an “express” advance, you’ll pay a $4 fee, but regular ACH transfers are free.

What makes Cleo stand out?

- Sassy attitude

- Free budgeting help

- New users can borrow up to $70 with no credit check

- Account monitoring

- Credit builder card

- Cleo has no requirement for regular income, so it’s a good option for gig workers and freelancers

- Tries to make saving and investing fun (you can even set up a “swear jar” that “fines” you for spending money you shouldn’t. The fines go into your savings account.)

Cleo APR estimate

If you borrow $100 through Cleo and pay the monthly fee of $5.00 and a $4 fee to have the transfer expedited, you’ll pay the equivalent of a 260% annual percentage rate.

If you borrow that same $100 but don’t pay the instant transfer fee, you’re paying an equivalent of 156%.

Cleo’s key features

Cleo’s most unique feature is that it’s designed to be conversational. It can make learning seem fun and there are no awkward personal conversations. Cleo will be brutally honest but not overbearing. However, Cleo’s sense of humor won’t be for everyone.

When you first sign up, you’ll immediately have to link your bank account. Cleo will ask you a series of questions, confirm your income and review your monthly bills.

It will then tell you whether your spending is within an appropriate range and mock you for your largest purchases. You can set up a “budget” with essential spending, and it will tell you how close you come to hitting those numbers. And if you aren’t sure whether you can afford a purchase, you can ask Cleo and get a brutally honest response.

The above are all free services.

This breaks down the differences between the three plan levels.

In addition, Cleo offers:

- Cash advances up to $250

- Budgeting and savings help

- A secured credit card

- Provides early access to your paycheck

Pros and cons of Cleo

Pros

- Helps with budgeting and goal-setting

- Helps you prevent overspending

- Cashback rewards (when you shop through the app)

- Automatic savings

- Payday advances (if you have the premium plan)

- Privacy protections because the app never actually sees your banking information

- Funds are sent directly to your linked bank account, so you can withdraw them at an ATM

Cons

- AI-powered — some people prefer human interaction and feedback

- Not insured by the FDIC

- The wallet doesn’t earn interest

- The premium plan is $5.99 per month, which is expensive compared to a few other platforms

- No help investing

- No free savings account

How to request a Cleo cash advance

First, you’ll need to download the app on your Apple or Android device

Then, you’ll have to link your bank account and answer a series of questions about your income and bills.

Next, you’ll have to sign up for a paid membership

In the chat section, type “spot me.” Tap the “spot me” button and Cleo will let you know if you’ve been approved

Once you’re approved, Cleo will offer an initial advance between $20 to $100. Choose a repayment term of up to 28 days.

Cleo’s requirements

- You must be 18 or older

- Provide your state of residence

- Have a bank account that’s compatible with Plaid

The Cleo experience

Cleo is fairly simple to use and the chatty format is pleasant. However, there are a few flaws with the AI bot.

For example, Cleo can’t really tell the difference between the essential bills and nonessential expenses (Cleo roasted me for blowing money on my biggest monthly expense – my mortgage – and told me I have a particular fondness for buying items from Mr. Cooper (the mortgage company), Stash and Acorns. Stash and Acorns are both investment accounts.

The next month, I was “roasted” for overspending at my “favorite merchant”: The company that recently replaced the roof on my home (an expense that was primarily covered by insurance).

Before downloading the app, it’s worth it to poke around the website a bit. It frequently uses such colloquialisms as “pissed away,” drops a few f-bombs, and occasionally throws up a symbolic middle finger. While many appreciate the self-deprecating humor, some may find it off-putting.

READ MORE: Not sure Cleo is for you? Here are 21 apps like Cleo

How long does it take to get a cash advance from Cleo?

If you don’t pay an additional fee for an instant transfer, expect your advance to take three to four business days. Otherwise, it will cost an additional $3.99 “express fee” to get your money almost instantly.

Is Cleo legitimate?

Yes, Cleo is not a scam. Cleo was launched in 2016 by Barnaby Hussey-Yeo. Hussey-Yeo is adamant that Cleo is not just a payday advance app. According to an interview with Money Week:

“Cleo is a free artificial intelligence financial assistant that helps 150,000 people manage their money every day. She makes money simple, putting people back in control with instant, personalized and intelligent information, given in a way that makes them want to engage with their finances.”

Is Cleo secure?

Yes. When Cleo connects your bank account, the platform can only access your transaction history and data through an encrypted read-only mode.

Plus:

- They don’t store or access banking login details

- They use security practices in line with the rest of the financial sector

- They hold regular security tests and audits

Does Cleo use Plaid?

Cleo uses Plaid to connect your bank accounts. Plaid is a service that securely connects your bank accounts to various apps. 12,000+ banking institutions around the world use it. Unfortunately, not all financial institutions are compatible with Plaid. Chase, Capital One, and PNC are among the major banks that don’t work with Plaid. If you bank through one of these, you will have to switch banks in order to use Cleo.

How to cancel Cleo

Deleting the Cleo app will not cancel your subscription. You must open a chat and type “Cancel,” then Cleo will do the rest.

You will have to answer a few questions first – if you don’t answer the questions, you won’t reach the point in the conversation where you can officially cancel your subscription, and you’ll have to start over.

After you’ve answered the questions, you’ll get an “Unsubscribe” button. Tap that, and you should get a confirmation email confirming your canceled subscription.

Pro tip: If you cancel while you still have an active advance, you must repay it by the due date.

If you have paid a Cleo subscription within seven days of signing up (and have not requested a cash advance), your subscription fee will be refunded.

How long does it take to withdraw money from Cleo?

You can only withdraw money that’s in your Cleo “Wallet.” If your money’s status is “pending,” you’ll have to wait for it to clear.

After you withdraw from your Wallet, it can take up to four business days for your money to post to your bank account.

To withdraw money, open a chat window and type “withdraw $amount.”

Make sure you tap the “confirm” button.

If you change your mind, hit “Wait no,” and the transaction will be canceled.

Legal challenges

There do not appear to be any pending legal issues with Cleo.

Customer ratings

- BBB accredited? No

- BBB rating: F

- BBB customer reviews: 1 of 5 stars

- Apple App Store score: 4.7 of 5 stars

- Google Play score: 4.2 of 5 stars

Customer opinions

Customer feedback on Cleo’s Better Business Bureau page is mostly negative, with comments focusing on the small advances and trouble canceling the service. It fares far better in Apple App Store and Google Play reviews, though there are still a number of complaints about a glitchy system and high monthly subscription fees.

Most helpful reviews

From the Better Business Bureau:

From Apple’s App Store:

From Google Play:

At a glance: Cleo vs payday loans

| Cleo | Payday loan |

| Maximum advance of $250 | Typically as high as $1,000 |

| Up to three business days unless you pay an additional fee | The app requires a linked bank account |

| The simple application usually requires a Social Security number and banking information or a postdated check. | The monthly subscription fee of $5.99 per month required for advances, plus additional charge of $3.99 for expedited transfers |

| Fees range from $15 to $25 for each $100 borrowed | Fees ranging from $15 to $25 for each $100 borrowed |

| Currently only available to U.S. residents | Not available in states where payday loans are illegal |

READ MORE: Best cash advance apps

The bottom line

If you’ll benefit from an app that will tell you when you’re making poor financial decisions or encourage you to save, Cleo is the app for you. Cleo will analyze your spending, hype you and roast you – all for free.

However, if you need a cash advance, you’ll have to pay for a monthly subscription. That may or may not be worth it, depending on how much Cleo decides you can borrow.

FAQs

Cleo was founded in London in 2016 by Barney Hussey-Yeo. However, by 2022, the app was only available to U.S. residents when the company decided to focus on growth in the U.S.

Many complaints about Cleo cite difficulty reaching someone if they encounter a problem. If you need to speak to a person rather than an AI chatbot, call 833-313-3171. You can also email [email protected] or send messages via Facebook or Instagram.

Cleo is based in New York, NY. The mailing address is:

Cleo AI Inc.

150 West 25th Street, Room 403

New York City, NY 10001