With all of the headlines and squabbling recently over forgiving student loans, you may wonder whether there are any payday loan forgiveness programs.

Unfortunately, the answer is probably no. While the Coronavirus Aid, Relief and Economic Security (CARES) Act offered some relief for financial hardship due to illness and/or unemployment caused by the pandemic, it did not include payday loan relief. There are no federal government programs to help you with payday loan debt, and state laws don’t address loan forgiveness.

Table of Contents

The hard truth: Payday loan forgiveness doesn’t exist

Most lawmakers in Washington, D.C., don’t care if you’re debt-free, particularly when the payday loan industry contributes millions of dollars to political campaigns. Some states have enacted their own laws, but they’re inconsistent and also won’t help you repay your loans or get out of debt.

However, if you regret your payday loan or can’t repay it, there are some steps you can take.

Stuck in payday debt?

DebtHammer may be able to help get a portion of your loans forgiven.

Are you within the loan cancellation period?

Most states require a cancellation period for payday loans. You will usually have to cancel by midnight of the business day following the day you took out the loan. For example, if you take out a loan on Saturday and the lender is closed on Sunday, your cancellation period would expire at midnight on Monday.

You will have to return the loan proceeds, but you will not be charged interest or fees. You will have to submit a written notice of cancellation. Your loan agreement will explain the cancellation process, which varies from state to state. Check your state’s laws to be sure.

Does your payday lender offer an Extended Payment Plan?

Some states require payday loan lenders to offer Extended Payment Plans (EPPs). Lenders who are members of the Community Financial Services Association of America are also required to offer EPPs.

An EPP extends the repayment period, allowing payday loan borrowers to pay off the loan in a series of installments without adding additional fees or interest.

Many lenders will not tell you that they offer an EPP. You will have to ask, and you will have to apply no later than one business day before the loan is due. Don’t wait until it’s too late if you know for certain you won’t be able to pay.

READ MORE: How EPPs work

Pro tip: A lender may ask you to renew or “roll over” your loan. This is not the same thing as an EPP. Rolling over a payday loan means that you are paying a fee, often a large one, to delay paying back your loan. The fee is charged on top of the loan amount.

Is your payday loan illegal?

Your state government won’t pay your payday loan, but some states have policies that can limit the damage. Payday loans are banned in 18 states and Washington, D.C. Others limit the annual percentage rates and fees that lenders can charge.

Check the payday loan laws in your state to see if your loan is legal. You may not be required to repay a loan that does not comply with state laws. Contact your state attorney general if you believe your lender violates state law or is unlicensed by your state’s banking regulator.

READ MORE: States where payday loans are illegal

Has the statute of limitations expired?

A payday lender or debt collector can only sue you until the statute of limitations on the payday loan expires. This commonly occurs in six years, but it can be as little as three years or as much as ten years. You must look up your state’s statute of limitations on debt. Remember that over these years, your credit score will continue to decrease due to the missed payments.

Even after the statute of limitations expires, a collector can still ask you to pay the loan (and you technically still owe the debt), but they cannot take legal action against you for lack of payment.

READ MORE: What is the statute of limitations on debt?

Is your loan through a tribal lender?

Some online payday lenders partner with Native American tribes. These enterprises are usually bankrolled by non-tribal payday lenders but are registered on Native American reservations as companies operated by the tribe. This gives them sovereign immunity from suit and enables them to violate state laws.

Unfortunately, this means you have far fewer options if you need help.

If your loan is technically illegal due to your state’s laws or your state caps interest rates, it typically won’t matter. These lenders are not required to follow these laws. They also are not obligated to adhere to the debt collection restrictions established by the Fair Debt Collection Practices Act. You have virtually no legal protections. The sovereign immunity of these lenders makes them almost impossible to sue.

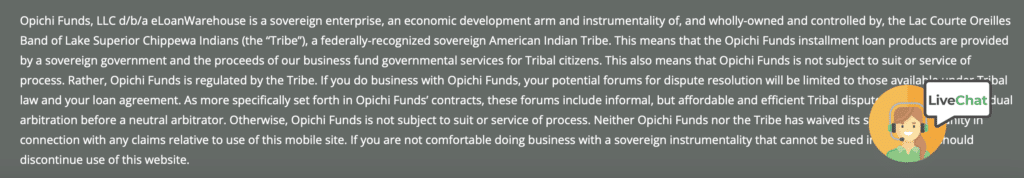

Tribal lenders often have names that sound like traditional lenders. For example, eLoanWarehouse has the following disclosure in fine print on its website. The disclosure is even partially obscured by the “live chat” button.

Pro tip: Tribal loans are worse than payday loans. The high interest rates commonly exceed 1,000% APRs and loan repayment terms are longer, allowing the interest to accumulate. Many borrowers find that even after several months of payments, they are only paying interest and have not reduced the principal at all. Reports of unauthorized withdrawals are also common.

READ MORE: Tribal payday lenders

Ask your bank or credit union about a new loan

Many local financial institutions offer small personal loans and credit unions offer Payday Alternative Loans, a newer type of loan designed to serve as a better alternative to payday loans. These loans have longer repayment terms and lower interest rates than traditional payday loans. Some credit unions only require an active checking account for eligibility.

READ MORE: Payday Alternative Loans

Ask your credit card company for help

If you’re struggling to repay your payday loans due to high monthly credit card payments, it may help to call your credit card company to explain your hardship. They may offer to let you skip your monthly payments, lower your interest rate or work with you in some other way, freeing up money in your monthly budget to repay your payday loan.

Talk to a credit counselor

If negotiating with your credit card company seems daunting, a nonprofit credit counseling agency can help you. They will work with your credit card companies to negotiate lower interest rates and a repayment plan. You will then make one single monthly payment to your credit counselor, who will then make your credit card payments. However, you will have to close your credit card accounts, and credit counseling agencies usually work exclusively with credit card debt, so they won’t be of much help if you have other types of unsecured debt.

READ MORE: Credit counseling

Example: The payday loan debt trap

The Consumer Financial Protection Bureau (CFPB) offers a good example of how quickly a payday loan can spiral out of control. When you take out your payday loan, you will likely be charged a fee of between $10 and $30 for each $100 you borrow. So, if you need $300 immediately, you’d have to pay back $345 from your next paycheck, assuming your fee is $15. If your budget is already tight, it may be hard to come up with that extra money on top of the original $300 you borrowed.

And if your payday lender tries to debit your account on the loan due date and the money isn’t there, it will trigger overdraft fees, making your short-term loan even more expensive.

More than 90% of borrowers regret their original payday loan, so think twice before turning to a payday lender.

READ MORE: Payday loan interest rates

More ways to get payday loan help

Payday loan forgiveness may not be an option, but there are plenty of other financial products and services that can help you escape the debt trap.

- Payday loan consolidation

- Debt settlement/consolidation companies

- Debt consolidation loans

- Bankruptcy

- Credit card cash advance

- Cash advance apps

- Borrow from friends or family

- Peer-to-peer lending

The bottom line

Unfortunately, no one is going to swoop in and help you out of payday loan debt. While student loan forgiveness is a popular topic with voters, there appears to be little interest in helping payday loan borrowers. There are no payday loan forgiveness programs. However, there are other ways to escape the debt trap.

Payday loan relief programs that work

Most people trapped by payday loans can’t qualify for many of the options above, and that’s a big problem.

Payday loan debt causes a massive amount of stress for borrowers — and that’s why we started DebtHammer.

DebtHammer offers payday loan consolidation programs. We don’t provide loans, but we analyze loans and consolidate some of them into one, and offer a flat monthly payment. If you have one or more payday loans, contact us for a consultation and we’ll see if we can help get you out of payday loan debt for good.