Are you looking to borrow up to $5,000? Lenme is a peer-to-peer lending platform whose founders believe the traditional lending industry has failed borrowers.

To solve that problem, they’ve created an easier way to borrow – you enter your loan application and lenders compete to win your business. But customer reviews aren’t great, would-be borrowers complain that they are getting no offers from investors and there are complaints about the lack of customer support. Because of this, borrowers may be better off seeking out better alternatives.

Our take: Lenme matches you with investors willing to fund your loan – for a price. You compare the loan offers and choose which one you prefer. However, some investors charge APRs of 200% or higher, and that’s in addition to the $1.99/month subscription fee and a loan origination fee that’s a minimum of $3. That can add up quickly for a $50 loan. And if you can’t repay your loan, it will be turned over to debt collectors, damaging your credit score. You may be better off checking out some of the other options first.

Table of Contents

What you need to know about Lenme

Lenme is a platform that matches borrowers with lenders. It is different from similar apps because once you submit a loan request, lenders send you competing loan offers. The idea is that the competition will help you get more favorable loan terms and lower interest rates — even if you have bad credit.

With Lenme, borrowers (in theory) get immediate access to investors willing to issue loans – regardless of their credit score. The idea is that because lenders compete for your business, the interest rates may be better than what you’d find through traditional banks, credit unions or online lenders. However, Lenme currently doesn’t have enough investors to fill the loan requests. Hundreds of loan requests a day go unfunded.

Note: Lenme used to be called Lenmo. The name was changed in early 2020.

Lenme is a better option than payday loans because you can borrow a larger loan and repay it over time. Plus, the interest rate will likely be lower than the 300% annual percentage rate (or more) you’d pay a payday lender. Lenme also says it reports on-time payments to the three major credit bureaus, which will help you boost your credit score.

Click here if you want to go directly to the Lenme review.

Nine apps like Lenme for cash advances

Most of Lenme’s peer-to-peer competitors match borrowers and lenders, but the lenders aren’t competing for your business, so the loan terms may be slightly less favorable. SoLo Funds, Hundy, Prosper and Peerform connect borrowers with individuals. Upstart, Quilo and Possible Finance connect borrowers with banks or credit unions. Borrowers can request loans on reddit and fellow Redditors will make them loan offers, and Zirtue only works if you’re borrowing from people you already know.

The best option for you will depend on a few key factors, including how much you need to borrow, your credit score and the time you need to repay the loan.

| App | How it works | Interest/fees | Loans | Repayment |

| SoLo Funds | P2P platform matches borrowers and lenders | Lenders set the loan terms and borrowers pay optional tips | Up to $1,000 | 30 days |

| Hundy | P2P cash advances | Hundy doesn’t charge a fee; tips are requested | Up to $250 | Next payday or within 30 days |

| Prosper | Matches investors and borrowers | APR is determined based on credit score | $2,000 to $40,000 | Fixed installments over three or five years |

| Peerform | Connects borrowers with individual investors | APR ranges from 5.99% to 29.99% with an origination fee of. 1% to 5% of the total loan balance | Up tp $25,000 | 36 or 60 months |

| Zirtue | The fee is 5% of the total loan amount; no interest from lenders | Fee is 5% of the total loan amount; no interest from lenders | Flexible | Determined by lender and borrower |

| Upstart | Connects borrowers with banks and credit unions | APRs up to 35.99% | Up to $50,000 | 5 years |

| Possible Finance* | Traditional lender offers small-dollar payday loan alternatives | APRs range from 54.51% to 240.52% | Up to $5000 | Repaid in four installments |

| r:borrow subreddit | Negotiated directly with the lender | Formalizes loan agreements with friends and families | Usually small loans of less than $1,000 | Negotiated directly with lender |

| Quilo | All-digital, unsecured personal installment loans used to make new purchases or pay down credit card balances. | Varies by credit union but ranges from 0% to 22.96% APR | Up to $20,000 | Depends on the amount borrowed |

Possible Finance loans are only available to residents of Alabama, California, Delaware, Florida, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, Ohio, Oklahoma, Rhode Island, South Carolina, Tennessee, Texas, Utah or Washington.

Update: MyConstant is another popular peer-to-peer lending app. Unfortunately, the platform has had to suspend loans due to an active class action lawsuit. MyConstant states, “We will not be able to declare any further distribution until the matter is resolved.”

Ten more apps for cash advances

Lenme ultimately offers loans up to $5,000, but initially you’ll only be able to borrow about $300. Cash advance apps typically offer small loans up to $500 and don’t charge interest, so they may be a more-affordable option. They are typically repaid from your next paycheck, but there are no interest charges or late fees. Instead, borrowers pay a monthly subscription fee and some loan apps accept optional tips.

Best for low fees: Dave

- Monthly membership fee: $1

- Maximum cash advance: $500

- Repayment terms: Between three days and three weeks or on your next payday

- Interest rate: None

- Other fees: Optional fast-funding fee of up to $15 to a Dave Spending account or up to $25 for external transfers; Requests optional tips of up to 25% of the total loan amount

Best for access to real humans: Albert

- Monthly membership fee: $14.99 for Albert’s “Genius” plan, which is required for all cash advances. However, Genius includes additional financial services like savings accounts and access to a real person for financial advice

- Maximum cash advance: $250

- Repayment terms: Whenever your next direct deposit hits your account, up to 10 days

- Interest rate: None

- Other fees: $6.99 fee for instant transfers, tips requested

READ MORE: Albert review

Best for budgeting tools: Brigit

- Monthly membership fee: Ranges from $9.99 to $14.99; offers other features including budgeting tools

- Maximum cash advance: Up to $250

- Repayment terms: You choose your repayment date, which is typically your next payday

- Interest rate: None

- Other fees: Optional fee of up to $4 to get instant cash; no tips requested

READ MORE: Brigit review

Best for flexibility: MoneyLion Instacash

- Monthly membership fee: Ranges from $1 to $19.99, depending on features

- Maximum cash advance: $500 (or up to $1,000 if you use other MoneyLion products)

- Repayment terms: MoneyLion says it aims to coordinate your due date with your next paycheck

- Interest rate: None

- Other fees: Optional fee ranges from $0.99 to $7.99 for “Turbo” cash

Best for overdrafts: Chime SpotMe

- Monthly membership fee: None (You must be a current Chime customer with an activated debit card to be eligible)

- Maximum cash advance: Offers overdraft protection up to $200

- Repayment terms: Repaid on the next payday

- Interest rate: None

- Other fees: None

Best for multiple loans per pay period: Earnin

- Monthly membership fee: Up to $8, though you can opt out

- Maximum cash advance: $100 per day, up to $750 per pay period

- Repayment terms: Repaid on the next payday

- Interest rate: None

- Other fees: $1 to $3.99 to get your money at “lightning speed”; optional tip of up to 10% of advance requested

Best for a free trial: Empower

- Monthly membership fee: Free for 14 days, then $8 per month

- Maximum cash advance: Up to $250

- Repayment terms: Repaid on the next payday

- Interest rate: None

- Other fees: Optional fee from $1 to $8 to get your money instantly; tips of up to 20% of your total loan amount requested

Best option with no subscription required: Klover

- Monthly membership fee: None for short-term loans, though additional financial services may require a paid Klover+ subscription

- Maximum cash advance: Up to $200

- Repayment terms: Repaid on the next payday

- Interest rate: None

- Other fees: Optional fee of $2.99 to $20.78 to get expedite your loan transfer; optional tips up to 20% of loan amount

READ MORE: Is Klover legit

Best AI-powered option: Cleo

- Monthly membership fee: $5.99 for Cleo Plus, which is required for cash advances

- Maximum cash advance: Up to $250

- Repayment terms: Repaid on the next payday

- Interest rate: None

- Other fees: Optional fee of $3.99 for instant transfers; optional tips up to 20% of loan amount; no tips requested

READ MORE: Cleo review

Best for help paying bills: Gerald

- Monthly membership fee: $9.99 per month (required for cash advances)

- Maximum cash advance: Up to $100 or half of your paycheck early

- Repayment terms: Repaid on your next payday

- Interest rate: No interest or hidden fees

- Other fees: Instant transfers cost $3.99

Lenme review

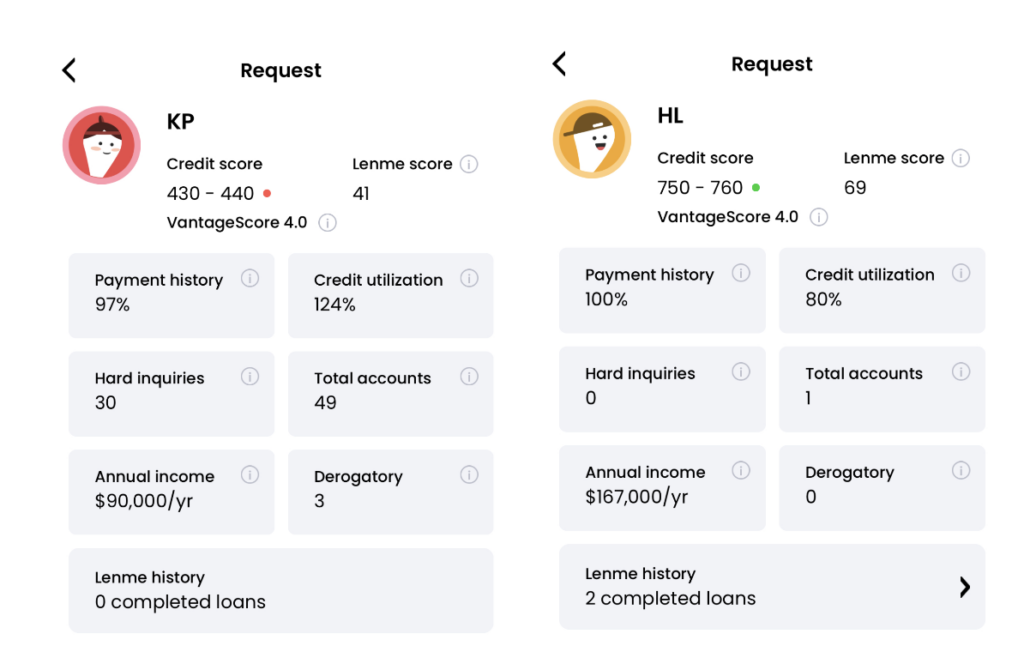

When you request an installment loan from Lenme, they will run a soft credit check. This will not affect your credit score. The information will be used to calculate your “Lenme score,” which is what potential investors will see when they view your loan request.

Lenme is slow. When you request a loan, it can take a couple of days for the investor to make a loan offer. After that, it can take a few business days for you to get the money. Once you repay your loan, it can take up to two weeks for the money to be posted back to the investor’s account to be reinvested. This leads to frustration with the platform, and some investors have had to cancel loan offers because they can’t issue new loans until the proceeds from previous loans have been posted back to their Lenme accounts.

Lenme score

Pro tip: Lenme uses VantageScore 4.0, which will be slightly different from your FICO score.

In addition to your credit score, your Lenme score is based on far more than just your credit score. It is based on factors including:

- Your debt-to-income ratio is also a key component of your overall credit score. Your DTI measures the percentage of your monthly gross income used to pay debts. It is calculated by dividing the total monthly debt payments by gross monthly income and then multiplying by 100 to get a percentage.

- Your Lenme history: Having previously borrowed through Lenme and successfully repaid the loan will boost your Lenme score. Any late payments will lower your score.

This is how loan requests appear to potential investors. The color denotes your Lenme score:

Pro tip: If you’ve missed a payment at any point in the past, you will no longer be able to borrow through Lenme.

Why am I getting no offers on Lenme?

You’re in good company if you submit a loan request on Lenme and don’t get offers. Hundreds (if not thousands) of people post loan requests each day that go unfunded. Lenme currently doesn’t have enough investors to fund the requests it receives. When borrowers don’t repay their loans, Lenme doesn’t take much action, leaving investors hanging. In theory, the unpaid loans are sent to collections, but getting any details about the process is impossible. Roughly 25% of Lenme’s loans have gone unpaid; investors lose their money if that happens.

Lenme does not respond to investor emails about the status of their defaults. Nor does Lenme keep investors updated on the collections process. Because of this, many investors have stopped funding loans on the platform at all, and others will only loan money to people who have already repaid at least one other loan.

First-hand experience: DebtHammer initially funded three loan requests through Lenme, all to borrowers with the highest Lenme scores. Of those three, one defaulted, one was repaid in full, and one has (so far) completed two of three payments. That’s a default rate of 33%. Since then, we have re-invested the repaid money by funding two more loans. We will update the article to reflect the payment status and the collections process. So far, repeated attempts to contact customer service to learn about collections efforts have gone unanswered.

To get a successful offer, your best bet is to try to match with a Lenme investor on a separate platform, like Reddit. Individuals are typically more willing to issue loans if they can contact you if you fail to repay them.

This is important to know because if you post a loan request on Lenme and do not receive offers, you cannot repost the request until the initial post expires (in roughly a month).

Lenme’s fees

Lenme charges a monthly subscription fee of $1.99 for borrowers (or $9.99 for a full year). There is no fee for Lenme investors.

Lenme also charges borrowers an origination fee of 1% of the total loan amount (or a minimum of $3), regardless of interest rate and pay period. This fee is built into your loan request and repayment plan. These fees are in addition to the interest rate that the investor offers.

How to borrow money from Lenme

The process is supposed to be relatively simple.

- Download the Lenme mobile app (available at the Google Play Store for Android and Apple’s App Store for iPhone (ios)

- Create an account

- Verify your identity by adding your Social Security number and government-issued ID

- Connect your bank account

- Pay the membership fee

- Choose your desired loan amount

- Submit loan requests

- Wait for lenders to submit offers

However, loan requests did not go through upon completing the registration and paying the membership fee. The app kept flashing a message stating that “something went wrong.”

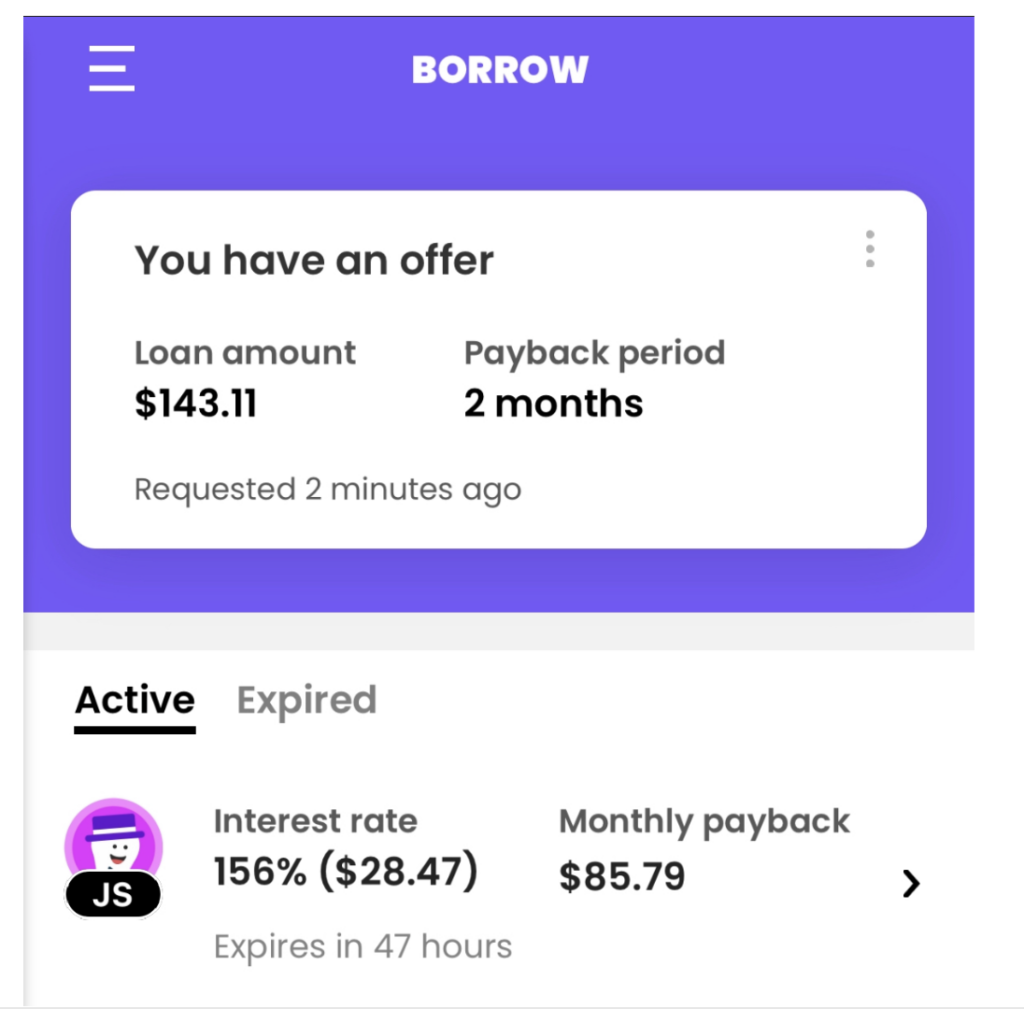

Once a loan has been requested, the status will be “pending,” meaning investors are now free to make you an offer. Your request will remain active for 30 days. However, offers from lenders are only valid for 48 hours, so you’ll have to be prepared to act quickly.

You will be notified of all loan offers.

The offer will include the interest rate and your monthly payment.

As you can see, this loan request for $140 repaid over two months includes a $3 Lenme fee, and the investor is offering an interest rate of 156% APR, meaning the total repaid would be $171.58.

If you accept a loan offer, the investor has 48 hours to approve the loan. At this point, it’s possible that a hard credit score inquiry could be run, which could cause your credit score to drop slightly.

Pro tip: Even though a loan was offered and you accepted, that does not mean the loan is guaranteed. The investor still has to approve the loan.

If the loan is approved, the funds will be transferred to your checking account via direct deposit in up to a business day.

If the investor fails to approve the loan, all previous loan offers will still be available (as long as they haven’t expired). In addition, new investors will be able to see your loan request.

Pro tip: Loan requests cannot be canceled until you’ve received at least one offer, and loan payments can only be made via ACH transfer from your bank account. Credit cards cannot be used to make loan payments.

Interest rates

Rates will vary based on the investor and your Lenme score. However, typical offers will have higher rates than most traditional installment loans but will be lower than what you’d pay a payday lender.

Lenme requirements

To borrow money, you must:

- Be at least 18

- Have a government ID (you will be asked to show this before you can create an account)

- Have a bank account

- Be a U.S. resident

How fast will you get your money?

Investors can make offers within minutes of your loan request, and your loans can be approved in as little as one day. That’s significantly faster than a bank loan, though you should expect it to take a few business days for the loan to post to your bank account. The ACH transfers seem to be slower than most others.

Late payment penalties

If you don’t make your monthly payment on time, you will be charged a late fee. The incident will also be reported to the credit bureaus, which could affect your credit score.

Can I cancel a loan?

Yes and no. You can cancel a loan request once you’ve received at least one offer. However, once a loan is approved, it cannot be canceled. It becomes a legally binding contract. You must repay it and pay the interest and fees you’ve agreed to.

Customer ratings

Poor customer feedback is a concern, with many complaining that investors are not making loan offers and cannot cancel or resubmit their requests until they expire after 30 days.

Lenme has an F grade from the Better Business Bureau, where it earns 1.23 out of five stars. Customers say that once they’ve repaid their first loan, reborrowing is difficult, and customer support is not responsive. The platform is cumbersome, and the filtering system is ineffective if you’re an investor looking for a specific loan request.

Reviews from the Apple App Store and Google Play are far more favorable.

Lenme earns 4.3 out of five stars on Apple’s App Store, with more than 26,000 reviews.

On Google Play, it has earned 2.9 stars out of five in about 4,000 ratings.

The bottom line

Lenme is unique because it allows potential borrowers to request loans, then allows prospective investors to present them with loan offers. Because loan offers are based on your Lenme score rather than your credit score, it provides more options for bad credit borrowers and makes offers more competitive than what you’d find on other peer-to-peer lending platforms. However, poor reviews from customers are a red flag. Because of the potential for high interest rates and repeated technical issues, you’ll be better off if you first explore other lower-cost options.

FAQs

Lenme was founded in 2018 by Albert Mansour, Beshoy Louka, John Hakim and Mark Maurice.

Lenme’s customer support team is on duty from 7:00 a.m. to 11:00 p.m. EST. You can reach them by completing this form or by calling (844) 426-6606.

Chime offers an array of financial tools, including bank accounts. Chime can be linked with many external bank accounts using Plaid. Since Lenme uses Plaid to link accounts, you should be able to link your Chime account as long as the name associated with your Lenme account matches the name on your Chime account.

Plaid connects your bank accounts with lending platforms and banking apps. It appears that Lenme requires Plaid to link your accounts. If your bank is not compatible with Plaid, you likely won’t be able to link your accounts to request Lenme loans.

Lenme has a user base of more than 300,000 borrowers and investors. The company has partnered with the three major credit bureaus, payment processors, and data aggregators.

Payment transactions and credit report information is encrypted using SSL technology.