SoLo Funds is a peer-to-peer lender that matches borrowers with investors willing to fund loans for higher-risk borrowers. You set the terms of your loan, and all fees and tips are optional. It can be an ideal option for borrowers with less-than-perfect credit scores, particularly people who fear that a payday loan or title loan is their only option.

But what happens if you apply for a loan through SoLo Funds and you don’t get any offers? Luckily, there are several other platforms to try.

Our take: SoLo Funds offers a lower-cost alternative to payday loans. You can control the cost, since tips and fees are optional. However, don’t expect your loan to be free. Most investors won’t be willing to fund loans unless they’re offered a fairly significant tip. Since some lenders have reported default rates as high as 33%, many will be wary to issue loans to new applicants without a financial incentive.

| App | Monthly subscription fee | Loan amount | Interest/fees |

| Zirtue | None | Up to $20,000 | Fee is 5% of the total loan amount; no interest from lenders |

| LenMe | $1.99/month | Up to $5,000, but the maximum starting loan is $200 | Origination fee of 1% of total loan amount ($3 minimum) plus an interest rate determined by the lender |

| Albert | $14.99/month | Up to $250 | None |

| Brigit | $9.99/month | Up to $250 | None |

| Cleo | $5.99/month | Up to $250 | None |

| Dave | $1/month | Up to $500 | None |

| Earnin | Up to $8/month | $100 per day, $750 maximum per pay period | None |

| Empower | Free for 14 days, then $8/month | Up to $250 | None |

| FloatMe | $3.99/month | Up to $50 | None |

| Klover | None | Up to $200 | None |

| MoneyLion | $1 to $19.99, depending on the services you choose | Up to $500 | None |

| Possible Finance | None | Installment loans up to $500 | Up to 248% APR |

| Chime | None | Up to $200 overdrafts | None |

| Varo | None | Up to $500 | Small fee based on the amount borrowed |

Table of Contents

More peer-to-peer loan apps like SoLo Funds

Best for loans from friends and family: Zirtue

Like Solo Funds, Zirtue is the middleman between borrowers and the friends and family members who agree to lend them money. It also manages loan deposits and payment withdrawals.

Unlike SoLo Funds, Zirtue requires you to make loan requests directly to your lender. The idea is that my using a lending platform as a middleman, it avoids any hassle or discomfort that comes with having to hound friends or family members to repay their loans.

Best for competitive offers: LenMe

LenMe focuses more on connecting borrowers with investors. LenMe borrowers are assigned a LenMe score, which investors see when searching through loan applications. Even if you have bad credit, your LenMe score rises with each loan you pay off. Investors then submit loan offers. You can get multiple offers from different investors, so a competitive aspect is intended to keep interest rates low. LenMe charges borrowers a membership fee of $1.99 per month. There is no fee to invest.

It’s worth noting that Lenme has had a number of complaints from borrowers who have signed up, paid the membership fee, and submitted loan requests but have received zero offers. The platform doesn’t have enough investors to cover the number of loan requests.

READ MORE: LenMe review

How cash advance apps work

A cash advance app is an app that you can use to bridge the gap until your next payday. You connect the app to your bank account. The app then uses your banking history to determine how much you qualify for, deposit your advance, and automatically withdraw your payments.

Best apps for cash advances

Cash advance apps have more in common with payday loans and installment loans than P2P lending. That said, they are a much better alternative to payday and installment loans. Cash advance apps have much better terms, fees and repayment schedules, and they’re rapidly growing in popularity: 33% of Americans have now used at least one cash advance app. Here are some of the best to choose from:

Best if you need help from a genius: Albert

Albert allows users to borrow up to $250 until their next payday, but you must pay for a “Genius” subscription to be eligible. However, the Genius subscription also offers access to live people to help you with your money management and investing. The app also users to request paycheck advances a couple of days before their direct deposits land. The app offers a checking account, debit card and cash-back bonuses.

READ MORE: Albert review

Best for budgeting tools: Brigit

Brigit is an all-in-one money management app that allows users to get up to $250 in cash advances — if they can prove that they can pay that back with their next deposit. The app also offers money management and credit-building tools. The basic service is free, and the premium service costs $9.99 per month. However, only premium subscribers are eligible for cash advances.

READ MORE: Brigit review

Best AI-powered option: Cleo

Cleo bills itself as “a money app that doesn’t suck.” It allows cash advances of up to $250 until your next payday, but only for Cleo Plus subscribers. Cleo Plus costs $5.99 per month. They promise they don’t do credit checks. Cleo is AI-powered, so it isn’t ideal for people who need advice from real people. However, Cleo’s bot offers some straight talk, roasting your spending habits when you make poor financial choices. Cleo also offers credit building and budgeting services.

READ MORE: Cleo review

Best for low fees: Dave

Dave is a banking and cash advance app. Users can get advances of up to $500, depending on their banking histories. There is a small monthly fee of about $1 per month. The Dave app also offers other financial services, including budgeting and credit-building tools and help finding side hustles to earn extra cash.

READ MORE: Apps Like Dave: Here are 12 More Cash Advance Options

Best for multiple loans per pay period: Earnin

Earnin is a little different than other cash advance apps. Instead of basing your advance amount on your credit or banking history, Earnin allows you to “cash out” the money you’ve already earned. The app connects with your bank and your employer. You’re allowed to get access to the money you’ve already made that pay period. Then, when your paycheck is deposited, the app automatically withdraws whatever you’ve already “cashed out.”

Earnin also offers a service called “Balance Shield.” Balance Shield monitors your bank accounts and lets you know when your balance gets low. It also gives users up to $100 to help cover expenses that might otherwise overdraft your account.

Best for a free trial: Empower Cash Advance

Empower offers users a paycheck advance of up to $250 to cover unexpected expenses. Empower offers a free trial, then costs $8 per month. The app’s main product is actually a credit-building credit card that can help you boost your credit score. Unlike other apps that encourage you to use them for banking, Empower connects to your existing accounts.

Best for very small loans: FloatMe

FloatMe is a cash advance app. That’s all it does. FloatMe uses Plaid to connect to your existing bank accounts and offers cash advances of $50. That advance is automatically paid back out of your next direct deposit.

READ MORE: Apps like FloatMe

Best for a chance to win money: Klover

Klover connects to your bank account. You will qualify for a cash advance if you have at least three direct deposits over the last two months. The app uses an algorithm to determine how much you can advance. It does not require a credit check. Klover doesn’t charge a monthly fee for cash advances. Instead, it makes money from mining data. For an extra fee, users can upgrade to Klover+ to get access to extras like budgeting tools. Klover holds a daily sweepstakes where one winner can win $100 and five runners-up can win $20. To learn more, check out our review.

READ MORE: Klover review

Best for flexibility: MoneyLion Instacash

When MoneyLion says it’s an “all-in-one” finance app, they aren’t kidding. In addition to their InstaCash service, which offers cash advances of up to $500, MoneyLion offers budgeting tools, credit building, and even crypto! They also offer banking and investment tools to people who pay for the app’s premium services. The monthly fee ranges from $1 to $19.99, depending on the services you choose.

READ MORE: Best Cash Advance Apps Like MoneyLion

Best if you need extra time: Possible Finance

Possible Finance is an installment loan lender. You can request up to $500 through their app. The fees for their loans are not quite as bad as on payday loans, but they aren’t exactly low. Possible Finance typically charges 150 to 250% APR on their loans. If paid on time, a loan of $200 costs the borrower about $230. One good thing is that the loans don’t have to be repaid in full from your next paycheck. That means you don’t have to worry about having most of your next paycheck earmarked for repayment. You can parcel payments out over a few pay cycles. Another positive: Possible Finance reports your payments to credit bureaus. As long as you make your payments on time, your credit score should increase.

READ MORE: Apps like Possible Finance

Online banking apps

Online banking apps often offer benefits like cash advances and early direct deposit access. Unlike cash-advance apps, however, online banking apps have more in common with traditional banks than traditional lenders. Here are a couple of the most popular online banking apps out there right now.

Chime

Chime has been getting a lot of attention and for a good reason. This online banker offers a spending account and savings account. Account holders are given a Visa debit card, which provides access to a large ATM network.

Chime allows people to access payroll direct deposits a couple of days early. They also offer a service called “Spot Me.” Spot Me is a type of overdraft protection. If a payment goes through and you don’t have enough money in your account to cover it, Chime will “spot” you up to $200 to cover that expense.

READ MORE: Apps that work with Chime

Varo

Varo is an online bank that offers spending and savings accounts. It also offers payday advances up to $500 (to those who qualify) and has a credit-building program called Varo Believe.

Varo also has a “Perks” program. Customers who use the Varo app to shop online can earn cashback on those purchases.

READ MORE: Apps that work with Varo

Employer-sponsored cash advance apps

In addition to cash advance apps for people to use personally, there are also paycheck advance apps that work in conjunction with employers. These apps connect to your employment information and time clock activity. The primary difference between them and apps like Earnin is that your employer will provide access to these apps. The big disadvantage is that many employers, particularly small businesses, are not enrolled. Here are just a few of the different employer-sponsored cash advance apps available.

Review: How SoLo Funds works

SoLo Funds is a little different than your typical cash advance app. Instead of providing payday advances that you pay back with your next direct deposit, SoLo Funds is a peer-to-peer lending platform.

Here’s how it works:

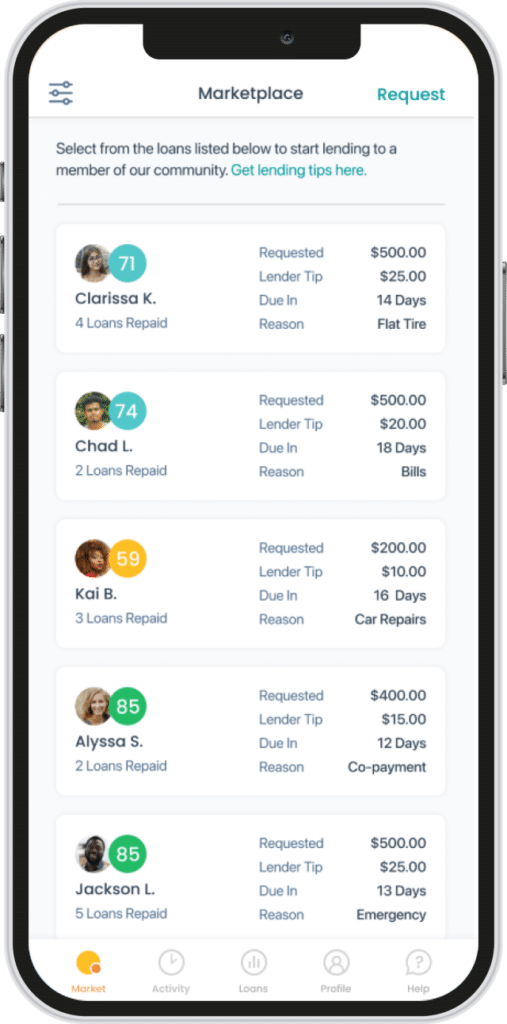

You download the mobile app — it’s available for iPhone (iOS) and Android — create an account, and create a post requesting your funds. Lenders will see your request and, hopefully, one of them will agree to loan you the money you need. You, then, accept their loan and pay it back on time and in full. Every time you borrow money and pay it back on time, your “SoLo Score” goes up. The higher your SoLo Score, the more money you are able to request (and the easier it will be to find individual investors who are willing to fund your loan request.)

When you submit your loan request, this is what potential lenders will see:

SoLo Funds was founded in 2015 by Rodney Williams and Travis Holoway. They created the platform as a way for underserved communities to gain access to funding opportunities they previously lacked. They understood that not everybody has access to lending opportunities with traditional institutions. They also understood that not everybody has a friend or family member willing to float them during hard times. They wanted to create something to help fill that void.

SoLo Funds requirements

When signing up, SoLo will need your Social Security number, your banking and debit card information and a scan of your driver’s license (or official state-issued ID). Note that not all banks are supported.

Pro tip: If you bank with Chime, SoLo Funds will not be supported and you will need to choose a different platform.

What makes SoLo Funds stand out?

What’s different about SoLo Funds is the founders’ goal of creating a community. Their hope is that, eventually, borrowers will choose to become lenders and pay forward the help they have gotten.

In an interview with Fast Company, Travis Holoway said:

“If we can have individuals come here, take loans when they need them, pay them back on time, get access to more traditional financial tools and resources, and ultimately come back as a lender and pay that forward, that is the best life cycle of a user on our platform”

It’s certainly a nice idea, right?

And it seems to be working. According to AfroTech, 30% of the lenders on SoLo Funds were previous borrowers.

The company has also been recognized for its effort by B Lab. It was granted B Corp certification in December 2021.

Pros and cons of using SoLo Funds

On the one hand, SoLo Funds seems pretty great:

- Outside of needing a valid photo ID, there are no barriers to entry

- Borrowers don’t have to submit background or credit checks

- Loans aren’t based on credit or other typical factors

- Most loan requests are funded within a half hour or so

Instead of interest or fees, borrowers have the option of “tipping” their lenders (more on this later). And, as long as the loan isn’t sent to collections, it won’t appear on your credit report.

On the other hand, there are some drawbacks to the SoLo system:

- Borrowers have to explain why they need the money and how the loan will be used. Not everybody feels comfortable sharing that information

- Not all banks are supported

- There’s a 48-hour verification period while your ID is verified

- If borrowers fail to pay a loan back on time, their SoLo score goes down. This makes it more difficult to secure funding in the future

- The temptation to offer large tips to entice lenders is strong. Some borrowers end up paying more in tips for their loans than they would in fees to a traditional lender

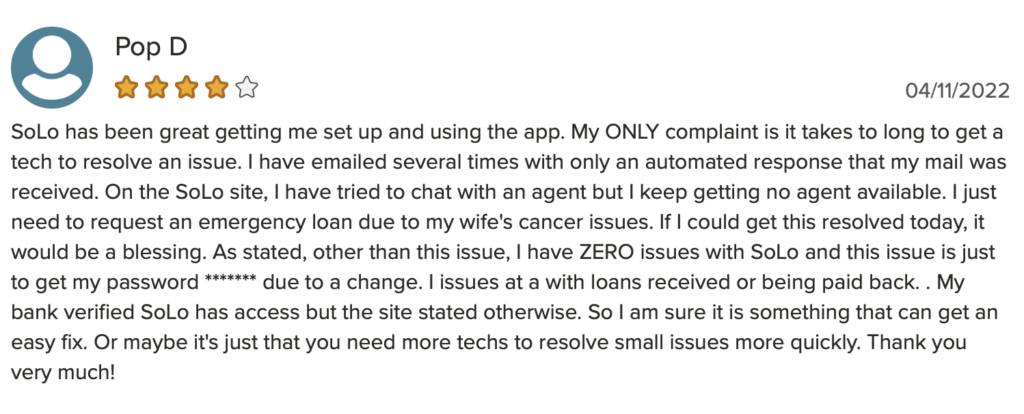

Customer reviews

SoLo Funds has earned a B rating but only about 1.25 stars on BBB with more than 150 complaints, almost all regarding technical problems or backlogs, and more than a few from lenders who haven’t been repaid.

Pro tip: It is important to note that because these are peer-to-peer loans, your loan is being funded by a real person who is actively working to help people in a tough financial spot. If you don’t repay the loans, it will discourage people from making further investments. Additionally, if you default and your loan is sent to collections, your credit score will be seriously damaged.

On Trustpilot, SoLo Funds earns 2.2 out of five stars, with investors complaining that the loans aren’t being paid.

On Google Play, the app earns four out of five stars in more than 13,000 reviews.

In Apple’s App Store, the app earns 4.4 out of five stars in more than 23,000 ratings.

The bottom line

SoLo Funds targets borrowers who likely won’t qualify for traditional loans. It helps to match you with investors who are willing to cover short-term loans in order to help them avoid payday loans. There are no mandatory fees or tips. However, the service won’t be free. The more you agree to tip, the better the odds of finding an investor who is willing to fund your loan.

FAQs

Peer-to-peer lending is a system that matches borrowers with individual investors. P2P lending platforms connect people who need to borrow money with others who have money they’re looking to invest. It bypasses the traditional banking and credit systems.

SoLo Funds was founded by Travis Holoway and Rodney Williams in 2018.

You can submit questions and problems to SoLo Funds using this form. The mailing address is 555 W 5th St Fl 35, Los Angeles, CA 90013-1010. The phone number is (213) 238-7176.

Yes. Plaid is a fintech platform that allows apps to connect with your banking information. Plaid has data access agreements with many major banks, including JPMorganChase, Wells Fargo, Capital One and U.S. Bank. Unfortunately, not all major banks (PNC, for example) are compatible with Plaid, making it difficult to use those apps to borrow.