If you’re struggling with paying a payday loan, you need to know whether your lender is licensed. If your lender is not licensed, your loan may not be legally collectible, meaning you may not have to pay it.

Stuck in payday debt?

DebtHammer may be able to help.

Table of Contents

How to determine whether your payday lender is licensed

Each state has an agency that’s responsible for licensing lenders. This may be the state attorney general’s office or the state agency handling financial regulation. The Consumer Financial Protection Bureau has compiled a list of each state’s banking regulator. Find the contact information for your state and check with that agency to see if your lender is licensed.

Your lender should also be able to produce a license number or other evidence that they’ve registered with the state regulators. Don’t be afraid to ask. If they are legitimate, they will be willing to prove it. If they aren’t willing to show a license, that’s a red flag and you should research the lender more thoroughly.

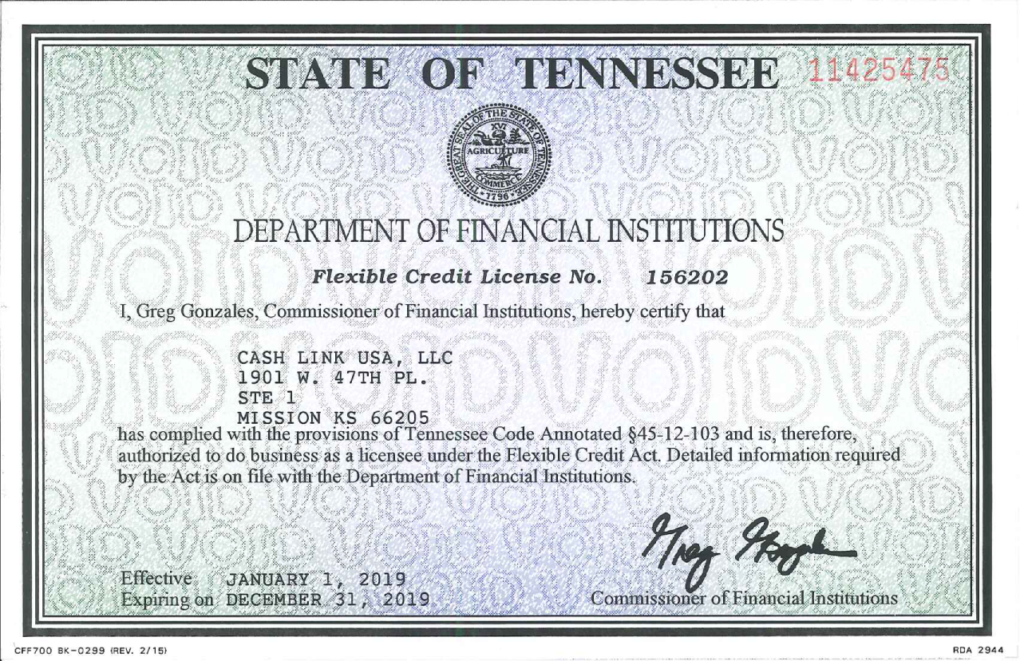

Here’s an example of a legitimate license:

Find out where the lender is based

It’s important to determine the actual identity and location of your lender. If your lender is based in a different state, they may not have a license to issue loans in yours. Beware of lenders based on Native American tribal territory. These are known as tribal lenders, and because the U.S. Constitution grants sovereign immunity to Native American tribes, tribal lenders are not obligated to follow state laws.

Some tribal lenders go so far as to create their own “licenses” that are posted on their loan websites. These are not issued through banking regulators. Check the fine print of your lender’s website for information about the company owner. Tribal lenders must note the tribe with which they are affiliated, but the information will be buried in very fine print.

Other payday lenders or the companies behind them may be based outside the U.S. This is a red flag and may indicate an illegal lender or scammer. Run searches on your lender — both under the business name or the name on their license, if they have one — and see what you can learn. Check their Better Business Bureau pages as well.

Some online lenders may advertise themselves as check cashing services that will cash any check you bring in and give you immediate cash – often for a fairly high fee. Though most of these storefronts also offer payday loans, paying for the check cashing service isn’t the same as a paycheck advance. You will need to bring in your physical paycheck before any check cashing service will give you your money.

Keep in mind that payday lenders are not banks. They are storefronts with names such as Amscot, Advance America, Check Into Cash, and Cash ‘N Go. They usually only offer limited services, including money orders, payday loans, check cashing, title loans and bill payments for a fee.

Pro tip: Banks will not offer payday loans. However, federal credit unions offer what’s known as a Payday Alternative Loan, which is similar to a payday loan but with capped interest rates and a longer repayment period.

Online lenders are more likely to be unlicensed

About 73% of payday loans are still issued at physical storefronts, but online lenders are gaining in popularity. Online lenders also present unique problems.

A study by the Pew Charitable Trusts found online lenders are “more expensive than those offered in stores” and account for the majority of consumer complaints. Many are set up to renew automatically. If you can’t afford to repay your payday loan, costs can mount quickly.

Pro tip: You should have no problem finding a physical payday loan store if you need one. There are more payday loan stores in the U.S. than McDonald’s and Starbucks.

Tribal lenders are most likely to be exclusively online. Most traditional payday lending companies will have both physical storefronts and an online application.

If you’re stuck with a tribal loan you can’t afford to repay, DebtHammer can help. Contact us today to schedule a free consultation.

Payday loan laws and licensing requirements

Use the table below to determine if your lender is licensed.

Payday loans may not be legal in your state

Payday loans are not legal in all states. Some states ban payday loans entirely or impose requirements that lenders aren’t willing to meet. Many states require payday lenders to be licensed.

Arizona, Arkansas, Colorado, Connecticut, Georgia, Hawaii, Illinois, Maryland, Massachusetts, Minnesota (as of Jan. 1, 2024), Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Pennsylvania, South Dakota, Vermont and West Virginia plus Washington D.C. and Puerto Rico all have laws or interest rate caps in place that essentially make payday lending illegal.

READ MORE: States where payday loans are illegal

Two states heavily restrict payday loans

Maine caps interest at 30% but permits fees that equate to a 261% APR for a two-week loan of $250. Oregon allows loans with a one-month minimum term at 36% APR, less an initial loan fee of $10 per $100. This means that the APR to borrow $250 for a month is 154% for the initial loan plus 36% for rollovers and subsequent loans.

Many licensed payday lenders will refuse to loan money to military service members and their families

That’s because the Military Lending Act strictly caps the amount of interest servicemembers and their families are allowed to be charged. Because legitimate payday lenders don’t want to have to lower their fees to meet those lending requirements, they will simply refuse to issue loans instead.

Safer alternatives to payday loans

Payday loans are a fast, easy way to get emergency cash, but the cost can be extreme. Consider these other ways to get out of financial trouble.

- Cash advance apps

- A credit card cash advance

- Payday Alternative Loans

- Installment loans

- Borrowing from friends or family

Remember that while payday loans seem like an easy solution, they can create a bigger problem. Before considering a payday loan, you should look closely at your options and do everything possible to find a better way.

The bottom line

Times are tough right now, and a lot of Americans are struggling. Many people caught in the payday loan trap blame themselves. More than 90% of payday loan borrowers end up regretting their original loan. Remember that these loans are intentionally and carefully designed to trap you. That’s their purpose. You may regret taking the bait and falling into the trap, but that regret won’t get you out of the trap.

If you’re in that trap, you need to take action and consider your alternatives. You probably won’t be able to pay the loan because it’s designed to be unpayable. You need to look for another way out. Finding out whether your payday lender is licensed in your state is a start.