Update: Aspen Financial Direct is now centz. However, existing customers can continue to service their loan online.

If you’ve gotten a loan offer in the mail from centz, you may have some questions. What is centz? How did they get my information? Is this loan worth it?

We researched the lender and here’s what we’ve learned.

Table of Contents

What is centz?

Centz issues short-term installment loans in some states. It used to issue loans under the name Aspen Financial Direct. The new name, centz, is trademarked by Aspen Financial Direct, so the parent company remains unchanged.

Most importantly, centz is only issuing loans to people who have received a mailer from them. They are currently not accepting unsolicited loan applications. And that mailer you got promising you a certain amount of money? That amount isn’t guaranteed. You won’t learn the actual amount you’re eligible to borrow until you submit the application.

You also have to reside in specific states. Based on the information provided on their website, those states are:

- Alabama

- Delaware

- Idaho

- Missouri

- New Mexico

- South Carolina

- Texas*

- Utah

- Wisconsin

According to the website, while it used to offer loans in California, as of December 20, 2019, Aspen Financial Direct is no longer accepting applications or granting loans there.

*In Texas, Aspen Financial Direct is not technically a lender at all; it is a “Credit Access Business,” and any loan applications approved by Aspen Financial Direct are provided by First Financial Loan Company, LLC.

Is centz licensed?

The footer on the centz landing page says:

“The lender is licensed and regulated by the New Mexico Regulation and Licensing Department, Financial Institutions Division, P.O. Box 25101, 2550 Cerrillos Road, Santa Fe, New Mexico 87504.”

It is essential to know that each state has its own licensing requirements. Aspen Financial Direct lists some information about licensing in each state in which it does business.

Currently, the website shows presumably current licensing (in other words, no expiration date is listed on the license) for South Carolina, Texas and Wisconsin.

The following states display expired licenses for centz, Aspen Financial Direct or its parent company, Aspen Financial Services:

- Alabama

- Missouri

- New Mexico

- Utah

The following states do not have licenses or licensing information displayed. Instead, their listings simply contain the contact information for that state’s licensing body:

- Delaware

- Idaho

It is possible that each state’s license is current, and the website simply hasn’t been updated yet. Make sure you contact the licensing bureau in your state to find out if centz is legally allowed to lend you money before you submit your application!

What can you expect from an Aspen Financial Direct loan?

Each state has very specific requirements for terms a borrower can get if approved for a loan with centz.

- Loan amount: $2,000 to $5,000

- Repayment terms: 18 to 24 Months

- APR: 99% to 149%

Repeat customers who make enough successful payments may qualify for more on future loans.

In Texas, borrowers can get loans from $500 to $1,200, pay 299% interest, and only have 5-6 months to repay the loan.

It is possible to be charged a fee for a late or missed payment, but the company does not explain how much these fees are until you have submitted your application. Instead, they encourage borrowers to contact the company’s customer service department if they think they won’t be able to make a payment on time.

Note: As of 2016, Aspen Financial Direct does not offer loans to people who would be covered by the Military Lending Act (for example, active-duty service members and their dependents). The website does not explain why, but given the interest rates they charge, the cap imposed by the MLA may have something to do with it.

Remember: Rates and terms also vary by state. You can check your individual state’s terms on this page of the Aspen Financial Direct website.

Can I have more than one centz loan?

No, you must pay off any outstanding loan before you’re eligible for a new loan.

How do I reapply?

Existing customers will have to sign in to their existing account to apply for a loan. You must wait 1-10 days after paying off your previous loan before you can reapply.

What is required for a centz loan?

- You must receive a loan offer from centz

- You must be at least 21 years old

- You must live in a state in which centz issues loans

- You must have a job or regular source of income

- You must have an active and valid checking account (savings and prepaid accounts not accepted)

- You must have an email address to receive account information

Why did I receive an invitation code in the mail?

If you received a centz invitation code in the mail, you meet the lender’s initial loan criteria. You will need to complete an application online.

What does pre-selected mean?

“Pre-selected” means you’ve met the lender’s initial loan criteria. Pre-selected does not mean you’re guaranteed to receive a loan.

Why is my loan amount different from the amount on the mailer?

Centz says the final offer will into account the income you entered on the application. The lender may offer you a lower amount to ensure the payment is affordable.

How long does it take to get a loan decision?

The results are typically available almost immediately after you submit your application. In some cases, centz may request additional information or proof of income before your application can be approved. If your application is declined, centz will provide a Notice of Adverse Action.

Is a centz loan considered a payday loan?

Technically speaking, centz loans are not payday loans. They are short-term installment loans. What’s the difference?

A payday loan is a loan that is typically paid back in full in one single payment that is made on a date that the borrower and the lender agree upon. That payment can be taken automatically out of a borrower’s bank account. If the borrower can’t make the payment, they have the option of extending their loan, but usually have to pay some hefty fees.

A short-term installment loan is a loan that is paid back via a series of payments made over time — typically every couple of weeks for a period of months. While both are expensive loans, the short-term installment loan is more expensive than a payday loan because the interest compounds over time.

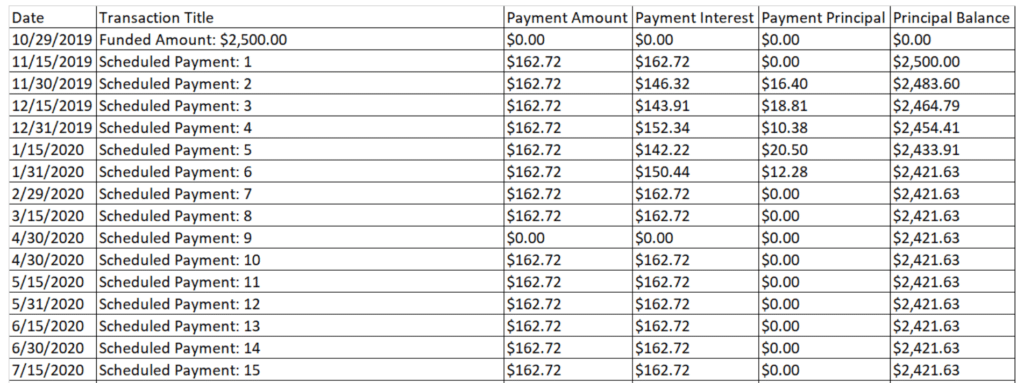

Sample centz loan

In October 2019, a customer took out a $2,500 loan from Aspen Financial. The borrower was required to make bi-weekly payments of $162. After making 40 payments (the borrower missed two, which incurred penalty fees), the borrower had paid more than $6,000 and still owes more than $2,000 in principal. This means that of that $6,000+ paid in, less than $500 has been applied to the original loan amount.

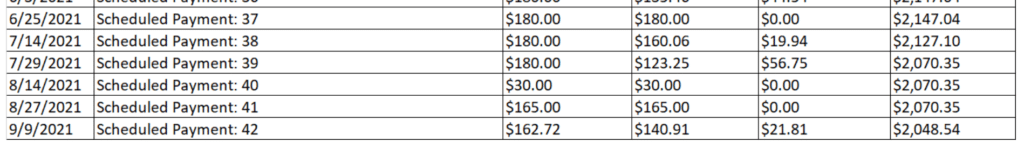

Online reputation

While centz boasts a TrustPilot score of 4.4 stars, the majority of positive reviews cite speed or customer service.

Other review sites are not as generous.

The Better Business Bureau, for example, gives Aspen Financial Direct an F.

One customer wrote this in their review:

Pros and cons of a centz loan

Pro

The website claims the application process is fast and easy (see the next section)

Cons

Incredibly high and predatory interest rates, hidden fees, lack of transparency on the website, expired licenses, basically everything except for what the site claims is a fast and easy application process.

How to apply for a loan from centz

The website boasts a fast and easy application process that can be done online. It also states that, before filling out their information online, applicants must first receive an invitation to apply in the mail for their applications to be considered.

We tried to verify the application process but couldn’t make it beyond the first page because we didn’t have a loan offer.

Better alternatives than a loan from centz

If you are desperate for cash, there are lots of better alternatives out there than a loan from Aspen Financial Direct. Here are some of them:

- A reputable online lender, like Upgrade

- PenFed credit union or a credit union that is local to you (credit unions have better rates than almost every other lender)

- A peer-to-peer lending site, like Upstart

- Setting up a GoFundMe to borrow from friends and/or family

- Credit card advance or a low-interest balance transfer offer

- Home equity loan or home equity line of credit (HELOC)

- 401(k) loan

- A reputable paycheck advance app like Dave or Klover

The bottom line

When you are going through a really hard time, the last thing you need is a predatory lender breathing taking advantage of your desperation. No matter how dire your situation is now, a loan from centz will only make your situation worse.

Instead of borrowing from this company, explore your other options, like the suggestions we listed above. Any of those is better than a short-term installment loan from a predatory lender.