Payday loans are a controversial topic across America, thanks to their tendency to trap borrowers in debt. Unfortunately, each state can regulate the predatory industry within their borders how they see fit, and some do a better job than others. Here’s what you should know about the Illinois payday loan laws if you live in the state.

Table of Contents

Payday lending status in Illinois: Heavily regulated

Payday lending in Illinois is heavily regulated. In March 2021, Illinois Governor J.B. Pritzker signed The Predatory Loan Prevention Act, which caps the interest on payday loans to a 36% annual percentage rate (APR). Previously, the APRs could reach the mid-triple digits.

While lenders can still offer small loans that follow the payday loan structure, they can’t carry the excessive interest rates that previously made them predatory. As a result, legislators have effectively defanged the payday loan trap in Illinois.

This further tightens protections that were implemented in 2005 when Governor Rod R. Blagojevich signed the Payday Loan Reform Act, which first regulated the payday loan industry in the state, and strengthened consumer protections.

READ MORE: States where payday loans are illegal

Loan terms, debt limits, and collection limits in Illinois

- Maximum loan amount: $1,000 or 25% of gross monthly income, whichever is less

- Interest rate (APR): 36%

- Minimum loan term: 13 days

- Maximum loan term: 45 days

- Number of rollovers allowed: None

- Number of outstanding loans allowed: 2

- Cooling-off period: 7 days after 45 consecutive loan days

- Installment: Yes

- Finance charges: $1 verification fee

- Collection fees: Insufficient funds fee not to exceed $25

- Criminal action: Prohibited

In early 2021, Illinois passed legislation that rendered payday lending all but extinct in the state. It imitates the Military Lending Act, which went into effect in 2006 and caps interest rates at 36% on loans to military members and their families.

The Predatory Loan Prevention Act eliminated finance charges that previously reached $15.50 for every $100 loaned. Under the new law, annual percentage rates (APRs) can be no higher than 36%, and lenders can only charge a $1 verification fee and a single $25 insufficient funds fee.

READ MORE: Payday loan consolidation and relief that works

Illinois payday loan laws: How they stack up

Before the Predatory Loan Prevention Act passed earlier this year, the Illinois payday loan laws were among the least restrictive in the country. However, since the new legislation took effect, it’s a much more consumer-friendly state.

Here’s a more in-depth look at the effect the legislation has had on payday lenders.

Maximum loan amount in Illinois

The maximum loan amount in Illinois is the lesser of $1,000 or 25% of the borrower’s gross monthly income. In addition, payday lenders cannot make loans to borrowers who have outstanding balances on two payday loans.

For example, say that a borrower approaches a payday lender that offers loans from $100 to $1,000 in increments of $10. The borrower has a $3,000 gross monthly income and an existing payday loan with a balance of $250.

The lender can’t offer them a loan that would put their outstanding balance above 25% of $3,000, which is $750. Because the borrower already has a $250 loan, the most the lender can give them is a loan for $500.

Rates, fees, and other charges in Illinois

The maximum annual percentage rate on payday loans is 36% as of March of 2021. That includes a $1 loan verification fee. Lenders can also charge a $25 fee for insufficient funds if your post-dated check doesn’t clear.

For example, say you take out a $500 payday loan. The lender requires a finance charge of $5.90 and a verification fee of $1. That works out to an APR of roughly 36%.

To qualify for the loan, you have to give the lender a post-dated check for $506.90. When your loan comes due, they attempt to cash it. If it doesn’t go through, they can assess a single $25 NSF fee and no more.

Lenders can’t charge any other additional interest or fees as a result of the default.

The maximum term for a payday loan in Illinois

The maximum term for a payday loan in Illinois is 45 days, and the minimum is 13 days. Lenders may not rollover payday loans or charge a fee to extend the due date.

If you still owe one or more payday loans after 35 consecutive days, you can demand a repayment plan. That will give you another 55 days to repay your loan in equal installments, free of any additional charges.

Repayment plans must include at least four installments with at least 13 days between them, but the repayment term can’t exceed 90 days in total.

In addition, consumers must wait a cooling-off period of 7 days after having a loan for 45 or more consecutive days before being allowed to take out another loan.

What is the statute of limitations on a payday loan in Illinois?

A statute of limitations is the period during which a creditor can sue a borrower for failing to pay their debts. If your payday loan is older than the statute of limitations in your state, you can use the age of the debt to defend a lawsuit.

In Illinois, the statute of limitations on a payday loan is ten years.

Consumer information

The Illinois Department of Financial and Professional Regulation (IDFPR) supervises financial institutions in the state. The IDFPR issues licenses and enforces regulations, including the ones involving payday loan companies.

The IDFPR has a publicly available license look-up so that you can check the status of any payday loan company before doing business with them. In addition, payday lenders in Illinois must input all consumer loans into their Consumer Service Reporting database to promote transparency.

Where to make a complaint or get more information

If you need to submit a complaint about illegal lending activities in Illinois, you can do so by reaching out to the Illinois Department of Financial and Professional Regulation. Here’s their contact information:

- Regulator: Illinois Department of Financial and Professional Regulation

- Address:100 West Randolph Street, 9th Floor Chicago, Illinois 60601

- Phone: (312) 814-5145

- Email: [email protected]

- Link to website: https://www.idfpr.com/admin/DFI/DFIcomplaint.asp

As a consumer, you also have the right to submit a complaint to the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency aimed at helping consumers with financial issues, including any problems you have with payday lenders.

Number of Illinois consumer complaints by issue

The following statistics are from the CFPB Consumer Complaint Database.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 185 |

| Struggling to pay your loan | 112 |

| Problem with the payoff process at the end of the loan | 66 |

| Can’t contact lender or servicer | 57 |

| Getting the loan | 42 |

| Problem when making payments | 36 |

| Incorrect information on your report | 28 |

| Can’t stop withdrawals from your bank account | 25 |

| Loan payment wasn’t credited to your account | 20 |

| Received a loan you didn’t apply for | 19 |

| Problem with additional add-on products or services | 13 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 13 |

| Applied for loan/did not receive money | 10 |

| Was approved for a loan, but didn’t receive money | 9 |

| Problem with a credit reporting company’s investigation into an existing problem | 6 |

| Vehicle was repossessed or sold the vehicle | 6 |

| Vehicle was damaged or destroyed the vehicle | 4 |

| Improper use of your report | 4 |

| Unable to get your credit report or credit score | 1 |

| Property was sold | 1 |

Source: CFPB website

The most complained about lender in Illinois: AmeriCash Holding, LLC

Before 2021, Illinois let lenders charge $15.50 per $100 borrowed. Unsurprisingly, these predatory lending rates left many consumers feeling outraged over the high costs of their small loans.

The most complained about lender in all of Illinois is AmeriCash Holding, LLC. Consumers have complained primarily about their prices, which have caused many people to struggle to pay off their loans.

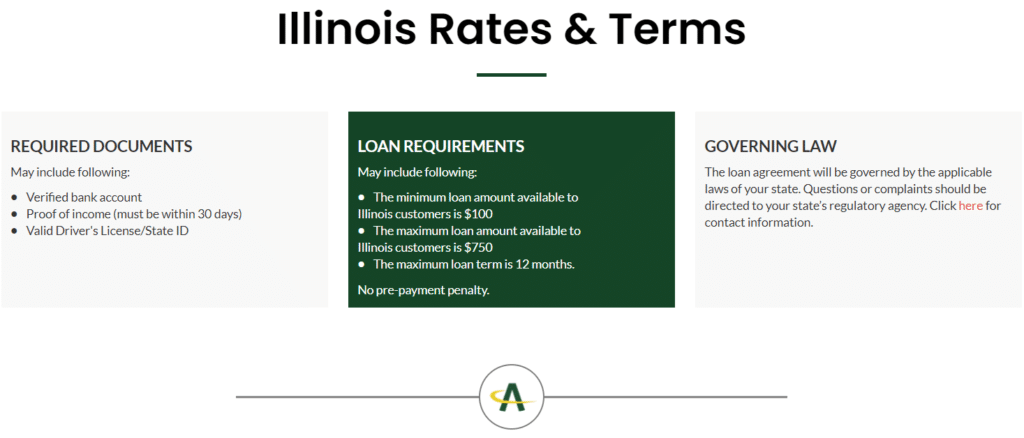

AmeriCash Holding, LLC’s subsidiary, AmeriCash Loans, still offers installment loans in Illinois between $100 to $750. They have a maximum loan term of 12 months. Their rates and fees aren’t publicly listed, though.

Most common complaints about AmeriCash Holding LLC

Here are the most common complaints filed against AmeriCash Holding LLC.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 15 |

| Struggling to pay your loan | 12 |

| Problem with the payoff process at the end of the loan | 5 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 4 |

| Can’t stop withdrawals from your bank account | 3 |

| Problem when making payments | 2 |

| Incorrect information on your report | 2 |

| Can’t contact lender or servicer | 1 |

| Problem with additional add-on products or services | 1 |

| Loan payment wasn’t credited to your account | 1 |

Source: CFPB website

The most common complaint consumers have made about Americash Holding in Illinois since 2013 is that they charged fees or interest that borrowers didn’t expect. That’s the same issue people tend to have with other predatory lenders too.

Payday loan regulations are lax in most states, so unexpected fees and high interest rates are frequent occurrences. Fortunately, since March of 2021, payday lenders in Illinois are capped at 36% interest, which will help protect borrowers from exorbitant fees.

Top 10 most complained about payday lenders

| Lender | No. of complaints | Primary complaint reason |

| AmeriCash Holding LLC | 46 | Charged fees or interest you didn’t expect |

| Big Picture Loans, LLC | 35 | Charged fees or interest you didn’t expect |

| OneMain Financial Holdings, LLC. | 30 | Problem with the payoff process at the end of the loan |

| LDF Holdings, LLC | 24 | Charged fees or interest you didn’t expect |

| CNG Financial Corporation | 24 | Struggling to pay your loan |

| CURO Intermediate Holdings | 19 | Charged fees or interest you didn’t expect |

| Enova International Inc. | 16 | Problem with the payoff process at the end of the loan |

| PLS Group, Inc. | 15 | Struggling to pay your loan |

| Opportunity Financial, LLC | 14 | Struggling to pay your loan |

| Rosebud Economic Development Corporation | 14 | Charged fees or interest you didn’t expect |

Source: CFPB website

Of course, AmeriCash Holding, LLC isn’t the only lender that people have complained about in Illinois. High-interest loans have been legal in the state for a long time, and many predatory institutions have taken advantage of the loose regulations.

Unsurprisingly, the primary complaint consumers made about most of the other lenders on the list above also had to do with the cost of their loans. Of the top ten most complained about lenders in Illinois, people complained about unexpected charges or an inability to pay back their loans 80% of the time.

If you’re struggling financially because of a loan from one of these lenders, DebtHammer can help. Contact us today to get a free quote. We can show you how to get out of debt and stay out permanently.

Are tribal loans legal in Illinois?

Tribal loans are technically legal in Illinois, but this is a gray area and many states have started challenging these lenders in court.

Payday lenders often look for loopholes that will let them get around state laws capping interest rates. For example, even though Illinois payday loan laws now include stricter consumer-protecting legislation, tribal lenders will still charge rates significantly higher than the state’s interest rate cap of 36% APR.

Tribal lenders pay Native American tribes in exchange for the right to use their tribal immunity. As sovereign nations within the United States, Native American tribes can generally ignore state regulations. They can extend that privilege to the lenders they partner with.

Technically, every lender has to be licensed by the Illinois Division of Banking, but some tribal lenders are licensed by the tribe rather than the state. If your lender isn’t appropriately licensed, the loan technically isn’t legally collectible. But don’t gamble on this loophole. The safest course of action is to avoid these loans altogether.

Don’t assume that your loan adheres to Illinois state laws. Carefully review your loan paperwork to calculate the rates you’re paying and research the lender’s online reputation. Many borrowers are under the impression that they’re paying the legally-mandated 36%, only to find out when the first payment comes due that they’re actually being charged an APR of 800% or more in biweekly installments.

A few states, including Illinois, have aggressively challenged these lenders in court with class-action lawsuits. Because of this, some tribal lenders are no longer issuing loans in Illinois.

READ MORE: Is my payday loan lender licensed?

The most complained about tribal lender in Illinois: Big Picture Loans, LLC

Big Pictures Loans, LLC is the tribal lender that consumers have the most problems with in Illinois. They offer installment loans that carry the same exorbitant interest rates as payday loans.

Their loans have the following general terms:

- Loan Amount: $200 – $3,500

- Interest Rates: 35% – 699% APR

- Length of Loan: 4 – 18 months

The APR for new customers, though, start at a whopping 350%. Only returning customers with eligible credit qualifications can qualify for the lower APR, and the chances of anyone returning are slim.

Most common complaints about Big Picture Loans, LLC:

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 23 |

| Struggling to pay your loan | 4 |

| Can’t contact lender or servicer | 3 |

| Can’t stop withdrawals from your bank account | 2 |

| Received a loan you didn’t apply for | 2 |

| Problem with the payoff process at the end of the loan | 1 |

Source: CFPB website

Once again, the most common complaint consumers have made about Big Picture Loans is that they charge unexpected fees and interest. Given that they advertise rates as low as 36%, people are probably surprised to learn that virtually no one qualifies for those rates.

Payday loan statistics in Illinois

- Illinois ranks as the 6th state for the most overall payday loan complaints.

- Illinois ranks as the 19th state for the most payday loan complaints per capita.

- There have been 18,281 payday loan-related complaints made to the CFPB since 2013―657 of these complaints originated from Illinois.

- The estimated total population in Illinois is 12,671,821 people.

- There are 5.1847 payday loan complaints per 100,000 people in Illinois.

- The most popular reason for submitting a payday loan complaint is “Charged fees or interest you didn’t expect.”

Historical timeline of payday loans in Illinois

Payday loans weren’t always tightly regulated in Illinois. Before 2021, the payday lending landscape was completely different. Here’s a look at the history of Illinois payday loan laws:

- 2000: Illinois passed legislation to limit the amounts consumers can borrow using short-term loans. They also capped the number of times borrowers could roll over these loans. Lenders got around this by offering 31-day loans instead of the previous 14-28 day loans.

- 2005: The Payday Loan Reform Act went into effect and began regulating payday loans with terms less than 120 days. Once again, lenders tried to get around this by offering longer loans.

- 2011: The House Bill 537 amended the Payday Loan Reform Act to account for installment payday loans and regulate them as well.

- 2021: On March 23, 2021, Governor J.B. Pritzker signed a bill that capped APRs for consumer loans to 36% and prohibited lenders from charging exorbitant finance fees.

It took several tries, but Illinois has finally established legislation that can effectively prevent payday lenders from trapping borrowers in a cycle of debt. The 36% APR limit is the gold standard in America for putting a stop to predatory lending.

Flashback: An Illinois payday loan law story

Historically, when lawmakers pass new Illinois payday loan laws, lenders quickly find a workaround. Fortunately, the latest law caps the interest rates on all short-term consumer loans and bans the previously allowable finance charges, making loopholes much harder to find.

That doesn’t mean lenders won’t try, though. Payday loan companies are notorious for creating new products they think will bypass current regulations. Fortunately for consumers, justice sometimes wins out, and their strategies can backfire.

For example, take the case of All Credit Lenders. They’re a payday loan company based in Elgin, Illinois. in 2014, All Credit Lenders tried to get around APR caps by imposing hidden fees on their borrowers.

They advertised their short-term loan products with interest rates between 18% and 24%. What they didn’t tell borrowers was that they’d also be paying “account protection fees.” These added as much as $10 in fees for every $50 borrowed. When All Credit Lenders included the additional charges into the loan, borrowers ended up paying 375-500% APR.

Fortunately, the acting Attorney General, Lisa Madigan, filed a lawsuit against them. It eventually required All Credit Lenders to waive balances for more than 5,000 consumers.

According to Madigan, All Credit Lenders presented borrowers with payment schedules where “not one penny” of their payment was going to the principal balance, making these loans impossible to pay off.

In 2016, the settlement went through, and All Credit Lenders forgave $3.5 million worth of high-interest loans.

The bottom line: Should I take out a payday loan in Illinois?

With the addition of the Predatory Loan Prevention Act to the Illinois payday loan laws, lenders can’t charge more than 36% APR on a consumer loan. As a result, payday loans are likely to die out in the state.

If any payday lenders do stick around, they’re still probably not the best ones to work with, given their history of predatory tactics. Take your business elsewhere whenever possible.

For short-term financial support without a credit check, consider using a cash advance app like Brigit. You can get an advance of up to $250 with no interest and minimal fees.

Of course, relying on paycheck advances and debt will only get you by for so long. Eventually, you must address the underlying problems that are dragging down your finances.

If you’re an Illinois resident looking to get out of payday loan debt, contact DebtHammer for a free quote. We’ll help you eliminate your debts once and for all.