If you have bad credit, payday loans may seem like the only way to borrow money in an emergency. However, they have such significant finance charges that they usually only make situations worse for consumers. Fortunately, state legislation can mitigate that problem to some degree. Here’s how the South Carolina payday loan laws protect you.

Table of Contents

Payday lending status in South Carolina: Legal

Though the federal government doesn’t offer much help with payday loan issues, some state legislatures have taken action. Sadly, the South Carolina payday loan laws still allow the industry to operate in its traditional form. Payday lenders continue to issue credit accounts that are repayable at the borrower’s next paycheck, with triple-digit annual percentage rates (APRs).

As is the case in many states, legislators have struggled to eliminate the payday loan industry. As a result, they’ve settled for introducing consumer protections, like limiting borrowers to one payday loan at a time and prohibiting rollovers.

You can read the full text of the relevant regulations in the South Carolina Code of Laws, Title 34, Chapter 39: The Deferred Presentment Services Act.

Stuck in payday debt?

If you’re a South Carolina resident, DebtHammer may be able to help.

Loan terms, debt limits, and collection limits in South Carolina

- Maximum loan amount: $550

- Maximum Interest Rate (APR): 391% APR on a 14-day loan

- Minimum loan term: N/A

- Maximum loan term: 31 days

- Installment option: Yes

- Number of rollovers allowed: None

- Number of outstanding loans allowed: One

- Cooling-off period: N/A

- Finance charges: 15% of the loan’s principal balance

- Collection charges: $30 nonsufficient funds (NSF) fee

- Criminal action: Prohibited

READ MORE: Stuck in a payday loan nightmare? Here’s how to break free

Because the law forces them to, payday lenders reluctantly acknowledge that their products cost more than other credit accounts and are unsuitable for long-term borrowing needs. If that were the worst of their faults, payday loans would be expensive but not crippling to the average person’s finances.

However, the reality is much more insidious, as payday loans often catch people in a cycle of debt. The trap occurs when a borrower can’t afford their payday loan. They then pay a rollover fee equal to the original finance charge, which pushes the due date without reducing the loan balance. In a survey, 93% of payday loan borrowers said they regret their original payday loan.

Fortunately, the South Carolina payday loan laws prohibit rollovers and enforce them through database tracking. Consumer advocates couldn’t get legislators to cap interest rates, but that’s a decent compromise.

READ MORE: South Carolina debt relief and resources

South Carolina payday loan laws: How they stack up

The South Carolina payday loan laws are pretty average in the level of protection they provide for consumers. The industry can still charge triple-digit APRs on loans of a few hundred dollars or so in the state, but some laws in place keep lenders in check.

Here’s a more comprehensive examination of the state’s lending laws to help you understand what they mean and how they compare to the regulations in the rest of the country.

READ MORE: How to get out of payday loans

Maximum loan amount in South Carolina

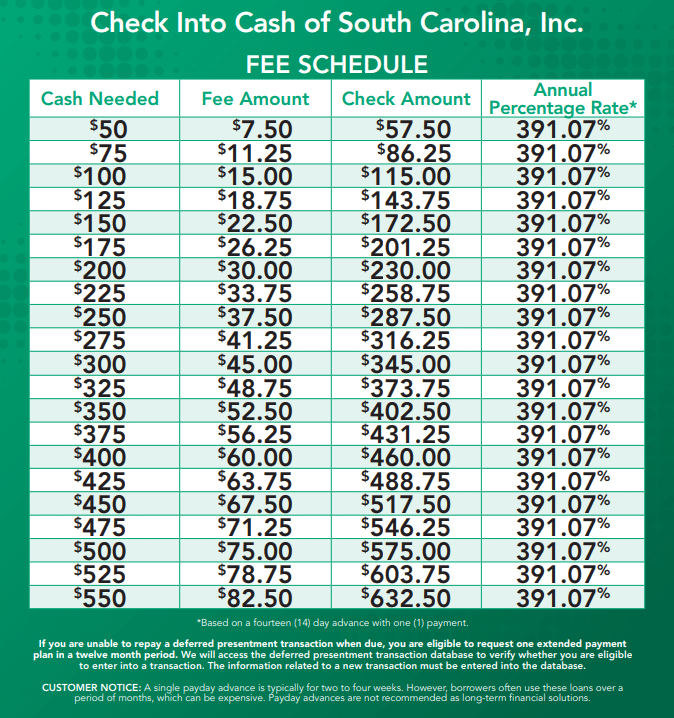

The maximum payday loan amount in South Carolina is $550. There’s no minimum balance, but payday lenders often start in the vicinity of $50. They then increase their offers in increments of $10 or $25 up to the maximum limit.

READ MORE: Payday loan consolidation and relief that works

What is the statute of limitations on a payday loan in South Carolina?

A statute of limitations on debt establishes the time that creditors and debt collectors have to sue borrowers over accounts in default. The rules vary significantly between different locations and types of credit accounts.

Payday loans are written contracts. In South Carolina, the statute of limitations on them is three years.

Rates, fees, and other charge limits in South Carolina

The South Carolina payday loan laws require that lenders charge no more than 15% of a loan’s principal balance. To be clear, that doesn’t mean a 15% interest rate. A 15% finance charge actually works out to 391% APR for two-week loans.

In other words, lenders can demand no more than $15 per $100 in principal, so the most you should pay in finance charges for a single payday loan transaction is $82.50 given the $550 principal balance limit.

However, you’ll incur additional costs if your lender fails to collect due to insufficient funds. Because they take your payment using post-dated checks or direct debits to your bank account, you may face NSF fees up to $30 or overdraft charges.

Maximum term for a payday loan in South Carolina

Though you’ll often encounter payday loans with two-week repayment terms, the maximum allowable length of a payday loan is 31 days in South Carolina. Lenders can’t extend that period through rollovers.

However, if you can’t pay back your loan by the time it comes due, you can request an extended payment plan once every twelve months. The payment plan must let you pay your remaining balance in four equal payments, with no additional finance charges.

In addition, each installment must fall on or after the day that you receive your regular earnings. In other words, they should give you two weeks in between each payment so you can pay after your paycheck arrives.

How many payday loans can you have in South Carolina?

No law limits the number of payday loans a borrower can have simultaneously, but if you need more than one, you’ll likely have to use a different lender. Though payday lenders don’t report loans to the three major credit bureaus, they do have their own reporting system, so if you already have a couple of outstanding payday loans — or have defaulted on a previous payday loan — the new lender will typically be aware.

There’s also no overall limit to the number of payday loans you can have, so once you pay off your original loan, you’re immediately eligible for a new loan. However, this isn’t recommended.

READ MORE: Can you have multiple payday loans?

Are tribal loans legal in South Carolina?

Legally, Native American tribes are sovereign nations that reside in the United States. They have the authority to regulate themselves a lot like a state would, which means they’re typically immune to lawsuits for breaking other states’ laws.

A tribal lender is a short-term lender that partners with a Native American tribe to take advantage of that immunity. In other words, they charge rates that exceed state limits and give a tribe a small cut of the profits in exchange.

Because they operate exclusively online and stand firm behind their tribal immunity defense, it can be difficult for regulators to take legal action against tribal lenders. That said, their loans are generally illegal in South Carolina.

To lend to consumers in the state, you have to get a license from the State Board of Financial Institutions. Because tribal lenders don’t follow state laws, they can never qualify for one, making their loans unenforceable in court.

Consumer information

The South Carolina Board of Financial Institutions is in charge of overseeing the financial services industry in the state. Their Office of the Commissioner of Consumer Finance looks after four types of regulated institutions, including deferred presentment providers, also known as payday lenders.

The office’s official mission is to “protect the citizens of South Carolina by preserving a sound financial industry through effective and efficient regulatory oversight of financial institutions in order to strengthen consumer confidence, assure reliable access to financial services, and encourage economic growth.”

In other words, they enforce the regulations that prevent payday lenders from doing whatever they want. To practice payday lending, you must get a license from the Office, and they manage the payday loan database that tracks all transactions in the state.

Where to make a complaint

While the South Carolina Board of Financial Institutions is the agency primarily responsible for regulating payday lenders, they prefer that you send complaints to the Department of Consumer Affairs. Here’s how you can get in touch with them:

- Regulator: South Carolina Department of Consumer Affairs

- Physical Address: 293 Greystone Boulevard, Ste. 400, Columbia, S.C. 29210

- Mailing Address: PO Box 5757, Columbia, SC 29250

- Phone: 803-734-4200

- Website: https://consumer.sc.gov/consumer-resources/consumer-complaints

If you have a complaint, it’s also a good idea to submit the details to the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency that protects consumers from predatory financial institutions, including payday lenders.

Number of South Carolina consumer complaints by issue

These statistics are all according to the CFPB Consumer Complaint Database.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 144 |

| Struggling to pay your loan | 63 |

| Problem when making payments | 44 |

| Can’t contact lender or servicer | 26 |

| Received a loan you didn’t apply for | 24 |

| Problem with the payoff process at the end of the loan | 23 |

| Getting the loan | 21 |

| Incorrect information on your report | 18 |

| Can’t stop withdrawals from your bank account | 16 |

| Problem with additional add-on products or services | 15 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 13 |

| Loan payment wasn’t credited to your account | 13 |

| Applied for loan/did not receive money | 6 |

| Problem with a credit reporting company’s investigation into an existing problem | 4 |

| Improper use of your report | 4 |

| Vehicle was damaged or destroyed the vehicle | 3 |

| Was approved for a loan, but didn’t receive money | 2 |

| Credit monitoring or identity theft protection services | 2 |

| Vehicle was repossessed or sold the vehicle | 1 |

Source: CFPB website

American consumers’ most common complaint about payday lenders is that they charge unexpected fees and interest. That’s also true in South Carolina, where there are more than twice as many complaints about the issue as the next most common. There are several reasons for this, including the disinterest borrowers show for reading the terms of their loans and their lack of financial knowledge.

However, the responsibility isn’t entirely with consumers. There’s no denying the almost incomprehensibly expensive rates that payday lenders charge. In addition, payday lenders often minimize their rates as much as possible, which is why there are so many rules requiring that they disclose them in specific places and legible fonts.

The most complained about lender in South Carolina: Enova International, Inc.

In South Carolina, the most complained about lender is Enova International, Inc. While they don’t originate loans directly to consumers, they’re the parent company of two predatory lending brands: CashNetUSA and NetCredit.

CashNetUSA provides various credit account types across the country, changing their offerings in different states to stay within the various laws. In South Carolina, they offer lines of credit with limits from $650 to $2,800. Their APRs range from 149% to 325%, almost as expensive as a payday loan.

Meanwhile, NetCredit offers personal loans from $1,300 to $20,000 in South Carolina. Their APRs are lower but still not affordable for the typical borrower, reaching as high as 155%.

Unfortunately, because these lines of credit and personal loans involve much higher amounts of money than payday loans, they can be even more financially ruinous to their users.

Most common complaints about Enova International, Inc.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 4 |

| Received a loan you didn’t apply for | 1 |

| Can’t stop withdrawals from your bank account | 1 |

| Problem when making payments | 1 |

| Struggling to pay your loan | 1 |

Source: CFPB website

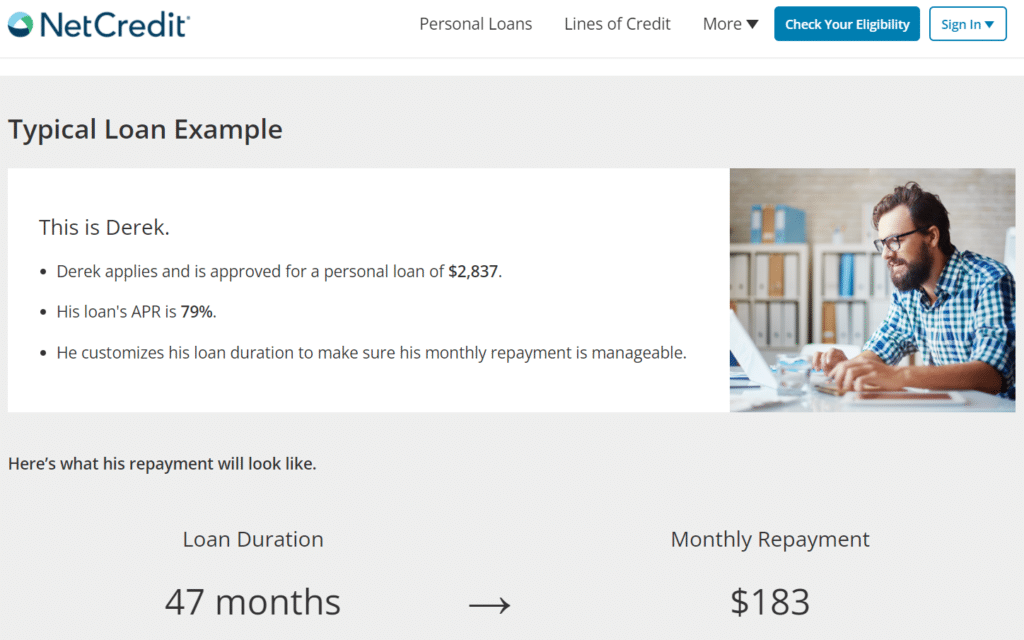

The most common complaint people make about Enova International, Inc. and its subsidiaries is that they charge unexpected fees and interest. As mentioned above, that’s at least partially because the businesses downplay how expensive they can be.

For example, NetCredit breaks down the repayment terms for one of their standard loans. They say that Derek, their imaginary borrower, “customizes his loan duration to make sure his monthly payment is manageable.”

They also say that Derek took out a loan for $2,837 and agreed to pay it back in 47 monthly installments of $183, which equals 79% APR. However, they don’t say in total he’ll pay $8,601, which totals $5,764 in interest, roughly twice the initial principal balance.

Top 10 most complained about payday lenders

| Lender | Number of Complaints Since 2013 |

| Enova International, Inc. | 34 |

| Big Picture Loans, LLC | 18 |

| TMX Finance LLC | 18 |

| Community Choice Financial, Inc. | 17 |

| Thaxton Investment Corporation | 16 |

| OneMain Financial Holdings, LLC | 15 |

| World Acceptance Corporation | 14 |

| CNG Financial Corporation | 14 |

| Advance America, Cash Advance Centers, Inc. | 14 |

| Regional Management Corporation | 13 |

Source: CFPB website

The CFPB receives more complaints about Enova International, Inc. than any other lender in the state, but they get a sizeable number of them about many others too. As you might expect, the rest of the top offenders offer accounts similar to payday loans like title and pawnshop loans.

For example, TMX Finance, LLC is the parent company of several lending businesses that promise consumers fast cash, even those with bad credit. They include TitleMax, TitleBucks, and InstaLoan, which specialize in title-secured, pawn, payday, and high-interest personal loans.

If you’re struggling financially because of lenders like the ones on the list above, contact DebtHammer today. We can help you dig yourself out of the debt trap, reach financial stability, and make predatory lenders a thing of your past.

The Most Complained About Tribal Lender in South Carolina: Big Picture Loans, LLC

Enova International, Inc. is the most complained about lender in South Carolina overall, but Big Picture Loans, LLC takes the title among tribal lenders. In fact, the CFPB gets more complaints about them than any other tribal lender in most states.

Like many tribal lenders, Big Picture Loans offers short-term installment loans that are more expensive than state laws would typically allow. Their loans have the following terms:

- Principal balances between $400 and $3,500

- Repayment terms between four and 18 months

- APRs between 35% and 699%; new customers have a 200% minimum

With APRs in the mid-to-high triple digits and principal balances in the thousands, their products can be even more financially destructive than traditional payday loans. Before doing business with them, always check whether a lender has a legitimate state lending license to avoid these predatory products.

Most Common Complaints About Big Picture Loans, LLC

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 15 |

| Received a loan you didn’t apply for | 2 |

| Problem with the payoff process at the end of the loan | 1 |

Source: CFPB website

Unsurprisingly, the most common complaint people make about Big Picture Loans is that they charge fees and interest that borrowers don’t expect. Since their prices exceed what a lender can legally charge in South Carolina, that probably won’t shock you.

Payday loan statistics in South Carolina

- South Carolina ranks as the 12th state for the most overall payday loan complaints.

- South Carolina ranks as the 3rd state for the most payday loan complaints per capita.

- There have been 18,281 payday loan-related complaints made to the CFPB since 2013 ― 442 of these complaints originated from South Carolina.

- The estimated total population in South Carolina is 5,148,714 people.

- There are 8.5847 payday loan complaints per 100,000 people in South Carolina.

- The most popular reason for submitting a payday loan complaint is “Charged fees or interest you didn’t expect.”

READ MORE: Payday loan debt statistics

Historical timeline of payday loans in South Carolina

Unfortunately, the South Carolina payday loan laws have always been friendlier to lenders than consumers. In addition, there haven’t been very many significant changes to the regulations over the years.

Here are the highlights of the state’s history with short-term lending:

- 1998: Legislators passed the Deferred Presentment Services Act. It capped finance charges at 15% of the loan amount and repayment terms at 31 days, prohibiting rollovers. The number of loan transactions per year was over four million back then.

- 2009: Legislators updated the Deferred Presentment Services Act and restricted borrowers to one $550 payday loan at a time.

- 2010: Instead of renewing their previous licenses, many payday lenders switched to supervised lender licenses. That let them avoid the new payday loan laws and demand collateral from borrowers, which gave birth to the title-secured loan industry in the state.

- 2010s: The number of payday loan transactions decreased significantly after the new legislation. In 2013, roughly 128,000 borrowers took out just one million payday loans.

Unfortunately, South Carolina remains a haven for predatory lenders, including purveyors of payday and title-secured loans. There are still hundreds of licensees in the state, especially for supervised lenders.

You can look up both types of licensees at the State Board’s Consumer Finance Division website.

Flashback: A South Carolina payday loan story

One of the most troubling things about payday lenders is that they fight tooth and nail against every attempt to impose regulations on their industry. They’re like bacteria evolving to become increasingly resistant to antibiotics.

While they can often defeat undesirable legislation by aggressively lobbying against it, bills sometimes get through anyway. When they do, a favorite tactic of payday lenders is to switch lending licenses to avoid having to abide by the new laws.

For example, in South Carolina, payday lenders opted not to renew their licenses in 2010 after legislators limited borrowers to one payday loan at a time. Instead, they switched en masse to supervised lender licenses, which let them continue to operate without impediment.

Of the 245 payday lenders that elected not to renew their licenses after the legislative updates in 2009, 99 became supervised lenders instead. Many of these lenders began to offer car title loans in the years since, which are just as dangerous as payday loans, if not more.

For example, 1st Capital Finance is a supervised lender licensee in 2022, and the interest rate on their car title loans is 25% per month or 300% annually. On top of charging predatory rates, they can seize your vehicle if you default.

The bottom line: Should you take out a payday loan in South Carolina?

When you have bad credit, financial emergencies may drive you into the hands of a payday lender. They’re generally willing to loan you a few hundred dollars as long as you have a job, a bank account, and a pulse.

Unfortunately, payday loans are so expensive that they often trap you in a cycle of debt. While South Carolina technically prohibits rollovers, you’ll often find that you have no way to repay your payday loan other than to ask another predatory lender for help.

Because of this, you should always avoid payday loans when you can, especially in South Carolina, since triple-digit APRs are still legal. As an alternative, consider a cash advance app like Dave. You can get an advance on your earnings about the size of a payday loan with no interest or fees. Or follow some of these tips.

Of course, short-term solutions won’t be able to keep you going indefinitely. Eventually, you’ll need to get your finances back under control. To get help with that, contact DebtHammer. We’ll show you how to leave predatory lenders in your dust forever.