It’s easy to overreact when you get a call from a debt collector informing you that you owe a debt you don’t remember. If you’ve gotten a call or email from a debt collector called ACS llc or ACS Debt Collector, there is cause for concern. It may be an attempt to scam you.

ACS Incorporation is a legitimate debt collection company, but the email or phone call you’ve received may not be from the real ACS. There are several different reports of companies using the ACS acronym as part of their scams. Scam artists are very good at tricking people into thinking they’re dealing with a legitimate company. The Federal Trade Commission reports that consumers lost $8.8 billion in scams in 2022 — a 30% increase over 2021.

Before responding to ACS, you must verify that the call or email is legitimate. Here’s how to do it.

Table of Contents

Our take

- ACS stands for Advanced Collection Services, or ACS Incorporation. It is a legitimate mid-sized debt collection agency

- That doesn’t mean that every call or letter from ACS is legitimate — scammers regularly use the ACS initials to trick people

- There are dozens of official and consumer complaints about ACS debt collection scams

- If ACS contacts you, tell them they must sent you a debt validation letter before you speak with them, then end the call

- If you truly owe the debt, it will appear on your credit report, so pull free copies of your reports at annualcreditreport.com

Are debt collectors calling you nonstop?

We may be able to help. It’s easy and free to find out.

Disclaimer: DebtHammer may be affiliated with some of the companies mentioned in this article. DebtHammer may make money from advertisements or when you contact a company through our platform.

What is ACS Incorporation?

Established in 1985, Advanced Collection Services, or ACS Incorporation, is a mid-sized debt collection agency. It’s headquartered in Lewiston, Maine. Like other debt collection agencies, ACS helps creditors and lenders collect payments on delinquent consumer debts like credit cards, loans, and utility bills.

Although there is a legitimate agency called ACS, many scammers have used these same initials in letters and phone calls to commit fraud. If you’ve received a notice or phone call about an old debt from a company claiming to be ACS Inc., it may be a scam.

Before you take any action or respond, make sure these letters or calls come from the real collection agency. Otherwise, you may end up paying money for something you don’t actually owe.

If you got an email or phone call from ACS, it could be a scam — here’s why

According to the Washington State Department of Financial Institutions (DFI), there have been many complaints about a debt collection scam surrounding ACS.

The people running the scam use ACS’ initials in an attempt to convince people they’re authentic. They also often have access to private information like the consumer’s bank account number and Social Security number.

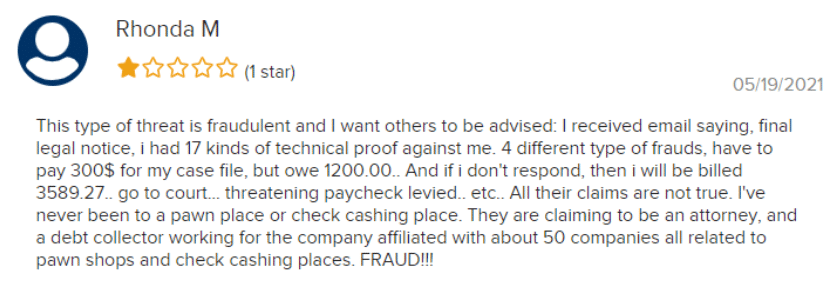

Many consumers report being harassed or receiving threatening phone calls and emailed letters claiming they owe debts already paid. Some of these calls and letters come from people claiming to be attorneys or law enforcement personnel. The scammer often harasses the individuals’ friends and family members, mainly if they’ve been listed as credit references.

Typically, those behind the scam threaten to take legal action if the individual fails to pay them. This action includes sending the account to collections, which could severely damage their credit score, or taking them to court.

Pro tip: If you get an email or phone call from ACS (or Advanced Collection Services) threatening a lawsuit, do not respond. Instead, demand that they send you a debt validation letter. Do not give them any of your personal information. If you’re dealing with a legitimate debt collector, they’ll already have all of the information about you that they need.

Other legitimate debt collectors called ACS

Note that there are a couple of legitimate companies with similar names.

- Advanced Collection Services, Inc. is a legitimate business that’s headquartered in Lewiston, Maine. Its mailing address is 155 Center St Auburn, ME 04210-5229.

- Advanced Collection Service, Inc. is also a legitimate company based in Nebraska. Its mailing address is 714 Tara Plz, Papillion, NE 68046-2032.

- Action Collection Service is a legitimate business headquartered in Idaho. Its mailing address is First Street Plaza, 100 N Woodruff Ste 160, Idaho Falls ID 83401

- American Collection Service, Inc. is a legitimate company based in Ohio. Its mailing address is 202 W Johnstown Rd., Columbus, OH 43230

- Associated Credit Services is a legitimate business located in Massachusetts. Its mailing address is PO Box 1201, Tewksbury MA, 01876

But as you can see, it could be easy to lose track of which ACS companies are legitimate. Scammers use similar (but not exact) names to try to trick people into thinking that they’re dealing with one of the legit companies.

According to a report from the Washington State Department of Financial Institutions, ACS scammers have used such names as:

- ACS Legal Group

- ACS Legal & Collection Department

- ACS Inc. Payday Loans

- ACS, Inc.

- ACS Incorp.

- ACS Incorporation

- ACS Cash Services

- American Cash Services

- American Cash Services USA

- Advance Cash Services

- Ace Cash Services

- American Credit Solutions, Inc.

- ACE Incorporation

The report says that the following individuals have been associated with this apparent scam:

- Shawn Johnson

- John Harris

- Liam Smith

- Adam Wind

- James Mason

Pro tip: If you get a threatening email from any of these people or companies, immediately request that they send you a letter that proves that the debt is yours. Here’s how. But don’t give them your home address. A debt collector attempting to collect a legitimate debt should already have that information.

Learn how to recognize a scam

Dealing with debt collectors can be stressful. It’s even worse when you’re not sure if the person contacting you is who they say they are or if you actually owe them money.

Pro tip: Scam artists often use the same type of information you might expect from a real company. This includes things like the consumer’s full name and the actual amount of a debt they may have owed.

In some frequent scams, the scam artist may even use a seemingly real name, address, and website to appear convincing. Those behind the scam use persuasive language in their letters and phone calls to get you to make payments on old debt. Since they appear legitimate in (nearly) every way, it can be hard to see through them.

READ MORE: How to prove a debt is not yours

Does the email from ACS threaten a lawsuit?

The email or phone call from ACS could even threaten a lawsuit. If that happens, don’t panic.

However, there are a few ways to verify if you’re being scammed: your credit report and the email itself.

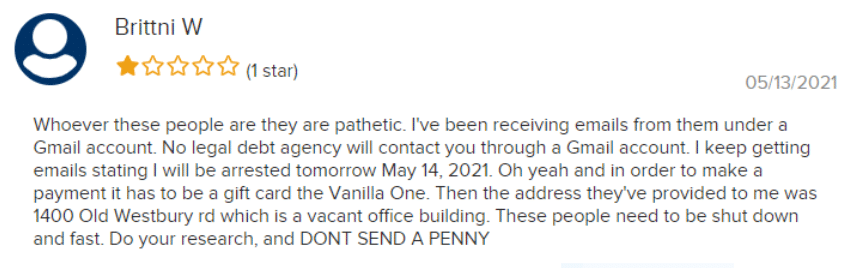

Start by checking the email address attached to the sender. If it comes from a common domain like Hotmail.com, Gmail.com, or Yahoo.com, then it’s probably a scam. A real company will have its own email server.

While you’re at it, read through the email (if you’ve already opened it) for any obvious grammatical or spelling errors. One or two mistakes may not be a red flag, but multiple certainly is. Keep an eye out for strange formatting such as all-caps sentences or red writing.

Pro tip: If you’ve received multiple emails, check if the sender is consistent. If it’s not, chances are it’s a scam. Any emails with suspicious attachments, demanding personal information, or immediate payment are also probably a scam.

Now, check your credit report. If the person contacting you is in fact the legitimate ACS, it will appear on your credit report. While you’re at it, check if the sender or caller is licensed or registered to conduct business in your state. If they’re legitimate, they will be.

Never respond to any suspicious emails or phone calls. Don’t send money or private information to any person, website, or company until you’ve verified it’s legitimate. If you’re part of a scam, report it to the Better Business Bureau (BBB), Federal Trade Commission (FTC) and Consumer Financial Protection Bureau (CFPB) immediately.

Does the email mention a payday loan you don’t recognize?

Some of the names scammers use reference payday loan providers, specifically Ace Cash Services (note that this is NOT the same as Ace Cash Express, a well-known payday lender). Most of the sent emails have the domain name “Google” and use the words “payday,” “paydaycash,” or “paydayloan” in the email address.

If you’ve never taken out a payday loan or other short-term loan, there’s a good chance you’re dealing with attempted fraud. Report it to the authorities immediately.

READ MORE: How to protect yourself from payday loan scams

Is it a final notice email?

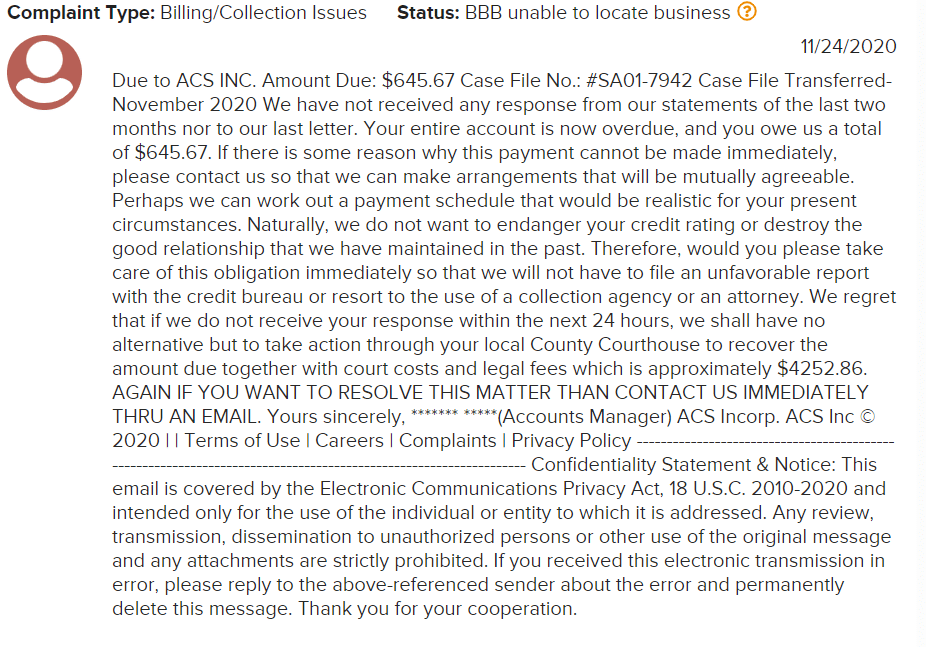

The initial ACS scam letters you receive may appear official and list a fairly high amount of debt you owe. However, the ACS Incorporation final notice email will likely include some odd language or phrasing.

Here are some examples from people involved in the ACS scam:

“Dear Customer as we were investigating your profile, we found you to be a genuine person so it is our duty to help you out but for that we need some right answers from your side. Also we would like to know your intentions”

“Dear Debtor, Alright, Get ready with your attorney to fight the case against the company because we are going to download your case file and you are going to be legally prosecuted in the Court House within a couple of days. So do not ignore our notification and kindly pay back your debt and close this case file ASAP. We would like to tell you if Once this case is downloaded then you have to bear a lawsuit amount of $4206.00. Do revert ASAP.”

“AGAIN IF YOU WANT TO RESOLVE THIS MATTER THAN CONTACT US IMMEDIATELY THRU AN EMAIL”

“NOTE: THIS CASE IS UNDER INVESTIGATION UNDER MAJOR CREDIT BUREAUS”

In addition to using odd language, these scam emails have a distinct lack of punctuation, odd formatting and poor grammar. They often refer to the recipient as “customer” or “debtor,” rather than by name.

Pro tip: A letter like this is generally a red flag. If you’ve received a similar letter, verify that the sender is from ACS Incorporation before responding. Do this by calling the real ACS Incorporation rather than any phone number listed on the letter. You can reach the real ACS at (207) 795-2220.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that spells out how a debt collector can contact you. Debt collectors must send a debt validation letter within five days of initial contact. After that, you have 30 days to dispute it. Legitimate debt collectors will be fully aware of the laws.

READ MORE: What is the Fair Debt Collection Practices Act?

Complaints against ACS

There have been dozens of official and consumer complaints about the ACS scam. Here are just a few.

Official complaints

On the Washington State DFI’s official website, official complaints about the ACS scam involve the following:

- Frequent debt collection scam by people with “ACS” in their names.

- Letters and calls harassing consumers about debts they don’t actually owe.

- Inconsistent or strange email addresses and domains, often associated with payday lenders.

- People behind the scam claiming to be attorneys or law enforcement officials.

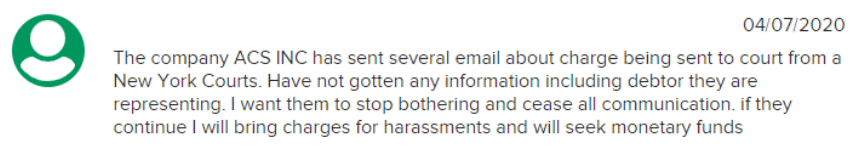

Consumer complaints

Various consumers have also filed complaints regarding the following:

- Calls to their home and workplace regarding debt they either never owed or already paid off.

- Phone calls to the consumer’s credit references.

- Threats of legal action.

- Access to private information such as bank accounts, SSN, etc.

Posted complaints

As of November 2021, the CFPB has received around 40 complaints about ACS Inc. These complaints primarily cite violations of their rights under the Fair Debt Collection Practices Act (FDCPA).

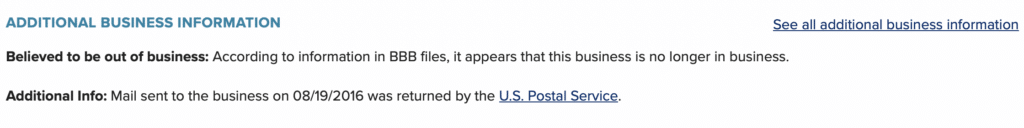

Other reputable sites also list various posted complaints. For example, BBB gives ACS, Inc. an NR (no rating) and says the company was based in Fresno, Calif. and is now out of business.

Here are some examples of online consumer complaints.

The bottom line

ACS Incorporation is a legitimate debt collection agency, but many scam artists have also used the name to commit fraud. Debt collection scams are common but avoidable, as long as you know your rights and what to look for.

Check the email of the sender and verify the account on your credit report before doing anything else. In the meantime, if you believe you’re being scammed, consult an expert or the local authorities for help.