Payday loans are short-term, high-interest loans with no credit check. They’re supposed to help underqualified borrowers in financial distress, but they’re so expensive that they often backfire. That’s made them highly controversial, and state authorities choose to regulate them very differently. Here’s how the Maryland payday loan laws work.

Table of Contents

Payday lending status in Maryland: Prohibited

Fortunately, the consumer lending laws in Maryland effectively prohibit payday loans within the state. Regulators passed a set of interest rate caps on consumer credit transactions that forbid payday lenders from charging their typical triple-digit APRs.

You can read the original regulations in the Maryland Code of Commercial Law under Title 12, Subtitle 3: Section 12-306.

Stuck in payday debt?

If you’re a Maryland resident, DebtHammer may be able to help.

Loan terms and debt limits in Maryland

Maximum Interest Rate: 33% APR (2.75% per month)

The predatory lenders who offer payday loans almost always charge as much as they can under state law, if not more, even though their clientele is inherently already strapped for cash.

For example, the Texas payday loan laws have virtually no limit on interest rates. As a result, the average payday loan interest rate in the state is 664%, and borrowers often struggle to repay their debts. They usually have to take out another payday loan or pay a rollover fee to extend the due date. Unfortunately, neither does anything to reduce their principal balances, and they get stuck in a cycle of debt.

Generally, the best way to prevent that trap is to implement a reasonable interest rate cap like Maryland’s. It ensures that licensed lenders provide loans at rates that borrowers can reasonably repay, while still allowing room for businesses to make a profit.

READ MORE: Maryland debt relief and resources

Maryland payday loan laws: How they stack up

The Maryland payday loan laws are significantly more consumer-friendly than the rules in most other parts of the country. In fact, Maryland is one of only 21 states to prohibit payday loans by setting a hard interest-rate limit. The remaining 34 states either expressly allow payday lending or have effectively failed to prevent it.

Here’s a more in-depth explanation of Maryland’s rules to help you understand how they protect you compared to the regulations in other states.

READ MORE: How to get out of a payday loan nightmare

Rates, fees, and other charge limits in Maryland

The Maryland anti-usury law is a set of rate limits based on principal balances. The higher the loan amount, the lower the interest rate lenders can legally charge consumers.

For loans with an original principal balance of $2,000 or less, the maximum interest rate is 2.75% per month on the first $1,000 and 2% per month on the portion above $1,000. If your loan’s original principal balance is more than $2,000, the maximum interest rate is 2% per month for the entire amount.

For example, if you took out a one-month payday loan for $2,000, your lender could charge you $27.50 for the first $1,000 and $20 for the other half. If you borrowed $2,500, the most they could charge you would be $50.

In addition, if a borrower defaults on their loan, lenders can charge collection fees for legal expenses incurred up to 15% of the outstanding principal balance, plus a $35 nonsufficient (NSF) fee.

While these rules don’t technically forbid payday loans, they prohibit their most predatory aspect. As a result, payday lenders have generally fled Maryland for more profitable territories.

READ MORE: Payday loan consolidation and relief that works

Are tribal loans legal in Maryland?

The federal government treats Native American tribes as sovereign nations. That means they have the authority to govern themselves like a state would, which also renders them virtually immune to lawsuits for breaking a state’s laws.

Tribal lenders partner with Native American tribes to take advantage of that immunity. They use it as an excuse to charge interest rates far higher than state lending laws allow, paying the tribe a small percentage of their profits in return.

The legality of tribal lending is highly controversial. While there’s no disputing the authority of Native American tribes to regulate themselves, there’s some debate over whether they should be able to ignore state lending laws. In addition, their immunity doesn’t necessarily extend to the lenders who partner with them.

Regardless, tribal loans are typically unenforceable in state courts, including Maryland’s. Regulators might not be able to stamp out tribal lenders without a legal battle, but you generally don’t have to worry about them garnishing your wages. They may threaten to take you to tribal court, but it has no authority over you.

READ MORE: How to get out of high-interest tribal loans

How many payday loans can you have in Maryland?

No law limits the number of payday loans a borrower can have simultaneously. Still, because traditional payday loans are illegal in the state, the only way you’d be able to get more than one payday loan at a time would be through a tribal lender. Though payday lenders don’t report loans to the three major credit bureaus, they have their own reporting system. This means that any new lender will typically be aware if you already have a couple of outstanding payday loans — or have defaulted on a previous payday loan.

Even a single tribal loan can be financially devastating. More than one could leave you considering bankruptcy, so it’s important to understand what you’re getting into.

READ MORE: Can you have multiple payday loans?

Consumer information

The Office of the Commissioner of Financial Regulation is the primary consumer financial protection agency and financial services regulator in Maryland. In other words, they’re responsible for enforcing the state laws that protect you from predatory payday lenders.

In addition, the office provides a wide variety of educational consumer resources, including financial relief guides, advisory publications, explanations of regulated industries, and a database of licensed financial service providers.

Where to make a complaint

Maryland’s Office of the Commissioner of Financial Regulation is also the best place to submit a complaint about a payday lender. Here’s how to contact them.

- Regulator: Department of Banking & Insurance, Division of Banking

- Address: 100 N. Eutaw Street Suite 611, Baltimore MD, 21201

- Phone number: 410-230-6077

- Email: [email protected]

- Website: https://www.dllr.state.md.us/finance/consumers/comphow.shtml

If you have a complaint, it’s also best to share the details with the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency that protects consumers from predatory financial institutions, including payday lenders.

Number of Maryland consumer complaints by issue

These statistics are all according to the CFPB Consumer Complaint Database.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 180 |

| Struggling to pay your loan | 53 |

| Can’t contact lender or servicer | 35 |

| Problem with the payoff process at the end of the loan | 26 |

| Getting the loan | 24 |

| Problem when making payments | 17 |

| Can’t stop withdrawals from your bank account | 16 |

| Loan payment wasn’t credited to your account | 14 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 13 |

| Incorrect information on your report | 9 |

| Applied for loan/did not receive money | 9 |

| Problem with additional add-on products or services | 8 |

| Was approved for a loan, but didn’t receive money | 6 |

| Received a loan you didn’t apply for | 5 |

| Vehicle was repossessed or sold the vehicle | 5 |

| Improper use of your report | 3 |

| Problem with a credit reporting company’s investigation into an existing problem | 2 |

| Credit monitoring or identity theft protection services | 1 |

| Vehicle was damaged or destroyed the vehicle | 1 |

Source: CFPB website

The most common complaint Maryland consumers make to the CFPB is that their lenders charge them unexpected fees and interest. In fact, it’s the most significant issue by far. There are over 100 more instances of it than the problem in second place.

Unfortunately, that’s the case in most states, even when regulations prohibit predatory interest rates like the Maryland payday loan laws. It’s likely the result of multiple factors, including a lack of due diligence from borrowers and a lack of transparency from lenders.

In addition, some borrowers may unexpectedly encounter lenders willing to charge more than state limits allow, such as tribal lenders. As a result, they may have been surprised by illegal and usurious interest rates.

The most complained about lender in Maryland: Enova International, Inc.

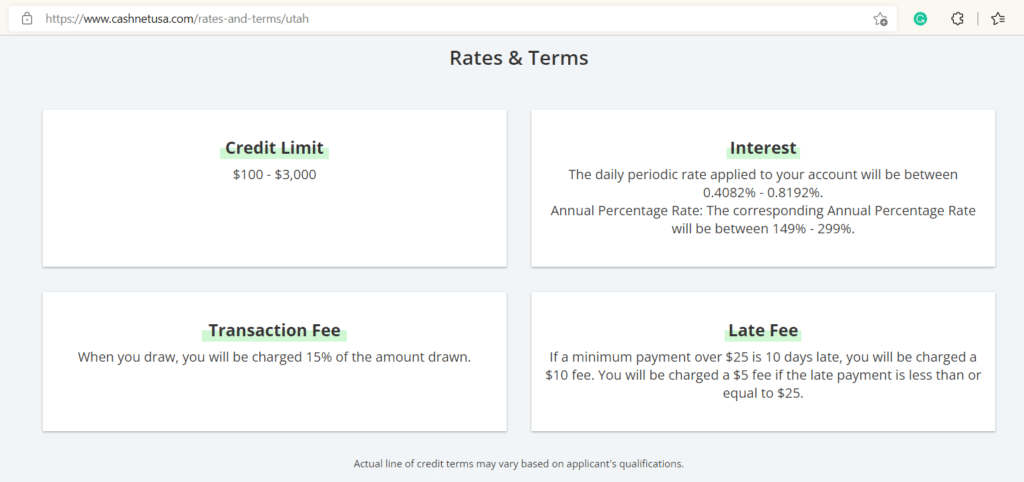

The most complained about lender in Maryland is Enova International, a parent company for several financial service providers. The two most relevant in this case are NetCredit and CashNetUSA. They’re both lenders that charge predatory fees in many states.

Fortunately, neither subsidiary operates in Maryland any longer, thanks to the interest rate caps in the state. Though they haven’t been able to offer payday loans there for many years, they were still able to provide usurious lines of credit. That stopped in 2017 when a new law limited revolving accounts to 33% APR, just like closed-end loans.

In their 2018 Annual Report, Enova notes that they had to cease making consumer loans in the state due to the legislation that went into effect on July 1, 2017.

Most common complaints about Enova International, Inc.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 36 |

| Struggling to pay your loan | 7 |

| Applied for loan/did not receive money | 5 |

| Loan payment wasn’t credited to your account | 5 |

| Can’t stop withdrawals from your bank account | 5 |

| Can’t contact lender or servicer | 4 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 4 |

| Received a loan you didn’t apply for | 2 |

| Incorrect information on your report | 1 |

| Problem with the payoff process at the end of the loan | 1 |

Source: CFPB website

Unsurprisingly, the most common reason consumers complain about Enova International is that they charge unexpected fees or interest. In addition to the typical contributing factors, Enova’s predatory APRs are likely to blame.

Prior to the cessation of their operation in Maryland, Enova’s subsidiaries would regularly charge triple-digit interest rates. If you look at their prices in a state where there’s no usury cap, like Utah, you’ll see that NetCredit products can cost as much as 155% APR, while CashNetUSA’s can reach 299%.

Top 10 most complained about payday lenders

| Lender | Number of Complaints Since 2013 |

| Enova International, Inc. | 70 |

| Big Picture Loans, LLC | 59 |

| Mariner Finance, LLC | 20 |

| LDF Holdings, LLC | 17 |

| Navy Federal Credit Union | 16 |

| Lending Club Corp | 13 |

| Lendmark Financial Services | 13 |

| Synchrony Financial | 10 |

| OneMain Financial Holdings, LLC | 10 |

| Kashia Services | 8 |

Source: CFPB website

The CFPB has received more complaints about Enova International than any other lender in Maryland, but they’re far from the only problematic provider in the state. There are many others that consumers have had consistent issues with over the years.

Unfortunately, several of the worst repeat offenders are tribal entities, including Big Picture Loans, LDF Holdings, and Kashia Services. That implies there’s a significant tribal lending presence in the state, which represents a danger to Maryland consumers.

The primary reason to become a tribal lender is to bypass state laws, so their interest rates are naturally well above the Maryland limits. If borrowers don’t do the proper due diligence to confirm they’re working with licensed lenders, they could easily get entangled with a predatory institution that ignores the 33% APR limit.

If you’re struggling financially because of an entity on the list above or others like them, contact DebtHammer. We’ll show you how to deal with predatory lenders and help you get out of their debt traps.

The Most Complained About Tribal Lender in Maryland: Big Picture Loans, LLC

Big Picture Loans, LLC is the most complained about tribal lender in Maryland by a significant margin. In fact, they were only 11 complaints short of being the most complained about lender in the state overall. For context, they received 39 more complaints than the third-place lender.

Sadly, Big Picture Loans is the most complained about tribal lender in many parts of the United States. They prey on borrowers throughout the country, operating online as an extension of the Lac Vieux Desert Band of Lake Superior Chippewa Indians.

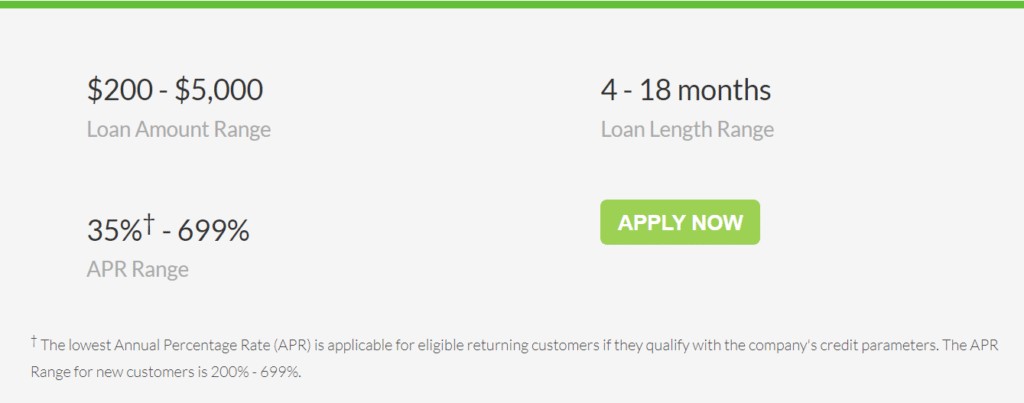

Like many tribal lenders, they’ve opted to provide short-term installment accounts rather than traditional payday loans. Unfortunately, that allows them to charge borrowers even more. These are their standard loan terms:

- Loan amounts from $400 to $3,500

- Loan terms from four to 18 months

- APRs from 35% to 699% with a 200% minimum for new customers

For example, say you took out a $1,000 loan with a six-and-a-half month repayment term and a 350% APR. You’d end up paying a whopping $1,272 in interest, which is even more than the original principal balance of the loan.

Most Common Complaints About Big Picture Loans, LLC

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 46 |

| Struggling to pay your loan | 3 |

| Getting the loan | 2 |

| Loan payment wasn’t credited to your account | 2 |

| Can’t stop withdrawals from your bank account | 2 |

| Was approved for a loan, but didn’t receive money | 1 |

| Problem with the payoff process at the end of the loan | 1 |

| Can’t contact lender or servicer | 1 |

| Improper use of your report | 1 |

Source: CFPB website

Once again, the most common reason people complain about Big Picture Loans is that they charge unexpected fees or interest. That should be no surprise to you, especially since their loan rates can reach more than 20 times the legal limit in Maryland.

Payday loan statistics in Maryland

- Maryland ranks as the 13th state for the most overall payday loan complaints.

- Maryland ranks as the 10th state for the most payday loan complaints per capita.

- There have been 18,281 payday loan-related complaints made to the CFPB since 2013 ― 427 of these complaints originated from Maryland.

- The estimated total population in Maryland is 6,045,680 people.

- There are 7.0629 payday loan complaints per 100,000 people in Maryland.

- The most popular reason for submitting a payday loan complaint is “Charged fees or interest you didn’t expect.”

READ MORE: Payday loan debt statistics

Historical timeline of payday loans in Maryland

Fortunately, the Maryland payday loan laws have prohibited usurious lending for decades. Because of this, there haven’t been as many significant refinements to the regulations there as in other states.

However, that doesn’t mean there haven’t been changes over the years. Here are the most significant ones:

- 2002: Maryland legislators passed usury rate caps that prevented lenders from charging more than 33% on small consumer loans, effectively prohibiting payday loans.

- 2017: Legislators expanded the 33% limit to include revolving credit accounts, such as lines of credit.

- 2018: Once again, legislators revised the rate cap to protect consumers. This time, it was to include closed-end loans up to $25,000 in the law. Previously, the limit had only applied to loans with principal balances below $6,000.

Currently, the most dangerous lenders in Maryland are sidestepping the law through strategies like partnering with tribal entities or out-of-state banks. To avoid them, always confirm that a lender has a proper lending license and obeys state interest rate limits before working with them.

Flashback: An Maryland payday loan story

The campaign to stop payday lending in the United States has stretched on for decades. Unfortunately, even in states like Maryland, where regulators have successfully imposed laws to prevent usury, predatory lenders often find ways to circumvent them.

One of the most common strategies they employ is to close their storefront operations and retreat to the anonymity of the internet. They then enlist the help of out-of-state banks to facilitate withdrawals from their borrower’s funds.

Traditional payday lenders use post-dated checks to collect from their borrowers. These online lenders convince borrowers to give them the authorization to debit their bank account directly instead. They can’t initiate the transactions themselves, so they ask out-of-state banks that aren’t subject to local lending laws to do it for them.

For example, Maryland regulators have been fighting against this setup since 2013. Mark Kaufman, then Commissioner of the Office of Financial Regulation, reported no less than eight banks to federal regulators that year.

Unfortunately, there was little else he could do to prevent the situation. The institutions were all located outside the state and Mr. Kaufman’s jurisdiction, which meant he couldn’t take direct action against them.

Because the payday lenders operated online, they were also almost impossible for him to shut down. As Mr. Kaufman said, “It’s very difficult as a state regulator to regulate a virtual business. I can’t issue an enforcement action without an address.”

The moral of the story is that even if you live in a protected state like Maryland, you’re still vulnerable to predatory online lenders. Think twice before doing business with one that has no storefront. There’s a lot less that regulators can do to keep you safe.

The bottom line: Should you take out a payday loan in Maryland?

In 2022, roughly 64% of Americans live paycheck to paycheck. That means a single surprise expense could send them running to a lender to make ends meet. Those with bad credit may turn to payday loans, thinking they have no other option.

Unfortunately, even in the best circumstances, those loans are more expensive than the average borrower can reasonably afford. Perhaps counterintuitively, they’re often even worse in states like Maryland, which have effectively outlawed payday loans.

That’s because the only payday lenders in these states are bending or breaking the law just to operate. That makes them even more likely to charge usurious and predatory interest rates.

As a result, you should avoid payday loans whenever possible, even in states like Maryland with interest rate caps. If you need another form of short-term financing, consider using a cash advance app like Earnin, which lets you borrow up to $500 against each paycheck at no cost.

Of course, these kinds of solutions will only get you so far. Eventually, you need to get your finances in order and stop relying on debt to make it to payday. For help with that, contact DebtHammer. We’ll show you how to leave predatory lenders in your past forever.