Debt consolidation can lower your monthly payments, but will it also lower your credit score? Well… it depends. Why does debt consolidation affect your credit score? In some cases, debt consolidation will get you a better interest rate, simplify your paydown process, and put you on the fast track to being debt-free. But in others, […]

If you’re among the millions of Americans with credit card bills, student loans or medical bills, you have unsecured debt. But what does that mean, and how does it differ from secured debt? Key points What does unsecured debt mean? Unsecured loans: This refers to types of debt not backed by collateral or any specific […]

Personal loans and balance transfer credit cards can both be effective and low-cost ways to consolidate high-interest debt. But which works best? It will depend on several factors. Key points Should I get a personal loan or a balance transfer credit card? If you’re struggling with debt, both of these are good options. There are […]

If you’re looking to save money, DIY will always be a cheaper option. But just like you wouldn’t try to replace your hot water heater without some basic idea of how it works, you shouldn’t attempt to settle your own debts without taking time to prepare yourself. Debt settlement is the process of getting your […]

Americans have a lot of credit card debt — $986 billion, to be precise. According to a recent survey, 57% have missed at least one payment and nearly half are using credit cards to pay essential bills. If you’re struggling to make multiple minimum payments each month, debt consolidation could solve your financial worries. Here’s […]

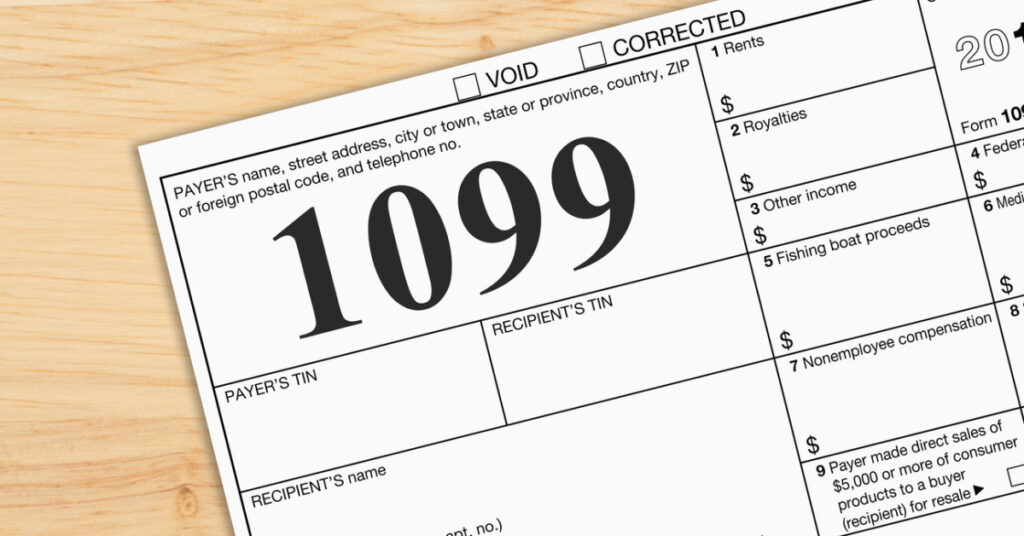

No one wants to see extra tax forms in the mailbox, particularly if you don’t know what they mean. If you’ve completed a debt settlement program or qualified for student loan forgiveness, you’re no longer obligated to repay the canceled debt. However, you may have to pay income taxes on the total canceled debt. That’s […]

Some people still prefer to manage their money the old-fashioned way. They balance checkbooks and manually enter all of their expenses into a spreadsheet. Other people prefer using apps—especially if those apps offer benefits like paycheck advances and financial advice. One of the most popular apps in this area of fintech is Empower. Looking for […]

According to cnbc.com, consumer debt has hit a record $16.9 trillion and delinquencies are also on the rise. Consumer debt was up about $1.3 trillion from a year ago across all major categories. And the Federal Reserve Bank of New York reports that credit card balances grew robustly in the fourth quarter. Credit card debt […]

Soaring prices and rising interest rates have left tens of millions of Americans struggling with debt, particularly high-interest credit card debt. Debt consolidation can be an effective solution, and there are unique options available for veterans. Are you eligible for debt consolidation? We may be able to help. It’s easy and free to find out. […]

Many of us have been there, which is not fun. You look at your checking account balance and see that it is negative. You don’t know how or when your account became overdrawn, but here is a guide to making it through the dreaded negative balance on your bank account. Pewtrusts.org indicates that about 18 […]