Debt consolidation can lower your monthly payments, but will it also lower your credit score? Well… it depends.

Table of Contents

Why does debt consolidation affect your credit score?

In some cases, debt consolidation will get you a better interest rate, simplify your paydown process, and put you on the fast track to being debt-free. But in others, you’ll get nothing for your trouble except a ding to your credit.

But it involves taking on a new loan — even if it’s a better one — and that will always have some impact on your credit score. How much impact it will have depends on your current credit score, your current credit utilization ratio and whether you’ve been making late payments.

To help you decide if debt consolidation is right for you, we’ve broken down exactly what it means, when it makes the most sense, and how it impacts your credit score.

READ MORE: 5 ways to consolidate credit card debt

Debt consolidation may initially lower your credit score

In the short-term, debt consolidation can hurt your credit scores by a few points.

If your credit score is good, the decline shouldn’t be enough to knock you down to the next category unless you’re already on the bubble. It shouldn’t fall more than 25 points, depending on your current score.

READ MORE: How debt consolidation works and the best loan options

Your credit score will rebound quickly and likely end up higher

Once your payments have been rolled into your new loan, your credit utilization will decrease, particularly if you have credit cards that are maxed out or close to your credit limit.

This means that if you have a card with a $5,000 limit that is maxed out, your credit utilization is 100%. If you transfer that amount to your new installment loan and your credit card balance is now zero, your credit utilization falls to 0%.

Pro tip: Credit utilization makes up 30% of your credit score, so this will be a significant factor.

If you don’t run up your credit cards again and make your payments on time, your credit score will start to increase quickly.

| How debt consolidation helps your credit score | How debt consolidation hurts your credit score |

| Fewer late payments | Hard inquiry on your credit report |

| Improved credit utilization ratio | Lower average age of credit |

| Lower interest rates help you repay debt faster | Unused accounts may be closed by creditors |

| Overall impact: Late payments and credit utilization combined account for 65% of your credit score, so even a minor improvement can easily erase credit score damage from the loan application process. | Overall impact: The good news is that each of these categories combined only makes up roughly 35% of your score, so the effects usually won’t be too significant. |

Four reasons debt consolidation affects your credit score

Depending on a few factors, debt consolidation can either hurt or help your credit. By opening another new account from the debt consolidation, the average age of all your accounts will be lowered and can negatively impact your credit history.

The credit inquiry from the hard pull can also lower your score, and higher credit utilization also reduces your score.

But it could also raise your score if the loan lowers your credits utilization and you make all your one-time payments on time, making this positive for your payment history.

READ MORE: Debt consolidation help for married couples

The bad

1. A hard inquiry is performed

A hard pull could lower your credit score by 10 points. Hard inquiries will only affect your credit score for one year.

2. Closed accounts may hurt your score

It may seem counterintuitive, but paying off accounts and closing them can hurt your credit score. The average age of your credit accounts makes up 15% of your score. The higher the average age of your accounts, the better your score. Your credit history’s average age decreases when you open a new account. If you close old or inactive accounts after consolidating, it will further lower the average age of your accounts.

READ MORE: Does debt consolidation close credit cards?

The good

3. The credit utilization ratio will decrease

Have a large credit card balance? You may also have a high credit utilization ratio.

Calculate this by dividing your current card balance by your total credit limit. You will want to keep your credit-debt ratio as low as possible.

But if you use a loan to pay off that balance, the utilization percentage drops and your credit score will rise. The credit utilization ratio accounts for 30% of your credit score

4. Fewer late or missed payments

Rolling your debts into one monthly payment lowers the risk of late or missed payments. Payment history accounts for 35% of your credit score. As long as you make your payments on time, your credit score will increase — particularly if you had established a pattern or skipping payments.

READ MORE: Debt consolidation pros and cons

Debt consolidation strategies

There are two general debt consolidation strategies:

- Low-interest loans: Use the proceeds from a personal loan to pay off all your previous lenders, then pay back the new (and cheaper) debt in fixed monthly installments.

- Balance-transfer credit cards: Transfer all your outstanding debts to the balance transfer card and pay off everything during the initial 0% interest period.

Here’s a simple example to show you how this might work:

Imagine having three credit cards, each with a $2,000 balance. They have 15%, 20%, and 25% annual percentage rates respectively.

If you made no payments and incurred no new charges, you’d rack up a whopping $3,031 in interest over the next two years (see for yourself). But if you consolidated that debt into a balance transfer card, you could pause your interest for that same period and pay off your entire debt with just $250 a month.

READ MORE: Debt consolidation loans for military veterans

What you need to know about debt consolidation

Debt consolidation is a technique that combines multiple debt payments into a single monthly payment, hopefully with better repayment terms.

Usually, that includes:

- A lower interest rate: To be effective, debt consolidation should lower — or at least maintain — your average interest rate. If consolidating raises your average rate, it might end up costing more than it’s worth.

- Fewer payments to keep track of: Dealing with multiple lenders and tracking multiple monthly payments makes it much more likely that one will slip through the cracks, delaying your repayment, racking up late fees and damaging your credit score.

- A more flexible payment schedule: Debt consolidation with the right type of credit account can pause your interest accrual, allowing you to pay down your debts aggressively.

- Lower monthly payments: Debt consolidations are for people who can’t keep up with their payments. It should reduce both the number of payments and the total amount leaving your bank account each month.

READ MORE: Best debt consolidation options for healthcare workers

Limitations of debt consolidation — and when it won’t work

Beyond potentially dinging your credit score, sometimes debt consolidation just doesn’t make sense. Here’s when it probably won’t be able to work for you:

- You have a high debt-to-income ratio: If your debt balance is simply too high to cover with your current income, debt consolidation probably isn’t going to solve your problems. While reducing your interest rate will help lower your payment somewhat, consolidation loans and balance transfer cards require you to start aggressively paying down your debt. If you can’t afford it, the consolidation will backfire.

- Your spending habits are poor: Debt consolidation only works if you subsequently follow through and pay off your new debt. If you have poor spending habits and don’t fix the problem that caused you to get into debt in the first place, you’ll just end up back where you started.

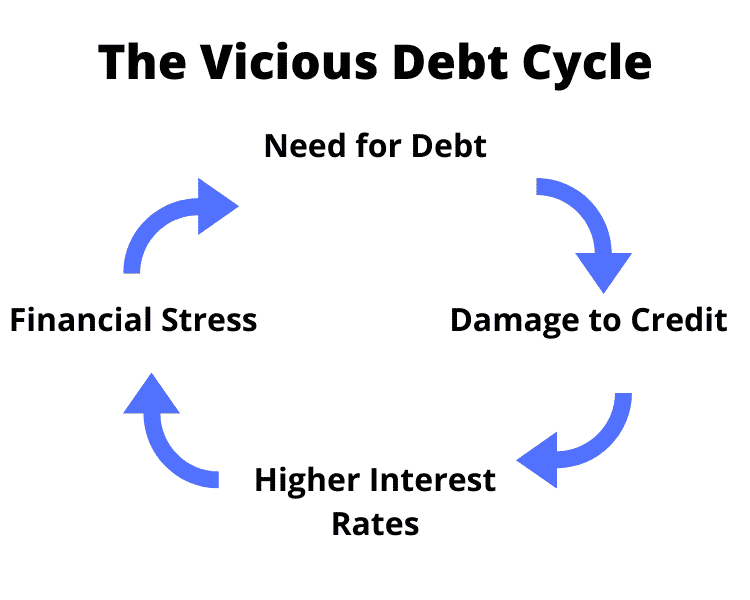

- You’re caught in the debt cycle: To qualify for a consolidation loan or a balance transfer card, your credit needs to be above a certain level. If your debt problem is so big that your credit score has fallen below 580, it may be difficult to consolidate.

READ MORE: Debt consolidation if you’re unemployed

Benefits of debt consolidation — and when it works best

Debt consolidation might not be a magic solution for everyone, but it’s a popular tool for good reasons. Here are the situations where it will benefit you the most:

- You lower your rates and monthly payments: Debt consolidation works best when you have multiple high-interest accounts. If you can consolidate to a loan with less interest and a smaller monthly payment, you can supercharge your debt paydown.

- Your credit score is (at least) fair: Debt consolidation is intended for individuals who are struggling with debt, so it wouldn’t make sense if only those with the best credit scores were eligible. Fortunately, the cutoff is usually around 600, which is an achievable credit score even if you’ve made some mistakes.

- You get a simplified repayment plan: For some individuals, the hardest part of managing your debt is just that – managing and making the payments. If you have a half dozen or more monthly payments to keep track of, debt consolidation can save you from ever missing one and damaging your credit score further.

READ MORE: Debt consolidation loans for bad-credit borrowers

Types of debt that can be consolidated

Fortunately, debt consolidation can work with all types of debt, including:

- Payday loans

- Credit cards

- Student loans

- Medical debt

But you don’t necessarily have to consolidate all of your debts. If one account already has favorable terms, you can take a consolidation loan out and use it to pay off a select few.

For example, imagine you currently hold a mix of credit card debt, payday loans, and student loans.

Credit card rates average around 18% APR, payday loans average around 400% APR, and student loans average around just 6% APR.

If you get a consolidation loan with a rate of 7%, you can (and should) use it only to pay off the credit cards and payday loans, leaving the student debt alone.

What if you don’t qualify for a debt consolidation loan?

If you cannot qualify for a debt consolidation loan because of your credit score, don’t panic. There are still options available to you.

First, shop around a little. Some lenders may be more or less willing to extend you a loan.

Second, do everything you can to improve your credit score. Get a free credit report and look for any errors. Cut back on your spending and focus on paying back your debt.

Third, consider getting expert help. If your situation feels unmanageable, DebtHammer can get you the support you need.

DebtHammer will thoroughly analyze your debts, create an achievable plan to tackle them and serve as a middleman between you and your lender. Take advantage of our free consultation and we’ll get your debt under control.

The bottom line

Debt consolidation will affect your credit score. It may take a temporary dip from hard credit inquiries and a new loan, but if you make your payments on time and don’t take on new debt, your score will slowly rise.

FAQs

Lenders use your credit scores to determine your creditworthiness. These scores dictate whether you’ll get the loan, your credit limits, and the rate you will pay. Insurers also use credit scores to set premiums for auto and homeowner coverage.

You can pull your credit report at annualcreditreport.com. It’s essential to be on top of your credit history. Monitor your credit report regularly, check for any inaccurate or incomplete information, and immediately dispute or correct any errors.

Start by creating a personal budget that will work with your income and expenses. This budget can help you pay off debt, build savings, and plan for the long term. A second option is to contact your creditors directly to see if they can modify your payment plans. If your situation is truly dire, bankruptcy may be another option. Speak with an experienced bankruptcy attorney to see if they recommend this.