When you need cash fast but struggle with bad credit, you may consider taking out a payday loan. Unfortunately, they have such high finance charges that they usually only make things worse. The Missouri payday loan laws, in particular, lack consumer protections. Here’s everything you should know about them if you live in the state.

Table of Contents

Payday lending status in Missouri: Legal

Unfortunately, the Missouri payday loan laws allow the predatory industry to operate virtually without limits. As a result, consumers can easily find themselves trapped in a cycle of debt after taking out a single payday loan.

Not only can lenders legally charge annual percentage rates (APRs) in the high triple digits, but they can also roll accounts over multiple times. That’s the combination that has made the payday lending industry so dangerous to consumers for decades.

You can find the actual regulations on the Missouri Division of Finance’s website.

READ MORE: States where payday loans are illegal

Stuck in payday debt?

If you’re a resident of Missouri, DebtHammer may be able to help.

Loan terms, debt limits, and collection limits in Missouri

- Maximum loan amount: $500

- Maximum Interest Rate (APR): 1,955% on a 14-day loan

- Minimum loan term: 14 days

- Maximum loan term: 31 days

- Number of rollovers allowed: Six

- Number of outstanding loans allowed: One

- Cooling-off period: N/A

- Finance charges: Interest and fees must not exceed 75% of the principal balance.

- Collection charges: $25 non-sufficient funds (NSF) fee. Late fee equal to 5% of the amount due after 15 days.

- Criminal action: Prohibited

The Missouri payday loan laws do nothing to stop lenders from catching consumers in the debt trap that’s made the industry so infamous. Borrowers have two to four weeks to pay back their initial principal balance plus as much as 75% in interest and fees.

If they can’t afford to make their payment, as happens to so many, the lender can charge them a fee and renew the account up to six times. That’s the perfect recipe for milking borrowers for every dollar they’re worth and keeping them stuck in debt.

Missouri payday loan laws: How they stack up

The Missouri payday loan laws are one of the most permissive in the country for predatory lenders. It’s one of the only states where payday lenders don’t charge the most they can under the law because it would be too much for the market to bear.

Here’s a more detailed review of the regulations in the state to help you understand how they compare to the rules for the rest of the United States.

Payday loans are currently illegal in Arizona, Arkansas, Colorado, Connecticut, Georgia, Maryland, Massachusetts, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, Pennsylvania, South Dakota, Vermont, West Virginia and the District of Columbia.

READ MORE: How to get out of a payday loan nightmare

Maximum loan amount in Missouri

Missouri allows payday lenders to offer accounts up to $500. There’s no legal minimum, but lenders usually offer accounts as low as $50 or $100 in practice. For amounts in between, they’ll typically provide loans in increments of $25.

What is the statute of limitations on a payday loan in Missouri?

A statute of limitations on debt is a law that restricts the time a creditor or debt collector has to sue a borrower to collect on an account that’s in default. Each state has different rules for the various types of credit accounts.

Payday loans are written contracts. In Missouri, lenders have ten years to sue for them.

Rates, fees, and other charge limits in Missouri

The Missouri payday loan laws let lenders charge up to 75% of the initial principal balance in interest and fees over the life of the loan. In theory, that means they could charge as much as $75 for $100 in principal. On a 14-day loan, that’s a 1955% APR.

However, lenders generally don’t charge that much in practice, possibly because that would be too much even for prospective payday loan borrowers to consider. The Center for Responsible Lending reports that the average APR for a payday loan in Missouri is actually 527%.

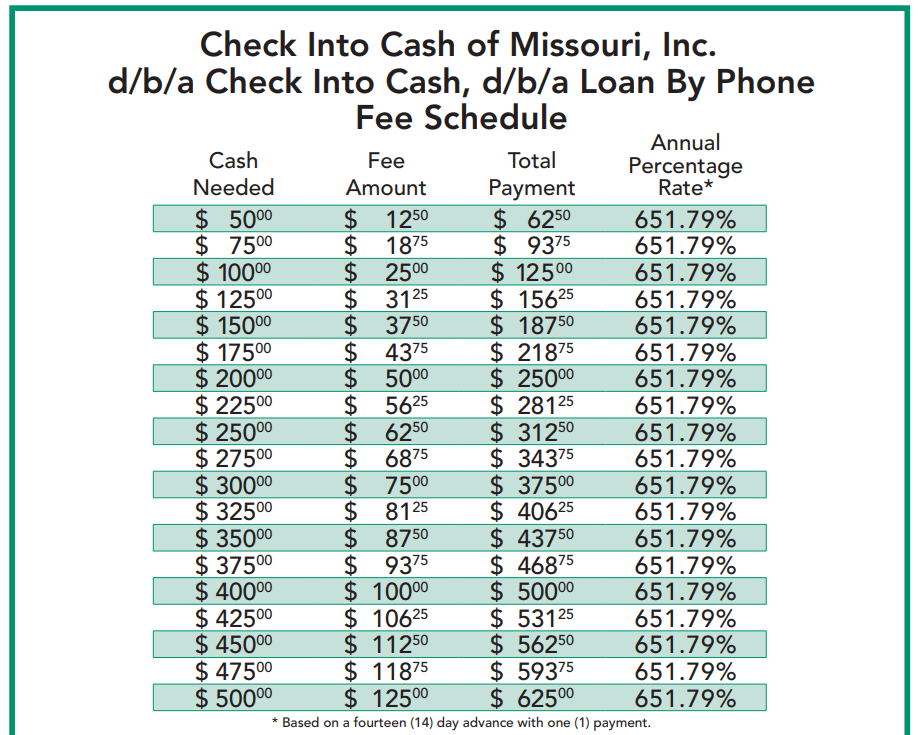

For example, Check Into Cash charges $51 for a $300 payday loan in their Missouri stores. That equals 443.21% APR on a 14-day loan. However, they charge $75 for a $300 payday loan in Missouri online or by phone. With a 14-day loan term, that’s 651.79% APR.

In addition, payday lenders can charge an NSF fee of up to $25. If your payment is delinquent by more than 15 days, they can also charge you a late fee equal to 5% of the amount due.

Maximum term for a payday loan in Missouri

Payday loans in Missouri can have a loan term between 14 and 31 days. However, lenders can extend that significantly by rolling over the account six times, as long as the borrower reduces their principal balance by at least 5% each time.

Unfortunately, payday lenders will also charge a renewal fee. It can be as much as they want, as long as they don’t violate the rule limiting their interest and fees to 75% of the principal balance.

For example, Cash Central takes a $25 fee per $100 borrowed for each rollover. They have the room to demand that much because they charge $25 per $100 borrowed for their initial finance fees.

Are tribal lenders legal in Missouri?

The United States considers Native American tribes sovereign nations. As a result, they have immunity to most state regulations, including lending laws. That makes it difficult to sue them for charging more than they should.

Tribal lenders partner with Native American tribes to take advantage of that loophole and charge consumers much more than they could otherwise. In exchange, they give the tribe a small percentage of their profits.

That strategy has had a lot of success over the years, and tribal lenders have become a popular online lending model. Fortunately, Missouri has pushed back against it, and it’s not as prevalent a practice there as it is in other states.

For example, Chris Koster, the Missouri Attorney General from 2009 to 2017, sued several tribal lenders operating as an extension of the Cheyenne River Sioux Tribe. They were charging fees over state limits and garnishing wages unlawfully. Koster forced the tribal lenders to refund hundreds of thousands of dollars to their previous customers, cancel their outstanding loan agreements, and stop doing business in the state.

The Missouri payday loan laws require that lenders have a license with the state to operate. Without it, any loan agreement the payday lender enters is illegal and unenforceable in court.

You can double-check whether a lender has a license to operate in Missouri online using the Missouri Division of Finance’s licensee search tool.

READ MORE: Is my payday loan lender licensed?

Consumer information

The Missouri Division of Finance is the agency responsible for regulating financial institutions in the state, including consumer credit facilities like payday lenders. Its primary objectives include monitoring their compliance with the law to ensure that consumers receive the proper protections.

To that end, the Division provides information on consumer rights and lender responsibilities, ensures proper licensing of financial institutions, and responds to consumer inquiries and complaints.

READ MORE: How to get out of high-interest tribal loans

Where to make a complaint

The Missouri Division of Finance is the best place to complain about the behavior of a payday lender in the state. Here’s how you can get in touch with them:

- Regulator: Missouri Division of Finance

- Address: Truman State Office Building, Room 630, Jefferson City, MO 65102

- Phone: (573) 751-3242

- Email: [email protected]

- Link to website: https://finance.mo.gov/consumers/consumer_complaint.php

It’s also a good idea to submit a complaint to the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency that protects consumers from predatory financial institutions, including payday lenders.

Number of Missouri consumer complaints by issue

These statistics are all according to the CFPB Consumer Complaint Database.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 102 |

| Struggling to pay your loan | 55 |

| Problem with the payoff process at the end of the loan | 33 |

| Can’t contact lender or servicer | 33 |

| Problem when making payments | 30 |

| Received a loan you didn’t apply for | 30 |

| Can’t stop withdrawals from your bank account | 25 |

| Getting the loan | 21 |

| Incorrect information on your report | 16 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 15 |

| Loan payment wasn’t credited to your account | 12 |

| Applied for loan/did not receive money | 10 |

| Problem with additional add-on products or services | 9 |

| Improper use of your report | 2 |

| Vehicle was repossessed or sold the vehicle | 2 |

| Was approved for a loan, but didn’t receive money | 1 |

| Property was damaged or destroyed property | 1 |

| Problem with a credit reporting company’s investigation into an existing problem | 1 |

| Vehicle was damaged or destroyed the vehicle | 1 |

Source: CFPB website

The most common issue consumers in Missouri have with their lenders is that they charge unexpected fees or interest. There are nearly twice the number of complaints about that as there are about the problem in second place.

Given the excessive finance charges the Missouri payday loan laws allow, that shouldn’t be much of a surprise. Lenders have to disclose their fees, but the typical consumer still struggles to understand how hard it is to pay everything by their next paycheck.

The most complained about lender in Missouri: Enova International, Inc.

The lender that consumers complain about the most in Missouri is Enova International, Inc. They don’t issue loans to borrowers directly, but they’re the parent company of CashNetUSA and NetCredit. Neither subsidiary offers payday loans in Missouri, but their other products are still potentially predatory.

In Missouri, CashNetUSA offers lines of credit from $550 to $2,800. Their APRs range from 149% to 325%. That might not be as much as a payday loan’s APR, but it’s still unaffordable, especially since their principal balances are higher.

Similarly, NetCredit offers personal loans in Missouri from $500 to $20,000. The APR ranges from a relatively affordable 19.9% to a whopping 155%. At the highest possible interest rate, an $1,800 loan would cost $3,722 in interest.

Most common complaints about Enova International, Inc.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 10 |

| Struggling to pay your loan | 8 |

| Received a loan you didn’t apply for | 5 |

| Applied for loan/did not receive money | 4 |

| Can’t contact lender or servicer | 3 |

| Can’t stop withdrawals from your bank account | 2 |

| Problem with the payoff process at the end of the loan | 2 |

| Getting the loan | 1 |

Source: CFPB website

The most common complaint consumers make about Enova International, Inc. is that the lender charged them fees and interest that they didn’t expect. That shouldn’t be much of a surprise since their APRs reach well into the triple digits and cause borrowers to pay more than double their principal in interest.

Top 10 most complained about payday lenders

| Lender | Number of Complaints Since 2013 | Complaint Reason |

| Enova International, Inc. | 35 | Charged fees or interest you didn’t expect |

| CURO Intermediate Holdings, LLC | 32 | Charged fees or interest you didn’t expect |

| Populus Financial Group, Inc. | 20 | Can’t contact lender or servicer |

| Tower Loan of Mississippi, Inc. | 19 | Struggling to pay your loan |

| Community Choice Financial, Inc. | 14 | Received a loan you didn’t apply for |

| TMX Finance, LLC | 13 | Struggling to pay your loan |

| Check Into Cash, Inc. | 10 | Can’t contact lender or servicer |

| QC Holdings, Inc. | 10 | Charged fees or interest you didn’t expect |

| OneMain Financial Holdings, LLC | 8 | Loan payment wasn’t credited to your account |

| RISE Credit, LLC | 8 | Charged fees or interest you didn’t expect |

Source: CFPB website

Consumers have made more complaints about Enova International than any other lender, but not by much. There have only been three fewer complaints about CURO Intermediate Holdings, the runner-up.

CURO is the parent company for Speedy Cash, one of the biggest payday lenders in the country. Ironically, they’ve opted not to issue payday loans in Missouri. Instead, they provide installment loans, title loans, and lines of credit.

Predictably, all of them have potentially predatory finance charges. For example, a $300 installment loan from Speedy Cash will cost a truly staggering $1,489 in interest over the next 18 months.

If you’re having problems meeting your financial obligations because of one of the lenders on this list or others like them, then contact DebtHammer today. We’ll help you get out of the payday loan trap once and for all.

READ MORE: Debt settlement — how to get your debt under control now

Payday loan statistics in Missouri

- Missouri ranks as the 15th state for the most overall payday loan complaints.

- Missouri ranks as the 13th state for the most payday loan complaints per capita.

- There have been 18,281 payday loan-related complaints made to the CFPB since 2013―399 of these complaints originated from Missouri.

- The estimated total population in Missouri is 6,137,428 people.

- There are 6.5011 payday loan complaints per 100,000 people in Missouri.

- The most popular reason for submitting a payday loan complaint is “Charged fees or interest you didn’t expect.”

READ MORE: Payday loan debt statistics

Historical timeline of payday loans in Missouri

Unfortunately, Missouri has long been one of the worst states in the country when it comes to payday loans. Consumer protections have been few and far between for decades, and all attempts to change that have failed.

Here’s a high-level review of the most significant changes to the Missouri payday loan laws over the years.

- 1998: Missouri legislators eliminated the usury cap, which allowed payday lenders to spread in earnest throughout the state.

- 2002: Legislators attempted to restrain the payday lending industry. They implemented a law restricting interest and fees to 75% of the principal balance. It turned out to hardly be a cap at all, and payday lenders continued to multiply.

- 2005: The Missouri payday loan laws were so relaxed that the industry became oversaturated. The Missouri Division of Finance issued 1,335 licenses that year.

- Post-2005: The number of payday lenders began to decline due to market forces instead of regulations. Many lenders shifted to installment loans instead of payday loans.

Payday lenders have had a tight grip on Missouri for years, and it’s going to be tough to change that. For example, House Rep. Martha Stevens has introduced bills that would implement a 36% APR usury cap at every legislative session since she was elected in 2016, and they’ve failed each time.

Flashback: An Missouri payday loan story

Payday lenders have a knack for blocking or dodging regulations that might limit their ability to take advantage of consumers. One of their primary tactics is manipulating legislative and public opinion.

Despite the evidence that payday loans do more harm than good, supporters of the industry argue that consumers with bad credit need their services. Without them, people would have to turn to even more expensive options, like unlicensed lenders.

They also claim that payday lenders operate on such thin margins that any reduction to their charges would put them out of business. Ironically, they say that in every state, no matter how high those charges happen to be.

One way to counter these arguments is to highlight the sheer damage these loans do to real people. For example, consider the story of Elliott Clark, a resident of Kansas City, Mo.

In 2003, Mr. Clark’s wife slipped on ice and broke her ankle badly enough to warrant surgery. It put her out of work for months, and she was ineligible for health benefits from her employer.

Because he was already supporting two daughters in college, Mr. Clark needed help paying his wife’s medical bills, which amounted to $26,000. Unfortunately, his credit score was 610, and he couldn’t get a loan from a traditional institution.

As a result, he had no choice but to turn to payday lenders. He took out five $500 accounts for a total of $2,500 in payday loan debt. In a fair world, he should’ve been able to pay them off in a matter of months, at most.

Instead, it took Mr. Clark five and a half years to escape his debt trap, during which he paid a heartbreaking $50,000 in interest, lost his car, and then his family home.

The bottom line: Should you take out a payday loan in Missouri?

Payday loans can help you get cash quickly, even with a bad credit score. However, that convenience comes at a steep price. The Missouri payday loan laws, in particular, allow lenders to charge excessive fees and trap borrowers in a cycle of debt.

If you have any other option, you should always choose not to take out a payday loan, especially in Missouri. It’ll only ever delay your cash crunch, and you’ll find yourself in an even deeper hole when the loan comes due.

For a better short-term option, consider a paycheck advance app like Dave. You can get up to $250 without paying any fees or interest, even if you struggle with bad credit.

Of course, you’ll eventually need to stop relying on debt and stabilize your finances. For help with that, contact DebtHammer. We’ll show you how to eliminate your outstanding debts and escape the payday loan trap for good.