In theory, the purpose of payday loans is to provide emergency funds to people with bad credit. However, they usually cause more problems than they solve. The best way to protect consumers from the trap they represent is with state regulations. Here’s what you should know about the current Washington payday loan laws if you live there.

Table of Contents

Payday lending status in Washington: Legal

Despite the evidence that payday lending harms consumers more than helps them, the industry is still legal in Washington. Their payday loan laws are slightly more permissive than average, allowing relatively high principal balances.

So far, the only way states have found to effectively eliminate predatory lending is to cap the maximum annual percentage rate (APR) at 36%. Unfortunately, Washington still allows APRs well into the triple digits. The average APR in the state is 391%.

You can find the full regulations from the Washington State Legislature in Chapter 31.45 of the Revised Code of Washington.

READ MORE: States where payday loans are illegal

Loan terms, debt limits, and collection limits in Washington

- Maximum loan amount: The lesser of $700 and 30% of gross monthly income

- Maximum Interest Rate (APR): 391% on a 14-day loan

- Minimum loan term: 7 days

- Maximum loan term: 45 days

- Installment option: Yes

- Number of rollovers allowed: None

- Number of outstanding loans allowed: Any, if the total principal is within $700

- Cooling-off period: No more than eight payday loans within 12 months

- Finance charges: $15 per $100 in principal for amounts up to $500; $10 per $100 in principal for amounts above $500 up to $700

- Collection charges: $25 non-sufficient funds (NSF) fee

- Criminal action: Prohibited

The Washington payday loan laws allow slightly higher than average principal balances compared to other states, but they’re standard in most other ways. Borrowers face triple-digit APRs and must pay back their balances within a couple of weeks to a couple of months.

There are no rollovers allowed in the state, but borrowers can take out as many as eight payday loans within a single year. As a result, you can still end up trapped in a cycle of debt.

Washington payday loan laws: How they stack up

In most respects, the Washington payday loan laws are average among the rest of the United States. Predatory lenders can still issue the traditional payday loan with a principal balance of a few hundred dollars, a triple-digit APR, and repayment due with the next paycheck.

Here’s a more in-depth exploration of their laws to show you how they stack up against the payday lending regulations in other states.

READ MORE: How to get out of a payday loan nightmare

Maximum loan amount in Washington

The maximum loan amount in Washington is the lesser of $700 and 30% of your gross monthly income. These principal balance limits apply whether you have a single payday loan or multiple.

For example, say you make $4,000 per month before taxes. 30% of $4,000 equals $1,200, which is above the $700 limit. As a result, you’d only be able to borrow $700, whether you get the funds from one lender or several.

What is the statute of limitations on a payday loan in Washington?

A statute of limitations on debt restricts the length of time a creditor or debt collector has to sue a borrower in pursuit of a delinquent account. The duration varies between states and different types of credit accounts.

Typically, payday loans are written contracts. That means they have a six-year statute of limitations in Washington.

READ MORE: Payday loan consolidation and relief that works

Rates, fees, and other charge limits in Washington

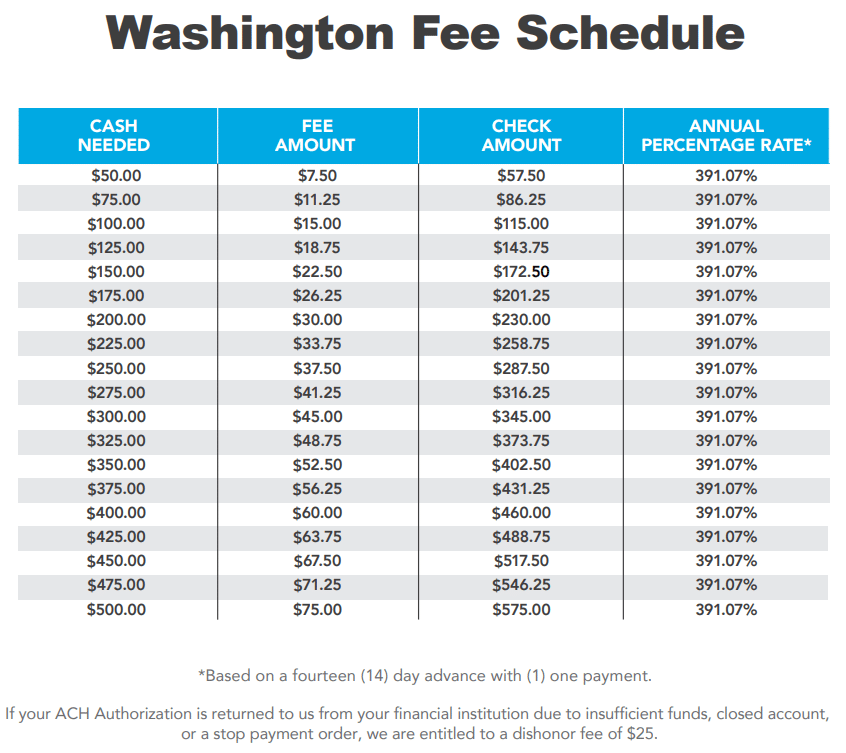

The Washington payday loan laws let lenders charge 15% of the principal balance up to $500 and 10% of the remaining principal balance up to $700. On a 14-day loan, that’s a maximum APR of 391%.

For example, say you take out a $700 payday loan. Your lender can charge you 15% of the first $500, which equals $75. For the remaining $200, your lender can only charge you 10%, which equals $20. As a result, you’d pay a total finance fee of $95.

If the lender attempts to collect through a post-dated check or a debit to your bank account and fails because you didn’t have enough money, they can add on a $25 NSF fee.

Maximum term for a payday loan in Washington

In Washington, payday loans can have a loan term no longer than 45 days. However, if a borrower notifies their lender that they can’t pay their loan at the original due date, their lender must let them convert it into an installment loan at no additional cost.

If the loan amount is less than $400, the installment plan must be 90 days or longer. If it’s more than $400, the installment plan must be at least 180 days.

Are tribal loans legal in Washington?

Legally, Native American tribes are sovereign nations within the United States. That means they’re not subject to most state regulations. Sadly, that includes the payday loan laws in place to protect consumers.

Tribal lenders are predatory lenders that partner with Native American tribes. They then take advantage of the tribe’s immunity to state lending laws by charging interest and fees well above the state limit.

Unfortunately, the legality of these tribal lenders is something of a gray area. They’re not illegal in such a way that authorities can casually shut down their operations, especially because they operate exclusively online.

To take action against them, regulators must sue them and go through a court battle or come to a settlement. Some are unwilling to do so, and Washington seems to be one of them. As a result, many of the most complained about lenders in the state are tribal lenders.

Their Department of Financial Institutions states: “Washington State agencies are generally not able to assist consumers in matters involving federally recognized Indian Tribes.”

Fortunately, there is some good news. Tribal loans are generally impossible to enforce in Washington and other states where lenders need a license to operate. Lenders that don’t have one can’t get a judge to rule in their favor, so they can’t garnish your wages.

Before you enter into a loan agreement, it’s always best to confirm that your prospective lender has the right to conduct their business. You can verify the license of any Washington lender on the Department of Financial Institutions’ website.

READ MORE: Is my payday loan lender licensed?

Consumer information

The Washington Department of Financial Institutions (DFI) is the primary agency responsible for regulating financial service providers in the state, including payday lenders.

Its official mission is to “protect consumers and advance the financial health of Washington State by providing fair regulation of financial services and educating consumers to make informed financial decisions.”

In other words, they make sure that lenders follow the rules and teach consumers how those rules work. You can find a wide variety of resources for consumers on the DFI website that are worth reviewing.

Where to make a complaint

The Washington Department of Financial Institutions is the best place to submit a complaint about a payday lender in the state. Here’s how you can get in touch with them:

- Regulator: Washington Department of Financial Institutions

- Physical Address: 150 Israel Rd SW, Tumwater, WA 98501

- Mailing Address: PO Box 41200, Olympia, WA 98504-1200

- Phone: 877-746-4334

- Email: [email protected]

- Link to website: https://dfi.wa.gov/consumers/payday-loan-complaint

It’s also a good idea to submit a complaint to the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal agency that protects consumers from predatory financial institutions, including payday lenders.

Number of Washington consumer complaints by issue

These statistics are all according to the CFPB Consumer Complaint Database.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 168 |

| Struggling to pay your loan | 40 |

| Problem with the payoff process at the end of the loan | 23 |

| Problem when making payments | 22 |

| Can’t contact lender or servicer | 21 |

| Getting the loan | 14 |

| Incorrect information on your report | 11 |

| Can’t stop withdrawals from your bank account | 11 |

| Loan payment wasn’t credited to your account | 9 |

| Received a loan you didn’t apply for | 8 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 7 |

| Applied for loan/did not receive money | 7 |

| Problem with additional add-on products or services | 4 |

| Was approved for a loan, but didn’t receive money | 3 |

| Vehicle was repossessed or sold the vehicle | 2 |

| Credit monitoring or identity theft protection services | 1 |

| Vehicle was damaged or destroyed the vehicle | 1 |

Source: CFPB website

By a significant margin, the most common complaint consumers have about lenders in Washington is that they charge fees or interest the consumers didn’t expect. There are four times more complaints about loan costs than the second most common issue.

Unfortunately, that’s usually the case in states that allow the payday lending industry to operate as freely as it does in Washington. The law requires that payday lenders display their finance charges and notify borrowers that their loans are unaffordable for that very reason.

Despite those rules, predatory lenders always try to minimize the cost of their loans as much as possible with their marketing tactics. As a result, even with the laws in place, their fees often catch borrowers by surprise.

The most complained about lender in Washington: Big Picture Loans, LLC

The most complained about lender in Washington is Big Picture Loans, LLC. In fact, they hold that title in many states across the country. They’re a tribal lender, and their loans are more expensive than most states allow.

However, Big Picture Loans doesn’t provide payday loans, opting instead for installment loans. These are their terms:

- Loan amounts from $400 to $3,500

- Loan terms from four to 18 months

- APRs from 35% to 699% with a 200% minimum for new customers

The combination of increased principal balances, longer repayment terms, and higher interest rates makes these loans even more dangerous than traditional payday loans.

For example, their website claims that a $1,000 loan with a six-and-a-half month repayment term would have a 350% APR and cost $1,272 in interest. Sadly, as expensive as that is, it’s on the lower end of what’s possible with them.

Most common complaints about Big Picture Loans, LLC

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 39 |

| Struggling to pay your loan | 3 |

| Problem with the payoff process at the end of the loan | 3 |

| Loan payment wasn’t credited to your account | 2 |

| Can’t contact lender or servicer | 2 |

| Problem with additional add-on products or services | 1 |

| Problem when making payments | 1 |

Source: CFPB website

The most common complaint consumers make about Big Picture Loans is that the lender charges unexpected fees or interest. There are three times as many complaints about that as there are about all other issues combined. Their APRs can reach nearly twice the state average, so that shouldn’t come as any surprise to you.

Top 10 most complained about payday lenders

Source: CFPB website

Big Picture Loans has more complaints than any other lender in Washington, but there are plenty of other problematic ones in the state. Unfortunately, many are tribal, which can make them harder to deal with than licensed payday lenders.

Seven out of the top ten most complained about lenders in the state are extensions of Native American tribes. That goes to show the importance of confirming that a lender has an up-to-date license from your state regulator before signing a loan agreement.

If you’re struggling financially because of a tribal or payday lender like the ones above, then contact DebtHammer today. We’ll help you get out of debt and show you how to leave predatory lenders in the dust.

The Second Most Complained About Tribal Lender in Washington: LDF Holdings, LLC

Washington has an unfortunate surplus of tribal lenders. Not only is the most complained about lender in the state tribally owned, but so are the next three on the list. In second place is LDF Holdings, LLC, an extension of the Lac du Flambeau Tribe of Lake Superior Chippewa Indians.

LDF Holdings offered short-term loans to Washington consumers through various subsidiaries, but they don’t appear to be doing so anymore. Their lending companies seem to have stopped issuing loans entirely or no longer do so in Washington.

For example, National Small Loan now lists Washington as one of their excluded states, and Lendgreen is no longer providing loans to any new customers.

Most Common Complaints About LDF Holdings, LLC

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 13 |

| Struggling to pay your loan | 5 |

| Problem with the payoff process at the end of the loan | 3 |

| Can’t stop withdrawals from your bank account | 2 |

| Received a loan you didn’t apply for | 1 |

Source: CFPB website

Like Washington lenders in general, the most common complaint consumers have about LDF Holdings is that they charge fees or interest that the consumers didn’t expect.

Unfortunately, tribal lenders are even more cagey about their rates than traditional payday lenders since they don’t worry about disclosure laws. When combined with finance charges that exceed state limits, it’s no wonder that borrowers are surprised by their fees and interest.

READ MORE: How to get your debt under control now

Payday loan statistics in Washington

- Washington ranks as the 20th state for the most overall payday loan complaints.

- Washington ranks as the 24th state for the most payday loan complaints per capita.

- There have been 18,281 payday loan-related complaints made to the CFPB since 2013 ― 352 of these complaints originated from Washington.

- The estimated total population in Washington is 7,614,893 people.

- There are 4.6225 payday loan complaints per 100,000 people in Washington.

- The most popular reason for submitting a payday loan complaint is “Charged fees or interest you didn’t expect.”

READ MORE: Payday loan debt statistics

Historical timeline of payday loans in Washington

Unfortunately, the Washington payday loan laws haven’t changed very much over the years. While there have been alterations to the rules, regulators have allowed the industry to operate virtually unimpeded for decades.

Here’s an overview of the most significant events in the industry’s history:

- 1995: The Check Cashers and Sellers Act, Chapter 31.45, established Washington’s stance on the short-term lending industry. It included the principal balance and finance charge rules in place today.

- 1997: The payday loan industry spread in Washington as check cashers started making short-term loans. That year, they issued 562,031 loans worth $144,923,986, with APRs between 261% and 913%.

- 2005 and 2006: Payday lending in Washington hit its peak. The number of payday loan transactions and storefront locations reached record highs.

- 2010: Legislators added the rule that limited borrowers to eight loans within a single year. They also established a database for tracking loan transactions and required lenders to check it to confirm borrower eligibility.

- The 2010s: The payday lending industry declined significantly. By 2017, the payday loan volume and number of lending locations were down 82% and 88.4%, respectively.

In 2022, the Washington payday loan laws remained the same. Conventional payday lending is still common but occurs noticeably less frequently than before the 2010 legislation.

Flashback: A Washington payday loan story

The Washington payday loan laws have never prevented predatory lending entirely. Legislators have struggled to pass regulations that would restrict finance charges, and lenders can still legally charge triple-digit interest rates to this day.

In 2009, consumer advocates realized that the payday lending industry would always vehemently try to block their attempts to cap interest rates. Instead of continuing that seemingly unwinnable fight, they went after a target that would be less well defended.

More specifically, legislators couldn’t eliminate the payday loan trap, but they could shorten the length of time it could hold consumers. That’s the origin of the Washington law that limits payday loan borrowers to eight transactions per year.

The legislation turned out to have a surprisingly powerful impact on the industry. While most payday loan borrowers took out less than eight loans per year anyway, the people over that threshold were the ones driving the industry.

In 2009, only a third of borrowers took out more than nine payday loans per year. Nonetheless, that minority was responsible for two-thirds of the total payday loan transactions. The CFPB later found that lenders received 75% of their loan fees from borrowers who took out more than ten payday loans per year.

As a result, the eight-loan limit drastically reduced the number of payday loan transactions and storefronts in Washington. The law passed in 2009; by 2011 they had decreased by 73% and 42%, respectively.

The moral of the story is that a single payday loan probably won’t bankrupt you as long as you pay it back. But if you can’t afford that first payment, you can get trapped in a cycle of debt that forces you to take out loan after loan and ruins your finances.

The bottom line: Should you take out a payday loan in Washington?

Finding a lender to work with you can be frustratingly difficult if you have a bad credit score. The payday loan industry’s alleged purpose is to help get funding to those people when they can’t get it elsewhere.

Unfortunately, the reality is that payday loans often make situations worse for those borrowers. They might get a couple of weeks of breathing room, but when the payday loan bill comes due, the next crisis is worse than each previous one.

As a result, you should always avoid payday loans when possible, especially in a state like Washington, where triple-digit interest rates are still legal.

If you’re looking for a more affordable alternative, consider a cash advance app like Dave. You can qualify for up to $250, but there’s no interest or fees, and tipping is entirely optional.

Of course, you can’t keep using short-term solutions indefinitely. Eventually, you’ll need to fix the imbalance in your finances. To get help with that, contact DebtHammer. We’ll help you make payday loans a thing of the past forever.