Payday loan lenders technically don’t charge “interest.” Since the loans are supposed to be repaid from your next paycheck, they wouldn’t make much profit if they relied on the monthly compounding used by most traditional lenders.

Instead, payday loan interest rates are presented as fees or finance charges. The fees sound relatively inexpensive, but they often equate to interest rates of 300% or more.

Table of Contents

Our take

- Payday loan interest rates are presented as fees — this tricks borrowers into agreeing to pay APRs that are significantly higher than what most credit cards charge

- Paying a $15 fee for a $100 payday loan is the equivalent of a 391% interest rate

- About 80% of payday loan borrowers can’t repay their loan on the due date and have to roll it over into a new loan

- These rollover loans tack on even more fees, increasing the total cost of the loan

- Some states have laws capping payday loan interest rates at 36% APR, and payday loans are illegal in 18 states and Washington D.C.

Stuck in payday debt?

DebtHammer may be able to help.

With payday loans, “interest” means fees

The interest rate on a payday loan is the “finance charge” you pay for using the lender’s money. The higher the loan fee, the more expensive the loan is. Interest rates are compared by using an annual percentage rate or APR, which puts all the loans you’re comparing on equal terms.

Pro tip: If you’re paying $15 to borrow $100 until your next paycheck, that equates to an interest rate of 391% – far higher than other types of loans, including credit cards.

Here are the interest rates for some common forms of loans.

- Payday loan interest rates range from 36% (in states with strict interest rate caps) to over 600% APR

- Tribal payday loan interest rates range from 300% to over 800% APR

- Car title loan interest rates average 300% APR

- Credit card interest rates range from 15% to 30% APR

- Personal Loan interest rates range from 14% to 35% APR

- Online lenders typically charge from 10% to 35% APR

Lenders that don’t do credit checks, like title, payday, and tribal lenders, have very high interest rates unless you live in a state with a strict rate cap.

Pro tip: Those interest rates impose crushing costs. The Pew Charitable Trusts reports that the average borrower takes five months and multiple loan rollovers to pay off their loans. If your APR is 662%, taking five months to pay will mean paying $1,001 to pay off a $300 loan.

How payday loan interest rates are calculated

Payday lenders won’t quote an APR. Instead, they will charge what they call a “loan fee” or “finance charge,” usually between $10 and $30 for each $100 you borrow. That sounds like you’re paying 10% to 30%, but that’s not the case.

The average payday loan term is only 15 to 30 days. You may only be paying 10% to 30% of the amount you borrow, but when you convert that to an annual basis, it translates to APRs of 300% to 600%.

How to calculate the APR on a payday loan

Payday lenders won’t tell you the APR on their loans, but you can calculate it yourself. For example, let’s say the loan is $300 for 14 days with a fee of $20 per $100 borrowed.

Here are the steps for calculating the interest rate:

- Divide your loan total ($300) by 100, and get 3.

- Multiply that by the fixed fee ($20) per $100 – your finance charge is $60.

- Divide the finance charge by the loan amount ($300) and get .2.

- Multiply that result (.2) by the number of days in the year (365) and you get 73

- Divide that total (73) by the number of days in the loan (14) and you get 5.21

- Multiply the result by 100 and you get your annual percentage rate: 521%.

If that’s more math than you’re prepared for, you can use a payday loan APR calculator like this one.

Pro tip: The Consumer Financial Protection Bureau offers a helpful list of payday loan costs and fees. Check it out at cfbp.gov.

Payday loans are illegal in some states

Payday loans are regulated by state laws, and laws vary widely from state to state.

Payday loans are illegal in 18 states and Washington, D.C. Several other states heavily regulate payday loans and cap interest rates.

Some states impose almost no regulations. In Texas, annual percentage rates on a $300 loan may be as high as 662%. If you borrowed $300 and paid it back in two weeks, you’d pay back $370.

These laws have a real impact. Short-term loans are four times more expensive in states with few controls on payday lending.

It also means you may be able to take your payday lender to court if it turns out your loan is illegal in your state. If you suspect that your loan is illegal, you’ll first need to determine whether you borrowed from a traditional payday loan lender or from a tribal lender.

READ MORE: Payday loan state regulations

What’s the difference between a payday loan and a tribal payday loan?

Tribal loans have some features in common with payday loans, including extremely high interest rates – usually even higher than traditional payday loan interest rates. The difference is that tribal lenders base themselves on Native American tribal lands and are registered as tribal businesses.

Tribal payday loan interest rates are even higher

Tribal lenders have sovereign immunity under a legal ruling that allows tribal groups to self-govern. Tribal lenders use this immunity to ignore state lending laws. This means that they can lend to you even if payday loans are illegal in your state, and they can charge rates far above any state’s interest rate cap. Many people who borrow from tribal payday lenders learn too late that they’re paying annual percentage rates of more than 1,000%, mistakenly believing they are protected by state laws.

“These lenders are often not governed by the same regulations and consumer protections as licensed lenders,” says Rick Chahal, a licensed paralegal/legal assistant at Kahlon Law. “Contract terms may not adhere to state or federal laws, making the borrower vulnerable to exorbitant interest rates and unfair practices.”

According to a report from CBS News, one Virginia resident borrowed $800 to help get through the holidays. Between January and February, the borrower racked up interest charges of nearly $582 and additional fees of $115. Within three months, the borrower owed the lender more than $1,800.

Most tribal loans are actually installment loans that don’t have to be repaid in full on your next payday, so that’s a good warning sign that you may be working with a dangerous lender. Check the fine print on your payday lender’s web page.

Here’s an example from eLoanWarehouse, a popular tribal lending entity:

Opichi Funds, LLC d/b/a eLoanWarehouse is a sovereign enterprise, an economic development arm and instrumentality of, and wholly-owned and controlled by, the Lac Courte Oreilles Band of Lake Superior Chippewa Indians (the “Tribe”), a federally-recognized sovereign American Indian Tribe. This means that the Opichi Funds installment loan products are provided by a sovereign government and the proceeds of our business fund governmental services for Tribal citizens. This also means that Opichi Funds is not subject to suit or service of process. Rather, Opichi Funds is regulated by the Tribe.

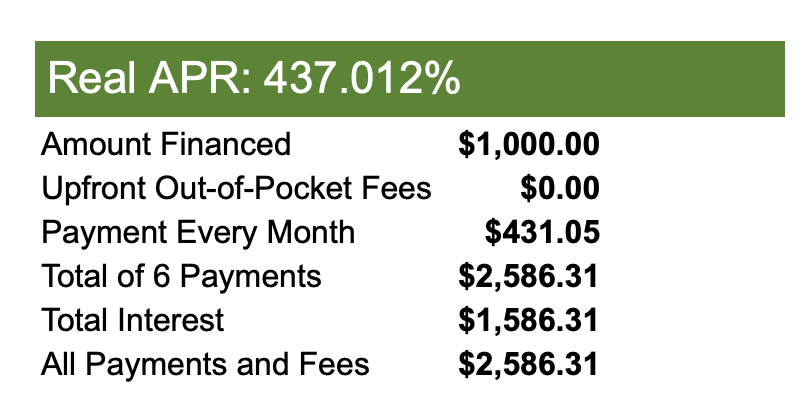

eLoanWarehouse doesn’t provide an example of a typical interest rate, but one complaint to the Better Business Bureau listed some loan specifics:

The borrower doesn’t say what his loan repayment term is, but if the loan was supposed to be repaid over six months, his interest rate at the state’s 16% APR would be $174.56 per month, paying a total of $1,047.35. However, since tribal lenders aren’t obligated to follow state laws, eLoanWarehouse can set its own interest rates.

If his $1,000 was repaid over six months, he would have been paying an APR equivalent of about 437% and paid more than $1,500 in interest.

Don’t get stuck with a loan that will be almost impossible to repay.

Learn more about the dangers of payday loans at responsiblelending.org.

READ MORE: Everything you need to know about predatory payday lending

What happens if you default on a payday loan

If you fail to pay a payday loan, the lender may sue you. If they win in court, they can garnish your wages. They may also sell your account to a debt collector, who will pursue you aggressively and may take you to court.

You can be sued over an unpaid payday loan until the statute of limitations expires. This varies from state to state, but it’s often six years.

Pro tip: If you are sued, always respond or appear when requested and follow all court instructions. You can’t be arrested or jailed for not paying a debt, but you can be jailed for refusing to follow court instructions.

Most payday lenders do not report to the credit bureaus, so missed payments will not hurt your credit score. If your debt is sold to a collection agency, they will report it and it will be noted on your credit report. Your credit will go down.

READ MORE: Will you go to jail for not repaying a payday loan?

The Military Lending Act caps payday loan interest rates

The Military Lending Act (MLA) caps interest rates on loans to active duty service members (including active Guard or active Reserve duty) at 36% APR. The APR includes interest and any other fees.

Pro tip: This is why you may see notations on lending websites stating that loans are not available to military service members and veterans.

Most payday lenders will not lend to service members because their interest rates are far above this level. If you are a service member and think a lender may have violated your rights under the MLA, contact your nearest Judge Advocate General legal assistance office.

Payday loan alternatives

Payday loans may not be the only choice if you need money. You may also be able to borrow to pay off a payday loan and pay off the new loan on more reasonable terms.

Consider these options.

- Cash advance apps

- Personal loans

- Balance transfer credit cards

- Payday Alternative Loans

- Debt Management Plans (DMPs)

If you’re stuck in the payday loan trap…

The payday loan trap is a vicious cycle. You feel like you’re working for the lenders instead of for yourself, and it may seem like there’s no way out. That’s what the lenders want you to feel: like there’s no option but to keep paying them.

You have choices. If none of the options above works for you, or if you’re looking for something different, DebtHammer’s proven program may work for you, as it has worked for thousands of others.

We have easy-to-understand plans for our services with no hidden fees, obligations or gotchas. Schedule a free consultation today!

The bottom line

If you have bad credit and are desperate for cash, a payday loan may seem like the perfect solution. It will almost always make your problems worse. Payday loan interest rates and fees are designed to trap you in a cycle of debt that will end with you paying far more than you borrowed. Avoid payday loans — even if there’s no other option.

Don’t get discouraged if you’re already stuck in the payday loan trap. You’re in a bad situation, but there are ways out.