If you’re wondering whether you can have more than one payday loan at the same time, the answer is yes, depending on your state.

Table of Contents

Our take

- Yes, it’s possible to have more than one payday loan at the same time

- It’s also possible to get two separate payday loans from two different places

- This doesn’t mean you’ll qualify for a second loan

- A lender won’t typically issue a new payday loan until the first one is paid off

- Getting a second payday loan is a bad idea

- There are plenty of other options, including Payday Alternative Loans and cash advance apps

Stuck in payday debt?

DebtHammer may be able to help.

You can have more than one payday loan

The laws around multiple payday loans vary from state to state. In some places, it is possible to have more than one payday loan — up to a point. However, just because you can doesn’t mean that you should.

READ MORE: How to pay off multiple payday loans

Laws do not prohibit multiple payday loans

The Consumer Financial Protection Bureau (CFPB) and the Federal Trade Commission (FTC) oversee the payday loan industry, but there are no federal regulations. State legislatures can set their own payday loan laws, and the rules differ widely from state to state.

Unfortunately, many payday loan lenders, especially online ones, bend or ignore the laws anyway. It’s tough to force online lenders to follow state laws since so many are in other states, on Native American reservations or even on other continents.

READ MORE: Payday loan interest rates

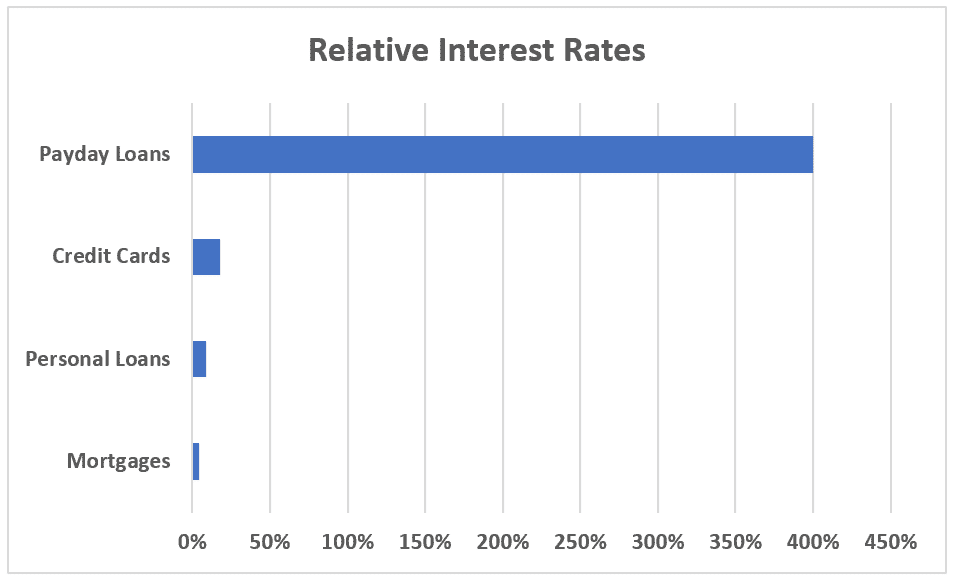

Payday lending is illegal in 18 states and the District of Columbia but legal in the other 32 states. Some states have laws setting interest rate caps, while annual percentage rates in states with no rate cap can often top 600%.

Some states have no payday loan restrictions

Some states have no loan limits. In Texas, for example, there is no legal limit to the amount a payday lender can loan you.

So if you already have a $500 loan, the same lender (or any other lender) is legally allowed to give you another $500 loan. Whether they will or not will depend on the lender.

READ MORE: Payday loan pros and cons

Strict state loan laws can be sidestepped

For example, in California, state law says you can only have one payday loan at a time. But since a tribal lender doesn’t have to follow state laws, you can still get a second payday loan.

READ MORE: What is a tribal payday loan?

And in Virginia, the maximum loan amount is $500, but that doesn’t mean you can only borrow $500. It simply means a single lender can only give you $500. You can visit a second lender and get a second loan.

Pro tip: You might not need a second loan. The original lender may offer an extended payment plan, and all payday lenders can and will allow you to roll over your loan into a new loan (and pay a new set of fees) if you can’t repay your original loan. However, that lender is not allowed to increase your initial loan amount.

For example, if you have a $500 loan from Check Into Cash, there’s nothing prohibiting Speedy Cash from giving you another $500 loan.

This means that even in states with loan limits, you can obtain a second payday loan. It will just have to be from a different lender.

Will lenders give you another loan?

Just because the law doesn’t necessarily prevent having multiple payday loans, there’s no guarantee that you’ll be able to qualify.

Payday loan qualifications are minimal. All you need is a checking account, ID and proof of income. However, payday lenders still want to ensure that they will be repaid. When you apply for a new payday loan, they’ll run a credit check.

However, it works a bit differently than a traditional lender’s credit check.

Payday loan lenders don’t usually report payday loans to the three major credit bureaus (Experian, Equifax and TransUnion). Instead, they report to minor credit bureaus (which are also sometimes called small credit reporting agencies). This means that while payday loans won’t show up when you check your traditional credit reports, payday loan lenders will be able to see whether you have outstanding loans or have defaulted on a previous payday loan.

Pro tip: Some of the small credit bureaus include ChexSystems, Certegy, Innovis, Clarity Services and Corelogic. They must follow the laws set by the Fair Credit Reporting Act, which means you’re entitled to check your credit reports and have the right to dispute inaccurate information. However, you must contact each agency directly to request a free copy of your credit report, and in some cases this must be done by mail.

It’s possible that the new payday lender might decide that lending to you is risky, and they may deny your application.

READ MORE: How are credit scores calculated?

Borrowers tend to take out multiple loans

Due to lax regulations, it’s perfectly legal for payday lenders to give you loans without considering your ability to repay them. In states where there are no limits on the number of payday loans you can have, borrowers can get themselves into trouble quickly.

Most payday loan borrowers take out multiple payday loans in relatively quick succession. This leaves them stuck in a cycle of debt because each paycheck has to go toward repaying a payday loan.

Pro tip: Payday lenders know that their loans are extremely difficult to repay, so they often offer “rollovers” or “renewals.” Essentially, they’ll extend the repayment term and charge you another (large) fee for the privilege. It’s not quite like giving you a second loan, but it’s close.

Should you get a second payday loan?

You should always do whatever it takes to avoid payday loans – work extra hours, sell unused items, even sell your plasma. But this is even more important when you already have one loan.

Taking out a single payday loan can trap you in a cycle of debt for months or even years. If you have two at once, the odds of you being able to repay your debts are virtually impossible.

Pro tip: This isn’t just because having to repay multiple loans from your next paycheck is extremely difficult. It’s also because each time you roll over a loan, the cost of the new loan increases. Each new loan will be more expensive than the previous one.

Payday lenders know that if you have one or more outstanding payday loans, the risk that you won’t pay them back is extremely high. As a result, they’ll charge you higher interest rates and fees to justify that gamble – if they’re even willing to take the risk of lending to you at all.

What happens if you can’t pay back a payday loan?

Many borrowers consider a second payday loan because they can’t afford to repay their original payday loan. It’s tough to lose $500 in a lump sum from your next paycheck, particularly when you have bills to pay.

Fortunately, there are some measures you can take to prevent defaulting on the loan.

Better alternatives

For those borrowers, it might feel like there are no practical alternatives to payday loans available. But that’s not true.

There are still better options out there, even if you have bad credit. If you need fast cash, make sure you consider the alternatives like:

- Payday Alternative Loans (PALs)

- Debt settlement (learn how it works)

- Nonprofits and charities

- Debt Management Plans

- Cash advance apps (like Dave or Albert)

- Buy Now, Pay Later plans

- Personal loans for borrowers with bad credit

READ MORE: How to get out of payday loan debt in 8 simple steps

The bottom line

It’s never a good idea to take out multiple payday loans. You have other options.

If you’re looking for funding because you’re currently stuck in the payday loan debt cycle, DebtHammer can help. Contact us today to set up a consultation so we can help you start paying off your debts, even if you currently have multiple payday loans.