The more credit card debt you have, the harder it can be to pay off due to compounding interest charges and minimum monthly payments.

Fortunately, there are debt relief solutions for most forms of consumer debt, including credit cards. Whether you owe $10,000 or $25,000 in credit card debt, following these strategies will help you pay it off.

Table of Contents

Key points

- Don’t panic: $10,000 in credit card debt isn’t much above the household average of between $5,525 and $8,701

- Debt consolidation will be a good option if you have a good credit score

- If debt consolidation won’t work for you, talk with a debt relief company

- There are some DIY options to try if you want to try to tackle debt on your own

Struggling with credit card debt?

We may be able to help. It’s easy and free to find out.

5 ways to help pay off $10,000 in credit card debt

It may seem daunting to have $10K in debt. But it really isn’t that bad.

Owing $10,000 in credit card debt might seem like a lot, but it’s not that unusual. The average American household owes between $5,525 and $8,701 in credit cards, so $10,000 is just a bit above average.

Here are five ways to pay it off.

1. Consolidate your debts

Debt consolidation is a slam dunk if you have multiple unsecured debts and a good credit score. It’s fast, easy, affordable and leaves you with a single monthly payment.

Debt consolidation involves combining several debts into one larger debt, usually with a lower interest rate. It can be done with a debt consolidation loan or a balance transfer credit card.

You could still have a good credit score even if you owe $10,000 in credit card debt. The better your score, the better the options for debt consolidation. But even if you have an average credit score, there will still be loan options. You’ll just have to pay a higher interest rate.

Pro tip: Credit card interest compounds quickly. Debt consolidation is particularly beneficial for people making multiple minimum payments toward credit card bills each month. By rolling your balances into one loan, you’re left with one manageable monthly payment, and you can pay as much as you can afford toward that single debt.

There are two primary ways to consolidate debts: balance transfer credit cards and debt consolidation loans.

Balance transfer credit cards

A balance transfer credit card lets you move the balance from one credit card to another. These cards usually require good credit. Some come with a 0% APR introductory offer that lasts between 12 and 21 months.

No interest charges accrue during this time, meaning any payments will go straight to the principal balance. Balance transfers usually cost 3% to 5% of the transferred amount.

For example, say you had to replace an air conditioner for $10,000. If you put that $10,000 on a traditional credit card with a 20% APR, you’d have to pay $650 a month for 18 months to repay it. But if you put it on a credit card that offered no interest for the first 18 months but charged a 3% balance transfer fee, you’d pay $600 a month, saving yourself $50 per month. The loan on the traditional credit card would cost a total of $11,651, while the balance transfer loan would cost $10,300. That’s a savings of $1,351.

Transfer as much high-interest credit card debt onto a balance transfer card as possible and try to pay it off before the promotional period ends. If the credit limit on the new card is lower than your total debt, pay off any high-interest debts first while making the minimum payment on the new card. Once the other debts are gone, pay off the balance transfer card.

Pro tip: Most credit card companies won’t let you transfer debt from one of their cards to another. This means that when you apply for a balance transfer card, it must be from another issuer.

Use a debt payoff calculator to determine how much the new card could save you in interest charges.

Debt consolidation loan

There are many debt consolidation loans, but they can all be used for the same purpose: combining multiple debts into one.

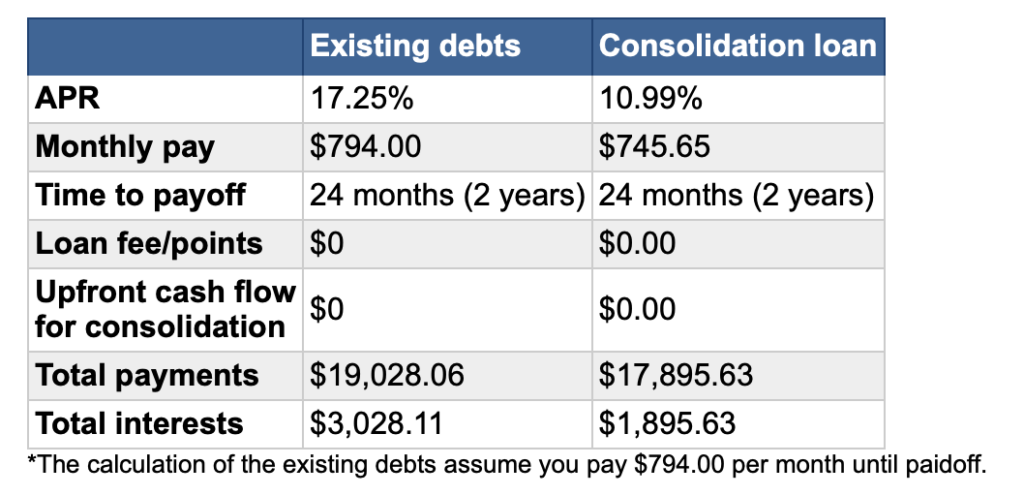

For example, say you have four loans: Two for $5,000 each with an 18% APR, and two more for $3,000 each with a 16% APR. You would be making four minimum monthly payments totaling $794 per month. By rolling these into one single loan for $16,000 at an APR of 10.9%, you’d save about $50 a month and save $1,132.48 in interest. And you could save even more by getting a loan with a repayment term of three or even five years.

Here’s the math:

Debt consolidation loans usually require stable income and a low debt-to-income ratio. A good credit score could lower the interest rate than most credit cards.

Pro tip: There are even debt consolidation loans for bad credit borrowers, married couples and healthcare workers.

2. Try a professional debt relief program

If you aren’t sure how to get started, set up a free consultation with a professional. Debt settlement companies and credit counseling agencies all offer free initial consultations.

Pro tip: Some debt relief companies (like DebtHammer) offer multiple services and will assess your financial situation and offer advice on how to proceed. They will tell you straight up whether debt consolidation will work for you or if you need a debt settlement program. DebtHammer can even check your eligibility for debt consolidation loans with 30+ lenders at one time and there are no upfront fees. Tap here to schedule a free consultation.

Debt settlement

A professional debt settlement company will work with your creditors to settle your debts for payment amounts that are lower than your total debt. If your credit score has already taken a hit and you won’t qualify for a debt consolidation loan, debt settlement could be the way to go.

However, you’ll have to completely stop paying your credit card bills for a few months, which could lead to calls from debt collectors. Those will stop once settlement negotiations start.

The average debt settlement client pays about 80% of the total amount they owe after paying the debt settlement company’s fees. That makes it a quick and efficient way to get back on track.

READ MORE: How to get your debt under control now

Credit counseling

Services from most credit counseling agencies are free or cost only a small fee. They employ certified counselors trained to help you get a better handle on your finances. Usually, they can help with things like budgeting, money management and credit building. They can also offer a free initial consultation to review your finances and help create a plan.

Many also offer a Debt Management Plan (DMP), which can be used to tackle credit card balances — these plans usually last 3 to 5 years. DMPs aren’t free though. They typically come with an initial enrollment fee of around $30 to $50. They also often have a monthly account maintenance fee that ranges from $20 to $80.

Once enrolled in a DMP, a credit counselor will help you set up a repayment plan with your creditors. Each month, you’ll deposit a set amount into a savings account that the agency will use to start paying off the debt.

Credit counseling on its own won’t reduce the amount of debt owed. However, the agency may be able to get your creditors to waive late fees or lower monthly payments.

Check with the Financial Counseling Association of America to locate a nonprofit credit counseling agency in your area.

READ MORE: Debt settlement vs. debt management

3. Negotiate with your credit card companies

Creditors want to get paid, so see if they can negotiate. Some will agree to reduce your interest rate or temporarily waive late fees. They may even agree to write off some of the debt if you pay the rest in a lump sum.

Pro tip: If the bills are piling up, don’t wait or try to ignore them. Contact your credit card issuers as soon as possible and ask about your options. Some offer hardship programs to those suffering from a legitimate financial situation, such as unexpected unemployment or medical hardship.

Interested in negotiating your credit card debt? Use this calculator to see how much hiring a professional debt negotiator can save you.

How much unsecured debt do you currently have?

(An approximate answer is fine - do not include loans for cars and mortgages)

Do you have payday loan debt?

Great news – you may qualify for debt relief!

Complete this form for immediate access to your free savings estimate.

- Relief available for many debt types

- Set your monthly & total savings

- Take control of your financial future

By submitting this form, I agree to be contacted by DebtHammer and / or it's partners via email, phone and SMS, including by automated dialers or by automatic voicemail. I agree to be contacted even if I am on the do not call list. I also agree to DebtHammer's terms of service.

Loading Results...

Please wait while we process your request.

You’re on the way to a debt-free life.

Financial freedom is just one click away. Please schedule a consultation to discuss your options for debt relief.

Thankyou ,

You’ve Been Matched With

DebtHammer.org is an organization that has helped thousands of people smash their debt and get back on the road to financial freedom. They help you compare 20+ loan options, plus other affordable ways to get rid of your debt – both short term and long term.

Please schedule an appointment so one of our specialists can walk you through your various solutions.

Redirecting you to a debt specialist in

DIY debt settlement

Debt settlement involves taking debt and getting it reduced to a lower amount. There are two ways to do it: DIY and through a company. Both options are risky, but DIY debt settlement could save you a lot of agency fees.

To get started, figure out how much you owe and to whom. Check with your creditors to see what options for debt relief or settlement they offer.

Then, create a fund and start adding to it. Even if your creditors agree to settle the debt, they’ll typically still require a certain amount — usually 20% to 50% of the original balance. Having this in advance could increase your odds of successfully settling the debt.

Pro tip: This will only work for skilled negotiators, and you should plan to devote several hours a week to to working on this project.

Once you’ve saved up enough, contact your creditors and make them an offer based on what you can afford. Be prepared with the reason — or reasons — why you need to settle the debt. The creditor may accept, provide a counter-offer or refuse.

If an agreement is made, get the new terms in writing to avoid any confusion or issues. Your creditor may also require you to pay in a lump sum or over a set period.

4. Set a budget (and stick to it)

If you’re dealing with high amounts of credit card debt, you should first create a budget.

To do this, add up all your monthly expenses — fixed and variable — and monthly payments. Then, subtract that number from your total monthly income. Use your net income (take-home pay) for a more accurate idea of how much you’ll have left over each month.

Common expenses include utilities, rent payments and groceries. Be sure to include any other debts with monthly minimum payments, too, such as:

- Other credit cards

- Mortgage

- Home equity loans

- Student loans

- Personal loans

- Car loans

- Medical bills

- Loans from family members or friends

Once you know how much you’re spending vs. how much you’re making, you can figure out if there’s any wiggle room. If your expenses exceed your earned income, you will need to find ways to cut back.

Pro tip: You can also use this as an opportunity to set financial goals for the future.

5. Pick a debt repayment strategy

Many strategies help pay off high amounts of credit card debt. Here are two of the most common — and effective — ones:

- Debt avalanche: This method starts by paying off the debt with the highest interest rate first while making the minimum payments on all other debts, regardless of balance. Once the highest-interest debt is repaid, move on to the next account and so on. As each account reaches a zero balance, you’ll have a little extra money to put towards the next one.

- Debt snowball: This method focuses on paying off the smallest debt first. In the meantime, pay the minimums on all other accounts. Once the smallest balance is paid off, move on to the next smallest account

- Pay more than the minimum: This isn’t as systematic as the other two options, but if you pay more than the minimum monthly payment on each bill, you’ll get out of debt faster. However, this will only be effective if you stop using your credit cards.

READ MORE: Debt avalanche vs. debt snowball — which is better?

All three strategies have their pros and cons.

The debt snowball method, for example, can feel more rewarding as you quickly pay off each small debt. However, the interest charges can still be added to the other accounts, increasing overall fees.

The debt avalanche method, meanwhile, can save you hundreds or thousands of dollars in interest charges. However, it can take longer to start seeing the results of your efforts.

Other debt relief options

If you’re looking for other ways to get help dealing with credit card debt over $10,000, here are some options:

- Borrow money from family or friends

- Take out a home equity loan or home equity line of credit (HELOC)

- Use a 401(k) loan

- Bankruptcy

The bottom line

If you need help with credit card debt over $10,000, or any amount, there are strategies to pay it back. This includes debt consolidation, balance transfer credit cards and credit counseling. Weigh your options and choose a strategy that best works for you and your budget. If you approach it methodically, you’ll be debt-free before you know it.