Paying off debt can be one of the biggest challenges in all of personal finance. Credit cards, student debt, and payday loans are all designed to trap you in a loop of endless minimum payments. But as long as you stay disciplined, it is possible to escape. All you need is the right debt repayment strategy.

The two most common options are the debt avalanche and the debt snowball. You’ll find supporters of both who are adamant that their strategy is the best, so it can be difficult to choose one over the other. Read on to learn the differences and which will work best for you.

Disclaimer: DebtHammer may be affiliated with some of the companies mentioned in this article. DebtHammer may make money from advertisements, or when you contact a company through our platform.

Table of Contents

Key points

- Avalanche is a strategy that makes paying off debts with the highest interest rates your priority

- Snowball focuses on paying off the debts with the largest balances first

- Both have pros and cons and can be effective

- What matters most is that you choose the one that’s right for you and stick to it

How does debt avalanche work?

The debt avalanche strategy prioritizes eliminating the debt with the highest interest rate. The goal is to pay off the most expensive accounts as quickly as possible and reduce your interest costs.

Here’s a quick rundown of the basic steps:

- List out all of your debts and sort them from highest to lowest interest rate

- Make minimum payments on everything below the top spot

- Apply every extra dollar you have each month to the debt with the highest rate

- Once that one’s paid off, move on to the next highest until you’re debt-free

To demonstrate, let’s run through a quick example:

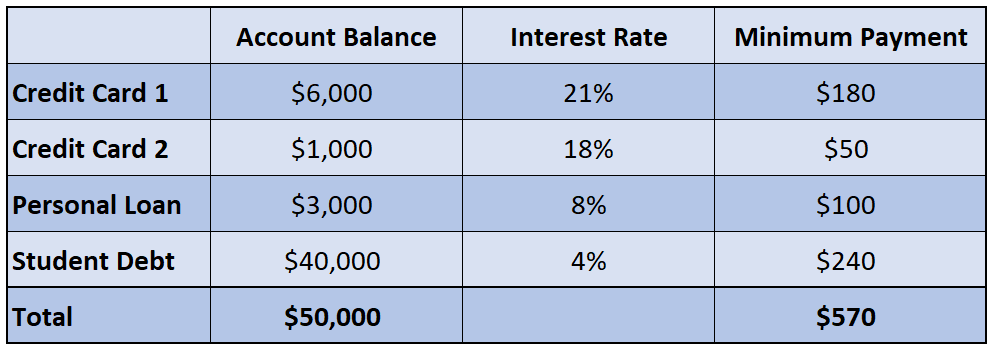

Imagine that this is your list of outstanding debt accounts and you have $1,000 to put toward your repayment plan each month.

If you were following the debt avalanche method, you’d make the minimum payments on your Student Debt, Personal Loan, and Credit Card 2, which would amount to $390. You’d put the other $610 toward Credit Card 1.

READ MORE: 5 easy steps to pay off $10,000 in credit card debt

Debt avalanche advantages

The debt avalanche is the most mathematically sound approach to repaying your debts.

By perpetually focusing on the account that’s accruing interest at the fastest rate, you’ll reduce both your total interest costs and the length of time that you stay in debt.

If you’re disciplined and you don’t feel overwhelmed by having a large number of payments each month, the debt avalanche is probably a good strategy for you.

In the example above, Credit Card 1 would cost you over $105 a month in interest charges. That’s almost 80% of the interest created by the Student Debt ($133), even though the Credit Card balance is just 15% of the Student Debt balance.

Debt avalanche disadvantages

While the debt avalanche is the most logical option, it can feel like a struggle.

If your account with the highest interest rate also has a relatively high balance, it may be quite a while before you’re able to pay it off. For many debtors, that lack of apparent progress can be disheartening.

In the example above, it would take 11 months (Almost a full year!) to pay off Credit Card 1. For someone who would prefer more milestones up front, that might be too frustrating.

READ MORE: Are you drowning in debt? Here’s how to save yourself

How does debt snowball work?

If you think that the debt avalanche would be too emotionally taxing for you, the debt snowball is probably a better strategy. It might not satisfy your spreadsheet, but it does appeal to human nature.

This strategy also focuses on one account at a time, but it doesn’t require you to pay any attention to interest rates. Instead, the debt snowball method tells you to focus on eliminating the account with the smallest balance and work up to the largest one.

The steps are similar:

- List out all your debts and sort them from smallest balance to largest

- Make minimum payments on everything below the top spot

- Apply every extra dollar you have each month to the debt with the lowest balance

- Once that one’s paid off, move on to the next smallest until you’re debt-free

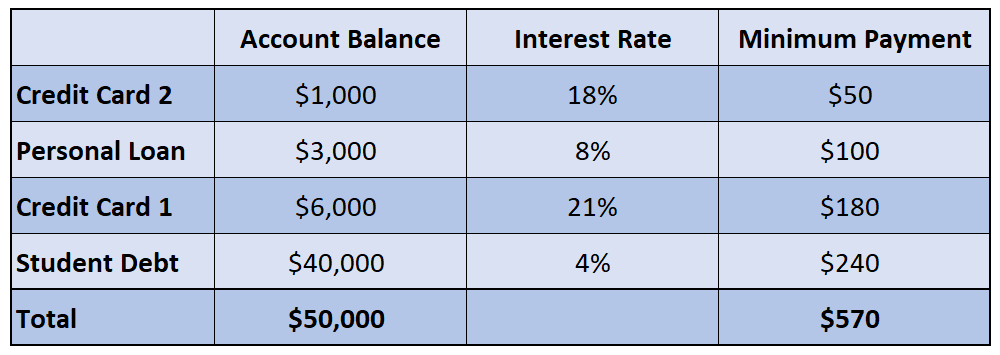

To keep things simple, let’s rearrange the accounts from the same list above using the snowball approach:

As you can see, the chart looks a bit different now. In this case, you’d make the minimum payments on your Personal Loan, Credit Card 1, and the Student Debt. That would add up to $520, which would leave you $480 to put toward paying off Credit Card 2.

Debt snowball advantages

Popularized by Dave Ramsey, this strategy is appealing because it helps kickstart a sense of progress and builds momentum up quickly.

While that might sound trivial, most people who fail to get out of debt do so because they give up. The truth is, understanding and controlling your behavior is the real key to succeeding in personal finance.

In the example above, you’d pay off Credit Card 2 in about two months and your Personal Loan in roughly another six months. You’d be able to pay off two of your accounts in less time than it would’ve taken you to pay off one had you used the avalanche strategy.

Debt snowball disadvantages

Of course, the downside to the debt snowball is that you’ll end up paying more in interest over the course of your debt repayment. Because your interest costs are higher, you’ll have a higher balance to pay back and increase the length of time that you’re in debt.

If you’re someone who wants to minimize your interest costs and get out of debt as quickly as possible, you’d be better off choosing the debt avalanche strategy.

READ MORE: Five types of debt you should be consolidating now

The bottom line

Whichever strategy appeals to you, what matters most is that you pick one and stick to it. Both of the strategies can work, but neither will if you don’t work them properly.

So while there may not be a best strategy, there probably is a best strategy for you. Choose the one that makes you feel the most comfortable, confident, and motivated along the way.

So which one are you, team avalanche or team snowball? Let us know in the comments below!

Need professional help? Please fill out our brief questionnaire, and a DebtHammer representative will gladly assist you.

FAQs

You will not go to jail for not paying consumer debts – that is, most loans, medical bills and credit cards. However, you could be found in contempt of court if you receive a court summons and don’t show up. If this happens, you could be arrested. You could also go to jail for not paying child support or another court-ordered payment.

There are 26 states in which you could go to jail for contempt of court. These are Arizona, Arkansas, California, Colorado, Florida, Georgia, Idaho, Illinois, Indiana, Kansas, Louisiana, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nebraska, Ohio, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas, Utah, Washington and Wisconsin.

Filing for bankruptcy should generally be considered a last resort, and $10,000 in credit card debt really isn’t that far above the national average. The average American household owes between $5,525 and $8,701 in credit cards. Before going this route, exhaust all other options. If nothing is working, consult with a bankruptcy attorney. They can advise you on if it’s the next best step for you.

There are quite a few ways to build or repair credit without a credit card. You can sign up for a credit-builder loan or auto loan, for example. Or you could sign up for a credit-reporting tool like Experian Boost. Additionally, you could become an authorized user on someone else’s account.