As consumer debt continues to rise, so does the popularity of debt settlement as an option to solve Americans’ financial problems.

U.S. households carried an average of $101,915 in consumer debt in 2022.

According to a report by John Dunham & Associates, 1,453,567 accounts were settled by debt settlement companies in 2019, compared to just over 900,000 accounts in 2018.

And the numbers continue to rise. The American Association for Debt Resolution reports that 1.6 million clients were enrolled in debt settlement programs.

There are almost 250 privately owned debt settlement companies in the U.S. How do you know which ones are trustworthy?

Table of Contents

Why work with DebtHammer?

DebtHammer prioritizes customer service, listening to clients and understanding their unique situations.

DebtHammer offers a free consultation, but you won’t be pressured to choose one particular strategy. Our team truly cares about solving your problems, which means finding the best option for you. If you aren’t a good fit for the program, no significant amount of time or money is lost.

DebtHammer was founded in 2020, specifically focusing on helping clients with payday loan debt. Payday loan users are generally desperate for options and have been traditionally overlooked by most commercial programs because these customers aren’t particularly profitable.

The company has since expanded its mission and now helps a wide array of borrowers negotiate settlements or find affordable debt consolidation loans to help them escape the high-interest debt trap.

READ MORE: How does it all work with DebtHammer?

Key points about DebtHammer

The minimum debt total to enroll is lower than the industry average. You can enroll if you have $7,500 in unsecured debts or $1,000 in payday loan debt

- Other debt relief services like debt consolidation loans

- An A rating from the Better Business Bureau and 4.8 out of five stars on Trustpilot.

- Proven track record of results

- Unique and unduplicated financial education content to help you build your money skills

- A team that truly cares about helping you get out of debt

- Expertise working with a wide array of creditors including payday lenders, tribal lenders, personal loan companies and credit card companies

- You don’t pay until we get results for you

- Offers legal help if issues arise during your debt settlement program

How does DebtHammer work?

DebtHammer’s process is straightforward:

- You’ll start with a free consultation to review your situation.

- A company representative will break down a list of options

- You choose the option you prefer

In addition to settlement services, DebtHammer’s team will support you during the process, offering advice and assistance.

There are no upfront fees. Though fees vary with the service selected, all fees will be disclosed upfront. Fees for debt settlement are approximately 25% of the enrolled debt.

You will not be charged any fees until settlement negotiations are concluded.

DebtHammer offers payday loan solutions in the following states: Alabama, Alaska, Arizona, Arkansas, Delaware, Florida, Hawaii, Idaho, Indiana, Iowa, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia and Wyoming.

If you have more than just payday loan debt, DebtHammer also offers solutions for people with other unsecured debts. Residents of Alabama, Alaska, Arizona, Arkansas, California, Delaware, Florida, Georgia, Illinois, Kansas, Louisiana, Maine, Massachusetts, Michigan, Montana, Nebraska, New Jersey, New York, North Carolina, North Dakota, Ohio, Oklahoma, Rhode Island, South Carolina, Tennessee, Virginia, West Virginia and Wyoming are eligible. Some service options may not be available in all states.

READ MORE: Debt settlement — how to get your debt under control now

Customer review

READ MORE: Debt settlement: How to get your debt under control

More of the best debt settlement companies

If you want to compare options, here are a few other industry leaders.

Accredited Debt Relief

Accredited Debt Relief is an established debt settlement company that has been in business since 2011 and has helped more than 200,000 clients settle more than $1 billion in debt.

Minimum debt required: You must have $10,000 or more in unsecured debt to sign up for their program.

Customer ratings: The company has an A+ Better Business Bureau rating, 4.9 out of five stars on Trustpilot and positive customer testimonials.

Accredited Debt Relief is operated as a division of Beyond Finance, LLC, a leading provider of debt consolidation services. Services are only available in Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Indiana, Idaho, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, New York, North Carolina, Oklahoma, Pennsylvania, South Dakota, Tennessee, Texas, Utah, Virginia and Washington.

Customer review

Americor

Americor is a big company that boasts 500+ employees. Based in Irvine, California (with a satellite office in Meridian, Idaho) Americor has helped customers save around two billion dollars through debt settlement over more than 15 years in business.

Minimum debt required: Americor requires $7,500 in unsecured debt to be eligible for its program. The company also offers debt consolidation loans through an affiliate partner.

Customer ratings: The company has an A+ rating from the BBB and 4.9 out of five stars on Trustpilot.

Americor only operates in 30 states, but it does not disclose which 30 states so you’ll have to set up a free consultation to figure out whether you’re eligible.

Customer review

Freedom Financial

Based in Arizona, Freedom Debt Relief says it has enrolled more than 850,000 customers and settled more than $15 billion in debt since 2002.

Minimum debt required: You may be eligible for a debt settlement program with Freedom if you have $7,500 in debt, but the company says most enrollees owe $10,000 or more.

Customer ratings: Freedom Debt Relief has a BBB rating of A+ and 4.6 out of five stars on Trustpilot.

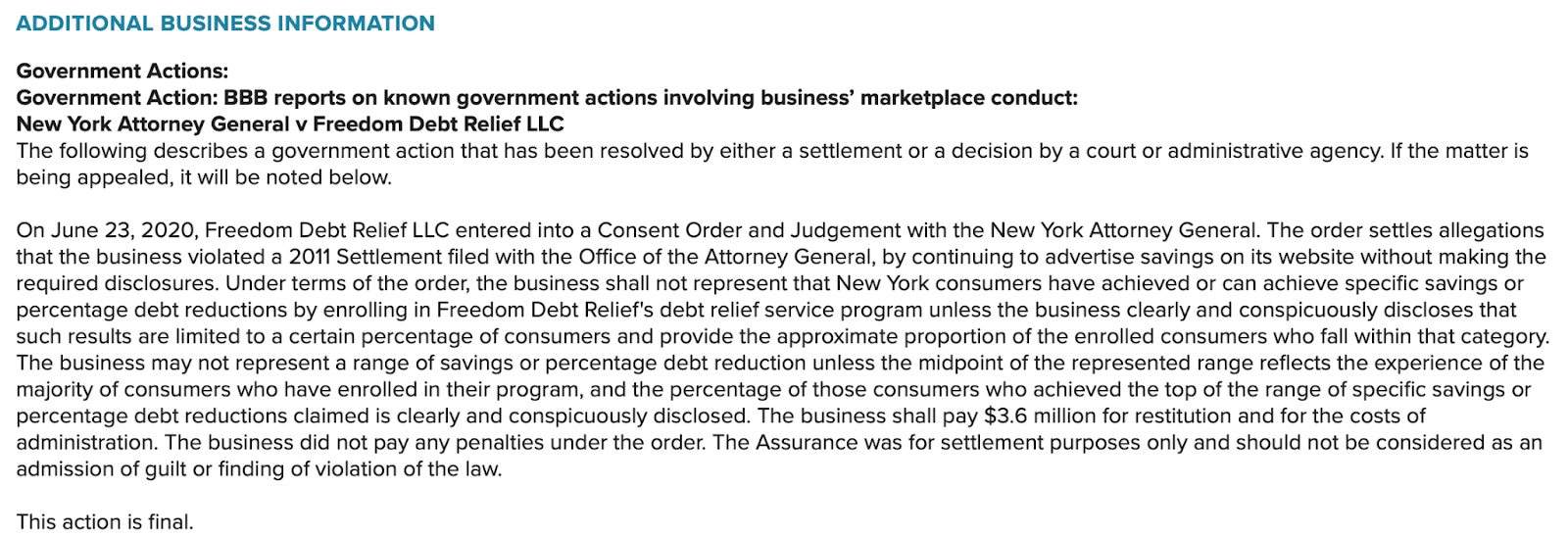

It’s important to note that the Consumer Financial Protection Bureau says 81 complaints about Freedom were reported in 2021 and that in June 2019, Freedom paid more than $20 million in restitution plus a $5 million fine after settling a lawsuit alleging it violated several governmental guidelines, including charging inappropriate fees.

The BBB notes this about the settlement:

Freedom offers services in Alabama, Alaska, Arkansas, Arizona, California, Delaware, Florida, Iowa, Idaho, Indiana, Kentucky, Louisiana, Massachusetts, Maryland, Michigan, Minnesota, Missouri, Mississippi, Montana, North Carolina, Nebraska, New Mexico, Nevada, New York, Oklahoma, Pennsylvania, South Dakota, Tennessee, Texas, Utah and Wisconsin.

Freedom works with legal partners to provide services to residents of Connecticut, Georgia, New Hampshire, New Jersey, Illinois, Kansas, Maine, Ohio, South Carolina and Virginia.

Customer review

National Debt Relief

In business since 2013, this New York, NY-based company says it has transformed the lives of hundreds of thousands of clients.

Minimum debt required: National works with customers with at least $7,500 in unsecured debt.

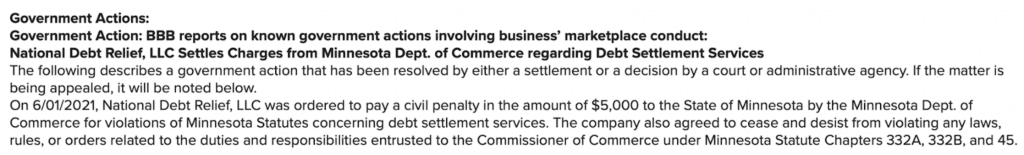

Customer ratings: National has 4.7 out of five stars on Trustpilot and an A+ rating from the BBB, but the page also contains this warning:

National is not available to residents of the following states: Connecticut, Georgia, Kansas, Maine, New Hampshire, Oregon, South Carolina, Vermont, and West Virginia.

Customer review

Rescue One Financial

In business for more than a decade, this Irvine, Calif.-based company says it has settled more than $5 billion in debt and has 500,000 happy clients.

Minimum debt required: Rescue One works with people who have $8,000 or more in unsecured debt.

Customer ratings: The company has an A+ rating with the BBB and 4.9 out of five stars on Trustpilot.

Rescue One notes that its services are not available in all states, but it does not disclose the states in which it operates.

Customer review

TurboDebt

A fairly new entry to the debt settlement industry, TurboDebt was founded in 2020 and is based in Sunrise, Fla. TurboDebt has built a name through social media and has already enrolled 500,000 customers and settled $15 billion in debt.

Minimum debt required: TurboDebt requires clients to have a minimum of $10,000 in unsecured debt.

Customer ratings: It has not been rated by the BBB (though it has three of five stars) but has five out of five stars on Trustpilot.

TurboDebt says it serves “nearly every state and Puerto Rico, USVI, and Guam.” It does not disclose the states where it doesn’t operate.

Customer review

Pro tip: TurboDebt is not the same as Turbo Debt, an Ohio-based debt collection company. They have two very different missions.

READ MORE: Debt settlement companies

How debt settlement companies work

Most debt settlement companies (including those listed above) have several things in common. These include:

- A free consultation

- A minimum debt requirement

- A fee ranging from 15% to 27% of the total debt enrolled, which you won’t pay until your debts are settled

- Programs that can take anywhere from one to four years to complete

- Most offer more than one debt solution and will review your options during your consultation.

Pro tip: All companies listed are accredited by the American Association for Debt Resolution (AADR) and employ debt resolution specialists trained and accredited by the International Association of Professional Debt Arbitrators (IAPDA). The American Association for Debt Resolution was previously known as the American Fair Credit Council.

READ MORE: Debt settlement pros and cons

How the debt settlement process works

It’s not common knowledge, but after you default on your debts, many creditors are willing to “settle” your accounts for a fraction of what you owe. Third-party debt settlement companies contact your creditors on your behalf and negotiate on your behalf. Most unsecured debts can be settled.

Types of debt that can be settled

- Payday loans

- Credit card debt

- Department store credit cards

- Signature loans

- Personal lines of credit

- Old repossessions

- Old judgments

- Private student loans

- Medical bills

Pro tip: Debt settlement won’t work for every type of unsecured debt. Alimony, child support and back taxes, for example, cannot be settled.

When you agree to enroll in a debt settlement program, your chosen company will ask you to stop making monthly payments on enrolled debts.

This serves a few different purposes: It shows that you’re currently experiencing financial hardship, and creditors have no incentive to agree to settlements if they’re still getting paid.

This also means your credit score will initially fall as you establish a pattern of missed payments. Don’t worry about this too much. Once the settlements are negotiated and accounts are paid off, your credit report’s notation will change to “settled” and your credit score will rebound.

Pro tip: “Settled” notations don’t hurt your credit score. The credit score damage comes when your accounts are charged off, which occurs before the settlement process even begins.

READ MORE: How does debt settlement work?

Instead of paying your bills, you will instead send money to the debt settlement company to be deposited into a savings account that’s earmarked for debt repayments.

Once settlements have been negotiated, the debt payments will be made directly from your savings account either as a payment plan or a lump sum.

If you’re enrolling the standard $7,500 to $10,000 minimum, it should take you anywhere from two to four years to complete the debt settlement plan, depending on your total debt. If you enroll a smaller amount of payday loan debt, the program could be considerably shorter.

READ MORE: Debt settlement qualifications

Do you need debt settlement?

Debt settlement is the idea debt relief solution for anyone who has more than $7,500 in unsecured debt, particularly if your credit score has already suffered due to late payments. But here are a few warning signs that it’s time to take action:

- You’re always struggling to make credit card payments

- You only ever make the minimum monthly payment

- Your income suddenly decreased

- You had a sudden major expense

- You’re using credit cards to pay for necessities like food or utilities

- Debt collectors are harassing you about your existing debts

- Your credit cards maxed out

READ MORE: When is debt settlement a good idea?

Why hire a debt settlement company?

There are a few key reasons to hire a professional debt settlement company.

They know which creditors are willing to settle

Settling debts can take time, and creditors are under no obligation to settle. However, an experienced debt settlement company will already have established relationships with lenders and creditors and will know which ones are willing to settle.

You won’t have to pay unless they get results

Though the fee may sound like a lot, you won’t pay anything at all until your settlements are paid. And according to the American Fair Credit Council, the average debt settlement customer will save 30% even after fees.

READ MORE: Debt settlement fees

That means that for every $10,000 in debt enrolled, the average customer will end up paying about $7,000 total after fees.

They legitimately want to help you

Your case is always a priority because the companies don’t get paid until they get results.

It will save you a lot of time

Negotiating settlements and making sure you’re depositing enough into a savings account to be able to afford the settlements requires time and effort — sometimes as much time as you’d need to devote to a part-time job. In addition, many debt collectors will leave you alone once they find out you’re working with a professional debt settlement company.

READ MORE: Debt settlement pros and cons

Make sure the company you choose is legitimate

There are a lot of debt settlement scams, but all of the companies listed here are reputable and have a proven industry track record. Be suspicious of any company that:

- Contacts you out of the blue

- Demands upfront fees

- Promises a money-back guarantee

- Cites vague government programs

- Promises results

Legitimate debt settlement services are heavily regulated by the Federal Trade Commission. They cannot charge fees for their services until settlements have been reached and you have signed off on them. So if someone contacts you and makes promises that sound too good to be true, hang up and check the company’s website.

READ MORE: Legitimate debt relief programs

Other debt relief options

If you don’t qualify for debt settlement or don’t think it is right for you, there are some other options:

Debt Management Plans: Debt Management Plans are similar to debt settlement, except nonprofit credit counseling agencies only negotiate lower interest rates and late fees. You’ll still repay the full amount of your debt and a monthly fee ranging from $25 to $75 per month. Look for a credit counselor that’s accredited by the National Foundation for Credit Counseling (NFCC).

READ MORE: Debt management vs. debt settlement

Balance transfer credit cards: This involves using a new credit card that offers a 0% APR for a fixed amount of time, allowing you to pay down your balance without accruing interest. However, you’ll have to have a good credit score to qualify for these cards.

READ MORE: Balance transfer credit cards

DIY debt settlement: You can contact your creditors on your own and make settlement offers. However, if you have multiple debts, you’ll need to be prepared to devote a significant amount of time and research to this.

READ MORE: DIY debt settlement

The bottom line

Debt settlement won’t be right for everyone. For example, if you have an excellent credit score and want to maintain it, you’ll be better off choosing debt consolidation. But if you have more than $7,500 in unsecured debt and are struggling to make your monthly payments, it’s actually a very affordable way to reset your financial situation and become debt-free.

FAQs

The IRS considers forgiven debts as taxable income. However, there is tax debt relief for people who can prove insolvency. Learn more at IRS.gov.

Auto loans are generally not eligible for debt settlement programs. Debt settlement is a negotiation process where a debtor and a creditor agree to settle a debt for a reduced amount, typically paid in a lump sum. However, auto loans are secured debts, meaning they are backed by collateral, which is the vehicle itself. As a result, the lender has the right to repossess the vehicle if the borrower fails to make the required payments.

However, if your car has been repossessed, it may be possible to settle any remaining debt.

The terms “debt settlement company” and “debt relief company” are often used interchangeably, but there are differences in how they operate.

Debt settlement companies specialize in negotiating with creditors on behalf of the debtor to reach a settlement for less than the total amount owed. Debt settlement companies typically work with unsecured debts like credit card debt or medical bills. Debt settlement companies often require the debtor to make regular payments into a dedicated account, which is used to accumulate funds for settlement offers.

Debt relief company is a broader category that encompasses various approaches to help individuals manage their debts. Debt relief companies may offer services such as debt consolidation, debt management plans, debt counseling, or debt settlement. While debt settlement is one debt relief program, not all debt relief companies specialize in or offer debt settlement services.