Payday loans help people with bad credit get fast cash. Unfortunately, so many state regulations allow such high finance charges and short repayment terms that the loans often trap borrowers in a cycle of debt. If you’re considering taking out a payday loan in Virginia, here’s what you should know about the Virginia payday loan laws.

Table of Contents

Payday lending status in Virginia: Legal

Payday loans are technically legal in Virginia, but in 2020 the Virginia General Assembly passed the Fairness in Lending Act, which restricts them significantly. This state law greatly reduced the dangers that small loans pose to consumers, though it didn’t eliminate them.

Previously, payday loans in Virginia were standard for the industry. Users could borrow a few hundred dollars at a time with payment due in a couple of weeks. Lenders could charge annual percentage rates (APRs) well into the triple digits. As a result, users often struggled to pay.

The Fairness in Lending Act altered the payday loan structure fundamentally. It reduced allowable finance charges, increased the maximum borrowing amount, and extended the minimum repayment term.

READ MORE: States where payday loans are illegal

Stuck in payday debt?

If you’re a Virginia resident, DebtHammer may be able to help.

Loan terms, debt limits, and collection limits in Virginia

- Maximum loan amount: $2,500

- Maximum Interest Rate: 36% APR (annual percentage rate)

- Minimum loan term: 4 months, unless your monthly payment is less than 5% of your gross monthly income or 6% of your net monthly income.

- Maximum loan term: 24 months

- Number of rollovers allowed: N/A

- Number of outstanding loans allowed: One

- Cooling-off period: N/A

- Finance charges: Monthly maintenance fee equal to the lesser of $25 or 8% of your principal balance.

- Collection charges: $25 nonsufficient funds (NSF) fee. Late fee after seven days equal to 5% of the missed payment up to $20.

- Criminal action: Prohibited

The primary issue with traditional payday loans is that they ask you to repay too much in too little time. Users have to cover their original balance and a significant fee when their next paycheck hits.

Usually, people who resort to payday loans have bad credit and no savings. When they face a financial emergency, their only choice is to take out a payday loan. It’s hard to turn that situation around in just two weeks.

For example, if you don’t have $300 on January 1st to pay for your car trouble, it’s not very likely that you’ll have $400 on January 15th when your loan comes due.

An infamous Consumer Finance Protection Bureau study found that roughly 80% of payday loan transactions result in a rollover, which means the borrower pays another fee just to push back their due date.

The new legislation lets borrowers pay their balance off in multiple installments over several months and reduces the finance charges to relatively reasonable levels.

Virginia payday loan laws: How they stack up

Federal regulations don’t generally affect the terms lenders can charge. As a result, it’s up to individual state governments to implement legislation that prevents predatory lending.

Unfortunately, despite the evidence that payday loans are dangerous to consumers, few of them have managed to eliminate the industry. Some states still allow payday lenders to operate virtually without restriction.

The Virginia payday loan laws sit somewhere in the middle. Here’s a more detailed explanation of them to help you understand how they stack up against the rest of the country’s regulations.

READ MORE: How to get out of payday loan debt

Maximum loan amount in Virginia

The maximum payday loan amount in Virginia is $2,500. In addition, you can only have one short-term loan out at a time. If you take out a payday loan for less than $2,500, you can’t borrow more until you’ve paid off the first one.

The law requires that lenders check whether you’re eligible for a short-term loan before offering one to you. That includes reviewing the state’s database to determine whether you have a loan outstanding. As a result, you shouldn’t be able to get a second payday loan with the same lender or a different one.

READ MORE: Payday loan consolidation and relief that works

What is the statute of limitations on a payday loan in Virginia?

The statute of limitations on debt is a rule that restricts the period during which a creditor or debt collector can sue you for a debt that’s in default. It varies significantly between states and types of debt.

Payday loans are written contracts. In Virginia, they have a statute of limitations of five years after the last payment you made.

Rates, fees, and other charge limits in Virginia

The Virginia payday loan laws let lenders charge up to 36% interest per year on the principal balance. In addition, they can charge a monthly maintenance fee equal to the lesser of $25 and 8% of your loan’s principal balance.

Spread over a repayment term of at least four months, that’s more affordable than a traditional payday loan. However, it’s still significantly more expensive than many other installment loans, like personal loans, auto loans, and mortgages.

For example, say you take out a $1,500 short-term loan repayable in five monthly installments. The lender charges you 36% interest on the loan balance plus a $25 monthly maintenance fee. You’d pay $137.66 in interest and $125 in maintenance fees, which equals a $262.66 finance charge and an effective APR of roughly 43%.

That’s much lower than traditional payday loans, which regularly reach APRs in the triple digits, but it’s still not quite affordable. For context, the national average interest rate on a personal loan is around 9.41%.

Maximum term for a payday loan in Virginia

The Virginia payday loan laws allow for a maximum loan term of 24 months. They also require that your loan term be at least four months unless your total monthly payment is below the greater of 5% of your gross monthly income or 6% of your net monthly income.

For example, say you earn $4,000 per month and have $3,356 left after your employer withholds taxes. 5% of $4,000 is $200 and 6% of $3,356 equals $201.36. In that case, payday lenders could only set your loan term below four months if their monthly payment was less than the latter.

How many payday loans can you have in Virginia?

Virginia specifies that residents can only have one payday loan at a time, but if you need more than one, you may be able to get another from an online lender based in a different state. Though payday lenders don’t report loans to the three major credit bureaus, they have a reporting system of their own, so they will typically be aware if you already have one outstanding loan.

There’s also no overall limit to the number of payday loans you can have, so once you pay off your original loan, you’re immediately eligible for a new loan. However, this isn’t recommended.

READ MORE: Can you have multiple payday loans?

Are tribal loans legal in Virginia?

The federal government considers Native American tribes to be sovereign nations within the United States. As a result, they don’t generally have to follow any state’s regulations, even if they reside or do business there.

Tribal lenders partner with Native American tribes to share in their “tribal immunity.” Usually, the lender offers the tribe a percentage of the lending profits in exchange.

Unfortunately, the legal status of tribal lenders is something of a grey area. For example, you generally can’t sue Native American tribes for breaking state regulations, but that doesn’t necessarily extend to tribal lenders.

The connection between the two parties often exists only on paper, and some courts have ruled that’s not enough for the lenders to benefit from the same privilege as the tribe.

Tribal lenders are also generally incapable of enforcing their loan agreements in a state court of law, which is the only way a lender can collect without collateral if you refuse to pay. However, they may try to bluff or take you to tribal court.

Fortunately, Virginia makes things simple. To offer payday loans in the state, lenders must have both a license and a physical location. Tribal lenders generally license themselves and operate online only. As a result, their short-term loans are illegal in Virginia.

When in doubt about a lender’s legal status, check the list of licensed lenders with the Virginia Bureau of Financial Institutions.

READ MORE: Is my payday loan lender licensed?

Consumer information

The Virginia State Corporation Commission (SCC) is the primary agency with regulatory authority over businesses and economic interests in the state. Its Bureau of Financial Institutions is responsible for the oversight of financial entities, including payday and short-term lenders.

It has the authority to issue additional rules and regulations to enforce the laws it’s supposed to uphold. That includes Title 6.2 of the Code of Virginia, which is the section that applies to short-term lenders.

READ MORE: Get out of high-interest tribal loan debt

Where to make a complaint

The Virginia State Corporation Commission’s Bureau of Financial Institutions is the best place to complain about a short-term lender. Here’s how to get in touch with them:

- Regulator: Virginia State Corporation Commission

- Physical Address: 1300 E. Main Street, Richmond, Virginia 23219

- Mailing Address: P.O. Box 640, Richmond, Virginia 23218

- Phone: 804-371-9657

- Email: [email protected]

- Link to website: https://www.scc.virginia.gov/pages/File-Complaint-Consumers

It’s usually worthwhile to submit a complaint to the Consumer Financial Protection Bureau (CFPB) too. The CFPB is a federal agency that protects consumers from predatory financial institutions, including short-term lenders.

Number of Virginia consumer complaints by issue

These statistics are all according to the CFPB Consumer Complaint Database.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 255 |

| Struggling to pay your loan | 78 |

| Problem when making payments | 45 |

| Problem with the payoff process at the end of the loan | 38 |

| Can’t stop withdrawals from your bank account | 38 |

| Can’t contact lender or servicer | 37 |

| Getting the loan | 28 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 22 |

| Loan payment wasn’t credited to your account | 21 |

| Received a loan you didn’t apply for | 21 |

| Incorrect information on your report | 16 |

| Problem with additional add-on products or services | 8 |

| Applied for loan/did not receive money | 7 |

| Was approved for a loan, but didn’t receive money | 6 |

| Improper use of your report | 5 |

| Problem with a credit reporting company’s investigation into an existing problem | 4 |

| Vehicle was repossessed or sold the vehicle | 4 |

| Problem with fraud alerts or security freezes | 2 |

| Unable to get your credit report or credit score | 1 |

| Vehicle was damaged or destroyed the vehicle | 1 |

Source: CFPB website

The most common complaint consumers in Virginia make to the CFPB is that their lenders charged them fees or interest that they didn’t expect. That’s almost always the case in states that allow high-interest, short-term lending like Virginia.

Despite the recent improvements to the legislation in the state, short-term lending can still trap many unsuspecting consumers. The only way to effectively eliminate predatory lending practices is to cap total loan costs at 36% APR.

The most complained about lender in Virginia: Enova International, Inc.

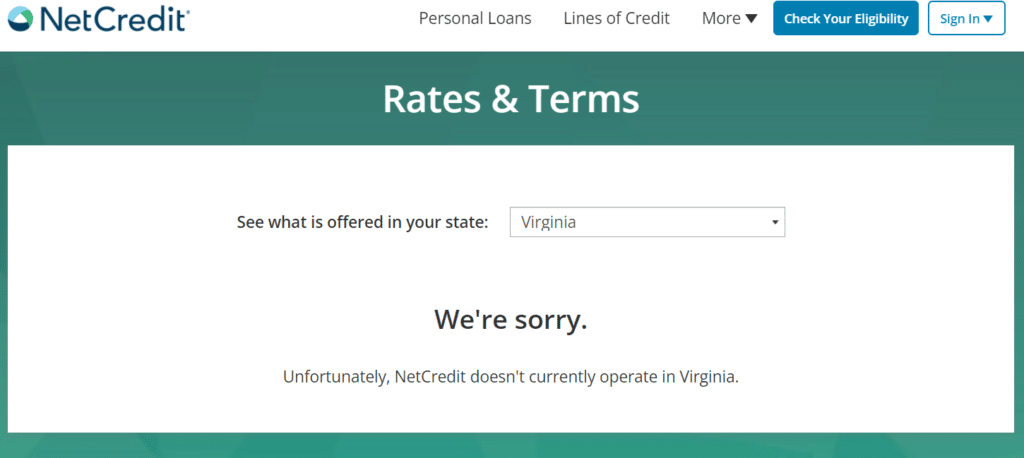

The most complained about lender in Virginia is Enova International, Inc., though they don’t make loans directly. They operate through their subsidiaries CashNetUSA and NetCredit.

Both companies provide personal loans similar to the short-term loans Virginia now mandates, as well as high-interest lines of credit. However, as of 2021, neither CashNetUSA nor NetCredit operates in Virginia. Either the licensing requirements or the recent regulatory changes shut them down.

Most common complaints about Enova International, Inc.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 64 |

| Struggling to pay your loan | 18 |

| Can’t stop withdrawals from your bank account | 10 |

| Received a loan you didn’t apply for | 7 |

| Can’t contact lender or servicer | 7 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 6 |

| Problem with the payoff process at the end of the loan | 6 |

| Applied for loan/did not receive money | 5 |

| Loan payment wasn’t credited to your account | 3 |

| Problem when making payments | 2 |

| Improper use of your report | 1 |

| Getting the loan | 1 |

| Incorrect information on your report | 1 |

| Problem with a credit reporting company’s investigation into an existing problem | 1 |

Source: CFPB website

The most common complaint consumers make about Enova International, Inc. is that they charge fees and interest that borrowers didn’t expect. While they don’t operate in Virginia anymore, their costs in other states indicate how expensive they can get.

For example, say you took out a personal loan from Enova through NetCredit in Alabama. A $6,300 personal loan would have a 49-month repayment term and cost you $5,900 in interest.

Top 10 most complained about payday lenders

| Lender | Number of Complaints Since 2013 |

| Enova International, Inc. | 133 |

| Big Picture Loans, LLC | 29 |

| OneMain Financial Holdings, LLC | 26 |

| CNG Financial Corporation | 25 |

| Harpeth Financial Services, LLC | 24 |

| Delbert Services | 18 |

| Community Choice Financial, Inc. | 18 |

| Lending Club Corp | 15 |

| Mobiloans, LLC | 15 |

| Lendmark Financial Services | 15 |

Source: CFPB website

Enova International is the most complained about payday lender in Virginia, but that doesn’t mean there haven’t been other significant offenders. However, many of them no longer operate in Virginia because of the new regulations.

For example, Community Choice Financial offers check cashing, installment, and payday loan services across the country, both online and in-store. However, they don’t operate online in Virginia anymore. Their site claims that options are available through their local stores, but even those seem to focus primarily on check cashing.

If you’re going through financial difficulties because of predatory lenders like the ones on the list above, DebtHammer can help. Contact us today, and we can get you out of the payday loan trap once and for all.

The most complained about tribal lender in Virginia: Big Picture Loans, LLC

The most complained about tribal lender in Virginia is Big Picture Loans, LLC. They don’t have a storefront and instead offer loans online to the entire country. As a result, they’re the top offender in most parts of the United States.

Like most tribal lenders, they don’t follow state lending regulations. Virginia caps short-term loans at $2,500 and limits their interest rates to 36%. However, Big Picture Loans offers installment accounts from $200 to $5,000 with APRs as high as 699%. In fact, the first time you get a loan from them, you can’t qualify for anything below 200%.

Most common complaints about Big Picture Loans, LLC

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 23 |

| Problem with the payoff process at the end of the loan | 2 |

| Can’t stop withdrawals from your bank account | 2 |

| Received a loan you didn’t apply for | 1 |

| Struggling to pay your loan | 1 |

Source: CFPB website

As you could probably guess, the most common complaint borrowers have about Big Picture Loans in Virginia is that they charge unexpected fees or interest. Since their costs are even higher than other short-term lenders in the state, that makes a lot of sense.

Here’s an example to illustrate how expensive their loans can get. If you took out a 12-month installment loan for $3,000 at 699% APR, you’d pay a whopping $4,781 in interest.

Payday loan statistics in Virginia

- Virginia ranks as the 7th state for the most overall payday loan complaints.

- Virginia ranks as the 8th state for the most payday loan complaints per capita.

- There have been 18,281 payday loan-related complaints made to the CFPB since 2013 ― 637 of these complaints originated from Virginia.

- The estimated total population in Virginia is 8,535,519 people.

- There are 7.4629 payday loan complaints per 100,000 people in Virginia.

- The most popular reason for submitting a payday loan complaint is “Charged fees or interest you didn’t expect.”

READ MORE: Payday loan debt statistics

Historical timeline of payday loans in Virginia

The Virginia payday loan laws haven’t always been what they are today. In fact, they’ve changed quite a bit over the years. Here’s a timeline of the most significant relevant events in Virginia’s history.

- 1998: The payday loan industry began infiltrating Virginia when national banks rented out their charters to payday lenders who wanted to evade consumer protection laws.

- 2002: The Payday Loan Act passed, officially allowing payday lenders to operate in Virginia.

- 2008: Complaints convinced legislators to alter the Payday Loan Act to restrict the industry, but payday lenders began making open-ended loans to avoid the rules.

- 2009: Legislators tried to restrict payday lenders by capping interest and loan fees. Lenders used various loopholes, such as operating online and using line-of-credit licenses to avoid the limitations.

- 2011: The Virginia Supreme Court ruled that providing a new loan to a borrower who just paid off their last one is illegal.

- 2021: The Fairness in Lending Act took effect, capping interest rates and extending repayment terms.

As you can see, payday lenders have a long history of bending the rules to get what they want. Fortunately, the new legislation has proven more effective than the previous attempts at curbing the predatory industry.

Flashback: An Virginia payday loan story

The Fairness in Lending Act took effect on January 1st, 2021. The year before, Virginia’s largest payday lender, Advance America, announced that it would no longer operate in the state because of the new regulations.

Like so many other payday lenders before them, they claimed that the limits on their loans would be unsustainable. Jessica Rustin, Advance America’s chief legal officer, made the following statement:

“Under-served consumers deserve opportunities for regulated, responsible credit, and rate caps like the new law’s 36% interest rate cap eliminate those options. Under such restrictions, lenders simply cannot accommodate both the higher loss rates that come with serving the needs of subprime consumers and basic operating expenses.”

These are the same tired arguments that payday lenders have used in every other state that threatened their ability to take advantage of consumers. Jay Speer, executive director of the Virginia Poverty Law Center, easily refuted Jessica’s words, saying:

“It’s simply not credible that payday lenders can’t operate under the new law. Payday lenders, including Advance America, offer a $500, 6-month loan in Colorado for $125. The new law lets them charge $204 for the same loan.”

The moral of the story is that payday lenders consistently bend the truth to get what they want. If they can’t have exactly their way, they’ll take their ball and go home. Legislators and consumers alike need to remain wary of their manipulations. If Virginians forget, the predatory industry could come creeping back.

The bottom line: Should you take out a payday loan in Virginia?

Before the Fairness in Lending Act changed the Virginia payday loan laws, payday lending in the state was an undeniably predatory industry. While their short-term loans have become significantly more affordable, they still shouldn’t be your first solution to financial difficulties.

Even at the newly reduced rates, short-term loans can be prohibitively expensive. If you have any alternative to taking one out, you should strongly consider using it instead.

Ultimately, short-term borrowing is never a viable long-term solution. The only way to solve financial problems permanently is to cut your expenses and increase your earning power until you can save a significant portion of your paycheck each month and build your cash reserves.

If you’d like to get expert help rebuilding your finances after payday loans, contact DebtHammer today for a free quote.