Payday loans have long been controversial for their tendency to trap borrowers in a cycle of debt. Unfortunately, individual states have the authority to regulate them within their borders, and many choose to allow the predatory industry to continue charging unreasonable interest rates. These are the California payday loan laws.

Table of Contents

Payday lending status in California: Legal

The payday lending industry is problematic in many ways, but the most significant is the sheer cost of the loans. You can limit the damage payday loans do with regulations that keep principal balances low and eliminate rollovers, but the only way to make credit accounts safe is to cap their interest rate at something affordable.

Most states eliminate predatory lending by implementing a 36% annual percentage rate (APR) limit. Any government that allows more than that either tacitly or explicitly endorses lenders taking advantage of consumers.

California has a 36% rate cap for personal loans between $2,500 and $10,000, but payday lenders can still charge triple-digit APRs on smaller loans.

READ MORE: States where payday loans are illegal

Stuck in payday debt?

DebtHammer may be able to help.

Loan terms, debt limits, and collection limits in California

- Maximum loan amount: $300 in principal and fees

- Maximum Interest Rate (APR): 460% APR on a 14-day, $100 loan

- Minimum loan term: N/A

- Maximum loan term: 31 days

- Number of rollovers allowed: None

- Number of outstanding loans allowed: One

- Installment option: No

- Cooling-off period: None

- Finance charges: 15% of the face amount of loan check

- Collection charges: $15 non-sufficient funds (NSF) fee

- Criminal action: Prohibited

Compared to the regulations in many other states, the California payday loan laws are easy to understand. There are clear limitations on allowable principal amounts and finance charges, which determine the cost of your loan.

Unfortunately, they’re not strict enough to protect anyone since lenders can still legally charge triple-digit interest rates.

READ MORE: Guide to debt relief in California

California payday loan laws: How they stack up

Despite the evidence that payday loans tend to trap borrowers in a cycle of debt payments, most states’ payday loan laws explicitly allow the industry to continue or fail to eliminate it.

In 2021, roughly two-thirds of the United States still permit payday loans, including California. Here’s a more in-depth explanation of the regulations in the state to help you understand how they stack up with the rest of the country.

READ MORE: How to get out of payday loan debt

Maximum loan amount in California

Consumers can’t take a loan from a payday lender that exceeds $300 when combined with its finance charge. Payday lenders usually collect by cashing a post-dated check from the borrower, so the legislation enforces this limit by restricting the face amount of the check.

As a result, most payday lenders only offer loans up to $255 because, at that point, they’d have to start lowering their finance charges by a dollar for each dollar they add in principal.

What is the statute of limitations on a payday loan in California?

A statute of limitations is a law that restricts the length of time a potential claimant has to initiate a lawsuit over damages they’ve suffered. In the case of payday loans, the statute of limitations is the period during which a lender can sue a borrower in default.

The statute of limitations on a payday loan in California is four years.

READ MORE: Payday loan consolidation and relief that works

Rates, fees, and other charge limits in California

The California payday loan laws limit finance charges to 15% of the face amount of the post-dated check used to secure the loan, which can be no more than $300 in total.

That means if a lender charges the full 15% (and they always do), then you can’t borrow more than $255 with a payday loan in California. 15% of $300 is $45, and $300 minus $45 is $255.

You can also think of this as $17.65 in finance charges per $100 in principal, up to $45. For example, you’d pay $33.53 for a $200 payday loan. That works out to 438% APR, assuming a 14-day repayment term.

In addition, lenders can charge a single $15 NSF fee if your post-dated check doesn’t clear. In other words, they can’t try to cash your check three times and charge you $45.

Maximum term for a payday loan in California

Payday loans can have a repayment term no longer than 31 days in California. There are no rollovers or extension fees. You can request an extended repayment plan, but lenders don’t have to give you one. Since they can’t charge you for the extra time, most of them won’t bother.

How many payday loans can you have in California?

California limits borrowers to one payday loan at a time. Though payday lenders don’t report loans to the three major credit bureaus, they have a reporting system of their own. If you already have a couple of outstanding payday loans — or have defaulted on a previous payday loan — the new lender will typically be aware. However, out-of-state lenders or tribal lenders may continue to fund multiple loan requests.

There’s also no overall limit to the number of payday loans you can have, so once you pay off your original loan, you’re immediately eligible for a new loan. However, this isn’t recommended.

READ MORE: Can you have multiple payday loans?

Are tribal loans legal in California?

As sovereign nations within the United States, Native American tribes have tribal immunity and can generally ignore state regulations. Tribal lenders partner with Native American tribes to try and share in that privilege so they can charge fees and interest above state limits.

Whether tribal lenders are legal in a state depends on the local government’s answers to the following questions:

- Can tribal lenders share in a tribe’s immunity?

- Does tribal immunity grant the right to ignore state lending laws?

The California Supreme Court ruled that tribal lenders don’t share in a tribe’s immunity, effectively prohibiting them. Unfortunately, many tribal lenders continue to fund loans in the state.

READ MORE: Is my payday lender licensed?

Consumer information

The California Department of Financial Protection and Innovation (DFPI) is responsible for protecting consumers from potentially predatory financial service providers. That includes payday lenders, which they refer to as deferred deposit lenders.

The DFPI oversees the licensing process for financial service businesses. You can access its database online to confirm that a payday lender has the right to practice before borrowing from them.

The DFPI also enforces regulations on licensees. If it finds that a financial service provider has violated the law, it can revoke the business’s right to operate, impose financial penalties, or file civil suits against them.

READ MORE: Get out of high-interest tribal loan debt

Where to make a complaint

The DFPI is also the best place to complain about a payday lender’s behavior in California. Even if you’ve registered your complaint with another agency already, notify the DFPI of the violation, too.

Here’s the contact information:

- Regulator: Department of Financial Protection and Innovation

- Address: Office of the Ombuds, 2101 Arena Boulevard, Sacramento, CA 95834

- Phone: (866) 275-2677 or (916) 327-7585

- Email: [email protected]

- Link to website: https://docqnet.dfpi.ca.gov/complaint/

You can also submit your complaint to the Consumer Financial Protection Bureau (CFPB). The CFPB is a federal organization that protects consumers from predatory financial institutions, including payday lenders.

Number of California consumer complaints by issue

These statistics are all according to the CFPB Consumer Complaint Database.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 794 |

| Struggling to pay your loan | 270 |

| Problem with the payoff process at the end of the loan | 179 |

| Can’t contact lender or servicer | 172 |

| Getting the loan | 169 |

| Problem when making payments | 166 |

| Received a loan you didn’t apply for | 155 |

| Can’t stop withdrawals from your bank account | 105 |

| Loan payment wasn’t credited to your account | 101 |

| Incorrect information on your report | 72 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 56 |

| Applied for loan/did not receive money | 47 |

| Vehicle was repossessed or sold the vehicle | 41 |

| Problem with additional add-on products or services | 29 |

| Was approved for a loan, but didn’t receive money | 23 |

| Improper use of your report | 20 |

| Problem with a credit reporting company’s investigation into an existing problem | 17 |

| Vehicle was damaged or destroyed the vehicle | 11 |

| Credit monitoring or identity theft protection services | 4 |

| Problem with fraud alerts or security freezes | 1 |

| Property was damaged or destroyed property | 1 |

Source: CFPB website

By far, the most common complaint about lenders in California is that they charge fees and interest their borrowers don’t expect. That’s usually the case in states where payday loans are legal, and the competition here isn’t even close.

There are roughly three times as many complaints about fees and interest as there are complaints about the second-place issue.

Ironically, both of the top two complaints have to do with the loan costs, which indicates that the California payday loan laws need to be more restrictive to adequately protect consumers.

The most complained about lender in California: CURO Intermediate Holdings

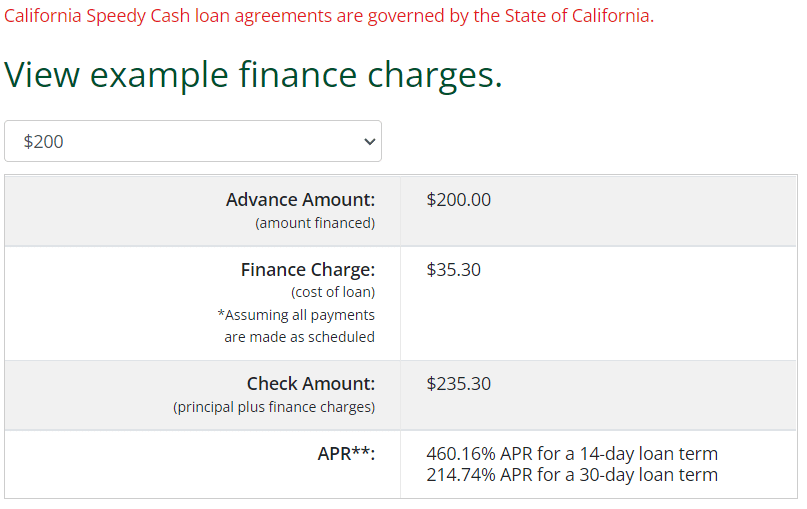

Consumers have complained about CURO Intermediate Holdings more than any other lender in California. It’s the parent company for Speedy Cash, which is one of the biggest payday lenders in the country.

They offer standard payday loans at the highest rates they can legally charge. For example, you’ll pay $35.30 for a $200 payday loan from Speedy Cash, which works out to 460.16% APR on a 140-day loan.

Most common complaints about CURO Intermediate Holdings

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 43 |

| Received a loan you didn’t apply for | 17 |

| Struggling to pay your loan | 15 |

| Loan payment wasn’t credited to your account | 13 |

| Can’t stop withdrawals from your bank account | 11 |

| Can’t contact lender or servicer | 8 |

| Problem with the payoff process at the end of the loan | 7 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 6 |

| Applied for loan/did not receive money | 6 |

| Incorrect information on your report | 4 |

| Problem when making payments | 4 |

| Getting the loan | 3 |

| Was approved for a loan, but didn’t receive money | 3 |

| Improper use of your report | 2 |

| Problem with a credit reporting company’s investigation into an existing problem | 2 |

| Problem with additional add-on products or services | 2 |

| Vehicle was damaged or destroyed the vehicle | 1 |

Source: CFPB website

The most common complaint about CURO Intermediate Holdings is that they charge unexpected fees and interest. That seems to indicate that consumers can’t fully comprehend how expensive payday loans are, even when they’ve read a clear breakdown of their costs.

Speedy Cash is perfectly forthcoming about their finance charges on their website, and anyone who signs up for one of their loans undoubtedly signs a contract with the same information. Nonetheless, people are still taken aback when they struggle to keep up with their payments.

Top 10 most complained about payday lenders

| Lender | Number of Complaints Since 2013 |

| CURO Intermediate Holdings | 147 |

| Bliksum, LLC | 122 |

| CashCall, Inc. | 109 |

| CNG Financial Corporation | 106 |

| Enova International, Inc. | 106 |

| Community Choice Financial, Inc. | 95 |

| Wheels Financial Group, LLC | 85 |

| Populus Financial Group, Inc. | 80 |

| Big Picture Loans, LLC | 61 |

Source: CFPB website

Payday loans are legal in California, so it’s no surprise that consumers make a lot of complaints about their lenders in the state. In fact, there have been more complaints about payday loans in California than in any other state in the country.

Of course, it’s also the most populous state in the country, but it’s also ranked 15th in most complaints per capita.

After CURO Intermediate Holdings, the second most complained about lender in California is Bliksum, LLC, which does business as LoanMe. They offer personal loans from $600 to $20,000, and their APRs reportedly reach triple digits in some cases, though LoanMe doesn’t share their rates publicly.

If you’re struggling to keep up with your bills because of a predatory lender like the ones on this list, contact DebtHammer today. We’ll help you turn the tables on them and get you out of debt for good.

The most complained about tribal lender in California: Big Picture Loans, LLC

Big Picture Loans, LLC is the most complained about tribal lender in California and many other states in America. They charge rates well above what the California payday loan laws allow.

Big Picture Loans accounts have principal balances between $200 and $5,000, repayment terms that range from four to 18 months, and APRs of 35% to 699%. First-time users can’t qualify for anything below 200%, though.

Most Common Complaints About Big Picture Loans, LLC

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 39 |

| Problem with the payoff process at the end of the loan | 5 |

| Can’t stop withdrawals from your bank account | 4 |

| Struggling to pay your loan | 3 |

| Received a loan you didn’t apply for | 3 |

| Loan payment wasn’t credited to your account | 2 |

| Can’t contact lender or servicer | 2 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 2 |

| Applied for loan/did not receive money | 1 |

Source: CFPB website

Like CURO Intermediate Holdings, Big Picture Loans has received more complaints about the fees and interest they charge than anything else. Even the most creditworthy new customers have to pay at least 200% APR, so that makes sense.

Payday loan statistics in California

- California ranks as the 1st state for the most overall payday loan complaints.

- California ranks as the 15th state for the most payday loan complaints per capita.

- There have been 18,281 payday loan-related complaints made to the CFPB since 2013―2433 of these complaints originated from California.

- The estimated total population in California is 39,512,223 people.

- There are 6.1576 payday loan complaints per 100,000 people in California.

- The most popular reason for submitting a payday loan complaint is “Charged fees or interest you didn’t expect.”

READ MORE: Payday loan debt statistics

Historical timeline of payday loans in California

Somewhat surprisingly, given its liberal leanings, California has welcomed payday lending for decades. There have been attempts to change that over the years, but none have been successful.

Here’s an overview of the history of the California payday loan laws:

- Early 1990s: Payday lenders were a relatively novel business in California, so legislation didn’t include any reference to them. As a result, the industry grew without restriction.

- 1996: Legislation passed that defined payday lenders and limited the fees and interest rates they could charge. Unfortunately, they allowed for the finance charges the state still follows today, which are too high.

- 2002: The California Deferred Deposit Transaction Law was passed. It didn’t change legal loan terms, but it intensified the licensing requirements for payday lenders significantly.

California has a rate cap that sounds like it should be low enough at first glance, but a finance charge equal to 15% of the payday loan check’s face amount is much higher than 15% APR. It usually works out to somewhere between 300% and 500% APR.

That means California consumers are still vulnerable to predatory lenders. Since the population there is higher than in any other state, it’s even more important that local legislators put in stronger protections.

Flashback: A California payday loan story

Despite the excessive price tag attached to payday loans, people continue to use them in every state that allows the industry to exist. Payday lenders use that fact to argue that they provide a valuable service to people who wouldn’t have access to credit otherwise.

But that’s a ludicrous argument. There’s demand for financing among all people, including those with bad credit and lower incomes. That doesn’t mean payday loans are even remotely affordable.

Claiming payday loans are moral is like visiting people stranded in the desert and selling them water at astronomical prices, then patting yourself on the back for providing a valuable product to people who need it.

These loans have been trapping people in debt for years. In 2008, the Center for Responsible Lending reported that the average payday loan gets rolled over eight times, bringing the cost of a $325 cash advance up to $793.

For example, consider the case of Sheryl Loebig. In 2006, she was a single mother of four working as a paralegal in Orange County, California. When her car died, payday loans were her only source of financing because she had previously declared bankruptcy due to medical debt.

Sherly took out six payday loans and managed to put together a down payment on a new Toyota Corolla. She tried to repay the loans for two years but rolled them over continuously to stay afloat.

She only earned $33,000 per year, and despite slashing her expenses to the bone, she couldn’t save enough to pay off her payday loan debt. After two years of payments, she had paid a whopping $7,000 in fees, but she still owed more than $1,000 to her lenders.

The bottom line: Should you take out a payday loan in California?

If you’re already struggling to pay your bills, payday loans are more likely to make things worse than they are to help you. Their excessive fees and short repayment terms make them hard to keep up with, especially if money is already tight.

Because the California payday loan laws allow payday lenders to charge interest rates well into the triple digits, they’re as dangerous in the Golden State as they are anywhere else. You shouldn’t take a payday loan there if you can help it.

A free or low-cost cash advance app like Earnin is a better short-term solution, but no debt is ever going to solve your problems for good. You’ll need to solve the fundamental issues in your finances at some point to reach stability.

Grow your income and cut your expenses until you have a healthy gap between the two that you can put toward saving money. Are you a California resident looking for a way out of debt? If you need help escaping your payday lenders and their debt trap, contact DebtHammer today for a free quote.