There’s a lot of misinformation out there about credit scores. People have been perpetuating myths about how they work and what affects them for years, so it’s no surprise that so many others are confused about how their credit scores are calculated.

But in truth, the process is pretty easy to understand if you can separate fact from fiction. Here’s a breakdown of everything you need to know about how your credit score works, including how it gets calculated.

Table of Contents

The highlights

- Your credit scores are a function of five variables that indicate how risky it is to lend to you.

- You have multiple credit scores that result from the application of various algorithms to credit reports with different information.

- Your credit score affects your ability to get new credit the most, but other factors (like your employment history) also have an impact.

- The average credit score in America is roughly 680.

You don’t just have one credit score

Your credit score may seem like an official and imposing number, but it’s just a result of an algorithm being applied to the information in one of your credit reports.

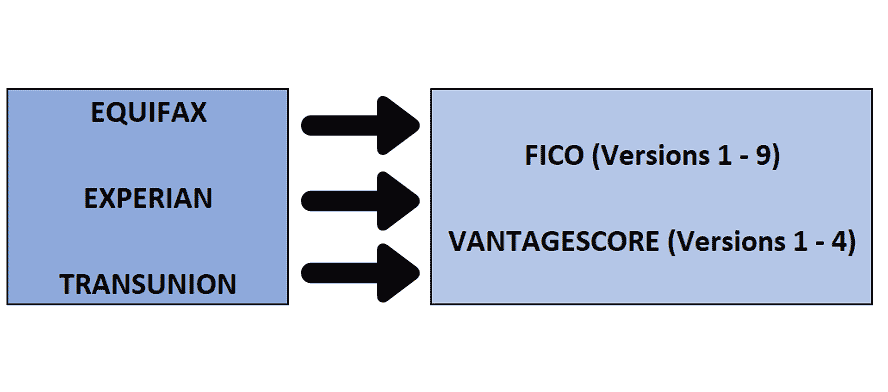

There are a dozen algorithms floating around and at least three different credit reports that lenders frequently apply them to, so you’ll never have a single universal score.

In practice, your “real” credit score can only be narrowed down to a range by comparing a handful of scores from various sources.

What Is a credit scoring model ?

Credit scoring models are the algorithm used by credit bureaus to evaluate your creditworthiness. The agencies track statistical characteristics from your credit payment patterns, analyze them and determine the three-digit number.

Calculations are based on such factors as payment record, frequency of payments, amount of debts, credit charge-offs and number of credit cards held.

Lenders use these credit scores to help determine the risk involved in making a loan, loan terms and the interest rate you’ll pay. For example, borrowers with a good credit score will pay a lower interest rate than borrowers with a fair credit score.

What is the average credit score in America?

To give you an idea of how your credit score stacks up, the average American credit score is roughly 680. That’s considered decent, but not amazing.

There’s some variation between FICO and VantageScore as to what’s considered good vs. great. Despite the differing credit score models, both use the same credit score ranges:

- Excellent credit: 800 to 850

- Very good credit: 740 to 799

- Good credit: 670 to 739

- Fair credit: 580 to 669

- Poor credit: 300 to 579

Both types of credit scores now use the same score range:

- FICO: Historically the most popular method and still widely used by most lenders, FICO was originally known as Fair Isaac Corporation.

- VantageScore: Created in 2006, this method is gaining in popularity, but follows the same principles and now uses the same score range (300 to 850)

The differences between them are slight, but they can lead to a noticeable shift in your score — even if a lender applies them to the same credit report.

To make matters more complicated, there are multiple versions of both algorithms. FICO Score 8 and VantageScore 3.0 are the most popular, but they’re not the most up-to-date.

As for the three major credit bureaus, they are:

- Equifax

- Experian

- TransUnion

Your creditors may report their interaction with you to one and not the others, which means that your credit reports won’t all contain the same information.

The five components of a credit score

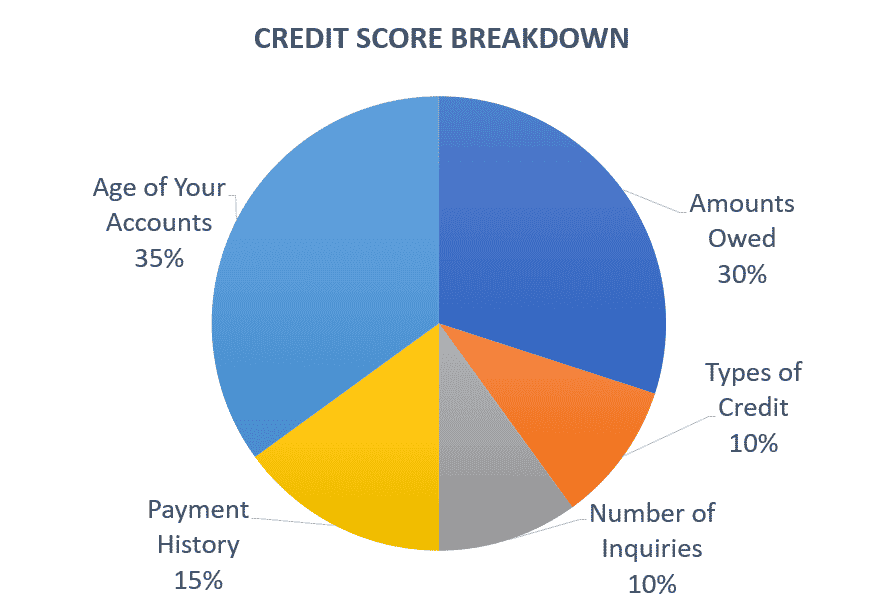

While FICO and VantageScore technically use different algorithms to calculate your credit score, they generally use the same five factors.

Behavior that increases your FICO score will always also increase your VantageScore, just to a varying degree. Although, in practice, they give relatively similar weight to each factor.

1. Payment history

Your payment history includes your record of paying back credit cards and any loans (like student loans or auto loans) that you might have on time and in full.

It accounts for 35% of your FICO credit score, which makes it the largest of their five factors. The VantageScore places a relatively large emphasis on it too, though they don’t provide a numerical value.

This makes sense since the most straightforward argument for whether or not you’ll be likely to miss future payments is your previous track record.

A single late payment or a missed payment will remain on your credit report for up to seven years, so it’s crucial to make on-time payments.

2. Credit utilization (used credit vs. available credit)

VantageScore’s previous versions had two separate categories called credit utilization and credit balances, but they’ve since combined them into one. Conveniently, that aligns with the FICO model, which sets aside 30% for it in its model.

Your credit utilization is an indicator to lenders of how likely you are to overstretch with debt. Ironically, lenders prefer to give higher credit limits to individuals who don’t necessarily need it. Both FICO and VantageScore reward having lots of unused credit and low debt balances.

General wisdom suggests that you should try to keep your total usage of your revolving debt below 30%. For example, if you have a $1,000 limit, try not to rack up more than $300 at any given time before paying it off.

3. Length of credit history

As you’d expect, the longer your track record of good behavior, the more impactful it will be. Both FICO and VantageScore reward you for demonstrating consistent responsibility over a long period.

You can’t even qualify for a FICO score unless you’ve had an account open for at least six months. VantageScore only requires you to have an account open for one month to calculate your credit score, but there’s no guarantee it’ll be any good.

Still, the length of your credit history has a lower impact on your score than the previous factors, only amounting to 15% in the FICO breakdown.

What is “credit age?”

Your “length of credit history” refers to how long an account has been open. The credit scoring algorithms track an average of how long all of your accounts combined have been open. This is known as your “credit age.”

This is why you’ll often be advised not to close the credit card accounts you’ve had the longest.

For example, let’s say you’re relatively young and have three open credit card accounts. One has been open 10 years, the second is 5 years old and you opened the third last year. If you decide to close one of the accounts, closing the 10-year-old one could actually end up causing your credit score to go down because it would lower your “credit age.” In addition, any new credit accounts will drive down your average.

It’s very difficult for young people to get a score above 800 because they have a low “credit age.”

4. Credit mix

Having a handful of diverse accounts is another sign to lenders that you’re a responsible borrower and a low-risk investment. Demonstrating the ability to manage different types of accounts — for example, a couple of credit cards, a personal loan, a home equity line of credit and a car loan — responsibly will boost your credit score, even though it may seem like a lot of debt.

This is one of the areas where FICO and VantageScore have a pretty big discrepancy in their algorithm. The FICO model weighs your different types of credit at just 10%, while VantageScore says that it’s a highly influential part of their model.

5. Hard inquiries and soft inquiries

Last and probably least, FICO and VantageScore reward individuals who take on new debt at a reasonable pace, though it’s the least influential factor in FICO (10%) and VantageScore.

Whenever you apply for new debt, your potential lender will perform what’s called a hard inquiry. They’ll officially pull and review your credit report, which will subsequently be seen by future lenders. Too many hard inquires can lower your credit score.

This is where the myth that it’s bad to check on your credit score comes from. You can only perform a soft inquiry on yourself, which doesn’t show on your report or affect your score.

What else matters when you apply for new credit?

Although these factors are the only ones included in your credit score calculation, they’re not the only ones that matter when you want to apply for new debt.

Lenders usually prefer to take a holistic approach to understanding your financial position. To round out the picture, they may also look at your:

- Debt-to-Income Ratio: Lenders want to see that you can comfortably afford your debt payments, especially when you sign up for a large loan like a mortgage. A large credit card balance can significantly impact this number. Try and keep your debt-to-income ratio below 36% in total (including your mortgage).

- Employment and Income History: It’ll be much easier to qualify for a loan if you can demonstrate a large and stable income. Lenders don’t want to give money to someone who might suddenly be out of a job.

- Liquidity and Assets: Creditors may also consider your liquid assets. As you’d expect, they’re much more comfortable lending to you when you have $100,000 in the bank or collateral that they can seize.

Know your credit score

You’re entitled to one free copy of your credit report every 12 months from each of the credit reporting companies. Find them online at annualcreditreport.com. Don’t trust any site that asks for you to pay for this information.

Unfortunately, your free credit reports won’t usually include your credit score. Check your VantageScore 3.0 with Equifax and TransUnion. You can also usually get a free credit score from your credit card company. There are also free credit scoring sites.

The bottom line

Credit scores aren’t a perfect representation of your financial health, but they’re still an important issue to consider. Like it or not, lenders rely on them heavily to make their lending decisions, and debt can be a necessary evil sometimes.

A poor credit score can hold you back from buying a home, going to school, or even just taking a loan out to pay for the expenses you need to live.

If you’re looking to raise your credit score, take advantage of your free credit report from the three bureaus and start working on credit repair. It’s easy to do yourself and will pay off the next time you need a loan.