Payday loans are an extremely expensive form of short-term borrowing and often trap people in a cycle of debt. Some states have tried to protect consumers by prohibiting the industry, but most still allow it to continue to some degree. If you live in Oklahoma, here’s what you should know about the state’s payday loan laws.

Table of Contents

Payday lending status in Oklahoma: Legal

Payday loans are still legal in Oklahoma, though they look different now than in previous years. Since 2003, the Oklahoma payday loan laws have followed the traditional model, with repayment terms between 12 and 45 days.

Such short turnaround times and high interest rates made it difficult for borrowers to keep up with their payments. That’s a proven recipe for trapping people in a cycle of debt. However, in 2019, Oklahoma legislators passed the Small Lenders Act. That significantly revised the rules for payday lenders in the state.

Notably, it changed the minimum and maximum repayment terms to 60 days and 12 months, respectively, making installment loans the new norm. However, it didn’t eliminate the industry, and payday lending remains legal.

READ MORE: States where payday loans are illegal

Stuck in payday debt?

DebtHammer may be able to help.

Loan terms, debt limits, and collection limits in Oklahoma

- Maximum loan amount: $1,500

- Maximum Interest Rate (APR): 204%

- Minimum loan term: 60 days

- Maximum loan term: 12 months

- Number of rollovers allowed: N/A

- Number of outstanding loans allowed: Any as long as the principal amount of all outstanding loans is less than $1,500

- Cooling-off period: N/A

- Finance charges: 17% interest per month so long as the monthly payment doesn’t exceed 20% of the borrower’s gross monthly income

- Collection charges: $25 nonsufficient funds (NSF); attorney’s fee up to 15% of outstanding amount at default

- Criminal action: Prohibited

Payday loans still carry triple-digit interest rates in Oklahoma, but they don’t follow the deferred deposit model that demands full repayment in a matter of weeks. Instead, they’re more like a typical installment loan, and borrowers have at least two months to pay.

The additional time may make it easier for borrowers to keep up with their debt payments, but it’s still problematic. 17% interest per month is 204% APR, and allowing loans up to $1,500 means people can do even more damage to their finances with a single loan.

READ MORE: Guide to debt relief in Oklahoma

Oklahoma payday loan laws: How they stack up

For years, studies have shown that payday loans consistently worsen your financial wellbeing. Despite this, payday lenders fiercely argue that they provide a beneficial product to people who struggle with bad credit but need financing.

As a result, the payday lending industry is controversial, and states take vastly different stances on the matter. Some allow payday lenders free reign, some have tried to restrict it, and others have prohibited it altogether.

Here’s a more comprehensive explanation of the Oklahoma payday loan laws to help you understand how they stack up against the rest of the United States.

READ MORE: How to get out of payday loan debt

Maximum loan amount in Oklahoma

The maximum payday loan amount in Oklahoma is $1,500. If you take out multiple payday loans, their combined principal amount can’t exceed $1,500 either. For example, if you have two $600 payday loans outstanding, you could take out a third, but it must have a principal balance of $300 or less.

READ MORE: Payday loan consolidation and relief that works

What is the statute of limitations on a payday loan in Oklahoma?

The statute of limitations on debt is the length of time that a creditor or collector has to take you to court to try and collect on a delinquent debt. It varies between states and debt categories.

Generally, payday loans are written contracts. As a result, they have a statute of limitations of five years in Oklahoma.

Rates, fees, and other charge limits in Oklahoma

The Oklahoma payday loan laws let lenders charge up to 17% interest per month. That usually works out to roughly 200% APR, depending on the principal balance and the exact life of the loan.

For example, CashNetUSA offers installment loans in Oklahoma from $300 up to the $1,500 limit. If you take out a $1,000 loan repayable in 12 monthly installments, you’d have a $197.33 monthly payment and a total finance charge of $1,368. That works out to 200% APR.

However, a lender can’t charge a rate that would cause the monthly payment to exceed 20% of the borrower’s gross monthly income. That sounds good, but it means you’d qualify for the loan above with a gross annual income as low as $11,820.

Lenders can also charge you a $25 NSF fee if any of your monthly payments fail due to a lack of funds. Should those missed payments eventually lead to default, they can take you to court and try to collect an attorney’s fee up to 15% of the loan’s outstanding balance as well.

Maximum term for a payday loan in Oklahoma

Payday loans can have a maximum repayment term of 12 months in Oklahoma. That’s significantly higher than most other states that allow payday loans. For comparison, the previous Oklahoma payday loan laws allowed a maximum repayment term of 45 days.

The additional time to pay might make it easier for borrowers to keep up with their payments, but it also means they’ll pay significantly more in interest.

For example, a 6-month payday loan for $1,000 from Speedy Cash costs $659 in finance charges. However, a 12-month payday loan for $1,000 from CashNetUSA costs $1,386. That’s more than double the interest, and the only difference between the two loans is their repayment term.

How many payday loans can you have in Oklahoma?

There’s no limit to the number of payday loans an Oklahoma resident can have as long as they don’t total more than $1,500. Though payday lenders don’t report loans to the three major credit bureaus, they have a reporting system of their own. If you’re close to the $1,500 maximum — or have defaulted on a previous payday loan — the new lender will typically be aware.

There’s also no overall limit to the number of payday loans you can have, so once you pay off your original loan, you’re immediately eligible for a new loan. However, this isn’t recommended.

READ MORE: Can you have multiple payday loans?

Are tribal loans legal in Oklahoma?

Native American tribes are sovereign nations residing in the United States, which means state regulations don’t typically apply to them. Tribal lenders share some of their profits with a tribe and call it a partnership, using it as an excuse to ignore state-imposed lending restrictions.

Usually, lenders do little more to establish that partnership than fill out paperwork stating that the tribe owns a portion of the lending operation. Some state courts have ruled that’s not sufficient to prove that the lender is an extension of the tribe.

Unfortunately, Oklahoma isn’t one of them. The State of Oklahoma once issued an amicus brief that sided with four online tribal lenders in a Consumer Financial Protection Bureau (CFPB) lawsuit. The brief expressed support for the tribal lenders’ immunity to state regulations.

READ MORE: Is my payday loan lender licensed?

Consumer information

The Oklahoma Department of Consumer Credit is in charge of administering the Uniform Consumer Credit Card. That includes enforcing limits on finance charges, interest rates, contract terms, and more.

The Department also has licensing and investigation responsibilities, which means it can look into complaints about creditors and take steps to rectify matters if it discovers any rulebreaking.

In addition to issuing fines, they can take away licenses and prevent lenders from doing further business. Before you borrow from a creditor, it’s usually a good idea to confirm that it still has an active license with the Department.

The Department supervises a long list of lender types, including pawnbrokers, credit service organizations, mortgage brokers, and small lenders that offer payday loans.

READ MORE: How to get out of high-interest tribal loans

Where to make a complaint

The Oklahoma Department of Consumer Credit is also the best place to submit a complaint about a payday lender. Here’s how you can get in touch with them:

- Regulator: Oklahoma Department of Consumer Credit

- Address: 629 NE 28th Street, Oklahoma City, OK 73105

- Phone: 405-521-3653 or 1-800-448-4904

- Email: [email protected]

- Link to website: https://www.ok.gov/okdocc/Complaints/index.html

It’s often a good idea to submit a complaint to the Consumer Financial Protection Bureau (CFPB) as well. The CFPB is a federal agency that protects consumers from predatory financial institutions, such as payday lenders.

Number of Oklahoma consumer complaints by issue

These statistics are all according to the CFPB Consumer Complaint Database.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 76 |

| Struggling to pay your loan | 37 |

| Problem when making payments | 27 |

| Can’t contact lender or servicer | 21 |

| Can’t stop withdrawals from your bank account | 14 |

| Received a loan you didn’t apply for | 11 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 10 |

| Getting the loan | 9 |

| Incorrect information on your report | 8 |

| Problem with the payoff process at the end of the loan | 8 |

| Loan payment wasn’t credited to your account | 8 |

| Applied for loan/did not receive money | 4 |

| Problem with a credit reporting company’s investigation into an existing problem | 2 |

| Was approved for a loan, but didn’t receive money | 2 |

| Problem with additional add-on products or services | 2 |

Source: CFPB website

The most common complaint consumers have submitted to the CFPB in Oklahoma is that their lenders charged them unexpected fees or interest. That’s usually the case in states where payday loans are legal.

Not only are payday loans more expensive than most borrowers can wrap their heads around, but lenders in the industry have a habit of minimizing those costs as much as they can within the boundaries of the law.

The most complained about lender in Oklahoma: Big Picture Loans, LLC

The most complained about lender in Oklahoma is Big Picture Loans, LLC. They also happen to be a tribal lender, which means their interest rates are significantly higher than the payday lenders that follow state laws.

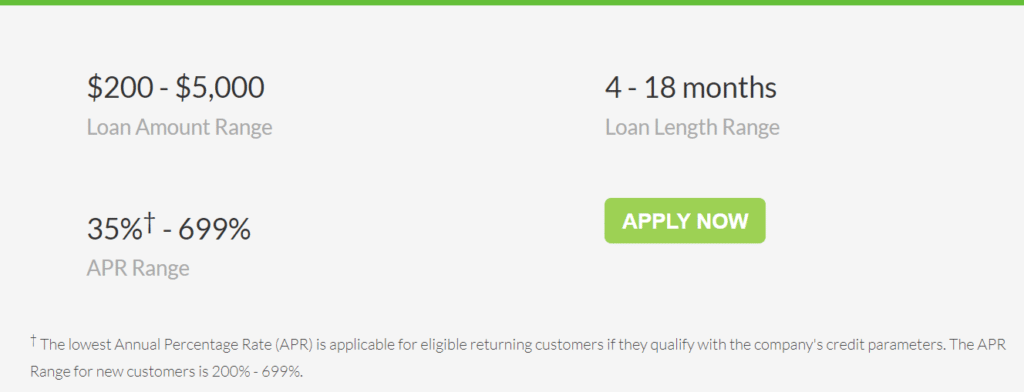

Big Picture Loans offers installment loans with the following terms:

- Principal amounts between $400 and $3,500

- Repayment terms between 4 and 18 months

- APRs from 35% to 699% for repeat customers; new customer rates start at 200%

Like the installment loans under the Small Lenders Act, the higher principal balances and interest rates can make these loans staggeringly expensive. For example, take the scenario that Big Picture Loans uses to illustrate their loan structure.

If you were to take out a $1,000 loan repayable in 13 bi-weekly installments at 350% APR, you’d pay $174.80 every two weeks for a total repayment amount of $2,272. Your interest costs would be a whopping $1,272. That’s $200 more than the original principal balance.

As outrageous as that is, Big Picture Loans’ highest possible interest rate is double that at 699%. Big Picture Loans can get away with these rates because they’re officially an extension of the Lac Vieux Desert Band of Lake Superior Chippewa Indians.

Most common complaints about Big Picture Loans, LLC

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 22 |

| Struggling to pay your loan | 1 |

| Can’t contact lender or servicer | 1 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 1 |

| Can’t stop withdrawals from your bank account | 1 |

Source: CFPB website

By far, the most common complaint Oklahomans make about Big Picture Loans is that they charge fees or interest that the customers didn’t expect.

Given that their loan’s interest rates reach just under 700% APR, that makes sense. That’s several times higher than other loans in the state, which now must cost around 200% APR to stay within the rules of the Small Lenders Act.

Top 10 most complained about payday lenders

| Lender | Number of Complaints Since 2013 |

| Big Picture Loans, LLC | 26 |

| Security Finance Corp | 14 |

| CNG Financial Corporation | 10 |

| LDF Holdings, LLC | 10 |

| Delbert Services | 10 |

| GVA Holdings, LLC | 9 |

| World Acceptance Corporation | 8 |

| Regional Management Corporation | 7 |

| Enova International, Inc. | 5 |

Source: CFPB website

The CFPB has received significantly more complaints about Big Picture Loans than any other lender in Oklahoma, but customers also have consistent problems with many others.

As you might expect, most of them offer short-term installment loans with high interest rates. For example, Check ‘n Go offers Oklahoma residents installment loans up to $1,500 and designs their loan agreements per the Small Lenders Act.

Notably, Big Picture Loans isn’t the only tribal lender on the list. LDF Holdings and GVA Holdings also have connections with Native American tribes, and their loan products are even more dangerous as a result.

Payday loan statistics in Oklahoma

- Oklahoma ranks as the 24th state for the most overall payday loan complaints.

- Oklahoma ranks as the 16th state for the most payday loan complaints per capita.

- There have been 18,281 payday loan-related complaints made to the CFPB since 2013―239 of these complaints originated from Oklahoma.

- The estimated total population in Oklahoma is 3,956,971 people.

- There are 6.04 payday loan complaints per 100,000 people in Oklahoma.

- The most popular reason for submitting a payday loan complaint is “Charged fees or interest you didn’t expect.”

READ MORE: Payday loan debt statistics

Historical timeline of payday loans in Oklahoma

The Oklahoma payday loan laws haven’t always been what they are today. In fact, they’ve changed quite a bit over the years. Here’s an overview of the most significant events affecting the industry in the history of the state:

- 1969: Lawmakers created the Oklahoma Uniform Consumer Credit Code, which governed all entities providing credit to consumers.

- 2003: The Deferred Deposit Lending Act passed, which officially granted lenders the right to offer traditional payday loans.

- 2004: The Oklahoma Department of Consumer credit began requiring payday lenders to record their transactions in a central database and check whether applicants have other outstanding loans in the system before working with them.

- 2012: The information in the database became confidential to protect consumers.

- 2017: Governor Mary Fallin vetoed a bill that would have given small lenders the option to offer installment loans up to $1,500 with 17% monthly interest because they would endanger consumers.

- 2019: Kevin Stitt became the new Governor of Oklahoma, and the Small Lenders Act passed, overturning some of Governor Fallin’s previous efforts.

Unfortunately, the recent passage of the Oklahoma Small Lenders Act hasn’t done much to help consumers in the state. Traditional payday loans are no longer legal under the new rules, but the installment loans that replaced them are still dangerous.

Borrowers may be at even greater risk due to the higher principal balances, longer repayment terms, and interest rates that remain in the triple digits.

Flashback: An Oklahoma payday loan story

Fighting against predatory lending is a seemingly interminable battle, and it’s one that consumer advocates are losing in many parts of the United States. Unfortunately, the payday loan industry knows well how to use its ill-gotten funds to affect state policy.

For several years, they’ve been pushing for high-interest installment loans across the country. In 2017, HB 1913 was their first attempt in Oklahoma. It would have opened up the way for high-interest installment loans on top of traditional payday loans.

Fortunately, consumer advocates defeated the bill, recognizing that anything predatory lenders wanted so badly couldn’t be good for consumers.

David Blatt, the Oklahoma Policy Institute Executive Director, said: “The Bill was written by the payday loan industry and promoted by the payday loan industry. They sent a small army of lobbyists to push the bill.”

Though those same loans are now available thanks to the passage of the Oklahoma Small Lenders Act, the efforts in 2017 were not in vain. HB 1913 would have allowed lenders to offer traditional payday loans and the new installment loans, while the Small Lenders Act eliminated the former in favor of the latter.

That said, it’s still not exactly a win for consumers. Other states have shown that the only way to eliminate predatory lending is to establish a 36% APR rate cap, and Oklahoma is still far away from that

The bottom line: Should you take out a payday loan in Oklahoma?

Even if you know what you’re getting into, taking out a payday loan is like playing with fire. All it takes is one mistake to end up with long-lasting consequences. Unfortunately, payday loans are far more likely to exacerbate your financial problems than solve them.

As a result, you’re usually much better looking for an alternative form of financing. Even if you have bad credit, there are safer ways to get the support you need. For example, if you’re looking for some quick cash, consider using a cash advance app like Earnin.

You can borrow up to $100 for your first pay cycle, but you can get up to $500 once you’ve proven your responsibility with the app. Best of all, you don’t have to pay anything in interest or fees. The app relies entirely on tips.

That said, debt is never a viable long-term solution for covering financial emergencies. Consistently saving part of your paycheck and building up a healthy emergency fund is the only way to protect yourself against unexpected expenses.

If you’re an Oklahoma resident who needs help getting out of debt to a predatory lender and rebuilding your finances, DebtHammer can help. Contact us today to request a free quote.