Payday lending is infamous in America for its predatory nature, but the industry is still present in many parts of the country. The federal government leaves it up to individual states to regulate their payday lenders, and each one has a unique approach. Here’s what you should know about the Kansas payday loan laws if you live in the Sunflower State.

Table of Contents

Payday lending status in Kansas: Legal

There have been many legislative pushes to limit the payday loan industry in Kansas over the years, but most of them have failed. Payday lending is still legal in Kansas under the current state laws in its traditional form. Lenders can charge interest rates well into the triple digits on loans as short as seven days.

Statute 16a-2-404 governs payday loans for the general populace, while 16a-2-405 contains minor supplemental protections for military members, such as a ban on wage garnishment to collect against them.

READ MORE: States where payday loans are illegal

Stuck in payday debt?

If you’re a Kansas resident, DebtHammer may be able to help.

Loan terms, debt limits, and collection limits in Kansas

- Maximum loan amount: $500

- Maximum Interest Rate (APR): 782% (on a 7-day loan)

- Minimum loan term: Seven days

- Maximum loan term: 30 days

- Number of rollovers allowed: None

- Number of outstanding loans allowed: Two per lender

- Cooling-off period: Lenders can’t give more than three loans to any one borrower within 30 days

- Finance charges: 15% of the amount of the cash advance. Late charges no more than 3% per month for balances outstanding after the maturity date.

- Collection fees: One non-sufficient funds (NSF) fee up to $30

- Criminal action: Prohibited

The payday loan trap is rooted in high interest rates, short repayment terms, and consistent rollovers. When borrowers don’t have enough time to come up with their massive loan payments, they pay an indefinite series of fees or take out another loan to push back the due date and stay afloat.

Unfortunately, the Kansas payday loan laws do virtually nothing to prevent this trap. Feel free to take a look at the original legislation for more details.

READ MORE: Kansas debt relief and resources to help

Kansas payday loan laws: How they stack up

Kansas is one of the thirty or so states that still allow the payday loan industry to operate largely unchecked within their borders. They’re in a comfortable majority, as only around a third of the United States have effective restrictions on payday lending.

Payday lenders have a well-deserved reputation for resisting the efforts to regulate them into submission. They make a lot of money from their operations, and they’re not afraid to use it to lobby for their cause. Kansas is a great example, as many attempts to restrict the industry have failed.

Here’s a deeper dive into the Kansas payday loan laws to help you compare them to other states.

READ MORE: How to get out of a payday loan nightmare

Maximum loan amount in Kansas

The Kansas payday loan laws prohibit lenders from giving out a payday loan for more than $500. Unfortunately, this limit is on individual loans only, not in the aggregate. Lenders can give two loans to a borrower at once, so someone could theoretically have up to $1,000 in payday loan debt per lender.

Payday lenders do not have to investigate the extent to which their borrowers are in debt with other lenders either. As a result, borrowers can take out additional payday loans from new providers to keep up with their other accounts.

What is the statute of limitations on a payday loan in Kansas?

A statute of limitations is the amount of time a debt collector has to sue you for unpaid debts. When it expires, courts can no longer enforce orders against you to pay the outstanding balance.

In Kansas, the statute of limitations for breach of written contracts, including payday loans, is five years.

READ MORE: Payday loan consolidation and relief that works

Rates, fees, and other charge limits in Kansas

Kansas payday lenders can require finance charges no higher than 15% of the balance of the loan. Don’t confuse that with a 15% interest rate.

On a $500 loan, 15% of the balance is $75. Depending on the repayment term, that can work out anywhere from 183% APR to 782% APR. On a typical two-week payday loan, it’s roughly 391%.

Fortunately, beyond this base finance charge, lenders can’t charge many other fees. There are only two exceptions.

First, there’s an allowance for a single returned funds fee up to $30 for payday loans secured by a post-dated check. Generally, lenders must disclose this charge, and borrowers must agree to it before the transaction.

Second, lenders can charge a fee equal to 3% of the outstanding loan balance after the maturity rate if the borrower does not repay their loan.

For example, say you take out a $300 loan with a two-week repayment term. If you don’t pay anything back on the maturity date, they can charge you $9 every month until you pay it back in full.

Maximum term for a payday loan in Kansas

Payday loans have a maximum term limit of 30 days in Kansas. They can also have repayment terms as low as seven days, but most will be for two weeks or fourteen days.

The Kansas payday loan laws prohibit lenders from offering refinances or rollovers to their borrowers. You can’t pay a loan that falls under Statute 404 with another loan of the same type from the same lender. Of course, borrowers can always take out a loan from another creditor and extend the term almost indefinitely.

How many payday loans can you have in Kansas?

Kansans can have two payday loans simultaneously, but if you need more than one, you’ll likely have to use a different lender. Though payday lenders don’t report loans to the three major credit bureaus, they have their own reporting system. So, if you already have a couple of outstanding payday loans — or have defaulted on a previous payday loan — the new lender will typically be aware of your other loans.

There’s also no overall limit to the number of payday loans you can have, so once you pay off your original loan, you’re immediately eligible for a new loan. However, this isn’t recommended.

READ MORE: Can you have multiple payday loans?

Are tribal loans legal in Kansas?

Native American tribes are sovereign nations in the United States. That means they’re generally immune to state regulations and it’s hard to sue them for breaching the laws of the states they reside in, though they usually follow applicable federal laws.

Tribal lenders are a type of short-term loan provider that partners with Native tribes to try and share in their tribal immunity. They use that as an excuse to sidestep the regulations meant to protect consumers, such as the rate restrictions on payday loans.

Using the standard of sovereign immunity, tribal loans are technically legal in Kansas. There are no prohibitions on offering lending services out of a Native American reservation. However, many of these lenders are not licensed by Kansas’ Office of the State Bank Commissioner, so the loans may not be legally collectible.

Kansas residents can search here to determine whether their lender is appropriately licensed.

READ MORE: Is my payday loan lender licensed?

Consumer information

The Kansas Office of the State Bank Commissioner regulates the providers of financial services in the state. Supervised lenders, including payday lenders, fall under their jurisdiction.

The office investigates financial institutions that violate regulations and can take punitive action against them, including imposing fines or disbanding the organization. Additionally, it offers educational programs on finance to help consumers protect themselves.

READ MORE: How to get out of high-interest tribal loans

Where to make a complaint

The Kansas Office of the State Bank Commissioner is the best place to register a complaint about illegal payday lending activities within the state. Here’s the contact information:

- Regulator: Kansas Office of the State Bank Commissioner – Division of Consumer & Mortgage Lending

- Address: 700 SW Jackson St #300, Topeka, KS 66603

- Phone: 785-380-3939 or 1-877-387-8523 (toll free)

- Link to website: https://www.osbckansas.org/consumers/file-a-complaint

Consumers can also submit a complaint to the Consumer Financial Protection Bureau (CFPB). They are the federal government’s organization dedicated to helping consumers with financial issues, including problems with payday lenders.

Number of Kansas consumer complaints by issue

These statistics are all according to the CFPB Consumer Complaint Database.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 35 |

| Struggling to pay your loan | 32 |

| Can’t contact lender | 21 |

| Problem with the payoff process at the end of the loan | 8 |

| Received a loan you didn’t apply for | 8 |

| Problem when making payments | 7 |

| Can’t stop charges to bank account | 7 |

| Incorrect information on your report | 5 |

| Payment to account not credited | 5 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 5 |

| Problem with additional add-on products or services | 3 |

| Applied for loan/did not receive money | 3 |

| Getting the loan | 3 |

| Vehicle was repossessed or sold the vehicle | 2 |

| Unable to get your credit report or credit score | 1 |

| Vehicle was damaged or destroyed the vehicle | 1 |

Source: CFPB website

The most complained about lender in Kansas: CURO Group Holdings

There have been more complaints about CURO Group Holdings than any other lender in Kansas since 2013. It’s the parent company for a half dozen different brands in the United States, including:

- Speedy Cash

- Rapid Cash

- Verge Credit

- Opt +

- Avio Credit

- Revolve Finance

Except for Opt + and Revolve Finance, which offer prepaid debit cards and online banking services, all of these brands provide payday or high-interest installment loans.

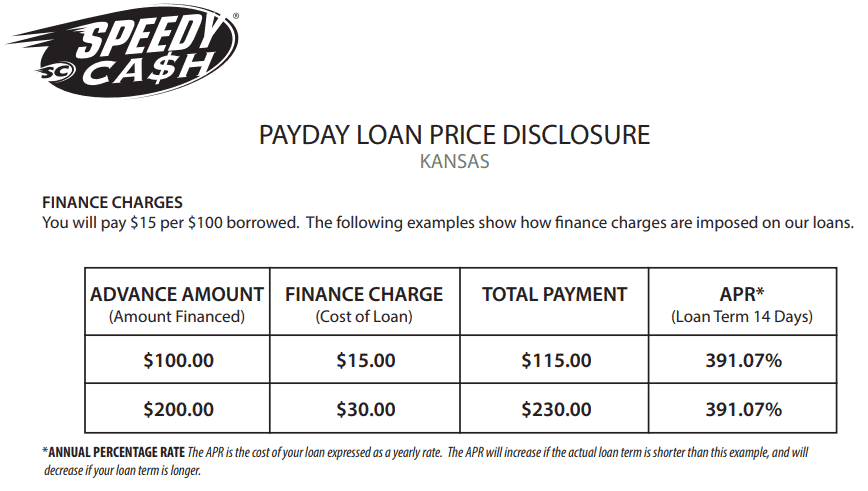

For example, Speedy Cash is one of the largest payday loan providers in the country. In Kansas, they charge the maximum allowable under the law.

You’ll pay $15 for every $100 you borrow, and if your check bounces due to insufficient funds, you’ll pay a $30 NSF fee. On their typical two-week loan, the APR is 391%.

Avio Credit, while not a payday lender, offers lines of credit that are almost as expensive. They offer accounts with limits between $1,000 and $2,500 that have APRs of 139%.

If you need a loan in Kansas, it’s probably best to do business with a non-CURO brand lender.

Most common complaints about CURO Group Holdings

| Complaint Reason | Count |

| Can’t contact lender | 5 |

| Received a loan you didn’t apply for | 5 |

| Charged fees or interest you didn’t expect | 4 |

| Struggling to pay your loan | 3 |

| Can’t stop charges to bank account | 3 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 2 |

| Problem with the payoff process at the end of the loan | 1 |

| Payment to account not credited | 1 |

| Vehicle was damaged or destroyed the vehicle | 1 |

| Vehicle was repossessed or sold the vehicle | 1 |

Source: CFPB website

The most common issues consumers have with CURO Group Holdings are an inability to contact the lender and the receipt of unrequested loans. Both of these speak volumes about the company.

First and foremost, a lender should always make themselves reasonably available to borrowers. In an arrangement where hundreds or even thousands of dollars are on the line, make sure you work with a lender with a strong customer service program. Anything less is a dangerous gamble.

Even worse than CURO’s problematic customer service is its practice of initiating loans without consumer consent. It might seem unbelievable, but the CFPB has confirmed that it’s a practice many predatory lenders engage in to generate sales.

For example, they took punitive action against the institution GreenSky in 2021 for facilitating loans to thousands of consumers without proper authorization. They had to cancel $9 million in loans, pay $2.5 million in penalties, and implement strict new procedures to prevent future offenses.

If you’re in debt to a CURO Group brand such as Speedy Cash because they initiated a loan without your consent, don’t hesitate to report them to the Kansas Office of the State Bank Commissioner.

Top 10 most complained about payday lenders

| Lender | No. of complaints since 2013 | Primary complaint reason |

| CURO Intermediate Holdings | 26 | Can’t contact lender |

| Enova International, INC. | 15 | Struggling to pay your loan |

| Harpeth Financial Services, LLC (out of business) | 8 | Charged fees or interest you didn’t expect |

| Populus Financial Group, Inc. | 6 | Can’t contact lender |

| Risecredit, LLC | 5 | Charged fees or interest you didn’t expect |

| CNG Financial Corporation | 5 | Charged fees or interest you didn’t expect |

| Select Management Resources, LLC (out of business) | 5 | Struggling to pay your loan |

| Advance America, Cash Advance Centers, Inc. | 5 | Can’t contact lender |

| QC Holdings Inc | 4 | Can’t stop charges to bank account |

| Onward Credit Holdings, LLC (no website listed) | 3 | Struggling to pay your loan |

Source: CFPB website

CURO Group Holdings and its subordinate brands aren’t the only problematic lenders in Kansas. The payday loan industry operates freely in the state, and the majority of the other top ten least wanted lenders in Kansas are also payday loan providers.

Unsurprisingly, the most common complaint consumers have about their products is the lack of affordability. 60% of complaints are about issues paying the loan or keeping up with their unexpectedly high interest rates.

If you’re struggling to stay afloat financially because of payday loan debt, DebtHammer can help. Contact us today for a free quote, and we’ll help you escape the payday debt trap once and for all.

Payday loan statistics in Kansas

- Kansas ranks as the 31st state for the most overall payday loan complaints.

- Kansas ranks as the 22nd state for the most payday loan complaints per capita.

- There have been 18,281 payday loan-related complaints made to the CFPB since 2013―146 of these complaints originated from Kansas.

- The estimated total population in Kansas is 2,913,314 people.

- There are 5.0115 payday loan complaints per 100,000 people in Kansas.

- The second-most popular reason for submitting a payday loan complaint is “Struggling to pay your loan.”

READ MORE: Payday loan debt statistics

Historical timeline of payday loans in Kansas

The Kansas payday loan laws have been lenient toward the industry for years, but there have been several attempts to regulate them into submission. Here are the highlights:

- 1991: SB 363 represents the first acknowledgment of the excessive payday loan interest rates in Kansas, which reached up to 1,600% at the time. Unfortunately, the bill fails.

- 1992: The Senate reconsiders SB 363 after adding amendments via HB 2749, but it again fails at the end of the session.

- 1993: HB 2197 passes, which limits payday loans for the first time in Kansas. It imposes a 30-day term maximum and caps finance charges at 10% of the loan balance, among other things.

- 1999 through 2002: Attempts to limit payday lending via HB 2193, HB 2877, and SB 272 fail. However, SB 301 passes, which eliminates interest rate caps on consumer loans.

- 2004: HB 2685 passes. It establishes a 7-day minimum term, $500 maximum balance, and 3-loan limit for payday loans.

- 2007 through 2008: SB 217, HB 2244, and HB 2717 all fail. Each of them included various forms of payday loan restrictions.

- 2013 through 2019: SB 30, HB 2036, SB 100, HB 2695, SB 234, HB 2267, HB 2254, and HB 2363 fail. Once again, all of them included various restrictions on payday lending.

- 2021: Twin bills HB 2189 and SB 218 are pending. They would cap interest rates at 36%, effectively eliminating payday loans.

As you can see, Kansas has had a particularly tough time getting payday loan regulations to stick. Only time will tell if the current legislation will pass and put payday loans away for good.

Flashback: A Kansas payday loan story

It might not be a flashback to very long ago, but this story is all the more relevant for its recency. At the beginning of 2021, the State Legislature’s House Committee on Judiciary introduced HB 2189.

It contains legislation that would limit the interest rate on payday loans to 36%, which is the standard limit for eliminating problematic payday lending across the country. The bill has received praise for its nature as a productive compromise for both lenders and consumers.

Notably, Representative Jim Kelly, a Republican who has been one of the primary roadblocks against payday loan restrictions for the last decade, has expressed positive sentiments toward it.

He’s been chair of the Kansas House’s financial institutions committee since 2011 and has repeatedly expressed disinterest in regulating payday lending. However, Mr. Kelly has been optimistic about this latest bill, saying:

“It has more positives than any of the ones that I can remember seeing before. This is one that I think is more workable than some of the ones that have come over the past years that I’ve been here.”

Unfortunately, due to recess, no further action on this measure is likely until at least 2022. If you’re a Kansas resident and recognize the predatory nature of these loans, consider showing your support for these bills. Reach out to legislators and voice your opinion — it makes a difference. You can even email Mr. Kelly directly at [email protected].

The bottom line: Should you take out a payday loan in Kansas?

Payday lending is a predatory form of financing that consistently traps borrowers in a vicious cycle of debt. The Kansas payday loan laws do little to protect consumers against them, so it’s best not to take out a payday loan in the state.

If you have bad credit and need affordable financing for a few hundred dollars or less, consider using a cash advance app like Earnin, Dave, or Even instead of a payday loan. Most don’t charge interest or check your credit, so you can use them to get back on your feet safely.