The federal government imposes few restrictions on payday lending and gives each state the right to create its own rules instead. Despite the controversy surrounding the industry, many parts of the country still let the predatory practice continue. Here’s what you need to know about the Michigan payday loan laws if you live in the state.

Table of Contents

Payday lending status in Michigan: Legal

Payday loans are still legal in Michigan. The Deferred Presentment Transaction Act, which was passed in 2005, regulates payday lenders in Michigan. It limits principal amounts, repayment terms, and finance charges for payday loans, but it’s not enough to prevent the payday loan trap.

READ MORE: States where payday loans are illegal

Stuck in payday debt?

If you’re a Michigan resident, DebtHammer may be able to help.

In 2022, Michiganders for Fair Lending proposed a ballot initiative that would have capped payday loan annual interest rate and service fees in Michigan at 36%. The measure also would have allowed the state’s attorney general to prosecute lenders who violated the rate cap. Unfortunately, the measure failed to get enough support to earn a spot on the November ballot.

Loan terms, debt limits, and collection limits in Michigan

- Maximum loan amount: $600

- Interest Rate (APR): 407% APR on a 14-day, $100 loan

- Maximum loan term: 31 days

- Number of rollovers allowed: N/A

- Maximum number of outstanding loans allowed: Two

- Cooling off period: None

- Installment: No

- Finance charges: 11% to 15% of each $100 in principal plus a database verification fee

- Collection fees: $25 non-sufficient funds (NSF) fee, adjusted for inflation

- Criminal action: Prohibited

Payday loans are primarily controversial because they tend to trap people in a cycle of debt. They have shockingly high interest rates, and borrowers have such a short amount of time to pay their balances back that they often fail.

When borrowers can’t pay their debts, their lenders often charge them a rollover fee to push back the due date or get a payday loan from another lender to pay it off.

Unfortunately, the Michigan payday loan laws don’t do much to prevent that cycle. Most importantly, they allow for interest rates well into the triple digits on short-term loans.

READ MORE: Michigan debt relief and resources

Michigan payday loan laws: How they stack up

Even though payday loans usually do more harm than good to the borrowers who use them, they’re still legal in most parts of the country. Roughly two-thirds of the United States explicitly allow payday loans or fail to implement legislation that effectively eliminates them.

Unfortunately, Michigan is one of the states with laws that impose restrictions on the industry but fail to destroy it. Here’s a deeper look at the rules in the state, which should help you understand how they compare to the rest of the country.

READ MORE: How to get out of a payday loan nightmare

Maximum loan amount in Michigan

The most payday loan debt you can have in Michigan is $600, whether your debt is concentrated in a single loan or spread across multiple. You can have up to two payday loans, though they must be from different lenders.

The $600 restriction applies only to the principal amount of the loan, not the face amount of the post-dated check. That means the fees you pay don’t factor into the restriction.

For example, say you borrow $300 from a payday lender. You can get a loan for another $300 from a second payday lender at the same time. The amount the first lender charges you is irrelevant to whether or not you can qualify for the second.

READ MORE: Payday loan consolidation and relief that works

What is the statute of limitations on a payday loan in Michigan?

Statutes of limitations restrict the length of time an injured party has to file a claim to recover damages. In the case of payday loans, it’s the length of time that lenders have to sue borrowers for their delinquent debts.

The statute of limitations on all debt in Michigan, including payday loans, is six years. Once that passes, you can use the age of your account as a defense against any lender or debt collector that tries to take you to court for it.

Rates, fees, and other charge limits in Michigan

The Michigan payday loan laws let lenders charge service fees based on the loan amount. The charges can’t exceed the following amounts:

- 15% of the first $100 borrowed

- 14% for the second $100 borrowed

- 13% for the third $100 borrowed

- 12% for the fourth $100 borrowed

- 11% for the fifth and sixth $100 borrowed

For example, say you take out a payday loan for $600. Your payday lender can (and would) charge you a maximum of $76 total in service fees. If you were to take out two payday loans for $300, you’d pay $42 for each one.

There may be a small database verification fee, but it’s usually negligible. For example, Check Into Cash charges a $0.61 verification fee.

At the due date of a payday loan, payday lenders usually either deposit a post-dated check from the customer or debit their account directly for the loan amount plus the service fees.

If there are insufficient funds in the bank account to cover the check, the payday lender can charge the borrower NSF fees up to $25, though that number adjusts for inflation over time. In 2021, it’s up to $28.66.

Maximum term for a payday loan in Michigan

The maximum loan term for payday loans in Michigan is 31 days. There’s no required minimum, but a two-week term is the standard anyway.

The Michigan payday loan laws also include provisions for a repayment plan if a borrower takes out eight or more payday loans in 12 months.

The borrower has to request it within 30 days of failing to pay their loan and pay a fee of $15, adjusted annually for inflation. The repayment plan must have three equal installments in line with the borrower’s paycheck dates.

How many payday loans can you have in Michigan?

Michigan residents are limited to up to two payday loans at one time. Though payday lenders don’t report loans to the three major credit bureaus, they have a reporting system of their own. So, if you already have a couple of outstanding payday loans — or have defaulted on a previous payday loan — the new lender will typically be aware.

There’s also no overall limit to the number of payday loans you can have, so once you pay off your original loan, you’re immediately eligible for a new loan. However, this isn’t recommended.

READ MORE: Can you have multiple payday loans?

Are tribal loans legal in Michigan?

Native American tribes are sovereign nations in the United States. That means they’re generally immune to state regulations and it’s hard to sue them for breaching the laws of the states they reside in, though they usually follow applicable federal laws.

Tribal lenders are a type of short-term loan provider that partners with Native tribes to try and share in their tribal immunity. They use that as an excuse to sidestep the regulations meant to protect consumers, such as the rate restrictions on payday loans.

Tribal lenders are technically legal in Michigan. There are no prohibitions on offering lending services out of a Native American reservation. However, Michigan has taken a stance against the use of tribal status to ignore regulations.

Unfortunately, tribal lenders still have a presence in the state. It’s even harder to eliminate them than traditional payday lenders since it takes a much more drawn-out legal process for authorities to impose sanctions on them.

READ MORE: Is my payday lender licensed in my state?

Consumer information

The Michigan Department of Insurance and Financial Services is in charge of regulating the state’s payday lenders. Its goal is to promote consumer access to safe insurance and financial services while fostering economic growth in both industries.

The Department has two offices that are relevant to consumer affairs. The first is the Office of Consumer Finance. It’s responsible for licensing entities and enforcing the laws that affect financial service businesses, including payday lenders. The second is the Office of Consumer Services, which manages consumer complaints.

Where to make a complaint

The Michigan Department of Insurance and Financial Services is the best place for consumers to lodge a complaint about any illegal activity that you witness from a payday lender. Here’s the contact information:

- Regulator: Michigan Department of Insurance and Financial Services

- Address: 530 W. Allegan Street, 7th Floor, Lansing, Michigan, 48933

- Phone: 517-284-8819

- Fax: 517-284-8837

- Link to website: https://www.michigan.gov/difs/0,5269,7-303-12902_12907—,00.html

Consumers can also submit a complaint to the Consumer Federal Protection Bureau (CFPB). The federal organization aims to help consumers with financial institutions, including problematic payday lenders.

Number of Michigan consumer complaints by issue

According to the CFPB Consumer Complaint Database.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 139 |

| Can’t contact lender or servicer | 55 |

| Struggling to pay your loan | 46 |

| Problem with the payoff process at the end of the loan | 33 |

| Problem when making payments | 29 |

| Received a loan you didn’t apply for | 26 |

| Loan payment wasn’t credited to your account | 17 |

| Can’t stop withdrawals from your bank account | 15 |

| Getting the loan | 12 |

| Applied for loan/did not receive money | 10 |

| Incorrect information on your report | 10 |

| Was approved for a loan, but didn’t receive money | 8 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 8 |

| Vehicle was repossessed or sold the vehicle | 4 |

| Problem with additional add-on products or services | 4 |

| Problem with a credit reporting company’s investigation into an existing problem | 2 |

| Improper use of your report | 1 |

Source: CFPB website

The most common complaint among Michigan consumers is that their lenders charge them unexpected fees or interest. That’s common in states that allow payday lending, for several reasons.

For example, payday lenders often hide their costs using underhanded tactics like posting it in a smaller font than the rest of a loan agreement or expressing it as a flat fee instead of an APR that you can compare to other products.

The most complained about payday lender in Michigan: CNG Financial Corporation

The most commonly complained about lender in Michigan is CNG Financial Corporation. CNG Financial Corporation is the parent company of Check ‘n Go, one of the largest payday lenders in the country.

CNG Financial Corporation also owns Allied Cash Advance, Tempoe, and Smart Pay. The latter two provide no-credit financing for retail products, but the first is another payday lender.

As the parent company of two payday loan businesses, it’s no surprise that people complain about CNG Financial Corporation so often.

Check n’ Go offers loans up to $600 with loan repayment terms between 7 and 31 days, which is in line with state law. Allied Cash Advance declines to share their loan terms, but they likely comply with the Michigan payday loan laws, too.

The fact that borrowers still have so many issues with both lenders is further evidence that the state regulations aren’t strict enough.

Most common complaints about CNG Financial Corporation

| Complaint Reason | Count |

| Can’t contact lender or servicer | 11 |

| Charged fees or interest you didn’t expect | 7 |

| Loan payment wasn’t credited to your account | 6 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 3 |

| Struggling to pay your loan | 2 |

| Applied for loan/did not receive money | 2 |

| Received a loan you didn’t apply for | 2 |

| Incorrect information on your report | 2 |

| Can’t stop withdrawals from your bank account | 2 |

| Problem with the payoff process at the end of the loan | 1 |

| Was approved for a loan, but didn’t receive money | 1 |

Source: CFPB website

The most common complaint borrowers have about CNG Financial Corporation is that they can’t contact the lender. That’s surprising since the top complaint in the state overall by far is that lenders charge unexpected fees or interest.

The communication problems people have with CNG Financial must be significant for them to be more problematic than the exorbitant loan costs.

The Better Business Bureau’s profile for Check ‘n Go confirms that they are. CNG’s subsidiary has a 1/5 star rating and 145 complaints. Here’s a summary of the most common consumer issues:

- Poor communication about loans and collection matters

- Not being able to get help with payment issues

- The company mistakenly double-withdrawing payments

As you can see, the complaints on the BBB profile align with the communication problems that consumers report to the CFPB.

Top 10 most complained about payday lenders

| Lender | No. of Complaints |

| CNG Financial Corporation | 39 |

| Big Picture Loans, LLC | 39 |

| LDF Holdings, LLC | 18 |

| BlueChip Financial | 15 |

| Delbert Services | 14 |

| Enova International, Inc. | 13 |

| GVA Holdings, LLC | 13 |

| Tribal Lending Enterprise, Inc. | 12 |

| WLCC | 9 |

| Advance America, Cash Advance Centers, Inc. | 9 |

Source: CFPB website

CNG Financial Corporation isn’t the only lender that Michigan consumers have a lot of complaints about, but that’s to be expected in a state with such loose payday loan regulations.

In fact, there’s a tie between CNG Financial Corporation and Big Picture Loans, LLC. Both of them are at 39 complaints each. Big Picture Loans doesn’t offer payday loans, but their short-term installment loans still have triple-digit interest rates.

If you’re struggling financially because of one or more of these lenders, you can still turn your financial situation around. Contact DebtHammer for a free quote, and we’ll help you get out of the payday loan trap for good.

The most complained about tribal lender in Michigan: Big Picture Loans, LLC

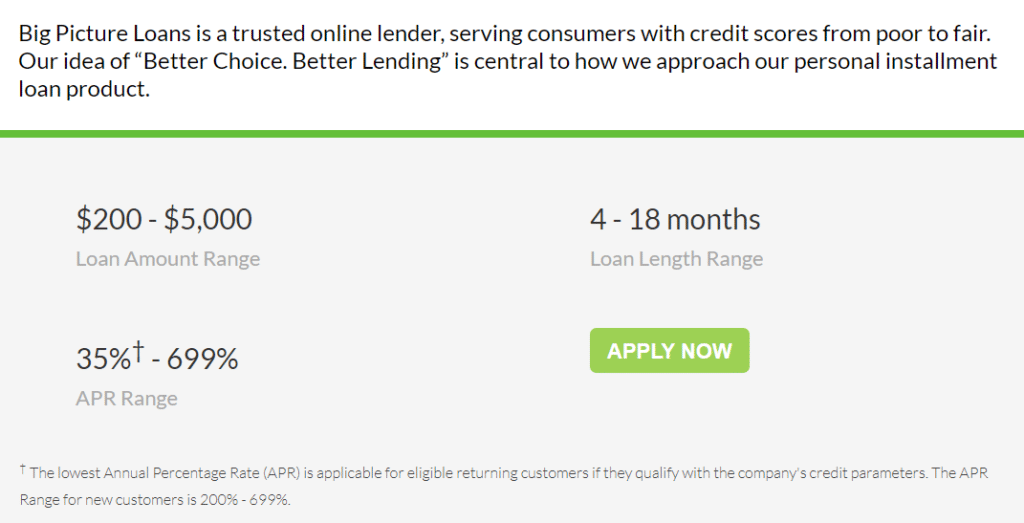

Big Picture Loans LLC is the most complained about tribal lender in Michigan. It operates as a subsidiary of the Lac Vieux Desert Band of Lake Superior Chippewa Indians and offers loans online.

Big Picture Loans, LLC offers installment loans that range from $200 to $5,000 in principal, with loan terms from 4 to 18 months. The interest rate at Big Picture Loans starts at 200% APR for new customers and can be as high as 699%.

Most Common Complaints About Big Picture Loans, LLC:

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 30 |

| Struggling to pay your loan | 4 |

| Received a loan you didn’t apply for | 3 |

| Can’t contact lender or servicer | 1 |

| Getting the loan | 1 |

Source: CFPB website

With 30 occurrences since 2013, the most common complaint among Big Picture Loans’ customers is that the lender charged unexpected fees or interest.

The second-place complaint received a paltry four complaints, but those were also about struggling to keep up with the cost of the loan. Both are understandable since Big Picture Loans’ products are even more expensive than the payday loans in Michigan.

READ MORE: How to get your debt under control now

Payday loan statistics in Michigan

- Michigan ranks as the 14th state for the most overall payday loan complaints.

- Michigan ranks as the 28th state for the most payday loan complaints per capita.

- There have been 18,281 payday loan-related complaints made to the CFPB since 2013―419 of these complaints originated from Michigan.

- The estimated total population in Michigan is 9,986,857 people.

- There are 4.1955 payday loan complaints per 100,000 people in Michigan.

- The most popular reason for submitting a payday loan complaint is “Charged fees or interest you didn’t expect.”

READ MORE: Payday loan debt statistics

Historical timeline of payday loans in Michigan

The Michigan payday loan laws have unfortunately been consistent for the past couple of decades or so. Here’s a look at the few notable events regarding Michigan payday lending in recent years:

- 2005: The Deferred Presentment Act went into effect. It capped payday loans to $600 and prohibited borrowers from taking out more than one loan at a time from the same lender. It also put limits on service fees and repayment terms.

- 2017: Senate Bills 430, 431, and 432 were introduced and would have increased payday loan amounts to $2,500 with a maximum loan term of four years and an APR of 180%. However, they stalled out in the senate.

- 2021: The Michigan House passed bill HB 4004, which would increase the amount of money consumers can borrow up to $2,500 and extend term lengths to 24 months. The bill is currently awaiting Senate approval.

Payday loans are still legal in Michigan in 2021, and it looks like they’ll be around for years to come. Some states have taken measures to regulate the payday loan industry more strictly, but Michigan is heading in the opposite direction with HB 4004.

Flashback: A Michigan payday loan story

One of the best ways to put the toll that payday loans have on consumers in perspective is to look at individual stories. It’s easy to dismiss predatory loans when they’re an abstract issue, but they affect real people.

For example, in 2013, a woman in Lansing, Michigan reported that she saw Western Sky’s television ad and decided to borrow from them. She was already struggling under the burden of two payday loans and thought the new lender might be a more sustainable solution.

She took out a $2,525 tribal loan and successfully used it to pay off her payday loans. It ended up costing her more than $11,000 in interest over the next four years.

Fortunately, the Michigan Department of Insurance and Financial Services filed a claim against the companies, and the suit settled in 2015.

The settlement sent out collective refunds of $2.2 million to eligible borrowers, canceled more than $15 million worth of loans, and reduced other loan balances by over $6 million. As a result, Western Sky Financial has not operated in the state since.

The bottom line: Should you take out a payday loan in Michigan?

Payday loans trap borrowers in debt more often than they help them solve their financial problems, and the Michigan payday loan laws do little to protect consumers from that risk. Triple-digit interest rates and deceptive practices are still commonplace.

As a result, taking out a payday loan in Michigan, or anywhere else for that matter, should always be a last resort. When you’re already struggling to make ends meet, payday loans usually just add an escalating series of loan payments to your financial burden.

In fact, adding more debt to your finances is rarely a sustainable long-term solution. You’re much better off looking for more or better-paying work and cutting back on your expenses as much as you can, or trying a lower-cost cash advance app, like Earnin.

If you’ve taken out a payday loan in Michigan and need help dealing with a predatory lender, contact DebtHammer today. We can help you escape the payday loan cycle and get your finances back on the right track.