Payday loans can destroy your finances in a matter of weeks. Lenders know that most payday loan borrowers won’t be able to repay their loans in full from their next paycheck. More than 80% of those loans must be rolled over into new loans, with additional fees.

Before you know it, you’re stuck in the payday loan debt trap. But payday loan settlement can be a way to break the cycle.

Table of Contents

Our take

- Debt settlement can get rid of your payday loan debt for good in as little as a year

- You’ll no longer have to pay the high interest rates and finance charges that are notorious in the payday lending industry

- A payday loan settlement company will help stop payday lenders’ automatic debits from your bank accounts

- You’ll probably need to have at least $1,000 in payday loan debt to enroll in a payday loan debt settlement program

- A legitimate debt settlement company will not charge you any upfront fees

What you need to know about payday loan settlement

1. It’s not as expensive as you think

Hiring a team of experts to help you get out of debt sounds expensive. A typical payday loan settlement company will charge a fee between 15% to 27% of your total payday debt. However, it’s important to remember that they are expert negotiators, and they will reduce the amount of money you will have to repay your lenders. And if they’re unsuccessful, you don’t pay anything at all.

A representative of Global DS Group LLC, a Florida-based debt relief company, says their average client repays about 50% to 60% of the total debt owed.

For context, an enrolled debt of $3,200 that’s settled for $1,890.98 would be a repayment of about 58%.

According to a study commissioned by the American Association for Debt Resolution, a typical payday loan settlement customer will save 32% of their total enrolled debt on average after fees. This means that the average customer who enrolls $1,000 in the program will end up repaying a total of $680 after fees for a savings of $320.

Note: The American Association for Debt Resolution was previously known as the American Fair Credit Council.

READ MORE: How debt settlement works

2. Other debts may also be eligible

If you’re saddled with payday loan debt, it’s likely that you’ve also accumulated other unsecured debts, such as credit card debt or even personal loans. These can sometimes also be enrolled in a payday loan settlement program.

Pro tip: Secured debts like car loans and home loans, which are secured with collateral, are not eligible.

Payday loan settlement won’t work for every type of unsecured debt. For example, alimony, child support and back taxes are not eligible for settlement.

READ MORE: Are payday loans secured or unsecured debt?

3. Payday loan settlement is different from payday loan consolidation

Though a payday loan resolution program may offer both services, they aren’t the same. Payday loan consolidation involves getting a new loan with a lower interest rate and using that loan to repay your payday loan debts. Though you can work with a payday loan relief company to get a consolidation loan, you can also apply for these loans through a bank, credit union or online lender.

Pro tip: Some companies can simplify the loan application process because they can check with several lenders at once to find out whether you’re eligible for a debt consolidation loan.

READ MORE: Debt settlement vs. debt consolidation

4. A repayment plan will be set up for you

The company will set you up with a payment plan when you enroll in a program. You will make a monthly payment to the company, and that money will be held for you in a designated bank account. That money will be used to make the payments when settlements are reached. The repayment period will vary based on the amount of money accrued in the account. There may be a fixed repayment period, or the settlement may be paid in one lump sum.

5. You could be debt-free in 12 to 18 months

Settling payday loans takes time, but you could be out of debt in as little as a year, depending on the number of loans you have and the total amount you enroll. However, you don’t have to handle the negotiations on your own, so all you need to worry about during that time is making a monthly payment into an escrow account and officially approving the settlements.

READ MORE: Top payday loan relief companies

How payday loan settlement works

When you hire a payday loan settlement company, you will be asked to stop making any payments to your payday lenders. You will likely cease contact with them altogether.

The reason is simple: Payday lenders won’t be willing to negotiate settlements until the lender has given up on collecting your debt. This won’t happen until it’s past due by between three to six months. After that, settlement negotiations will begin.

Think about it. Payday loan lenders have no incentive to settle if you pay them a new rollover fee every two weeks. They will need to get the idea that you don’t plan to pay them another cent. At that point, they’re usually willing to accept payments for less than the total amount you owe, particularly since there’s a good chance that you’ve already paid more in fees than the original amount you borrowed.

When you stop paying your payday lenders, you will start making a monthly deposit to the debt settlement company. They will hold that money in a designated bank account and use it to make settlement payments.

READ MORE: What does it mean when debt is charged off

Pro tip: Late fees will accrue when you stop making payments, and you may start getting threatening calls. Your credit score may fall if your payday loan debt is turned over to a debt collection agency. Don’t panic. The damage will be temporary and your payday loan settlement company will help you deal with debt collectors.

Are payday loan settlement companies worth the cost?

Payday loan settlement companies are the middleman between you and your creditors or debt collectors. Since they handle the negotiations, you will save time and aggravation. They are experienced negotiators and already have an idea of which lenders are willing to negotiate.

The Global DS Group official says that if you’re stressed or in denial about your payday loan debt, hiring a payday loan settlement company will provide peace of mind and the ease of making one monthly payment.

“That’s a huge difference,” she says.

It could also help free up some extra time that can be spent earning extra money by working overtime or starting a side hustle you enjoy.

After all, you’ll be:

- Paying a lot less to creditors

- Spending less time worrying about money

- Dealing with just one monthly debt payment

- Saving a ton of money

Pro tip: Payday loan settlement companies may also be called payday loan consolidation or resolution companies.

Customized plan

Most payday loan settlement companies will offer a free consultation to assess your financial situation.

They will carefully review your information to determine whether you’re a good fit for debt settlement. If they don’t think payday loan settlement will be effective in your case, this is the point where they will let you know.

Many payday loan settlement companies also offer payday loan debt consolidation services and can instantly check dozens of different loans to learn whether you’re eligible.

Every consultation is different and will be customized around your situation.

Legitimate payday loan settlement companies also work regularly with any number of payday loan companies. They know which lenders are willing to consider settlements.

Look for a company that makes you feel comfortable. You will need to be able to discuss confidential information about your finances.

You don’t pay until you’ve accepted the settlement offer

You must sign off on any payday loan settlements. No payments will be made without your approval. You will not be obligated to accept the terms if you don’t like the offer. And if you decline an offer, you still don’t pay the debt settlement fees. You will not pay any fees until you have agreed to the settlement terms.

Why choose DebtHammer?

- The team at DebtHammer are experts at working with payday lenders. We know which lenders are willing to work with you.

- You will work directly with our team of specialists who are certified by the IAPDA (International Association of Professional Debt Arbitrators)

- We provide access to legal help if problems arise with your case

- Our payday loan settlement program helps clients save an average of 30% of the total enrolled debts after fees

- We have an A rating from the Better Business Bureau and 4.8 of 5 stars on Trustpilot

- We will assess the type of loans you have, whether you meet the qualification criteria and whether we can get results for you. If we don’t think you’re a good candidate for debt settlement, you will not pay a cent

- We don’t charge any upfront fees. You do not pay until we get results. And if your creditors refuse to settle, you won’t pay at all

- We will contact your creditors and put an end to debt collection calls

- You could be debt-free in as little as a year.

- We are passionate about getting you out of debt

- You will get a free consultation when you complete this form

READ MORE: How DebtHammer works

Real DebtHammer results

| Enrolled debt | Settlement amount | Settlement percentage |

| $3,000 | $1,341 | 44.70% |

| $1,000 | $149.36 | 14.94% |

| $2,400 | $1,478.93 | 61.62% |

| $3,400 | $1,055.51 | 31.04% |

| $7,500 | $1,555.32 | 20.74% |

| $1,500 | $983.06 | 65.54% |

| $1,000 | $800 | 80% |

READ MORE: When is debt settlement a good idea?

Don’t worry (too much) about your credit score

Many clients who contact us are worried about the impact on their credit scores. Don’t focus on this. Your credit score is probably already less-than-ideal because otherwise, you would have had better borrowing options than no-credit-check payday loans.

If your score is already low, the damage from payday loan settlement will be less than if you start with a good credit score.

For example:

- 730 could fall to 535

- 630 could fall to 545

- 505 could fall to 470

As you can see, the higher score drops almost 200 points, but the bad credit score drops by just 35.

There are several other factors that will affect your credit score. These include:

- The number of open accounts you have

- Your credit utilization ratio

- The payment status of your other debts

Pro tip: Credit counselors or personal finance experts may tell you that payday loan settlement will hurt your credit score for seven years. This is not accurate.

Payday loan debt is unique. Payday loans don’t appear on your main credit reports at all unless they’ve been sent to collections. If settlements can be negotiated before this happens, there may be no record on your credit report at all. If the debts are sent to collections, they will appear on your credit report as “settled” or “paid in full.” A “settled” notation doesn’t affect your credit score. As soon as the account has been settled, the notice that you have an unpaid account will disappear and your credit score will rebound.

READ MORE: How debt settlement affects your credit score

Pros and cons

A successful payday loan settlement program can have a lot of benefits, but there are a few risks.

| Advantages | Disadvantages |

| You will be debt-free in a year without repaying the full amount you owe | Your payday lender(s) may not be willing to settle |

| No more need for short-term loans with high interest rates | Fees will add up during the process |

| It could prevent debt collection lawsuits | Not all types of debt are eligible |

| It is likely your cheapest path to becoming debt-free | You’ll have to deal with calls from debt collectors and collection agencies at first |

| It will hurt your credit score less than bankruptcy | It could take as long as four years to repay the settled debts |

| It could improve your mental health | You may face income tax consequences |

READ MORE: Debt settlement pros and cons

Pro tip: The Internal Revenue Service (IRS) could count any forgiven debt as taxable income, so you may need to consult a tax professional when tax time rolls around. However, there are often exceptions for borrowers who can show financial insolvency.

Who qualifies for payday loan relief?

Anyone with at least $1,000 in payday loan debt qualifies.

There are a few other considerations:

- You’re facing a legitimate financial hardship

- You never want to see another payday lender

- You’re serious about getting out of debt once and for all

- You can afford the monthly payment you will have to make into your payday loan settlement escrow account

- If your payday loan is already 90 days past due, the process may move more quickly

If any of this sounds familiar, set up a free consultation now.

READ MORE: Are you eligible for payday loan settlement?

You can settle debts on your own

You don’t have to hire a payday loan settlement company to negotiate settlements. You can payday lenders and debt collectors on your own.

The settlement process is the same. However, you will handle the negotiations and settlements.

Payday loan lenders and debt collectors can be unpleasant to deal with, and the process can be time-consuming. You’ll need to be able to devote several hours per week to the process, including research and the actual negotiations. In addition, you’ll also have to have the discipline to deposit enough money into a savings account so you can afford to pay the settlements.

READ MORE: DIY debt settlement

You may not have to repay your loan if it is illegal

Several state laws prohibit payday loans or cap the annual percentage rates payday lenders can charge. In addition, your payday lender must be licensed. If your state’s banking regulator hasn’t licensed your lender, the Consumer Financial Protection Bureau (CFPB) says you may not have to repay your loan.

“It’s illegal to make a loan without a license,” one official with Washington State’s Department of Financial Institutions told the Center for Public Integrity. “If you’re not licensed, it (the loan) is not collectible, and it’s not enforceable.”

Regulators advise that you check with state authorities to see if the loan is illegal. If it is, close your account and talk with a legal professional.

“If a lender is not properly licensed, the loan may be considered illegitimate, says Rick Chahal, a licensed paralegal and legal assistant at Kahlon Law. “The borrower might not be legally obligated to repay the loan.”

READ MORE: States where payday loans are illegal

Payday loan settlement scams

Scammers know that payday loan borrowers are usually desperate for money. That makes them prime targets. You must be constantly wary. Be on the lookout for these warning signs of a payday loan settlement scam:

- You get a call from a payday loan settlement company but never requested one

- The caller refuses to provide contact information for the company

- They require that you pay them a fee upfront

- They guarantee settlements

- They make unrealistic promises, like no credit score impact or instant results

- They cite vague “government debt relief programs”

- There is no Better Business Bureau presence (or a very negative one)

- There are records of lawsuits against the company

When in doubt, contact the Consumer Financial Protection Bureau (CFPB), your state attorney general’s office or another local consumer protection agency to find out whether complaints have been filed against the company.

READ MORE: How to protect yourself from payday loan scams

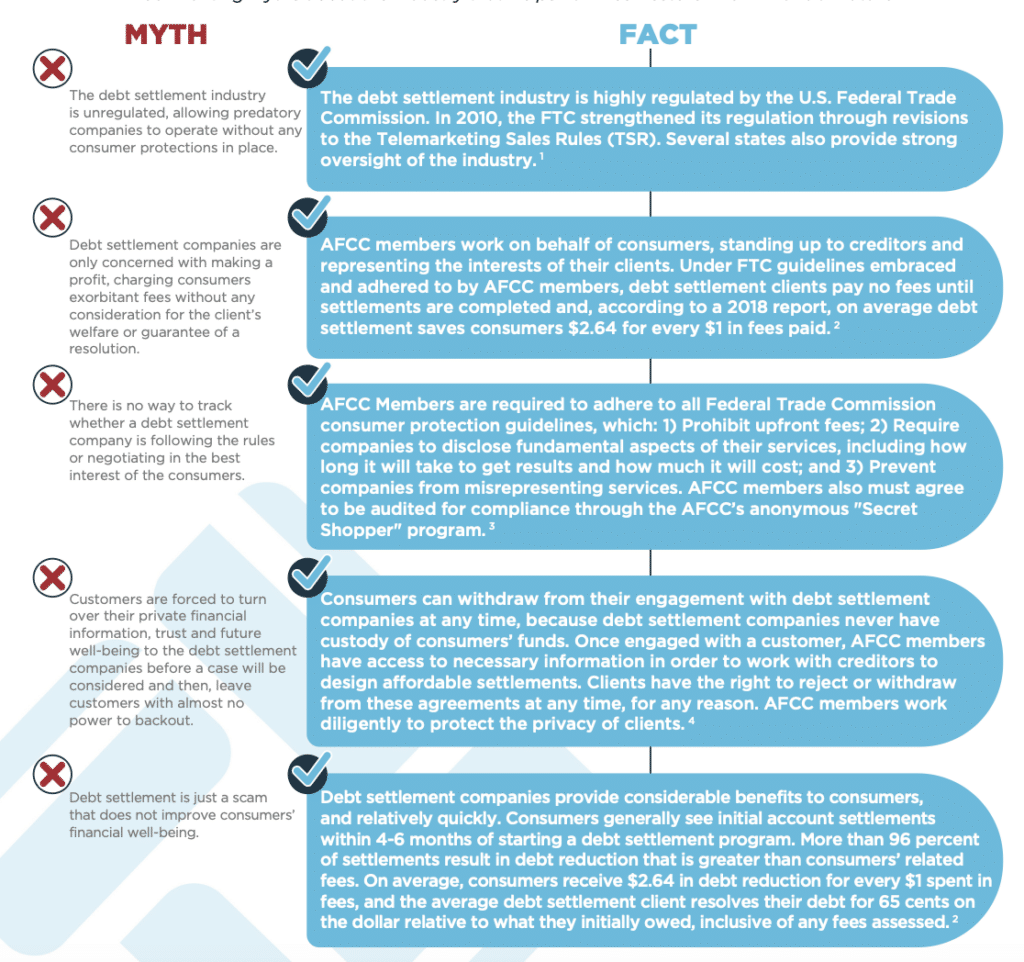

Myths vs. facts

The American Association for Debt Resolution refutes many of the myths about debt settlement:

More debt relief options

- Nonprofit credit counseling

- Payday loan debt consolidation

- Payday Alternative Loans

- Credit card cash advance or balance transfer

- Bankruptcy

READ MORE: Debt settlement vs. Debt Management Plans

The bottom line

Payday loan settlement won’t work for everyone. But if you successfully complete a program, you can break free from the payday loan debt cycle and reset your finances.

Get payday loan help now

At DebtHammer, our goal is for clients to say goodbye to payday loans and lenders. Contact us today to set up a free consultation and see how much you can save.