Payday loans are supposed to be a way for people with bad credit to get fast cash in emergencies. Unfortunately, they often cost so much that they cause more problems for borrowers than they solve. It’s up to each state to create regulations that protect its consumers from the debt these loans represent, and these are the Oregon payday loan laws.

Table of Contents

Payday lending status in Oregon: Legal

Payday loans are legal in Oregon, but they’re significantly less expensive than in many other states. That said, their finance charges still reach annual percentage rates (APRs) in the triple digits, and they can still trap you in a debt you can’t escape.

Despite that fact, many lenders find the Oregon payday loan laws too restrictive and therefore refuse to operate in the state. As a result, the industry has a much weaker presence in Oregon than in other parts of the United States.

You can find the full text of the relevant regulations in the Oregon Revised Statutes Chapter 725 and Chapter 725A.

READ MORE: States where payday loans are illegal

Loan terms, debt limits, and collection limits in Oregon

- Maximum loan amount: $50,000

- Maximum Interest Rate: 36% per year

- Minimum loan term: 31 days

- Maximum loan term: 60 days

- Number of rollovers allowed: Two

- Number of outstanding loans allowed: Any

- Cooling-off period: Seven days

- Finance charges: One-time origination fee of $10 per $100 advanced up to $30.

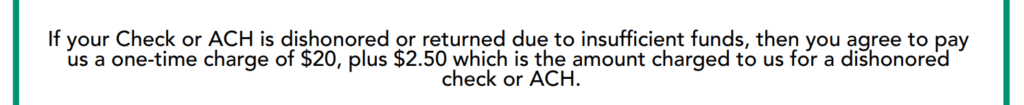

- Collection charges: One $20 nonsufficient funds (NSF) fee per loan transaction.

- Criminal action: Prohibited

The problem with payday loans is that they tend to trap their users in a cycle of debt. The issues begin with their high finance costs, which people often struggle to repay, especially within the two-week repayment term that most payday loans follow.

When borrowers realize they’re not going to be able to afford their debt payment, their payday lenders allow them a reprieve, but it comes at a price. In other words, they let them pay a fee to “roll over” the loan and push back the payment date.

That delays the problem, but it also signals the beginning of the debt trap since the borrower often has to do the same thing the next time. They can repeat that process until they’ve paid their original principal balance several times over without actually getting out of the loan.

The Oregon payday loan laws prohibit some parts of that trap by limiting lenders to two rollovers, but that’s still enough to cause significant financial hardship, especially since there’s not much that regulators can do to enforce the restriction.

READ MORE: Oregon debt relief and resources

Oregon payday loan laws: How they stack up

Despite the evidence indicating that payday loans do more harm than good to their borrowers, many states allow the industry to continue. Payday lenders have a long history of lobbying against attempts to restrict them and evading any legislation that passes.

The Oregon payday loan laws are an interesting case. The industry is still technically legal, but the regulations have made the state significantly less profitable to payday lenders than many others. As a result, they generally opt for more favorable climates.

Here’s a more in-depth explanation of the most significant aspects of their regulations to help you understand how they stack up with other state lending laws.

READ MORE: Payday loan consolidation and relief that works

Maximum loan amount in Oregon

Technically, Oregon defines a payday loan as a loan of not more than $50,000. However, you won’t find a lender in the state that offers payday loans anywhere near that principal amount. In practice, the maximum loan amount in Oregon is generally $300.

The Oregon payday loan laws limit the payday loan finance charges to $10 per $100 of principal up to $30, which disincentivizes lenders from offering more than $300 in principal. Payday lenders never do anything against their own interest, so that’s the most you can usually borrow from a licensed lender.

What is the statute of limitations on a payday loan in Oregon?

The statute of limitations on debt is a law that limits the length of time a creditor or debt collector can sue you to collect the balance. It varies between different states and types of debt. Payday loans are written contracts. They have a statute of limitations of four years in Oregon.

Rates, fees, and other charge limits in Oregon

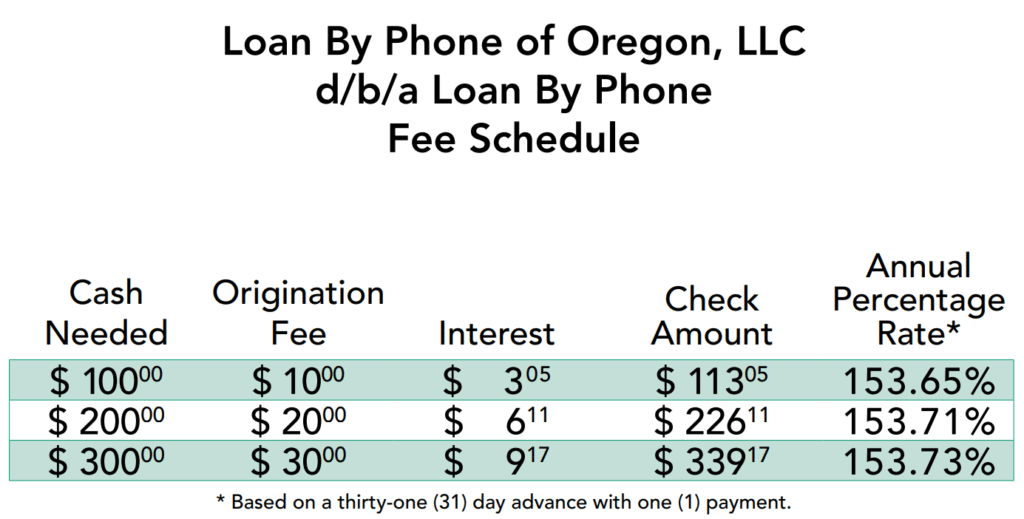

The Oregon payday loan laws allow interest rates up to 36% per year on the principal balance. That doesn’t include the one-time origination fee they charge for the loan. The origination fee can be no more than $10 per $100 in principal up to a maximum of $30.

For example, say you take out a payday loan for $200 repayable in 31 days. Your lender could charge you a $20 origination fee and $6.11 of interest, which is 153.71% APR.

In addition, the lender can charge you a $20 NSF fee if the check or the ACH you use to pay doesn’t clear. They may also charge an extra $2.50 to cover the fee they incur for a dishonored check or ACH.

Maximum term for a payday loan in Oregon

Oregon’s definition of a payday loan includes a line that states the loan agreement must not specify a term of more than 60 days. The legislation also requires that the minimum repayment term be at least 31 days.

Are tribal loans legal in Oregon?

Native American tribes are sovereign nations within the United States, which means the federal government gives them immunity to most state regulations. As a result, it’s difficult to sue them for breaking lending laws.

Tribal lenders share a small percentage of their profits with Native American tribes in exchange for a partnership. That lets them share in their tribal immunity and charge interest and fees significantly higher than state regulations would typically allow without risking a lawsuit.

However, that doesn’t mean that tribal loans are necessarily enforceable. Like any lender, the only way they can force you to pay is by taking you to a state or federal court and winning the case against you.

Fortunately, lenders need a license to offer payday loans in Oregon, and tribal lenders never have them. As a result, they can’t win a court case against you to garnish your wages and force you to pay.

It’s always a good idea to check a lender’s license before doing business with them. You can review Oregon’s list of licensed lenders with the Oregon Division of Financial Regulation.

READ MORE: Is my payday loan lender licensed?

How many payday loans can you have in Oregon?

No law limits the number of payday loans a borrower can have simultaneously, but if you need more than one, you’ll likely have to use a different lender. Though payday lenders don’t report loans to the three major credit bureaus, they do have their own reporting system, so if you already have a couple of outstanding payday loans — or have defaulted on a previous payday loan — the new lender will typically be aware.

There’s also no overall limit to the number of payday loans you can have, so once you pay off your original loan, you’re immediately eligible for a new loan. However, this isn’t recommended.

READ MORE: Can you have multiple payday loans?

Consumer information

The Oregon Division of Financial Regulation is the agency that’s primarily responsible for overseeing the financial industry in the state. That includes banks, collection agencies, consumer finance companies, and payday lenders.

The division’s mission is to protect consumer access to fair products and services through education, regulation, and consumer assistance. It’s part of the Department of Consumer and Business services, the largest consumer protection agency in the state.

They fulfill their mission by investigating consumer complaints, analyzing and monitoring the finances of financial and insurance institutions, licensing companies and professionals, and more.

Where to make a complaint

The Oregon Division of Financial Regulation is the best place to lodge a complaint about a payday lender. Here’s how you can get in touch with them:

- Regulator: Oregon Division of Financial Regulation

- Physical Address: 350 Winter St. NE, Room 410, Salem, OR

- Mailing Address: PO Box 14480, Salem, OR 97309

- Phone: 503-378-4140 or 888-877-4894

- Email: DFR.FinancialServicesHelp@dcbs.oregon.gov

- Link to website: Division of Financial Regulation: File a complaint

It’s usually a good idea to submit a complaint to the Consumer Financial Protection Bureau (CFPB) too. The CFPB is a federal agency that protects consumers from predatory financial institutions, including payday lenders.

Number of Oregon consumer complaints by issue

These statistics are all according to the CFPB Consumer Complaint Database.

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 55 |

| Struggling to pay your loan | 35 |

| Can’t stop withdrawals from your bank account | 14 |

| Problem when making payments | 13 |

| Getting the loan | 12 |

| Problem with the payoff process at the end of the loan | 10 |

| Can’t contact lender or servicer | 9 |

| Loan payment wasn’t credited to your account | 4 |

| Received a loan you didn’t apply for | 4 |

| Money was taken from your bank account on the wrong day or for the wrong amount | 3 |

| Vehicle was repossessed or sold the vehicle | 1 |

| Applied for loan/did not receive money | 1 |

| Was approved for a loan, but didn’t receive money | 1 |

| Problem with additional add-on products or services | 1 |

Source: CFPB website

Oregon consumers most commonly complain to the CFPB about lenders charging them unexpected fees or interest. That’s the case in the overwhelming majority of states that allow the payday lending industry to continue.

That goes to show that while the Oregon payday loan laws protect consumers better than many, they’re still not quite where they need to be. Borrowers are still paying annual percentage rates in the triple digits when 36% APR should probably be the limit.

The most complained about lender in Oregon: Big Picture Loans, LLC

The most complained about lender in Oregon is Big Picture Loans, LLC. They’re a tribal lender, so their loans are more expensive than the state regulations typically allow. Big Picture Loans doesn’t offer traditional payday loans, opting instead for high-interest installment loans with terms like the following:

- Loan amounts from $400 to $3,500

- Loan terms between 4 and 18 months

- APRs between 35% and 699%; new customer rates start at 200%

These are significantly more expensive than even the most costly payday loan in Oregon. For example, say you take out a $1,000 loan from Big Picture Loans at 350% APR. You’d make 13 payments of $175 every two weeks, and your total interest costs would be $1,272.

It can get even worse, as Big Picture Loans’ interest rates can be as much as double the APR in that example.

Most common complaints about Big Picture Loans, LLC

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 15 |

| Struggling to pay your loan | 2 |

| Problem when making payments | 1 |

| Was approved for a loan, but didn’t receive money | 1 |

| Can’t stop withdrawals from your bank account | 1 |

Source: CFPB website

Unsurprisingly, the most common complaint consumers make about Big Picture Loans, LLC is that they charge unexpected fees or interest. Not only do their finance charges defy understanding, but they’re also higher than what the Oregon payday loan laws would typically allow.

Top 10 most complained about payday lenders

| Lender | Number of Complaints Since 2013 |

| Big Picture Loans, LLC | 20 |

| LDF Holdings, LLC | 13 |

| CURO Intermediate Holdings, LLC | 10 |

| BlueChip Financial | 10 |

| Populus Financial Group, Inc. | 8 |

| LCO Financial Services, LLC | 6 |

| Lending Club Corp | 6 |

| GVA Holdings, LLC | 5 |

| Delbert Services | 4 |

| Rosebud Economic Development Corporation | 4 |

Source: CFPB website

Big Picture Loans is the lender that consumers in Oregon complain about the most, but that doesn’t mean they don’t have problems with others, as well. The CFPB has received a significant number of complaints about at least nine additional lenders.

Most of them offer either payday loans or high-interest installment loans, both of which carry finance charges that tend to be more than borrowers can afford to repay.

If you’re struggling financially because of the predatory lenders listed above or others like them, DebtHammer can help. Contact us today, and we’ll help you formulate a plan to turn the tables on your lender and get out of debt forever.

The second most complained about tribal lender in Oregon: LDF Holdings, LLC

LDF Holdings, LLC has received almost as many complaints in Oregon as Big Picture Loans. They’re an extension of LDF Business Development Corp., which belongs to the Lac du Flambeau Tribe of Lake Superior Chippewa Indians, making them another tribal lender.

Like many tribal lenders, LDF Holdings provides short-term installment loans, but their website offers neither insight into their loan terms nor a way to apply for financing. However, they’ve faced legal trouble before after charging triple-digit interest rates through National Small Loan.

National Small Loan’s site doesn’t share the details of their finance charges either, but it does disclose the following: “This is an expensive form of borrowing, and it is not intended to be a long-term financial solution.”

Most common complaints about LDF Holdings, LLC

| Complaint Reason | Count |

| Charged fees or interest you didn’t expect | 23 |

| Problem with the payoff process at the end of the loan | 2 |

| Can’t stop withdrawals from your bank account | 2 |

| Received a loan you didn’t apply for | 1 |

| Struggling to pay your loan | 1 |

Source: CFPB website

Like most tribal and payday lenders, the most common complaint consumers make about LDF Holdings is that the lender charged fees or interest they didn’t expect. Again, that’s almost always the case with these kinds of predatory lenders, whose finance charges regularly reach triple-digit APRs.

Payday loan statistics in Oregon

- Oregon ranks as the 30th state for the most overall payday loan complaints.

- Oregon ranks as the 31st state for the most payday loan complaints per capita.

- There have been 18,281 payday loan-related complaints made to the CFPB since 2013―163 of these complaints originated from Oregon.

- The estimated total population in Oregon is 4,217,737 people.

- There are 3.8646 payday loan complaints per 100,000 people in Oregon.

- The most popular reason for submitting a payday loan complaint is “Charged fees or interest you didn’t expect.”

READ MORE: Payday loan debt statistics

Historical timeline of payday loans in Oregon

The Oregon payday loan laws used to be significantly more permissive to lenders in the past. Fortunately, once state legislators changed their stance, they’ve never gone back. Here’s a quick overview of the turning points in the state’s history:

- Pre-2007: The Consumer Finance Act allowed payday lenders to charge whatever they wanted. Reportedly, they typically asked for $15 to $20 in fees per $100 in principal.

- 2007: Legislators enacted the limits on payday loans that are still in place today, including the 36% interest rate cap and the $10 origination fee per $100 principal limit.

- 2015: Senate Bill 278 made all payday loans from lenders without a license illegal and unenforceable.

Overall, the Oregon payday loan laws have effectively restrained the payday loan industry. The maximum APR is still high at roughly 153%, but it’s significantly lower than those in many other parts of the United States.

Flashback: An Oregon payday loan story

The payday lending industry has always had a remarkable ability to beat legislation intended to protect consumers, either by aggressively lobbying against it or simply finding a loophole.

They’ve consistently used the same arguments for years to muddy the waters and shut down legislation that would limit their profits. Namely, they have to charge excessive rates to be profitable, and even the slightest reduction would put them out of business.

Unfortunately, even when they fail to prevent effective restrictions on their practices, things don’t necessarily improve for consumers. For example, after Oregon lawmakers capped finance charges and made unlicensed payday lenders illegal, the industry retaliated.

First, there were massive payday loan store closures as the lenders took their ball and went home. Despite the fact that there are still licensed payday lenders operating in the state just fine in 2022, many of their previous peers claimed that the new rules were unreasonable and shut down preemptively.

Mysteriously, unlicensed payday lenders began popping up online in the state. Since they’re already illegal, they proved to be even more willing to dodge the law than the previous iteration of the industry.

For example:

- EZCash.com offered a 68-year old widow and grandmother of 11 a $300 loan. She declined, but their collection agents threatened lawsuit and arrest to get her to pay anyway until she called state regulators.

- A receptionist borrowed $150 from AmeriLoan and $200 from USFastCash. When she tried to pay them back, the company’s agents wouldn’t give her a written statement of her account balance, which is also illegal.

The moral of the story is that you should stay away from all payday lenders whenever possible, but under no circumstances should you borrow from an illegal or unlicensed lender, payday or otherwise.

The bottom line: Should I take out a payday loan in Oregon?

While convenient, payday loans are an extremely expensive form of financing. Even though the Oregon payday loan laws limit the maximum possible finance charges, they’re still too high to be affordable for most borrowers.

If possible, you should do your best to avoid taking out a payday loan, whether you’re in Oregon or any other state in the country. Even using it as a short-term financing measure does little more than push the problem down the road and make it worse.

If you need help staying on top of your bills while getting your finances in order, consider using a paycheck advance app. You can get a small sum roughly equivalent to a payday loan, but there are much lower fees.

For a more permanent solution, contact DebtHammer today. We’ll help you create a plan to turn the tables on your lender and keep you out of the payday loan trap for good.