Are you looking for money tips? How to start investing? Information on starting a side hustle? Help planning for early retirement? What if you need help saving money and reducing spending? There are scores of bloggers who specialize in these areas (and more). Here are some of the best. Best blogs for overall financial advice […]

Dealing with a debt collection letter or phone calls from debt collectors can be stressful. When this happens, you may be tempted to pay the account to make the problem go away. But what if the debt isn’t yours? Don’t simply agree to pay it. Learn how to prove a debt is not yours — […]

Intuit has announced that it is shutting down its popular budgeting app, Mint, on March 23, 2024. This will leave millions of users scrambling for a replacement. While Intuit is recommending that Mint users migrate to Credit Karma, it’s unclear which features will be offered or what the monthly cost will be. If you’re looking […]

The world gets more expensive every day. Unfortunately, wages have remained more or less the same. To bridge the gap, many Americans are turning to credit and loans for help. Is it any wonder that nearly half of all 18–34-year-olds feel like they are “drowning in debt”? When you feel like you’re buried by a mountain of […]

In divorce, it’s not just a marriage that splits. Assets and liabilities also have to be divided. Most American households have debt, and divorce doesn’t make it disappear. If you’re considering debt consolidation after a divorce, you must first understand how divorce affects debt. Key points Are you consolidating individual accounts — or joint ones? […]

What happens if you declare bankruptcy depends on a few things, including the type of bankruptcy you’re filing. Before filing, it’s important to understand the process, what happens next, and other debt-relief options. After all, bankruptcy can be an effective way to handle debt, but it also has long-term repercussions and isn’t right for everyone. […]

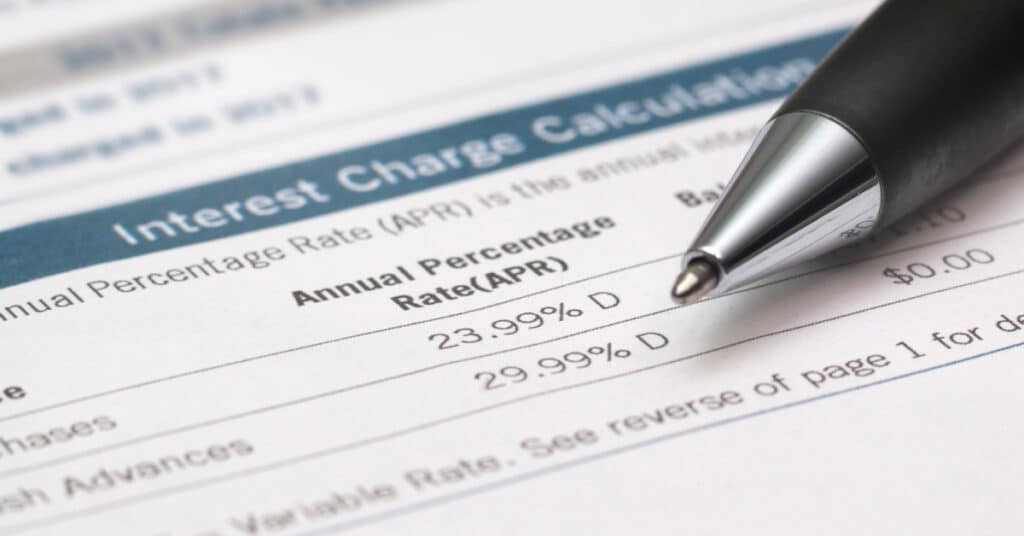

Credit cards offer users much more payment flexibility than cash or debit cards. Cardholders don’t need to have cash on hand to make a purchase. Instead, consumers can pay off purchases over time. Credit cards also offer valuable purchase protections. But paying with credit cards involves restrictions and fees, particularly if you don’t pay your bill […]

Around 30% of American adults have a “fair” or “poor” credit score – a credit score below 670. Another 20% of Americans are “credit invisible,” meaning they have no credit history or credit score. That’s half of Americans, and it’s unfortunate because your credit score determines what you’ll pay for a home, car, personal loan, […]

Combining finances often makes sense for long-term partners (whether married or not). It’s a way to commit more to each other and simplify financial affairs. But what about debt? According to a 2017 survey by MagnifyMoney, money problems were the primary cause of one in five divorces. And considering that 27% of Americans don’t have […]

It can be scary and intimidating when the debt collector calls. Their threats are designed to make you pay, so they say things like “We can take you to jail,” or “We’re going to sue you and garnish your wages,” or even “When you go to jail, Child Protective Services will take your children away.” […]