Intuit has announced that it is shutting down its popular budgeting app, Mint, on March 23, 2024. This will leave millions of users scrambling for a replacement. While Intuit is recommending that Mint users migrate to Credit Karma, it’s unclear which features will be offered or what the monthly cost will be.

If you’re looking for a replacement — or just want to start budgeting — here is a roundup of the best options.

Table of Contents

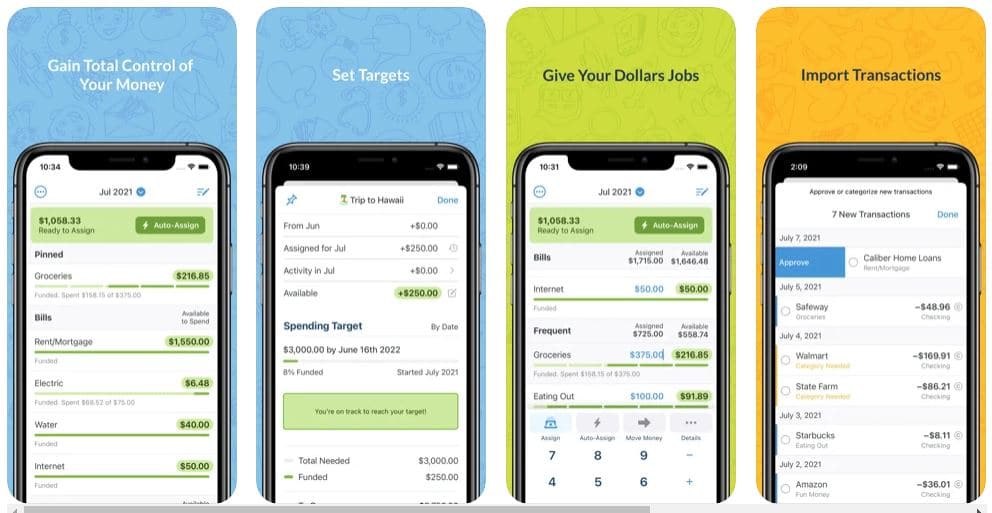

1. Best app for setting savings goals: YNAB (Youneedabudget.com)

YNAB promises real results. It says that on average, new budgeters save $600 in their first two months and more than $6,000 in their first year.

Standout budgeting features

They use a time-tested 4 Rule Budgeting, offer a ton of educational classes, real-time access from any device at any time, and you can have the ability to share finances with a partner. They have goal-tracking graphs and pie charts, offer live workshops for additional support, and teach you how to budget with a variable income, which is perfect for freelancers or independent contractors.

Budgeting tools

They have goal tracking where you can track your budget at a glance. A loan calculator calculates interest and time saved for every dollar you put toward a debt: spending and net worth reporting in graph and chart form.

Cost

- Free version: No, but there is a 34-day free trial period.

- Paid version: The monthly plan starts at $14.99 a month or $99.00 a year plus taxes. They offer college students YNAB free for 12 months in addition to the 34-day free trial with proof of enrollment, transcript, or tuition statement. And, when you subscribe at the end of your free year, you receive a 10% discount on the first year.

Ratings and reviews

Google Play rating: It has a 4.9-star rating out of more than 16,000 reviews.

Apple App Store rating: It has a 4.8 rating out of more than 48,000 reviews.

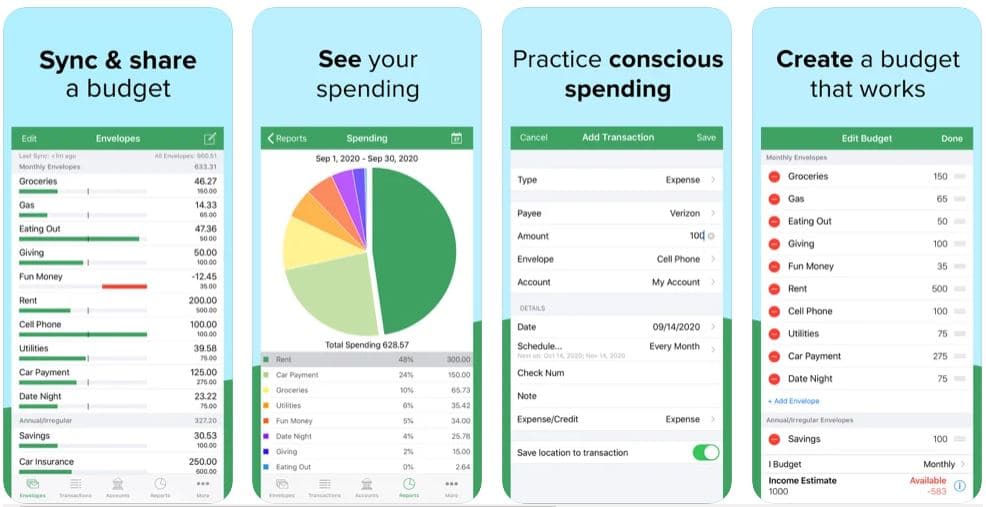

2. Best free budgeting app: Goodbudget

Goodbudget’s free version is the best option for no cost. Though they offer a paid version, you probably don’t need it. Goodbudget focuses on envelope budgeting. The envelope system assigns your income to various envelopes or spending categories such as groceries, dining out, debt payoff, and children. Next, all spending for each category is taken out of that designated envelope, and only that envelope. Third, you stop taking money from that envelope when emptied or beforehand.

Goodbudget helps you to stick to your budget limits without the hassle of keeping actual cash in physical envelopes.

Standout budgeting features

You can sync your budget with the people that matter the most and pay off debt using a time-tested budgeting method.

Budgeting tools

Goodbudget keeps you on the same page by syncing your household budget across all your iPhone (iOs) and Android devices. When you deduct money from an envelope, the person sharing the budget knows what’s spent, where, and when. There is also access to online budget courses.

Cost

- Free version: There is a free version for life for one account, two devices, ten regular envelopes plus ten more, one year’s worth of history, debt tracking, and community support.

- Paid version: The paid version is $8 or $70 per year with unlimited envelopes, unlimited accounts, five devices, seven years of history, debt tracking, and email support.

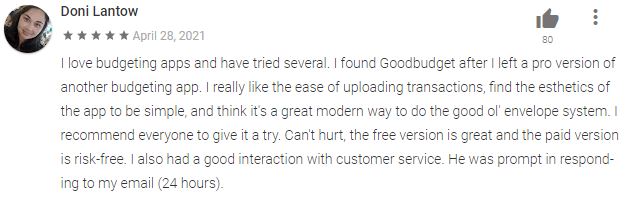

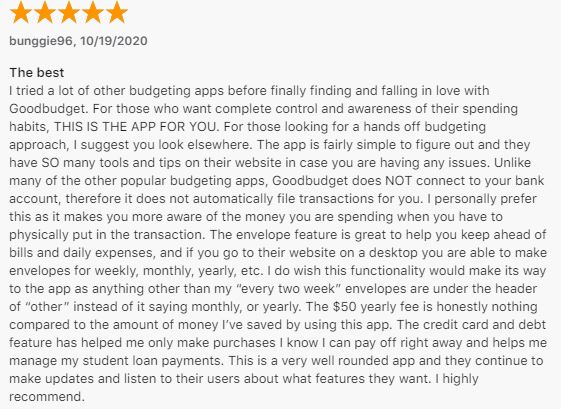

Ratings and reviews

Google Play rating: It has a 4.1-star rating out of 19,000 reviews.

Apple App Store rating: It has a 4.6 rating out of 12,000+ reviews.

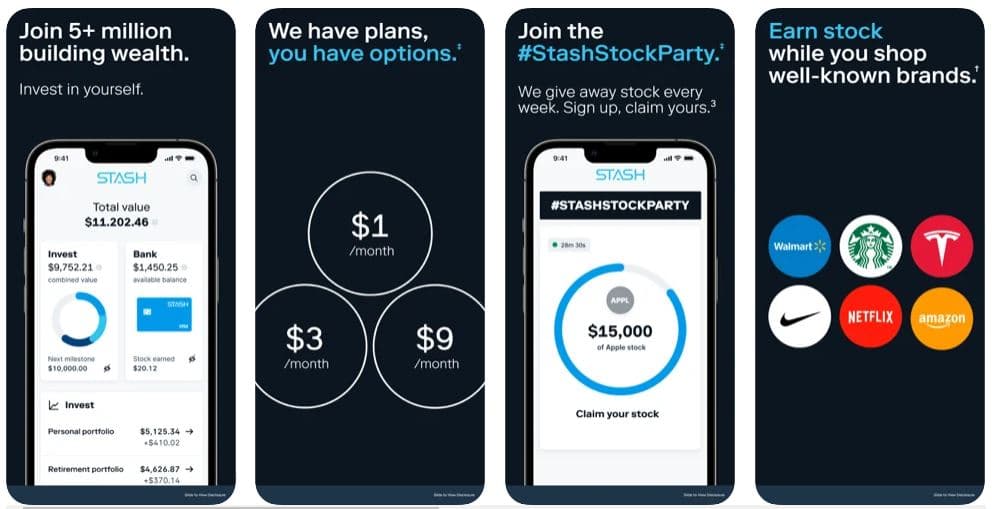

3. Best starter app: Stash

Stash is a personal finance app that simplifies investing, making it easy and affordable for everyday Americans to build wealth and achieve their financial goals.

Standout budgeting features

Stash makes investing easy with a mere $5. Ability to invest in fractional shares, they have both DIY and automated investing and values-based investment offerings. On Wednesdays, Stash offers a weekly “stock party,” which allows users to collect small portions of popular stocks (the initial value is usually about 12 cents). Recent offerings have included Apple and Uber.

Budgeting tools

Stash helps with your financial goals by providing specific advice for investing and budgeting. You can pick plans that offer a personal brokerage account, Stock-Back Card, budgeting and saving tools, guidance and education, insurance coverage, individual retirement accounts and investment accounts for children, too. You can route money automatically to savings on a regular basis.

Cost

- Free version: There is no free version, but Stash offers a 30-day free trial.

- Paid version: Stash Growth is $3 a month and includes $1,000 in life insurance coverage; Stash+ is $9 a month and offers everything included with Stash Growth, but includes $10,000 of life insurance coverage.

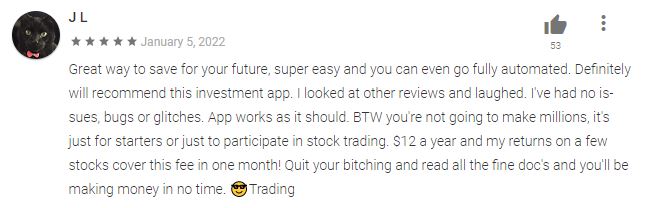

Ratings and reviews

Google Play rating: It has a 3.7-star rating out of 100,000+ reviews on Google Play.

Apple App Store rating: It has a 4.7 rating out of 300,000+ reviews.

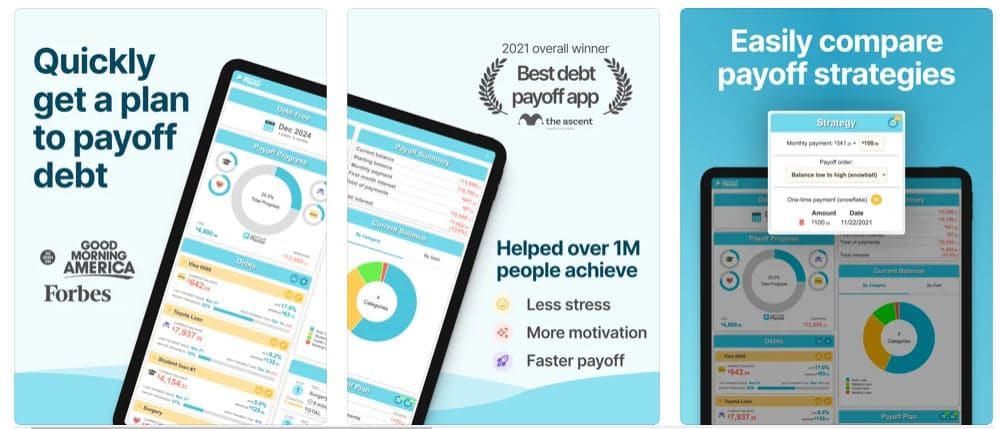

4. Best for debt payoff: Debt Payoff Planner

The Debt Payoff Planner can tell you how long it will take to become debt-free, how much you should pay on each bill, and which strategies to employ. This app gives you a clear plan for your payoff process.

Standout budgeting features

Provides you a monthly payment of the total amount of money you’ll be applying to all debts every month. The first number is the total of all the minimum payments for all debts. The second number is how much extra you can apply to any of your obligations every month to pay it off faster.

Budgeting tools

The app provides the specific details, and dollar amounts to pay to get out of debt and sends encouraging weekly updates of your payoff progress.

Cost

- Free version: Most features are included in the free version, but you’ll have to watch ads.

- Paid version: There are three ad-free pro plans available: $10 for two months; $24 a year for individual plans; or $36 a year for a family plan (maximum of five users).

Ratings and reviews

Google Play rating: It has a 4.4-star rating out of 3,000+ reviews.

Apple App Store rating: It has a 4.7 rating out of 4,000+ reviews.

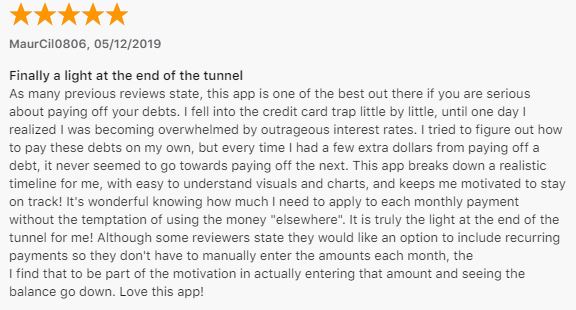

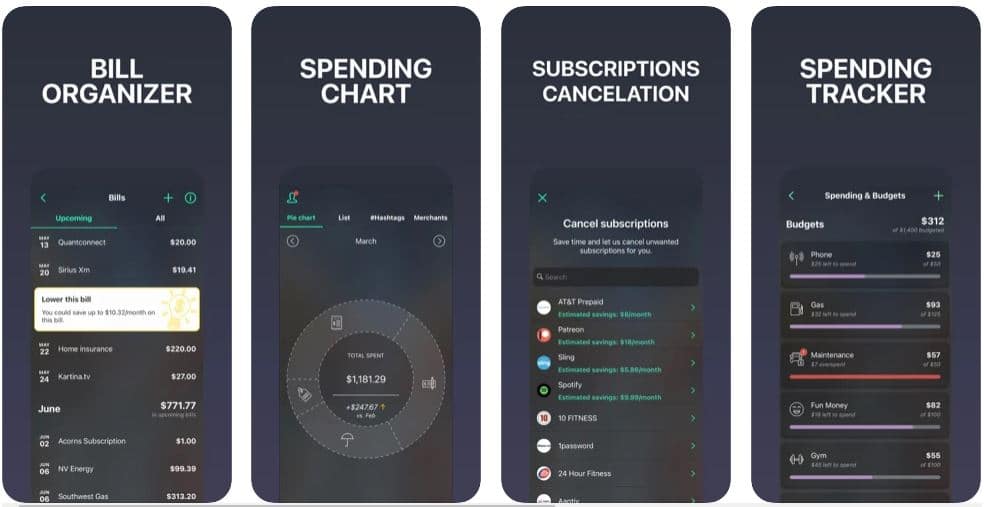

5. Best to help couples set spending limits: Honeydue

Honeydue is a simple way for couples to collaborate and manage money together.

Standout budgeting features

There’s a joint cash feature, but with the option to choose what you want to share and a built-in chat feature with your partner, so there’s no need to discuss this during dinner.

Budgeting tools

Instant notifications, real-time balances, and budgets for each partner.

Security

Your information is securely encrypted in 256 bits, both in transit and storage. They support and require multifactor authentication to your account.

Cost

- Free version: It’s free to sign up for you and your partner. You will have to watch ads.

- Paid version: There is no paid subscription.

Ratings and reviews

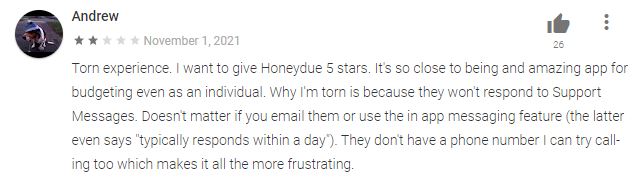

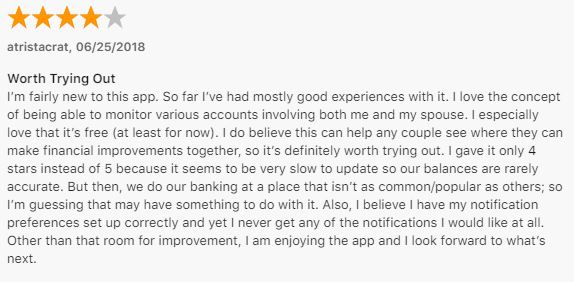

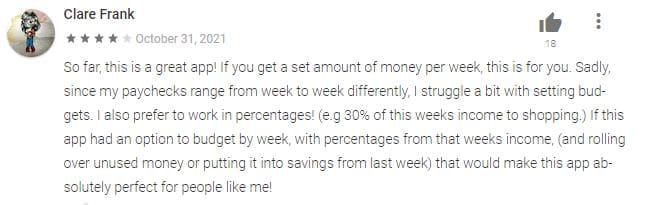

Google Play rating: It has a 3.3-star rating out of 2,000+ reviews.

Apple App Store rating: It has a 4.5 rating in 8,000+ reviews.

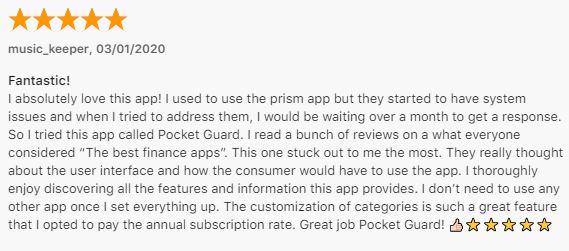

6. Best to track spending: PocketGuard

PocketGuard offers a holistic approach to personal finance to help you optimize spending and grow your spending automatically.

Standout budgeting features

PocketGuard’s “IN MY POCKET” feature shows how much money is left for everyday spending after all your bills, budgets, and goals are paid.

Budgeting tools

They have a spending pie chart. It shows all the expenses you’ve incurred over the current month divided into categories. It’s the best way to see where your money goes.

Cost

- Free version: You can sign up for the app and utilize many of its functions for free.

- Paid version: If you want features such as exporting transactions, unlimited goals, and categories for your budgeting and splitting transactions into different types, then the paid version, PocketGuard Plus, may be a better fit. Packages range from $7.99 a month, $34.99 a year or $79.99 for a lifetime membership.

Ratings and reviews

Google Play rating: It has a 3.7-star rating out of 2,000+ reviews.

Apple App Store rating: It has a 4.7 rating of 6,500+ reviews.

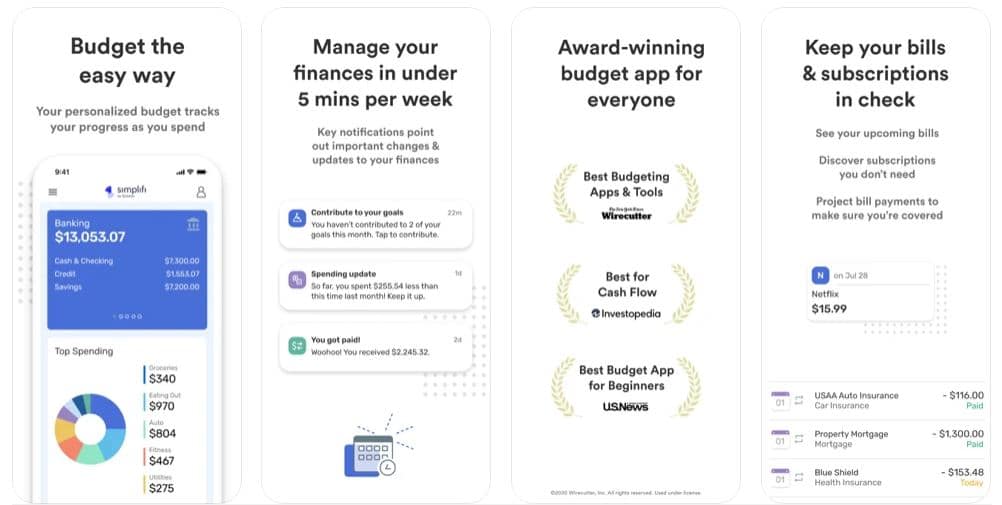

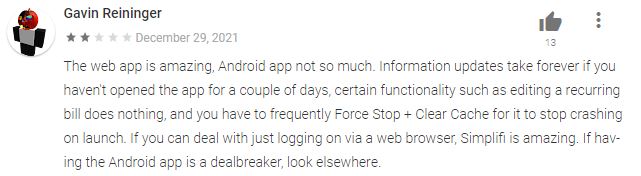

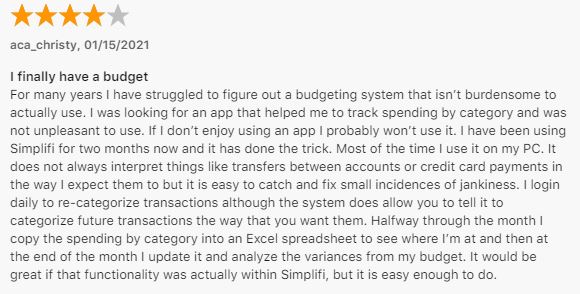

7. Best for simplicity: Quicken Simplifi

Simplifi is a simple mobile money management tool from Quicken that allows users to track their income and expenses in real time.

Standout budgeting features

Simplifi monitors spending on everything from essential expenses to splurges, you get a personal spending plan automatically, easy to track savings goals, projected cash flow, reports, and it gives you helpful insights to reach your financial goals and creates your customized categories for a truly personalized experience.

Budgeting tools

Sets up custom watchlists and limits your spending by category and payees to stay on track. Bill management so you don’t miss a payment and be slapped with late fees.

Cost

- Free version: There is no free version, but there is a free 30-day trial.

- Paid version: About $36 a year (the fee is $2.99 per month billed annually).

Ratings and reviews

Google Play rating: It has a 2.9-star rating out of 1,000+ reviews.

Apple App Store rating: It has a 4.0 rating out of 2,000+ reviews.

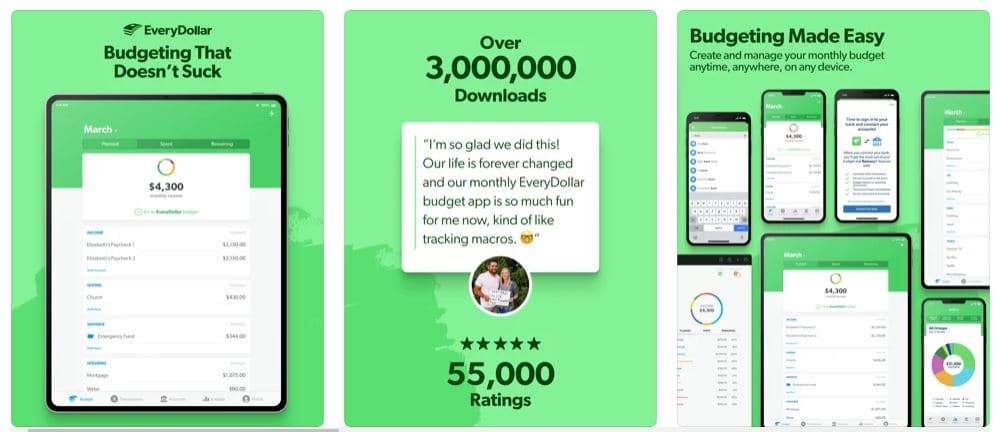

8. Best budgeting framework: EveryDollar

EveryDollar coaches you and walks you step-by-step through the budgeting process. It is based on Dave Ramsey’s signature Baby Steps program. Dave Ramsey is a seven-time #1 national bestselling author, personal finance expert, and host of The Ramsey Show with 18 million listeners each week.

Standout budgeting features

EveryDollar follows the zero-based budget system, income minus expenses. That means you account for every dollar. Allows for payment reminders and due dates, so you don’t miss a payment, only available in the paid feature. EveryDollar will even help track student loan debt.

Budgeting tools

The app offers Savings Fund to help you get started on an emergency fund, plus due date reminders. Budget insights tell you where your money went. It offers reports on your spending and income in an easy-to-read pie chart. The debt tracking tool also available in premium keeps track of balances, interest, minimum payments, and due dates all in one.

Cost

- Free version: EveryDollar offers a free plan, but you’ll have to enter all of your data manually.

- Paid version: After a free 14-day trial, it will cost $17.99 a month or $79.99 a year.

Ratings and reviews

Google Play rating: It has a 3.4-star rating out of 10,000+ reviews on Google Play.

Apple App Store rating: It has a 4.7 rating on the Apple Store rating out of 64,600+ reviews.

Pro tip: In addition to Mint, there are a few other provider updates: Mvelopes, one popular budgeting app, was shut down in 2022. Digit, another app, was acquired by Oportun, a lending app.

Features to look for

Good apps help you save money by tracking expenses, monitoring credit cards and other recurring bills, controlling overspending and tracking upcoming bills to prevent late fees. The apps also help you monitor spending habits, keep track of financial information, provide educational resources and money management skills, and set goals. Many will link to your bank account, which means you can route money directly to a savings account and set up bill payments. These apps will update in real time.

Pro tip: If your financial institution isn’t compatible with Plaid (a platform that connects your financial data with apps), you won’t be able to link your bank accounts directly to the app.

The bottom line

Whichever app you choose that best fits your needs, keeping a monthly budget is important because it helps you monitor and control your spending. It tracks your expenses, saves for the future, helps you make wise spending decisions, gets you out of debt, and stays focused on your long-term financial goals.