It’s a familiar struggle. You need to make an emergency trip home to visit the family, or the car has two damaged tires that have to be replaced, or you need that perfect new pair of shoes you’ve been eyeing that just went on sale. You don’t have the cash to pay, but waiting is […]

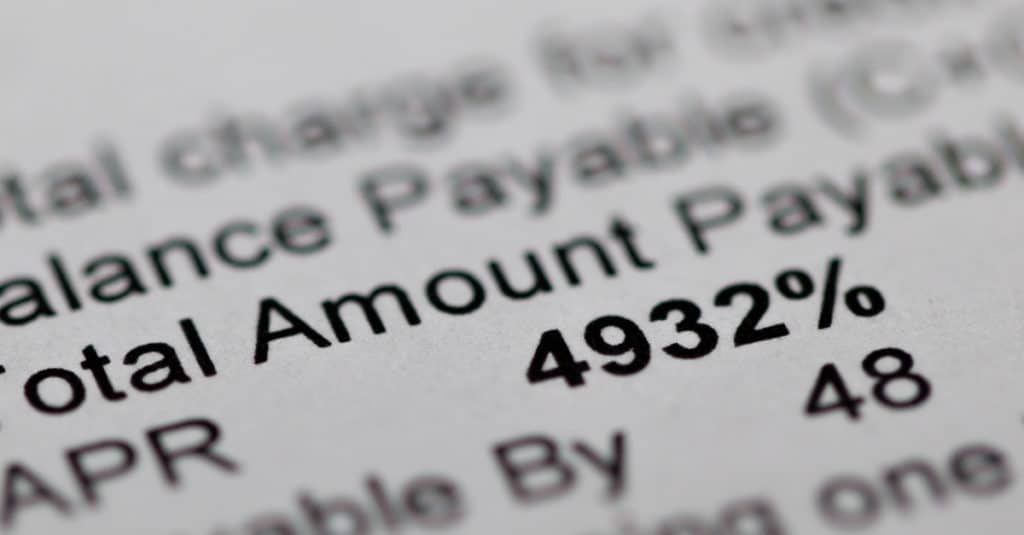

Payday loans are a common source of quick cash for low-income borrowers in the U.S. They’re so popular that there are about 23,000 payday lenders across the country — that’s twice the number of McDonald’s restaurants in America. The loans are lucrative for payday lenders — it’s a $9 billion industry — but costly for […]

It’s a common worry. The holidays roll around and there’s pressure to spend money you don’t have. In fact, a survey shows more than half of Americans expect to need a short-term loan to pay for their holiday celebrations. But the new year can offer a fresh financial start. Dr. Jim Burroughs, a professor at […]

B-A-N-K-R-U-P-T-C-Y. It may be only 10 letters, but it’s definitely an intimidating word. Bankruptcy isn’t something anyone wants to declare, but sometimes it’s necessary when things go bad with your finances. But bankruptcy isn’t a free solution, and coughing up the cash can be a problem when you’re already drowning in debt. How much does […]

Many people think all debt is bad debt, but there are times when debt can be helpful. It may not always be easy to distinguish between good debt and bad debt. However, learning the differences can make it easier to determine whether your money’s going where it should or not. If you’ve ever wondered about […]

Ask any financial expert and they’ll give you a whole slew of financial tips meant to improve your money habits and financial stability. While many of these pro tips are useful, that doesn’t necessarily mean they’re right for you and your unique financial situation. Here’s a quick dive into some of the most common financial […]

The general rule of thumb is to have enough savings set aside to cover at least three months of living expenses. That way, if you lose your job or if there’s a sudden financial emergency, you have something to fall back on. However, millions of Americans don’t even have a budget, much less any money […]

As many Americans suffer financially through the lingering COVID-19 pandemic, it’s a good time to be a payday lender, particularly in the South, where cities have the highest numbers of payday loan storefronts in the U.S., and residents are doing a lot of complaining to the Consumer Financial Protection Bureau. DebtHammer compared data from U.S. […]

Although the holidays are usually a time of joy, gratitude and celebration, they’re also often expensive. All the gifts, decorations, food, travel and parties add up over the holiday season. For many people, it’s easy to overspend or even go into debt. Fortunately, there are several ways to prevent this from happening. From setting up […]

“Look! Up in the sky! It’s the national debt of the United Kingdom!”“It’s the total GDP of Russia!”“No, it’s America’s student loan debt!” Don’t cry, little buddy. Joe Biden’s got your back. Probably. I’m going to go ahead and say what we’re all thinking. America’s student loan debt is getting just a teensy bit out […]