Payday loan borrowers are prime targets for scammers. They almost always need money fast and don’t have time to ask questions or thoroughly research the lenders.

In fact, according to the FBI, tens of thousands of people fall victim to payday loan scams each year.

Trust your gut. If you’re feeling panicked or rushed into paying, it’s a good sign that you’re dealing with a scammer or fake debt collector.

Stuck in payday debt?

DebtHammer may be able to help.

Table of Contents

Learn how to protect yourself

| Information a legitimate payday lender needs | Information a scammer might request |

| Basic contact information | Bank account log-in information |

| Social Security number | Prepaid debit card numbers |

| Proof of income (pay stubs) | Other detailed financial information, including bank account numbers |

| Bank account checking account number and routing number or a postdated check | Birthdate |

| Other detailed financial information including bank account numbers |

Pro tip: Do not provide any of this information over the phone, email, or another unsecured method. You should only provide personal information to a verified lender. Remember, a legitimate lender will not contact you first. If you did not initiate the exchange of information, hang up or ignore the email.

Red flags: 13 signs of a payday loan scam

Many payday loan scams target either young consumers or the elderly since they have the highest rate of success there. Regardless of demographic, here are the biggest red flags to look out for.

- You never requested a loan: Most payday loan lenders won’t call, text or send you a loan offer by mail unless you’ve initiated contact with them.

- You never followed through on a loan application: Scam artists often target people who’ve completed a payday loan application but never signed a contract or received funds.

- The lender guarantees approval: Payday loan standards are notoriously lax, but payday lenders still have minimum requirements borrowers must meet. If someone promises you a payday loan with “no questions asked,” you aren’t dealing with a trustworthy lender.

- The email comes from a generic Yahoo/Gmail/Hotmail account: If you receive an email from a generic service provider like Yahoo, Gmail, or Hotmail, it’s probably a scam. Legitimate lenders don’t use these providers. Instead, they’ll contact you through a company domain.

- Written communication uses improper spelling or grammar: Your basic scam email will have multiple grammatical or spelling mistakes. In some cases, the email might look like it’s been generated through an online translator.

- The lender demands an immediate decision: While some loan offers require a prompt response, a legitimate lender will not require that you make a decision on the spot.

- The lender demands you send a gift card: Legitimate companies do not accept payments in gift cards, and you should never be asked to pay money to a payday

- The lender offers you a loan over the phone: All loans must be offered in writing. It’s illegal to offer a loan over the phone. If you receive a loan offer this way, hang up immediately. Never give out or verify any personal information such as your address, date of birth, or bank account numbers.

- Slight company name variations: Some particularly clever scammers will use a seemingly legitimate company name. Oftentimes, this name will be a very slight variant of a real company.

- The lender is going door-to-door: Scammers sometimes go door-to-door to offer their products or services, typically for a small, upfront fee. A legitimate lender will never go to your door or make an unsolicited offer.

- The website in question is not secure: Whenever you’re looking for a lender, particularly if you’re planning to complete an application, checking to ensure that the website is secure is crucial. If you don’t see “https” at the start of the website address (and there’s no padlock icon), do not enter your personal information.

- The lender isn’t licensed or registered to do business in your state: It only takes a few minutes to check online and find out whether your lender is licensed.

- The offer sounds too good to be true: The best way to protect yourself is to assume that if a deal sounds too good to be true, it probably is.

Pro tip: Don’t assume that you’re smart enough to recognize a loan scam. Phishing attempts are getting more sophisticated, and even those who are extremely careful about data security have fallen victim. Even staffers at the Consumer Financial Protection Bureau were targeted, receiving fake texts purportedly from their boss, CFPB director Rohit Chopra.

Top scamming methods

Most people get scammed via an imposter, phone call, or text message.

- Imposter scams: An imposter scam is done by someone who claims to be someone they’re not. This person pretends to be someone you’re likely to trust like a debt collector or legal representative. According to the Federal Trade Commission, consumers lost over $3.3 billion in 2020 due to imposter scams.

- Phone calls: According to one report, nearly a fourth of American consumers were victims of a phone call scam in 2021.

- Text messages: The FTC has found that text messages and phishing are some of the biggest ways scammers try to steal your personal information. These text messages include links to spoofed websites where the scammer can steal or sell your personal information. Some messages will come with malware that infects your phone and steals your data that way.

Common types of payday loan scams

There are five primary types of payday loan scams: counterfeit payments, loan fee scams, no-credit-check scams, debt consolidation scams and debt collection scams. Here’s how to spot them:

Counterfeit payments

Counterfeit payments are one of the most common types of payday loan scams. In this scam, someone will mail you a fake check or remotely deposit funds into your account. In return, they’ll ask you to wire them a small sum through Western Union, MoneyGram or money transfer service. They promise that once you’ve done this, they will send a larger amount of money. However, this money will never come through. Any remotely deposited funds will show up as “pending” and never clear. If they send a check, it will bounce after a couple of days or even weeks. In 2019, the FTC received over 27,000 reports of fake check scams and a total loss of $28 million.

Loan fee scams

Some scam companies will try to offer you a payday loan but first require you to pay hundreds (or even thousands) of dollars upfront in “fees.” This is what’s known as an “advance-fee loan scam.” These scams mainly target those with poor credit or who can’t get a loan elsewhere. After the fees are paid, the lender disappears. You should never have to pay fees in advance for a payday loan.

Pro tip: Payday loan lenders roll all loan fees into your payday loans. If you’re trying to get a payday loan, you should never be asked to pay any money upfront. If someone is telling you differently, find another lender.

No-credit-check scams

Many payday lenders don’t use your credit score as a deciding factor for loan approval. They tend to use other criteria, like steady income. However, some scammers promise loans without credit checks. Payday lenders will still check your credit to ensure that you don’t have a history of loan defaults.

Debt consolidation scams

Debt consolidation can be a great way to help you break free from payday loan debt. It streamlines your debt into one larger loan with one monthly payment. However, if a debt consolidation company tries to push you into a loan with no application process or without disclosing the loan rates and terms, there’s a good chance you’re dealing with a scammer.

Debt collection scams

Another common type of payday loan scam is where the scammer poses as a debt collector. Oftentimes, they’ll contact you by phone or email to say you owe them money and must pay immediately.

The Fair Debt Collection Practices Act strictly regulates what debt collectors can say to you and what options they have when you cannot pay them, if you know the warning signs, the scammers are easy to spot.

Here are the key warning signs

- You don’t recognize the debt: If you don’t remember taking out the loan that a collector is urging you to pay, do your research to verify whether or not it belongs to you with the original creditor.

- The debt collector threatens you: Some fake debt collectors will claim to work with a law firm or the authorities to intimidate you. They might threaten you with arrest or legal action if you don’t pay them.

- They demand immediate payment by suspicious methods: They ask for immediate payment using gift cards or money orders. Don’t hand over any money at all until you’ve gotten a debt validation letter.

- They demand your banking info: Some scammers will ask you to verify bank so they can withdraw money from your account. Or they might set up a deposit into your account and ask you to send over funds. If you do this, however, you’ll be held responsible for any theft.

- They create a sense of urgency: Scammers will often provide excuses for why you have to give them your personal information immediately. Payday lenders don’t put their loans on sale.

- They ask for information they should already have: A legitimate debt collector should already have your personal information. They also won’t ask for confidential details over the phone or in an email.

- They refuse to share their information with you: A fake debt collector will refuse to provide certain information, including their name, employee number, the agency’s mailing address, a company phone number and a business email address.

- They refuse to send you a debt validation letter: Under the Fair Debt Collection Practices Act (FDPCA), debt collectors are legally obligated to send you a debt validation letter upon request. If a debt collector refuses, it’s a scam.

- They threaten you with job loss: Not only is it illegal for a creditor to share the details of your debts with a third party, but they also can’t leave that information where someone could find it (like on a voicemail).

- They threaten you with any other immediate repercussions: Scam artists almost always try to push you into making a snap decision. Any time you’re feeling rushed into making a decision, take a moment to consider whether you’re being scammed.

Examples of fake documents

Here are some real examples of scam letters Americans have received.

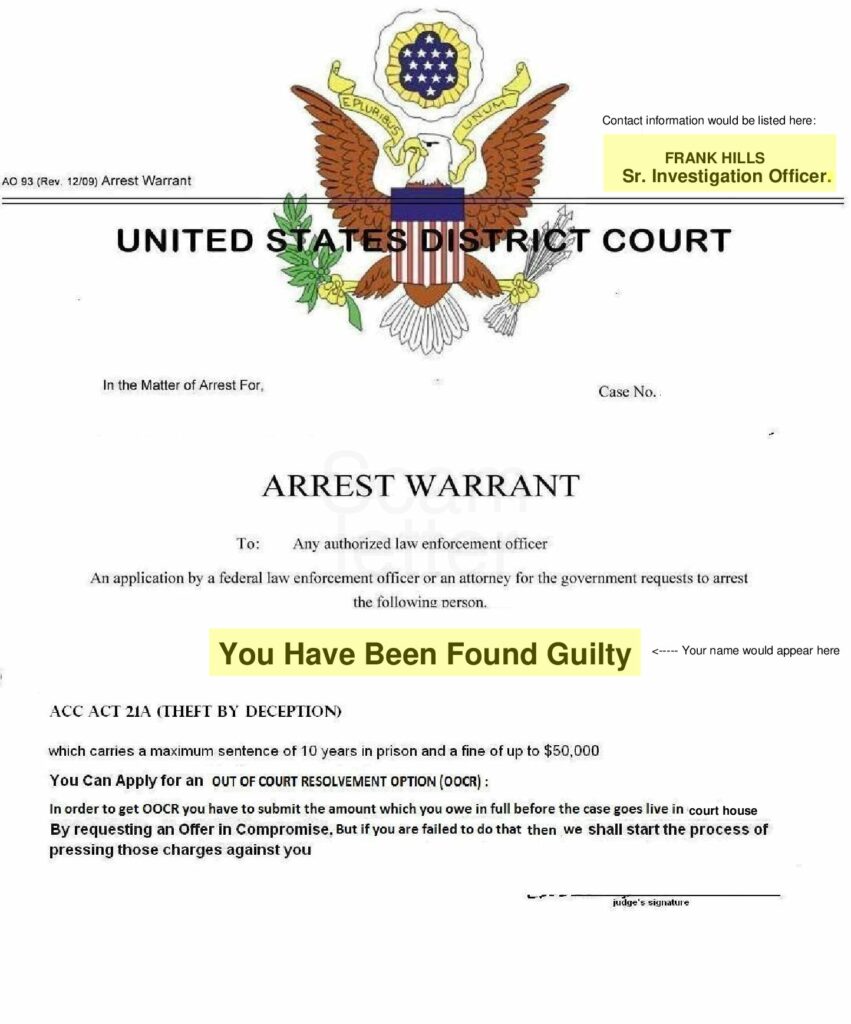

Fake arrest warrant

Most importantly, there is no name listed and no contact information. And it’s important to remember that failure to repay a debt is not a criminal matter. It’s a civil case, so no arrest warrant would be issued. If you’re in any way uncertain, contact the officer or court that the letter is allegedly from, but do not use any contact information provided on the letter itself (if there even is any.) Run a brief search on your own.

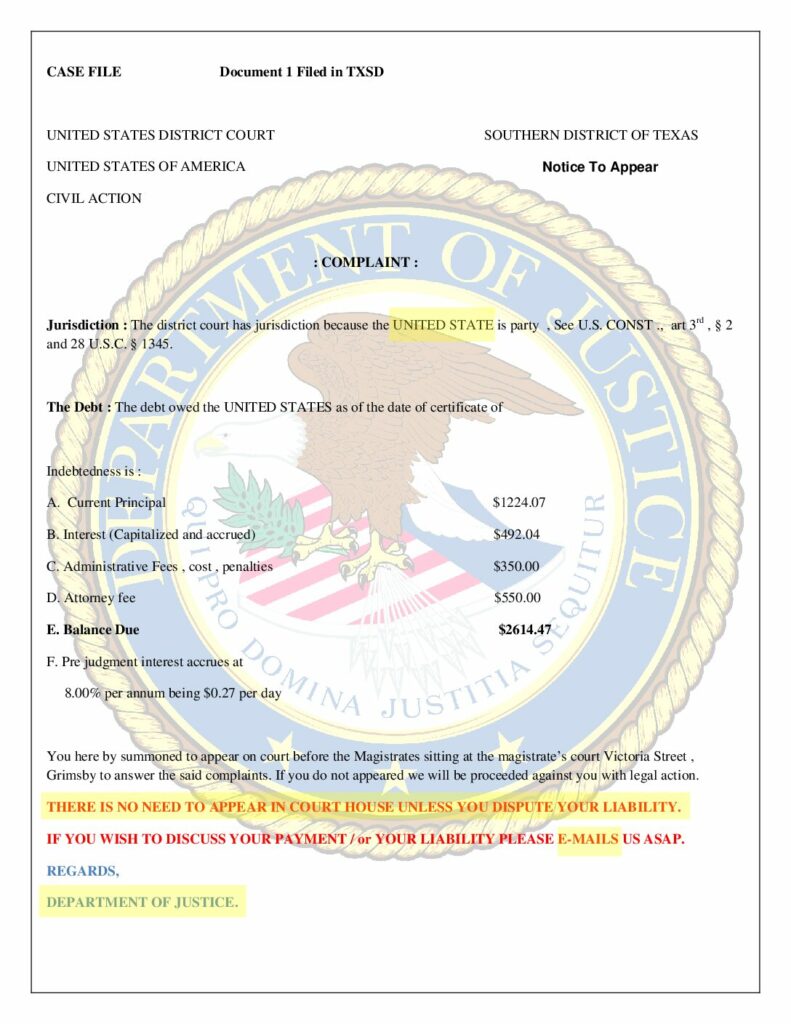

Fake notice to appear in court

The biggest red flag is that this tells you that you do not need to appear in court. An official “notice to appear” will always include your scheduled court appearance date. If you fail to appear on that date, you will automatically lose and a judge could order wage garnishment.

You will see that the United States is spelled incorrectly and that this document is full of grammatical errors. There is no signature, only “Department of Justice.” At the bottom, it says, “Do not consider we are going to be polite in any manner.” An official government document would never say that.

Any time a court notice to appear tells you that you do not need to appear in court, question it. If you fail to appear in court, you will automatically lose.

What to do if you’ve been scammed

No one likes to admit they’ve been scammed, but it’s important to take swift action to protect yourself and others.

- Gather documentation: Take screenshots, gather emails or collect any other documentation that will help your case. Have them ready before you contact the authorities.

- File a police report with local law enforcement: This will create an official record of the scam. Even if they can’t help you recover your money, you’re helping them learn about new scams and they may be able to save someone else from falling victim to the same scammer.

- Report it to oversight agencies: This includes your state attorney general’s office, the FBI, the Federal Trade Commission (FTC), the Consumer Financial Protection Bureau (CFPB) and the Better Business Bureau (BBB). This can help protect others.

- Close or freeze your bank accounts: Depending on the institution, you’ll be able to do this either online or via the phone.

- Call your credit card company: They should immediately cancel the card and stop any future transactions.

- Freeze your credit: While you’re at it, ask the three major credit bureaus (Experian, TransUnion, and Equifax) to put a freeze on your credit until you’ve figured out what’s going on.

The bottom line

Payday loan scams are highly prevalent in society, but there are ways to protect yourself from fraud and identity theft. Before filling out any type of online application, verify that the website is legitimate. Contact your state attorney general’s office or check online for reviews about the business or lender. Finally, before agreeing to anything, review the terms carefully.