Bad credit is like a shackle around your ankle. It can make getting a decent loan, buying a car, and even renting an apartment more difficult. Even the worst credit scores are salvageable, though. It’ll take some time, research, and discipline, but fixing bad credit is always possible. You don’t need to hire a credit repair service to do it for you, either. If you follow this guide to free credit repair, you’ll start seeing results without having to so much as open your wallet.

Table of Contents

What you need to know about credit repair

Credit repair is the process of improving a person’s creditworthiness, usually after they’ve made some mistakes that make lenders less likely to offer them loans or credit cards.

There are a couple of different ways to approach the credit repair process. You can choose to pursue free credit repair measures by yourself or hire a third party to handle it all, but the steps are similar in either case. It generally involves activities like paying down debt, establishing a consistent payment history, and addressing any other weak points found in their credit reports.

Fixing bad credit can take months or even years, depending on the extent of the damage done and the steps taken to remedy the problem. You may need to dispute information if you find mistakes or inaccuracies. Some negative items stay on a person’s credit report for longer than others. That said, there is no such thing as a person with credit beyond repair. It’s never too late to turn things around.

What is the Credit Repair Organizations Act?

The nature of financial concerns and the distress they cause provides a perfect opportunity for predatory businesses. Naturally, a wide range of scams and deceptive practices have cropped up in the financial industry over the years.

In the past, one of the most frequent offenders was the credit repair industry. Consumers consistently complained about companies promising miraculous credit improvements, taking their money, and then failing to deliver anything of value.

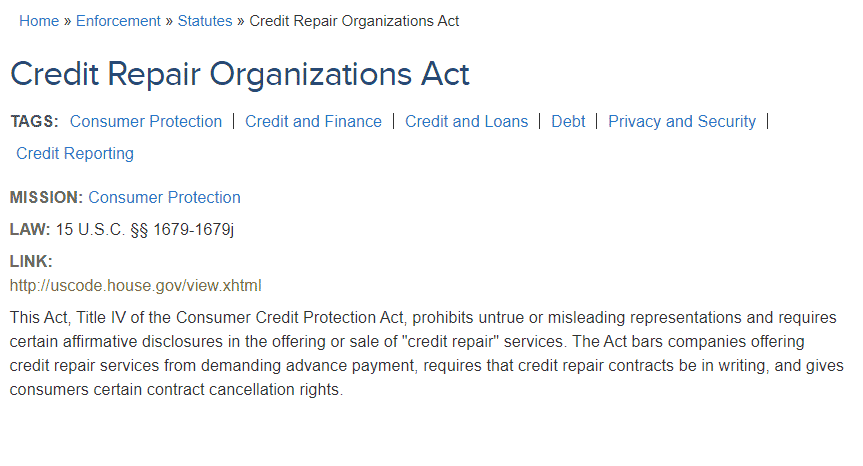

Fortunately, governmental bodies like the Consumer Federal Protection Bureau (CFPB) and the Federal Trade Commission (FTC) closely regulate the financial industry today and work to protect your legal rights. The Credit Repair Organizations Act (CROA) became federal law in 1996 and has done a lot to curb the issue since then.

The CROA protects consumers against less than honest business practices from credit repair organizations. In general, it stops businesses from making any false claims about their services or charging customers in advance.

More specifically, here are some of the most important rules it creates:

- Credit repair organizations can’t lie to customers, credit bureaus, or lenders.

- Companies can’t advise consumers to lie to the credit bureaus. That includes creating a new credit identity.

- No credit repair organization can request or accept payment before rendering its services.

- Companies must provide customers with a written copy of a contract that details the terms of the transaction, including the costs, scope of services, and any guarantees.

- Consumers have three days to cancel their agreement without reason or penalty.

It’s crucial to know and understand the implications of these rules before working with a credit repair service. If a company bends or breaks any of these laws, don’t engage their services. In fact, it’s probably worth reporting them to the FTC.

Is a credit repair service worth it?

In the vast majority of cases, it’s not worth working with a credit repair organization. There are too many ways for it to go wrong. People who work with credit repair services open themselves up to:

- Handing over valuable and sensitive data unnecessarily

- Paying significant fees for only minor results

- Accidentally working with scam artists or illegitimate companies

In any case, credit repair companies can’t take any action that consumers couldn’t. They have no special knowledge, connections, or leverage, and they often do a worse job of negotiating than most people would do for themselves.

6 Steps to free credit repair

Credit repair might not be an easy process, but it is relatively simple. The steps are straightforward and repeatable.

Here’s the best way to go about it:

1. Get free credit reports

You can request free copies of your credit reports once a year from each of the three major credit reporting agencies: TransUnion, Experian, and Equifax.

The credit bureaus’ reports are the same ones lenders use to calculate consumer credit scores and FICO scores, which means they can provide valuable insight into any limiting factors. You can also get copies at annualcreditreport.com. Knowing what’s in your credit file will be essential throughout any free credit repair journey.

2. Dispute any errors

The easiest way to boost a credit score is to correct any negative information on your credit report. Fixing errors is not instantaneous and still requires submitting a credit dispute letter, but disputing and removing incorrect information is typically the lowest hanging fruit. It may also represent a larger problem like identity theft, so make sure to verify everything in each credit report.

What is a credit monitoring service?

Credit monitoring services monitor for suspicious activity in your credit file, setting credit card spending alerts, reviewing account statements, and requesting free credit reports. You can do this on your own by regularly monitoring your credit reports, some banks or financial institutions include it as a free service, or you can pay a credit monitoring service a monthly fee to monitor activity on your behalf. Many banks and credit card companies also offer free fraud protection.

What is a credit freeze?

You can protect yourself by asking the major credit bureaus to “freeze” your credit, which blocks access to your credit reports, protecting against scammers’ attempts to steal your identities or open new fraudulent accounts. To freeze your credit, you must contact each of the credit bureaus individually. Placing a credit freeze is free. If you want to apply for new credit, you just need to contact the credit bureau to temporarily lift the freeze. This is also free.

3. Plan efficiently

With credit reports in hand, it’s much easier to create an efficient strategy for fixing bad credit. There are only five general factors that affect credit scores, and people can easily find which ones are holding them back using the details in their reports. The details in the reports can also help create an estimate of how long it will take to meaningfully improve a person’s credit scores.

4. Pay down debt

The most common issue that weighs credit scores down is missed debt payments. Missing debt payments often stems from having too much debt and not enough income. The combination of the two can quickly spiral out of control. High debt balances and credit utilization rates are some of the biggest red flags to lenders, so paying down debt should always be a priority. Look for ways to consolidate debt with high interest rates.

Consider using the debt avalanche or the debt snowball method to reign in any out-of-control debts. If that doesn’t work, it might be helpful to work with a credit counselor. They’re a free advisory service for people who are struggling with their credit and finances. Working with a credit counselor can also help your underlying personal finance issues, because they will help you set up a debt management plan.

5. Demonstrate responsibility

After removing the negative track record as much as possible, start writing a more positive story until you have good credit. The best way to do that is to take out a secured credit card with a reasonable limit and use it sparingly. Try to keep the balance below 30%, and make sure to pay it off each month in full. Or consider a credit builder loan, which helps build credit and savings.

6. Avoid the small mistakes

While paying off debt and keeping up with payments should take priority, there are other (slightly less impactful) mistakes to avoid. For example, even after catching up on credit card debt, try not to close any of your accounts. That can lower a person’s overall utilization and the average age of their credit accounts.

Remember, lenders calculate credit scores based on a credit profile using five key factors: payment history, outstanding balances and utilization, length of credit history, new credit activities, and credit diversity. The first two are the most important (roughly 65%) parts of a person’s credit score, but the others can make or break a person’s credit.

How long does it take to repair a poor credit score?

While it’s impossible to say exactly how long it takes to repair a credit score, it is safe to say that it will take most people somewhere between a few months and a few years of good behavior to turn things around.

Of course, that’s a wide window. Scoring systems vary between lenders, and there isn’t even a universal definition of what constitutes bad credit, which muddies the issue considerably. It’s always difficult to say how long it will take to progress away from an undefined starting point.

The recovery length also depends on the underlying issue that led to your bad credit. The type of credit will make a difference. People with low scores from bankruptcy can expect a different time frame from those who are currently overcome with high debt balances and missed payments, even if their scores are similar.

At the very least, it’s helpful to know that most of the significant negative pieces of information stay on credit reports for seven years. That includes late payments, Chapter 13 bankruptcy, foreclosures, and debt collections.

What happens if I’m a victim of identity theft?

If you suspect that you’ve fallen victim to ID theft, the most important thing you can do to fix your credit is to immediately dispute the fraud with your lenders and credit bureaus. You will have to contact all affected companies, creditors and financial institutions. If you think your Social Security number has been stolen, report it to IdentityTheft.gov. Also, be sure to notify local law enforcement.

Beware of credit repair scams

Despite regulations, credit repair scams are still fairly common. As recently as November of 2020, the FTC had to refund victims of one for over $150,000.

It’s usually better to pursue free credit repair than to engage a third-party service, but for those who are uncomfortable fixing bad credit alone, at least stay away from credit repair companies who do any of the following:

- Make grandiose promises: Don’t trust anyone who claims that they can do something that sounds too good to be true. That includes anyone who promises a fresh start with a new credit identity or guarantees that they can remove negative items from credit reports.

- Try to charge upfront: It is illegal for credit repair companies to ask for any money before they deliver on their promise to improve a customer’s credit. Don’t ever hand over any money until they do so. If they even ask, treat them like a scammer.

If it’s at all possible, just stay away from credit repair companies in general. Fixing bad credit yourself is safer, less expensive, and often just as likely to be effective (if not more).

The bottom line

Fixing bad credit is difficult, but it’s usually not complicated. Pay down any high debt balances, make monthly payments on time, and fix any other obvious problems in your credit reports (or wait them out). With good behavior, all credit scores will eventually begin to recover.

It’s usually best to take on the problem yourself, too. Most credit repair companies are more trouble than they’re worth, and some are outright scams. If you don’t want to go it alone but also don’t trust credit repair companies, consider consulting with a nonprofit credit counseling agency. A credit counselor can serve as a guide in the process and are usually free or charge a minimal monthly fee.

FAQs

Credit reports from the three major credit bureaus usually do not contain a credit score. You can usually obtain a credit score from your credit card company, financial institution or a loan statement. You can also use a credit score service or free credit scoring site.

When you’ve given permission to check your credit report in order to process a credit or loan application, it’s known as a hard inquiry. A hard inquiry can lower your score. Soft credit inquiries don’t harm your credit score but still involve a lender checking your score.

The Fair Credit Reporting Act protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the act.

Lexington Law is a law firm specializing in credit repair. For a fee, Lexington Law will identify and challenge questionable items on your behalf. The firm says clients have seen over 56 million negative items removed from their credit reports since 2004.

Charge-offs are posted when a creditor has given up hope that you will pay off the debt and instead has closed your account. A charge-off is very damaging to your credit score and does not mean your debt is forgiven.

You may be entitled to free credit monitoring through an existing account or due to a data breach. If so, it’s a no-brainer. Sign up because it’s useful to know if someone is trying to access your accounts. Fee-based credit monitoring, on the other hand, can get expensive. It’s worth taking the time to research to see whether the paid features are worth the extra expense.