Debt relief can be a saving grace when your monthly payments become unmanageable. And the amount of debt you’re grappling with can spiral out of control very quickly.

But debt relief includes a wide range of strategies. And all too often, people struggle to find the right plan or get pressured into a scam by a predatory lender. If you’re feeling overwhelmed or the debt collectors are hounding you, it’s time to start looking at your options. Here’s what you need to know about the different types of debt relief.

Are you eligible for debt relief?

Learn if it’s right for you. It’s easy and free to find out.

Table of Contents

Debt relief and when you should consider it

Debt relief generally includes any strategy that helps people who are struggling with their debt payments to make those ends meet. Usually, that looks like one of three things:

- Getting better repayment terms (like a lower interest rate)

- Reducing the total amount to be repaid

- Eliminating debt accounts entirely

Debt relief sounds like all upside at first glance, but it always comes with a price (usually a negative impact on your credit score). So make sure that you’ve attempted to reduce your spending and increase your income before you consider it.

If you’ve already tried to control your debt by yourself and are finding it impossible, debt relief is the next logical step.

Bankruptcy and when you should consider it

Bankruptcy is typically the last resort for getting out of debt. Don’t consider it lightly because it isn’t cheap, but if you’ve exhausted all other methods with no success, it’s a viable last-ditch option. It will hurt your credit score and stay on your credit report for up to 10 years, but if you’re drowning in debt you have bigger concerns until your financial situation is under control.

While debt settlement has the potential to reduce your total debt repayments, bankruptcy can essentially eliminate all of your unsecured debt.

There are different types of bankruptcy, and which type you qualify for will make a big difference in how much it will help your situation. We will explore those in a bit.

Debt relief options

There are several different ways to approach debt relief that don’t involve bankruptcy. They involve:

- Debt management plans

- Balance transfer credit cards

- Debt consolidation loans

- Debt settlement

READ MORE: Debt settlement vs. debt consolidation: which is better?

Here’s more on each of those options:

Debt management plans (DMPs)

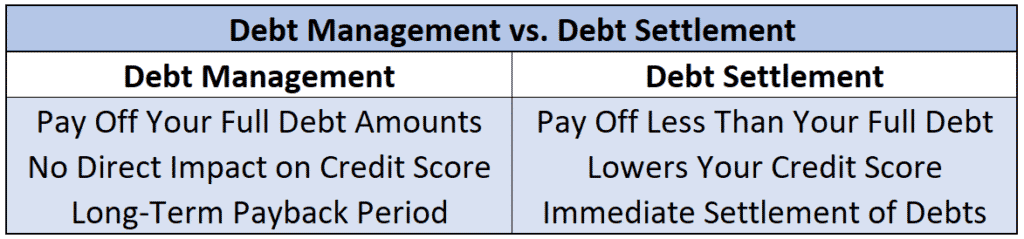

The simplest form of debt relief is debt management. Debt management is a combination of budgeting, financial planning, and negotiation with creditors to create an affordable repayment plan for you.

You can attempt to create your own debt management plan, but usually, the superior option is to work with a nonprofit credit counselor.

Credit counseling agencies are usually cheap and trustworthy and already have systems in place to quickly create plans that are beneficial to all parties. There are plenty of recommendations available through the National Foundation for Credit Counseling.

Debt management plans pros and cons

Debt management plans have a few key pros and cons.

Pros

Debt management plans are the least drastic debt relief option and probably the strategy you should consider first because:

- It’s the least harmful to your credit

- It’s the simplest to implement

- You don’t need to qualify for any new debt (like consolidation loans or balance transfer cards)

If you choose to use a credit counselor, it can also discourage aggressive lenders from contacting you. They serve as a middle-man, which can take some of the pressure off of you.

Cons

Unfortunately, debt management might not always be enough to control your debt if you have balances that are far beyond your ability to afford.

For example, if you’ve recently lost your only source of income or had to pay for an expensive medical emergency, it won’t be able to do much to solve your issue.

Balance transfer credit cards

Another alternative is to use a balance transfer credit card. You can transfer your balances to the A slightly riskier alternative is to use a balance-transfer credit card. Credit card companies will sometimes offer an introductory period where you will pay no interest. You can transfer your balances to the new account. When the introductory period expires, your interest rate will increase. This is really only a viable option for those with good credit. If your creditworthiness is less-than-ideal, it’s unlikely you’ll get approved for a new card.

Debt consolidation loans

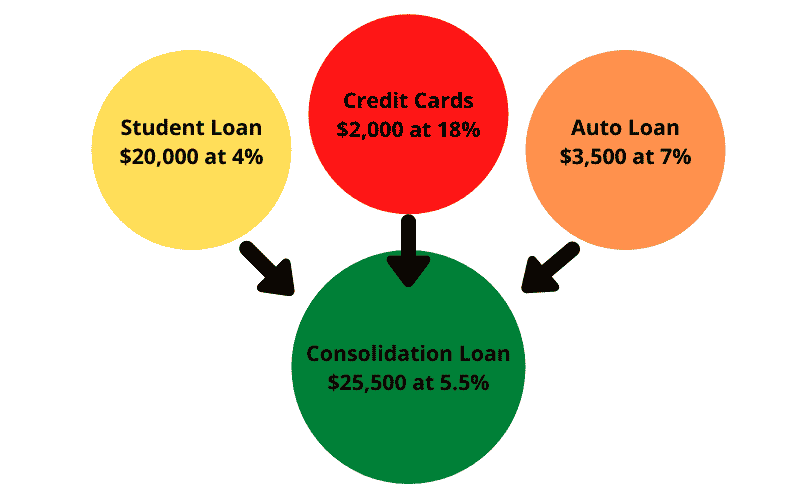

Debt consolidation is the combination of multiple debt payments into a single payment with better terms.

Traditionally, debt consolidation is accomplished with lower-interest consolidation loans. You’d use the proceeds to pay off all your other creditors, then pay back the new (hopefully cheaper) debt in fixed monthly installments.

Debt consolidation loans pros and cons

These loans have a few benefits and drawbacks:

Pros

Debt consolidation works best when you’re feeling overwhelmed by the sheer number of your debt accounts, and you think you can get a lower interest rate. It allows you to pay off all of your old lenders and worry about a single payment, ideally with a loan that will:

- Reduce your total interest costs

- Lower your monthly payment

- Have a more favorable payoff schedule

Cons

Unlike debt management (which doesn’t involve opening any new accounts), debt consolidation requires you to apply for a new loan or credit card.

A complete refinance allows you to significantly improve your repayment terms, but it also comes with a couple of drawbacks:

- It can lower your credit score: Whenever you apply for new credit, lenders make a hard inquiry on your credit history. Inquiries account for 10% of your credit score, so applying for a consolidation loan or balance-transfer card can cost you a few points initially.

- It’s harder to qualify: Debt management programs generally don’t require that you meet a credit standard, but any new creditor is going to be wary of lending to you if your score is poor. If you can’t convince someone to lend to you, you won’t be able to consolidate your debt.

Debt settlement plans

If your debt balances have grown so big that you can’t pay them back, a debt settlement program might sound appealing to you.

You can negotiate with creditors directly or hire a professional to do it for you, but the plan’s goal is to settle your debt for a smaller amount than you owe. This usually means you’ll have to make a lump-sum payment, but occasionally you can negotiate to lower your monthly payments.

Many professional debt settlement companies will require you to make payments into an escrow account until you’ve accumulated enough savings to make a reasonable settlement offer.

This option is for debtors who have no hope of ever making it out of debt with less aggressive methods and will have to consider bankruptcy if their creditors don’t strike a deal.

The threat of bankruptcy is your primary negotiating tactic in this scenario because if you declare bankruptcy, unsecured creditors won’t be able to collect anything from you.

Debt settlement pros and cons

Pros

The obvious advantage of a debt settlement plan is that it can drastically reduce the amount you have to pay. Generally, debt settlement companies will try to settle your debt for somewhere between 10% and 50% of the original balance.

Debt settlement plans are also usually the fastest way to become debt-free. Debt consolidation and debt management both require you to follow a long-term payment plan, while debt settlement is over after your one-time lump sum.

Cons

Debt settlement is essentially debt forgiveness, and you won’t get it for free. First and foremost, it’s going to be pretty rough on your credit score for a couple of reasons:

- A record of the debt settlement will be reported on your credit history

- You’ll probably have to stop making payments toward your debt for a while

To qualify for debt settlement, you have to demonstrate to your creditors that your settlement offer is the most they can reasonably expect to collect from you.

When you work with a debt settlement company, they’ll have you stop making payments (if you still are) and start setting that cash aside to put toward your lump sum.

Your payment history is worth 35% of your credit score, so this process can significantly damage your credit.

Additionally, if you don’t qualify for the insolvency exemption, any debt that you have forgiven will be considered income by the IRS, and you can be sure they’ll expect you to pay tax on it.

Want to know more about the benefits and disadvantages of debt relief and debt settlement? Check out this video to learn more.

When is bankruptcy your best option?

Debt relief options have the potential to ease the burden of repaying your debts, while bankruptcy can essentially eliminate all of your unsecured debt.

Regardless of which type you file, as soon as you file an automatic stay will be put in place, and collection agencies will have to stop contacting you. The automatic stay will also protect you from foreclosure, temporarily if you file Chapter 7 and permanently if you file Chapter 13 and successfully complete your plan.

READ MORE: Can you keep your house after filing for bankruptcy?

Pro tip: Before you make any decision, make sure you’ve consulted a lawyer to discuss your options. Bankruptcy laws are complicated. Many law firms offer a free initial consultation.

For individuals, there are two common types of bankruptcy:

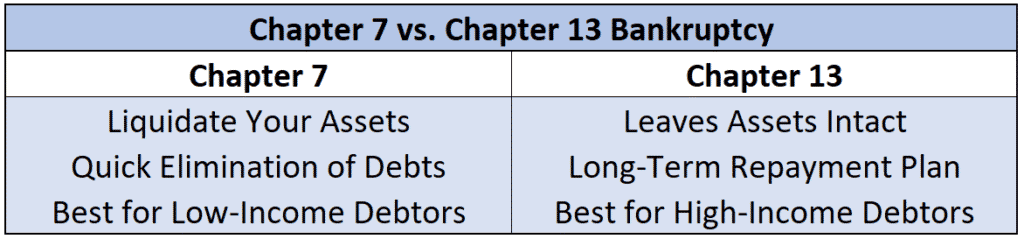

Chapter 7 bankruptcy

You liquidate all of your non-exempt assets and use them to pay your creditors as much as possible. Your primary residence, personal possessions, and vehicle (within reason) are all exempt from liquidation. If you meet the qualifications and are drowning in debt, this can be a very good option to wipe the slate clean and get a fresh start. You will have to pay some fees, though.

READ MORE: What are the next steps after filing for bankruptcy

Bankruptcy attorney fees

While it isn’t required to have a bankruptcy attorney, it’s highly recommended. Many charge a flat fee or some charge by the hour.

If you do decide to hire an attorney, look for those who offer free consultations. Make sure this is offered in advance and you get it in writing before sitting down with the attorney/law firm. The advantage of a flat fee is you know the total cost before you make a decision.

Court filing fees

The bankruptcy court filing fee for Chapter 7 bankruptcy is $338. You must pay it when the bankruptcy petition is filed unless the court grants you an exception.

Exception 1: Paying the fee in installments

If you get the OK to pay in installments, those payments will be made to the court. You get immediate protection from creditors without paying the entire fee at once. This becomes a plus if wage garnishment is involved. All installments must be paid within 120 days after filing.

If you plan to request an installment plan, it’s imperative to follow these steps before filing:

Fill out the application to pay the filing fee in installments. Find out the total amount your specific bankruptcy district charges as a down payment as it can vary per district but counts toward the total fee.

Exception 2: Asking for a fee waiver

If your application for a fee waiver is granted, you won’t need to shell out money for a court filing fee.

To be eligible, your annual income must be below 150% of the poverty line for your state and household size. Note: it’s not a guarantee that if you meet the eligibility requirements you’ll be approved.

The bankruptcy court will decide if it’s appropriate in your case and a judge will review your income, expenses, and assets when making this decision. This is known as a means test.

If your fee waiver is denied, you’ll need to pay the filing fee in installments, but not always, so do have a plan B.

Chapter 13 bankruptcy

If you earn too much to qualify (over $12,475 monthly) for Chapter 7, Chapter 13 allows you to create an affordable debt repayment plan. Typically, these plans are for installment payments over the next three to five years. Unlike Chapter 7, it doesn’t require you to liquidate your assets.

A Chapter 13 bankruptcy is an individual reorganization for people who have enough disposable income to pay both their bills and their debts, and who own property that they need to protect. In most cases, you cannot use Chapter 13 bankruptcy to wipe out income tax debts. Instead, you repay your tax debts during your repayment plan. Chapter 13 also will not discharge alimony or child support obligations.

Pro tip: Chapter 13 assigns a bankruptcy trustee who will basically control your money and spending until you exit the plan. You will lose quite a bit of control of your financial life. It could be worth it, however, particularly if you need someone to intervene and help you develop better spending habits.

How much does it cost to file Chapter 13 bankruptcy

The amount to file for Chapter 13 should you need to do so depends on a few factors:

- Attorney experience

- Complexity of your bankruptcy case

- Where you live

The court has to approve the amount you pay your attorney. To simplify this, many courts have established “presumptive” fees they feel are reasonable. These will sometimes be based on the basic services that must be covered. Costs will be higher if your case is more complicated, like if you own a small business.

Attorney fees

In most cases when you hire an attorney, the fees won’t be cheap.

The average is about $3,000 and the cost is usually higher than Chapter 7 fees because Chapter 13 cases are more complex. You won’t need to pay this amount in full before filing. The bankruptcy attorney can ask to be a priority creditor, which makes him/her more likely to accept a Chapter 13 case.

Court filing fees

The Chapter 13 bankruptcy filing fee is $313. Fee waivers are not available in Chapter 13 cases. Chapter 13 cases require that the filer have disposable income to make monthly plan payments to the trustee. Not being able to pay the filing fee makes it more difficult to make the court believe a Chapter 13 repayment plan is being offered in good faith.

However, you can ask the court to pay the filing fee in installments.

Additional fees for both types of bankruptcy

Credit counseling fees

If you plan to file for either Chapter 7 or 13 you will be required to enroll in two educational courses. One credit counseling course is before filing, and a debtor education course is after. On completion of both, you will get a credit counseling certificate known as a bankruptcy certificate. If you file for bankruptcy, you must obtain certificates at two stages of the process.

The courses are the same for Chapter 7 and Chapter 13 cases.

These costs can’t be more than $50 without a special exemption. If your income is less than 150% of the federal poverty guidelines, you can ask the course provider to waive the fee.

Miscellaneous other costs

Consider printing costs, travel expenses, paperwork, long-distance phone calls, cellular phone calls and other basic administrative expenses. The bankruptcy code is complicated and a trip to bankruptcy court is time-consuming. The bankruptcy petition is typically 60 pages. Depending on your district, you might be required to print multiple copies and need more forms and other papers to pull together. One mistake could lead to all of these documents having to be resubmitted. Also, copies of some documents may need to be submitted to the trustee. Other costs might include mailing documents and notices, fees to file amendments, travel and parking fees for proceedings, and lost wages.

READ MORE: Cheap ways to file for bankruptcy

Bankruptcy pros and cons

Pros

Bankruptcy offers you a clean slate. Most (if not all) of your debts will be forgiven.

Chapter 7 allows you to erase almost all of your unsecured debts, and if you don’t have any assets to liquidate, you can pay next to nothing to your creditors.

Chapter 13 might not save you quite as much, but it does protect your assets from liquidation. But because it’s reserved for high-wage earners anyway, it usually works out in the debtor’s favor to opt for a payment plan.

Cons

Unfortunately, bankruptcy will cripple your credit score for a long time. Usually, it will knock you down to somewhere in the mid to low 500s, which can make it extremely difficult to qualify for any sort of financing. You’ll struggle to buy a house, get an auto loan, or even qualify for a credit card.

Generally, Chapter 7 bankruptcy will hurt your credit more. Because it’s usually the better deal for the debtor (you can essentially pay nothing if you have no assets), the credit system naturally disincentivizes it.

Chapter 7 bankruptcy will stay on your record for a full decade, while Chapter 13 will only remain on your record for 7 years.

READ MORE: Bankruptcy pros and cons

When is filing bankruptcy a poor choice?

Bankruptcy isn’t right for every case, and it depends on every situation. Do you fall into one of these situations?

- Debts are not dischargeable in bankruptcy (for example: child support, some student loans, criminal fines, etc.)

- You haven’t filed your tax returns.

- You are considered “judgment proof,” meaning your assets and income are exempt from collection.

- You have a lot of non-exempt property that you don’t want to lose.

- You haven’t addressed your underlying spending problems and are likely to end up back in debt.

The bottom line

Everyone’s personal finance circumstances are different, and there isn’t a single debt relief plan that works for everyone. But in general, you should try them in the order of the list above and either bankruptcy option should be a last resort.

Never let a bankruptcy lawyer pressure you into declaring bankruptcy and paying hefty legal fees when a simple consolidation loan will do the trick.

Make sure to assess all of the options to decide what’s best for your financial situation.

Are you considering debt relief? Contact DebtHammer today for a free consultation.

FAQs

Filing for bankruptcy will not relieve you of your secured debts unless you agree to surrender the property that serves as loan collateral. If you file for bankruptcy, you will only keep your house and/or vehicle if you can still afford to make your monthly loan payments.

Whether you file Chapter 7 or Chapter 13 bankruptcy, a stay will go into effect and all creditors, including your auto lender, will be stopped from pursuing any collection activities. This stay would prevent a car lender from repossessing your vehicle. However, a lender has the ability to ask the court to lift the stay so the car can be repossessed.

Depending on whether you declare Chapter 7 or Chapter 13 bankruptcy, you can either eliminate or discharge most medical debts. Chapter 7 bankruptcy can get rid of all medical debt and credit card debt. Chapter 13 bankruptcy discharges some of your medical debt and grants you additional time to pay back the remaining balance.

Yes. Thanks to modern banking technology, it’s easier than ever to find a lender that offers personal loans to people with poor credit or a past bankruptcy. However, the terms won’t be very favorable. You can find a few options here.