In divorce, it’s not just a marriage that splits. Assets and liabilities also have to be divided. Most American households have debt, and divorce doesn’t make it disappear. If you’re considering debt consolidation after a divorce, you must first understand how divorce affects debt. Key points Are you consolidating individual accounts — or joint ones? […]

Paying off one installment loan is hard enough. Juggling multiple lines of installment debt is a nightmare. That’s why people are turning to installment loan debt consolidation as a solution. Pro tip: Installment loans are high interest rate loans that are offered at banks, credit unions and online lenders. The loans can sometimes be secured […]

What happens if you declare bankruptcy depends on a few things, including the type of bankruptcy you’re filing. Before filing, it’s important to understand the process, what happens next, and other debt-relief options. After all, bankruptcy can be an effective way to handle debt, but it also has long-term repercussions and isn’t right for everyone. […]

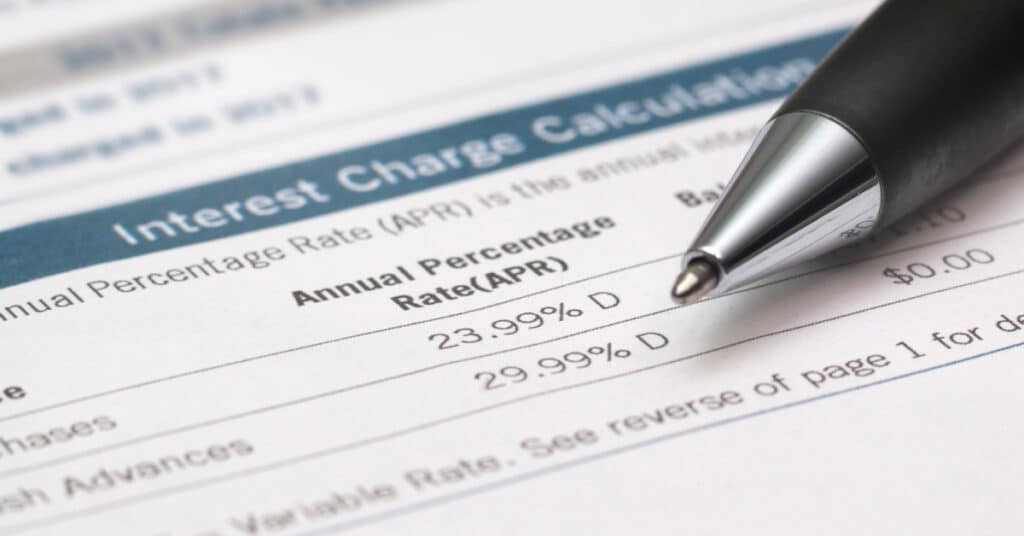

Credit cards offer users much more payment flexibility than cash or debit cards. Cardholders don’t need to have cash on hand to make a purchase. Instead, consumers can pay off purchases over time. Credit cards also offer valuable purchase protections. But paying with credit cards involves restrictions and fees, particularly if you don’t pay your bill […]

Around 30% of American adults have a “fair” or “poor” credit score – a credit score below 670. Another 20% of Americans are “credit invisible,” meaning they have no credit history or credit score. That’s half of Americans, and it’s unfortunate because your credit score determines what you’ll pay for a home, car, personal loan, […]

Combining finances often makes sense for long-term partners (whether married or not). It’s a way to commit more to each other and simplify financial affairs. But what about debt? According to a 2017 survey by MagnifyMoney, money problems were the primary cause of one in five divorces. And considering that 27% of Americans don’t have […]

It can be scary and intimidating when the debt collector calls. Their threats are designed to make you pay, so they say things like “We can take you to jail,” or “We’re going to sue you and garnish your wages,” or even “When you go to jail, Child Protective Services will take your children away.” […]

Sometimes you need to make a purchase and it can’t wait until payday. Many retailers will now give you a helping hand, allowing you to pay for purchases in four no-interest installments. Affirm is a well-known Buy Now, Pay Later (BNPL) service. When you use Affirm to finance an item, you can take it home […]

A debt consolidation loan is usually the simplest and most inexpensive way to consolidate credit card debts. The idea is to get a new loan with a lower interest rate and use that loan to pay off all of your other high-interest debts. Even if you have bad credit, qualifying for a new loan is […]

Debt-relief services can seem overwhelming when you’re already struggling with debt. It’s challenging to know which options will work for you, and there’s no one solution that works for everyone. Credit counseling is one option. Here’s what you need to know about whether it will be the best fit for your financial situation. Key points […]