Acorns offers a spare-change savings tool that rounds up your purchases to simplify savings and investing. But fees can be high. It’s important to know what you’re getting into before you sign up.

Our take: Acorns is simple to use and makes it easy to start a savings plan. But the fee can be high if you’re only saving five dollars a month from rounding up purchases. For example, if you have $100 in your Acorns account, the $3/month fee is equal to an APR of 36%. But the platform is easy to use and if you set it and forget it, your money can add up relatively quickly.

Table of Contents

Acorns at a Glance

| Account minimum | $0 to open an account; $5 to start investing |

| Monthly subscription fee | $3, $5 or $9, depending on the plan and features you choose |

| Acorns’ fees | $35 per ETF to have them transferred to another broker if you close you Acorns account; There is no charge if you sell your investments and transfer cash |

| Interest rates | Acorns’ high-yield checking account earns 3% APY and the savings account earns 5% APY. There is no minimum balance requirement. |

| Portfolio mix | Portfolios are diversified with access to various asset classes, including domestic and international stocks, bonds, real estate investment trusts and a Bitcoin-linked ETF. |

| Sustainable portfolios (ESG) | ESGs (Environmental, Social, and Governance) are a type of portfolio that focuses on sustainability. The idea is that your portfolio’s ETFs will provide exposure to companies that are more sustainable while still performing as well as a non-ESG portfolio. |

| Rebalancing | Asset allocations are automatically rebalanced, and there is no fee |

| Expense ratios | .05% to 0.18%. |

| Human financial advisor | No human financial advice is available. Acorns is a Robo-Advisor. |

| Customer support | Customer support is available seven days a week from 8:00 a.m. to 4:00 p.m. ET via email and live chat |

| Acorns is best for… | –People who have a hard time-saving money –People who want perks like cash-back rewards, financial education, etc. all in one place –People who prefer to take a hands-off approach to investing –People who prefer a wide array of investment options –People who aren’t worried about a tax strategy |

What you need to know about Acorns

Acorns is something of an all-in-one finance app for new investors: you can use it for investing, saving, regular banking (the company now offers a checking account), financial education and more.

Headed up by CEO Noah Kerner and President David Hijirida, Acorns is all about helping new people build their financial futures. According to the company’s website:

“Our mission is to look after the financial best interests of the up and coming, beginning with the empowering step of micro-investing.”

The idea is that users can use the app to learn about investing via real-world and relatively low-risk investments. They use “Round-Ups” from your bank and other financial accounts (like credit cards) to fund your portfolio.

Acorns investing uses your spare change

“Round-Ups” is Acorns’ word for spare change. Here’s how they work:

When you set up the app, you’ll connect the app to your bank account (and to other debit and credit card accounts if you want to do that). Every time you make a purchase, Acorns’ algorithm rounds up that purchase to the nearest dollar. It then sets aside the difference between the dollar amount and what you paid.

For example: If you buy a churro for $1.50, Acorns rounds that up to $2.00 and sets 50 cents aside.

However, Round-Ups aren’t withdrawn from your bank account with each purchase. Instead, Acorns tracks the total. When the amount “set aside” reaches $5.00, Acorns will debit that $5.00 from your bank account and it will be added to your investment portfolio via direct deposit.

You can also agree to invest a specific dollar amount on top of your Round-Ups to grow your fund faster. This is called a “recurring investment.” Whatever amount you decide to invest will be deducted from your bank account once a day, once a week, or once a month — whichever you choose. There is no account minimum.

Pro tip: Acorns Checking accounts are FDIC-insured up to at least $250,000 per depositor, per ownership category through banking partners Lincoln Savings Bank and NBKC Bank.

You can set it and forget it

What sets Acorns apart from other “spare change” apps is that it invests your money for you, giving your money the opportunity to make money. This is a low-cost way to invest since you’re investing a few cents at a time. You can set financial goals and work toward them.

Compounding can help your money grow

Compound interest is the interest you earn over time on your interest. It’s why it’s essential to start saving for retirement as early as possible. The benefit of setting up an account like this is that you don’t need to constantly monitor it. Just let it grow over time.

How compounding can help you: After setting up an Acorns portfolio, Sarah used the round-up feature to build savings. She set it up and ignored the app for about five years until she suddenly needed a new car. By that point, the Acorns account balance had accrued enough money to cover a sizable down payment on a new car.

Link as many bank accounts and credit cards as you like

Another difference between Acorns and other investing platforms is that Acorns allows you to use multiple sources for your investment fund. You aren’t limited to just one linked account. You can also link your account to as many debit and credit cards as you like. Doing this will help you grow your savings/investment fund even faster.

Not sure how to invest? Acorns is a Robo-Advisor

Sounds great, but what if you have no idea where to invest the money Acorns is saving for you? The Acorns Robo-Advisor will do that work for you.

The app will ask you a few questions about what type of investments you want to make. For example, do you want to maximize savings/earning potential or minimize risk? Then, based on your answers, the Robo-Advisor will create a diverse portfolio. Your work is now done. The app will take care of the rest.

Acorns pricing

Acorns charges three different prices based on the plan you choose: The Personal Plan is $3.00 a month, the Family Plan is $5.00 a month, and Acorns Premium is $9 a month (but the first month of Acorns Premium is free.)

Acorns Personal: $3 per Month

The Personal Plan is for people who are only investing for themselves. It includes:

| Investing | Banking | Earning and learning |

| Investment account with an expert-built, diversified portfolio | Acorns checking account that saves and invests for you | 450+ in-app partner brands to earn bonus investments with |

| Acorns Invest: Save and invest spare change everyday with Round-Ups | No overdraft fees | Find a side hustle with Job Finder |

| Includes built-in portfolio rebalancing, financial educational tools, and cash back (when you shop at partnered merchants). | 55,000+ fee-free ATMs nationwide and around the world | Browser extension to get bonus investments every time you shop at 15,000+ partners |

| Acorns Later: Acorns will recommend an IRA that best suits your needs. You can choose from Roth IRAs, SEP IRAs and traditional. | Acorns Visa debit card | Grow your financial confidence with videos and tips for investors both experienced and new |

Acorns Family: $5 per Month

Acorns Family gets you everything in the Personal tier plus some other features. The most important extra feature is access to Acorns Early.

| Investing | Mighty Oak Banking | Earning and learning |

| Investment account with an expert-built, diversified portfolio | Checking account that saves and invests for you | Found Money: 450+ in-app partner brands to earn bonus investments with everyday purchases. |

| Acorns Invest: Save and invest spare change everyday with Round-Ups | No overdraft fees | Find a side hustle with Job Finder |

| Includes built-in portfolio rebalancing, financial educational tools, and cash back (when you shop at partnered merchants). | 55,000+ fee-free ATMs nationwide and around the world | Browser extension to get bonus investments every time you shop at 15,000+ retailers |

| Acorns Later: Acorns will recommend an IRA that best suits your needs. Choose from Roth IRAs, SEP IRAs and traditional. | Limited edition Mighty Oak Visa debit card | Get your bonus investments matched by Acorns (up to 25%) |

| Emergency fund | Grow your financial confidence with videos and tips | |

| Grow your money with 3.00% APY on Checking, 5.00% APY on Emergency Fund | Live Q&As with investing experts |

Acorns Premium: $9 per month

| Investing | Mighty Oak Banking | Earning and learning |

| Investment account with an expert-built, diversified portfolio | Acorns checking account that saves and invests for you | Found Money: 450+ in-app partner brands to earn bonus investments with everyday purchases |

| Acorns Invest: Save and invest spare change everyday with Round-Ups | No overdraft fees | Find a side hustle with Job Finder |

| Includes built-in stock market portfolio rebalancing, financial educational tools, and cash back (when you shop at partnered merchants). | 55,000+ fee-free ATMs nationwide and around the world | Acorns Earn: Browser extension to get bonus investments every time you shop at 15,000+ retailers |

| Acorns Later: Acorns will recommend a retirement account that best suits your needs. Choose from Roth IRAs, SEP IRAs and traditional. | Limited edition Mighty Oak Visa debit card | Get your bonus investments matched by Acorns (up to 25%) |

| Acorns Early: This is an Acorns-managed UGMA/UTMA account (or accounts) you set up for your kids so help them build up savings for their futures.* | Emergency fund | Grow your financial confidence with videos and tips |

| Customize your portfolio with the ability to add individual stocks | Grow your money with 3.00% APY on Checking, 5.00% APY on Emergency Fund | Live Q&As with investing experts and educational courses |

Pros and cons of Acorns

While Acorns has some benefits, there are also a few key drawbacks.

Pros

- Automatic investing makes the app easy for beginners to use

- Offers affordable EFTs from iShares, Vanguard, and others

- Multiple asset classes

- Taxable brokerage accounts

- Investment options based on risk tolerance

- Offers IRAs

- Checking account with debit card

- Perks include bonus investments for referring people to the app and other unique offers

- Can help users build or improve their good financial habits

Cons

- Management fees are expensive compared to other investment apps

- Monthly fees are costly—way higher than competitors—and can feel especially burdensome if you have a small balance

- Not a lot of selection for funds

- It doesn’t offer a tax strategy to keep customers’ tax bills to a minimum

- Robo-Advisors are not as good as human advisors. Acorns does not provide access to human advisors, so you won’t be able to use them to get individualized financial guidance

What’s included In an Acorns investment portfolio?

This will depend on which sort of portfolio you choose from Acorns’ options. There are five basic core portfolios that vary depending on your risk tolerance and investment strategy.

- Conservative

- Moderately Conservative

- Moderate

- Moderately Aggressive

- Aggressive

Acorns mobile app

The Acorns app is straightforward and easy to use. It’s available for Android and iOS.The onboarding process can feel a little tedious — there are a lot of terms and conditions to review. Then, you’ll have to set up your accounts. It can take some time to get everything up and running. Once you’ve finished, though, it’s smooth sailing. The app takes care of everything.

Acorns customer reviews

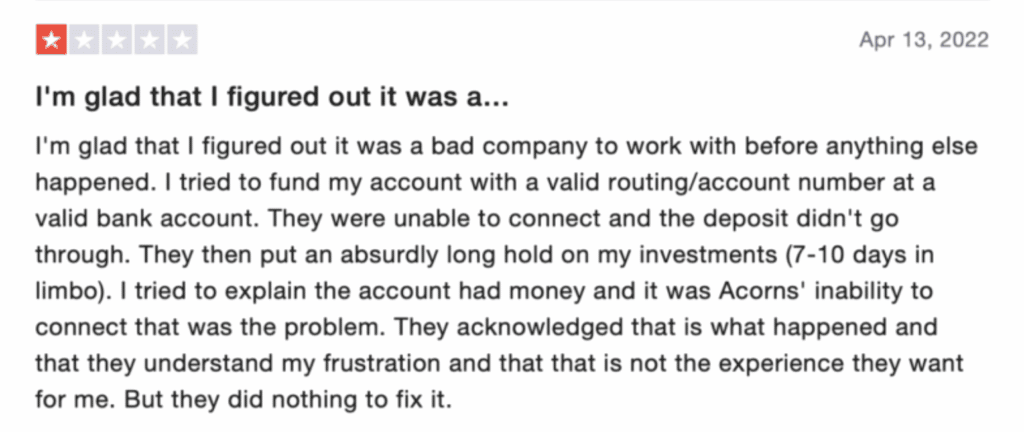

Acorns only gets 2.3 (out of 5) stars on TrustPilot. The reviews seem to focus on the same couple of issues. The company continues to charge monthly fees even after someone has closed their account, and people requesting payouts/refunds and having them take forever to process (or not end up getting processed at all).

From Bret Harper on TrustPilot:

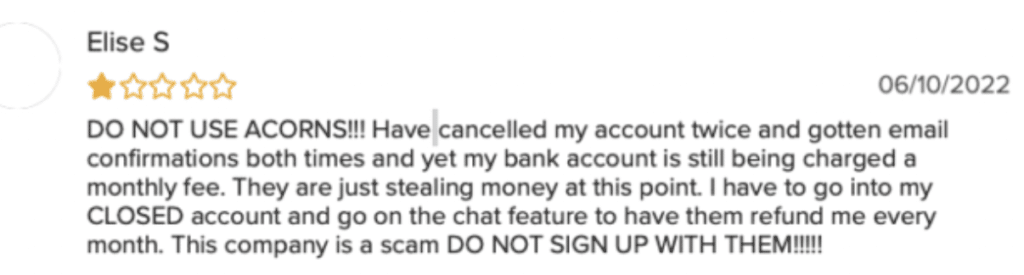

The rating worse at the Better Business Bureau. The BBB rated Acorns as F and the reviews give it a collective 1.1 out of 5 stars.

BBB Member Elise S left this review:

It’s important to note that there are a few positive reviews, including this comment from Lucie D.:

Real-world Acorns success stories

Other micro-investment apps

Acorns’ fees can be moderately high if you have a small account balance. However, there are plenty of other platforms to explore. These include:

- Betterment

- Wealthfront

- Stash

- Robinhood

The bottom line

Investing is an important element of financial success. The sooner you get started, the easier it will be to save for retirement, build up an emergency fund, etc. Whether you use the Acorns app to automate the process is up to you. If you’re just starting out, the automation and relatively low risk of micro-investing can provide a great learning experience.